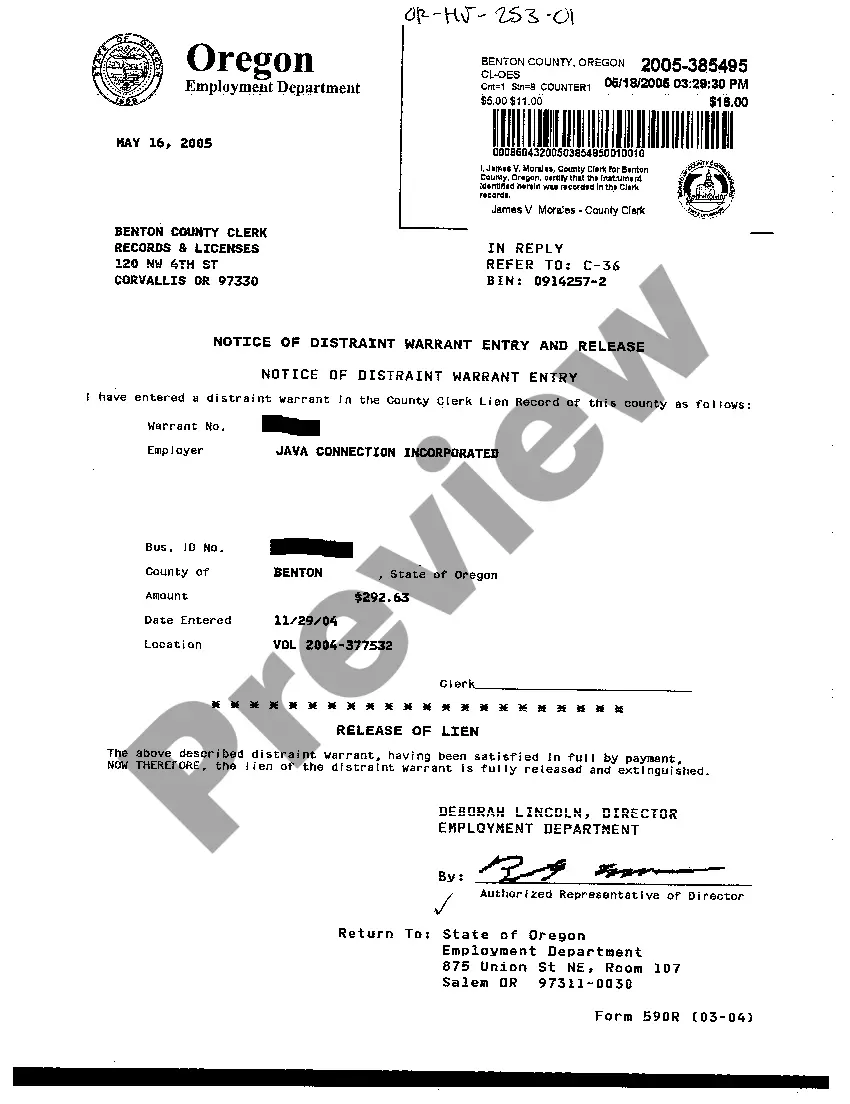

Bend Oregon Notice of Distraint Warrant Entry and Release for a Corporation

Description

How to fill out Oregon Notice Of Distraint Warrant Entry And Release For A Corporation?

We consistently endeavor to reduce or avert legal complications when handling intricate legal or financial issues.

To achieve this, we engage attorney services that, generally speaking, tend to be quite costly.

Nonetheless, not every legal situation is equally intricate. A majority can be managed independently.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to incorporation articles and dissolution petitions.

Simply Log In to your account and select the Get option next to it. If you misplace the form, you can always re-download it in the My documents section. The procedure is equally straightforward if you are new to the platform! You can create your account in just a few minutes. Ensure you verify that the Bend Oregon Notice of Distraint Warrant Entry and Release for a Corporation complies with the laws and regulations of your state and area. Furthermore, it's essential to review the form's description (if available), and if you detect any inconsistencies with your initial expectations, look for an alternate template. Once you confirm that the Bend Oregon Notice of Distraint Warrant Entry and Release for a Corporation is suitable for your situation, you can select the subscription plan and proceed to payment. Following that, you can download the form in any appropriate format. For over 24 years, we have assisted millions by providing customizable and current legal forms. Make the most of US Legal Forms now to conserve time and resources!

