Gresham Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder

Description

How to fill out Oregon Full Reconveyance Of Deed Of Trust - Individual Lender Or Holder?

Obtaining verified templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms library.

This is an online collection of over 85,000 legal forms catering to both personal and professional requirements across various real-world scenarios.

All documents are accurately categorized by usage area and jurisdiction, making it as simple and quick as one-two-three to find the Gresham Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder.

Utilize the US Legal Forms library to ensure that your paperwork remains organized and meets legal requirements, always having vital document templates readily available at your fingertips!

- For those already acquainted with our service and have utilized it previously, acquiring the Gresham Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder requires merely a few clicks.

- Simply Log In to your account, select the document, and hit Download to save it onto your device.

- The process will necessitate a few additional steps for new users.

- Adhere to the instructions below to initiate the most comprehensive online form library.

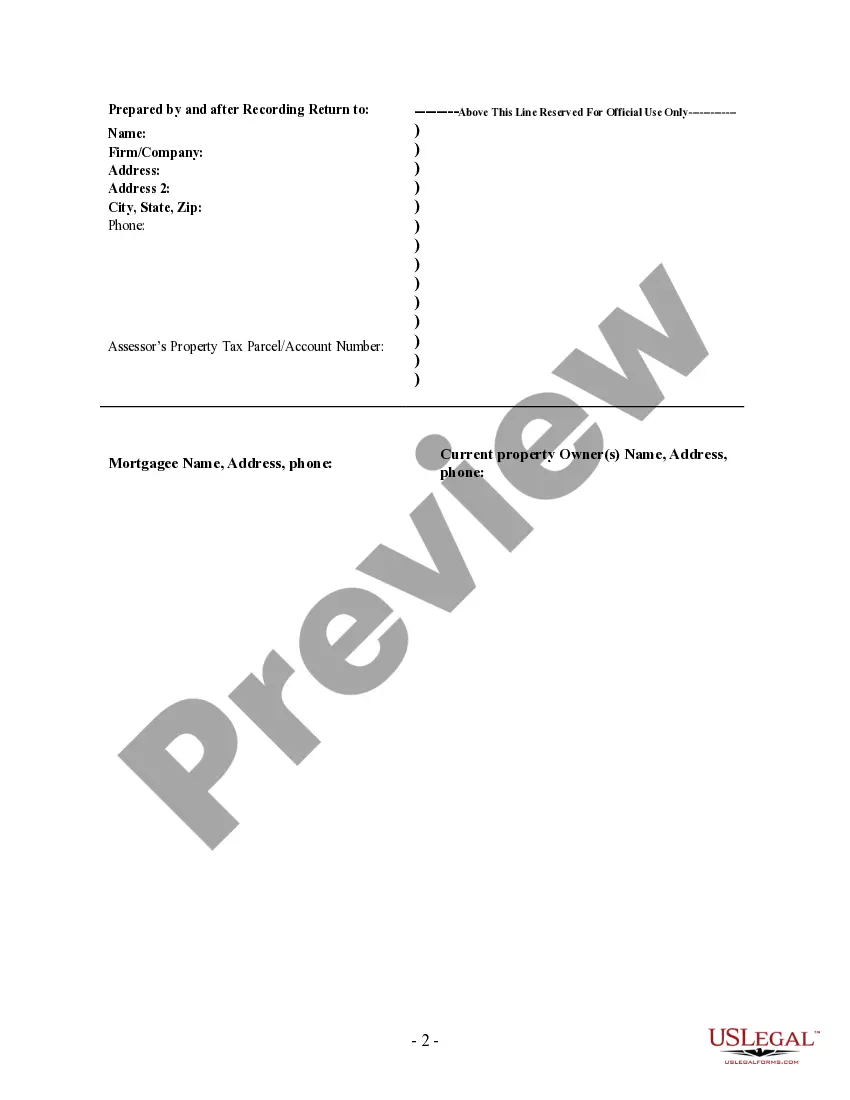

- Examine the Preview mode and form overview. Confirm that you’ve chosen the correct one that satisfies your needs and fully complies with your local jurisdiction standards.

