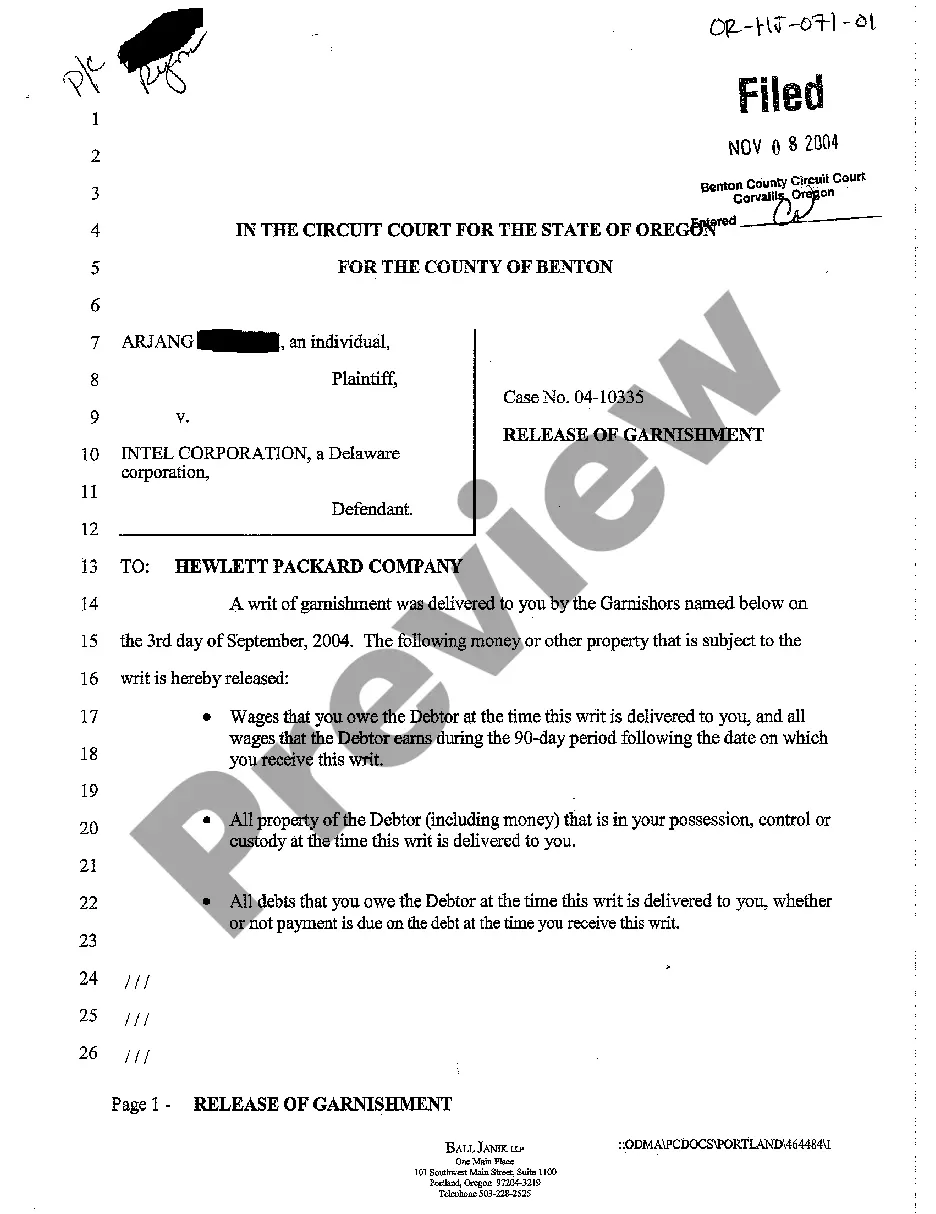

Bend Oregon Release of Garnishment

Description

How to fill out Oregon Release Of Garnishment?

Acquiring approved templates tailored to your regional regulations can be difficult unless you access the US Legal Forms database.

This online repository contains over 85,000 legal documents for personal and professional requirements as well as various real-life scenarios.

All the papers are appropriately sorted by category of use and jurisdictional areas, making the search for the Bend Oregon Release of Garnishment as simple and swift as 123.