- Our platform enables you to manage your affairs without reliance on legal advice.

- We provide access to legal form templates that are not always available to the public.

- Our templates are tailored to specific states and regions, greatly easing the search process.

- Leverage US Legal Forms anytime you need to find and obtain the Bend Oregon Notice of Distraint Warrant Entry and Release for a Corporation or any other document swiftly and securely.

Form popularity

FAQ

The 200 day rule in Oregon stipulates the time frame within which a corporation must respond to a distraint warrant. If your corporation fails to take action within this period, it may face automatic asset seizure. Understanding the implications of this rule is crucial when dealing with a Bend Oregon Notice of Distraint Warrant Entry and Release for a Corporation, ensuring you act timely and appropriately to protect your assets.

A distraint warrant in Oregon allows tax authorities to seize property to satisfy tax debts. This legal document directs law enforcement to take possession of a corporation's assets, ensuring the collection of unpaid taxes. If your business is facing issues related to a Bend Oregon Notice of Distraint Warrant Entry and Release for a Corporation, understanding this process is vital to managing tax obligations.

The routine use exception under the Privacy Act allows federal agencies to disclose personal data for specified, routine purposes that relate to the original data collection. This exception helps facilitate operations such as administrative functions or law enforcement needs. For businesses involved with the Bend Oregon Notice of Distraint Warrant Entry and Release for a Corporation, leveraging the routine use exception ensures compliance while allowing essential information sharing.

Disclosing personal information without consent is often referred to as an unauthorized disclosure. This action can lead to legal ramifications and violation of privacy laws. For corporations managing sensitive information related to the Bend Oregon Notice of Distraint Warrant Entry and Release for a Corporation, understanding the implications of unauthorized disclosures is crucial for protecting both individuals and the organization.

A routine use refers to the disclosure of personal information that is consistent with the purposes for which the information was initially collected. This practice is important as it allows organizations to use data effectively while still respecting privacy rights. When dealing with documents like the Bend Oregon Notice of Distraint Warrant Entry and Release for a Corporation, recognizing routine uses can aid corporations in making informed decisions on data handling.

There are numerous exceptions to the rule that prohibits disclosing personal information without the individual's consent. Each exception serves a unique purpose, such as protecting public safety or aligning with law enforcement needs. For a corporation, understanding these exceptions is essential, especially in relation to the Bend Oregon Notice of Distraint Warrant Entry and Release for a Corporation, as it highlights the balance between privacy and operational needs.

The Freedom of Information Act (FOIA) includes exemptions that protect sensitive information from disclosure. Specifically, it shields personal privacy interests, national security information, and confidential commercial data. Companies navigating regulations tied to the Bend Oregon Notice of Distraint Warrant Entry and Release for a Corporation need to recognize these exemptions to maintain compliance and avoid unintended disclosures.

The routine use exception permits the release of records for specific purposes that align with the original intent behind collecting that information. This often involves scenarios where sharing data helps to fulfill agency functions. Understanding this exception is crucial for businesses dealing with regulations related to the Bend Oregon Notice of Distraint Warrant Entry and Release for a Corporation, as it provides a framework for compliant data sharing.

The Privacy Act includes several exceptions that allow for the disclosure of personal data without consent. These exceptions often cover scenarios involving national security, law enforcement, or emergency situations. However, it’s vital to note that while some information may be shared, the overall privacy of individuals is still prioritized. For instances like the Bend Oregon Notice of Distraint Warrant Entry and Release for a Corporation, understanding these exceptions can aid in compliance and proper handling of sensitive information.

You can contact the Oregon Department of Revenue through their official website, which provides phone numbers and email options for inquiries. It is important for corporations to keep informed about state regulations and the Bend Oregon Notice of Distraint Warrant Entry and Release for a Corporation. Prompt communication with the Department can clarify tax responsibilities. For additional support, consider using UsLegalForms to navigate these communications effectively.