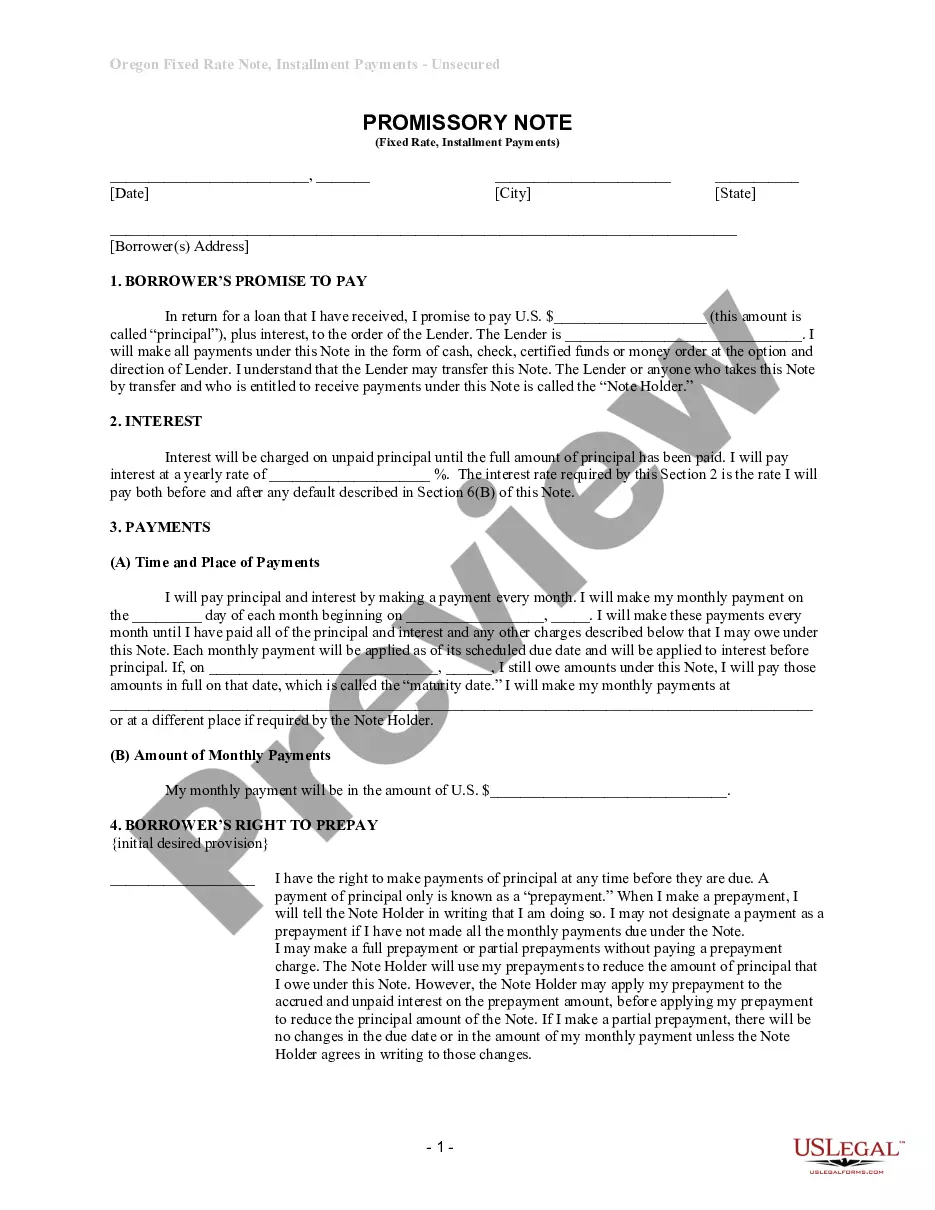

Portland Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out Oregon Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

If you are looking for an applicable form template, it's impossible to find a superior location than the US Legal Forms website – one of the most extensive online collections.

With this collection, you can discover a vast number of templates for corporate and personal uses by categories and areas, or keywords.

With the exceptional search tool, locating the most current Portland Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is as simple as 1-2-3.

Validate your choice. Click the Buy now button. Then, choose your desired pricing plan and provide information to register an account.

Complete the transaction. Use your credit card or PayPal account to finish the registration process.

- Additionally, the relevance of each entry is validated by a group of expert lawyers that routinely examine the templates on our site and update them according to the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to obtain the Portland Oregon Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is to Log In to your user profile and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the guidelines mentioned below.

- Ensure you have accessed the form you require. Review its description and use the Preview feature (if offered) to view its content.

- If it doesn’t fulfill your needs, utilize the Search option at the top of the display to find the suitable document.

Form popularity

FAQ

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

A Promissory Note must always be written by hand. It must include all the mandatory elements such as the legal names of the payee and maker's name, amount being loaned / to be repaid, full terms of the agreement and the full amount of liability, beside other elements.

Executing a note involves signing, dating and having your signature witnessed. Create the promissory note.Create date and signature lines for yourself and a witness. Sign the form in front of a witness.Give the note to the lending party.

A Promissory Note must always be written by hand. It must include all the mandatory elements such as the legal names of the payee and maker's name, amount being loaned / to be repaid, full terms of the agreement and the full amount of liability, beside other elements.

Some key features of promissory notes are as follows, It must be in writing. It must contain an unconditional promise to pay. The sum payable must be certain. The promissory notes must be signed by the maker. It must be payable to a certain person. It should be properly stamped.

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.

A promissory note refers to a written document stating that a certain amount of money will be paid to someone by a specified date. Generally, it is not necessary for the note to be recorded officially. The borrower is required to sign the note, but the lender may choose not to sign it.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.