Form popularity

FAQ

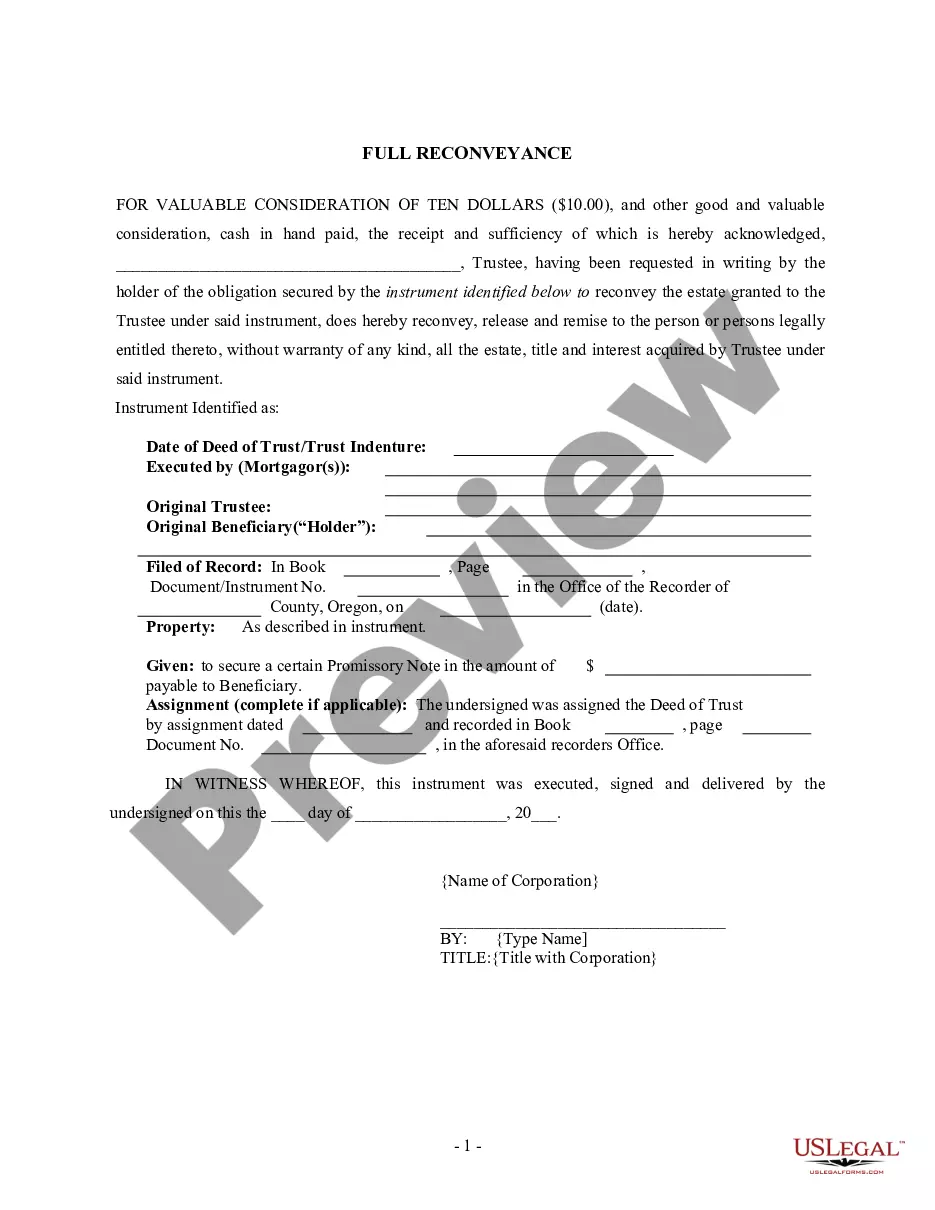

In Gresham, Oregon, the request for full reconveyance of a deed of trust must be signed by the lender or the legal holder of the note. This signature confirms that the debt has been satisfied and allows the property to be released from the deed of trust. If you are an individual lender in this scenario, ensure you follow all legal requirements when signing, as this validates the release. Using platforms like US Legal Forms can help you understand the exact signature needs based on your role in this agreement.

Yes, a deed of reconveyance is recorded with the county recorder's office in Gresham, Oregon. This recording is crucial as it officially documents the release of the lien on the property. By recording the deed, you provide public notice that the property is no longer encumbered by the trust deed. For assistance with this process, consider utilizing the US Legal Forms platform, which can streamline recording requirements for the Gresham Oregon Full Reconveyance of Deed of Trust - Individual Lender or Holder.

A Deed of Reconveyance is documentation that the debt secured by a Deed of Trust (a document that allows a third-party to hold the title to a property until it is completely paid for) has been fully paid.

Once the loan amount has been paid in full, California requires lenders to execute a deed of reconveyance within seventy-five days after the debt has been paid.

When a deed of trust/mortgage is paid in full, you can record a Full Reconveyance from the trustee stating publicly that the loan has been paid. The Full Reconveyance Form is completed and signed by the trustee, whose signature must be notarized.

A deed of reconveyance is a legal document that indicates the transfer of a property's title from lender to borrower. The deed of reconveyance is typically issued after the borrower has paid off their mortgage in full. Some states do not use mortgages but use deeds of trust.

In that context, reconveyance refers to the transfer of title to real estate from a creditor to the debtor when a loan secured by the property?i.e. mostly likely a mortgage with the property as collateral?is paid off.

A deed of reconveyance indicates that you've fully paid off your mortgage on your home, representing the transfer of ownership from your mortgage lender to you.

Start Deed of Trust StateMortgage allowedDeed of trust allowedOregonYPennsylvaniaYRhode IslandYSouth CarolinaY47 more rows

Most importantly, a deed of full reconveyance, known as a satisfaction of mortgage in some states, transfers title back to the borrower. Once the document is registered, it establishes the borrower as the sole owner of the property, which is now free and clear of the previous mortgage.