Purchasing the document involves clicking on the Buy Now button and selecting your preferred subscription plan. You'll need to create an account to gain access to the library's resources.

- Verify the Preview mode and document description.

- Ensure you've picked the right one that aligns with your needs and fully satisfies your local jurisdiction conditions.

- Look for an alternative template, if necessary.

- If you find any discrepancies, use the Search tab above to find the correct one.

- If it meets your criteria, proceed to the next step.

Form popularity

FAQ

Escaping a wage garnishment in Oregon requires a strategic approach focused on a Bend Oregon Release of Garnishment. Start by reviewing your financial situation and identifying grounds for contesting the garnishment, such as incorrect amounts or improper service. You may also file a motion to reduce or eliminate the garnishment based on financial hardship. Utilizing US Legal Forms can streamline your efforts by offering the right forms and clear instructions suited to your needs.

To initiate a Bend Oregon Release of Garnishment, you need to take specific actions. First, evaluate the reasons behind your garnishment; you might be eligible for a release if it results from incorrect or incomplete information. Next, consider negotiating directly with your creditor or filing for bankruptcy as potential solutions. Additionally, US Legal Forms can provide you with the necessary documents and guidance to help you navigate this process effectively.

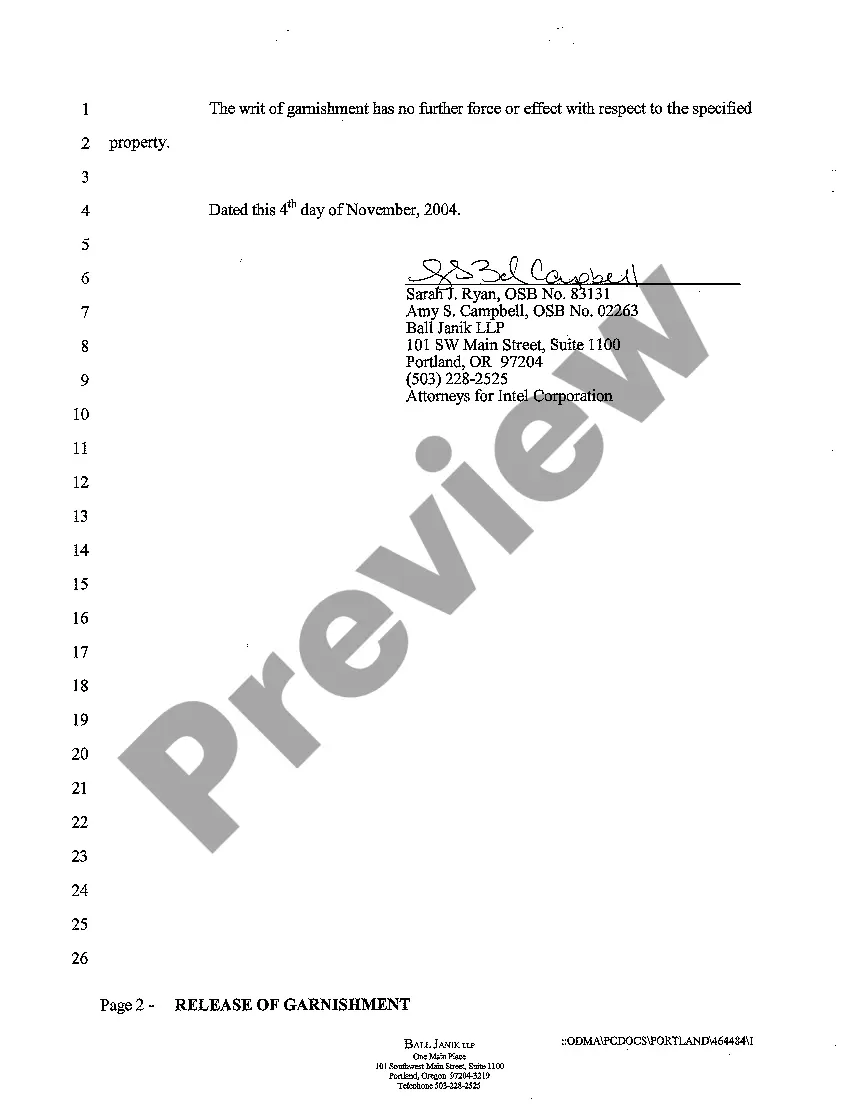

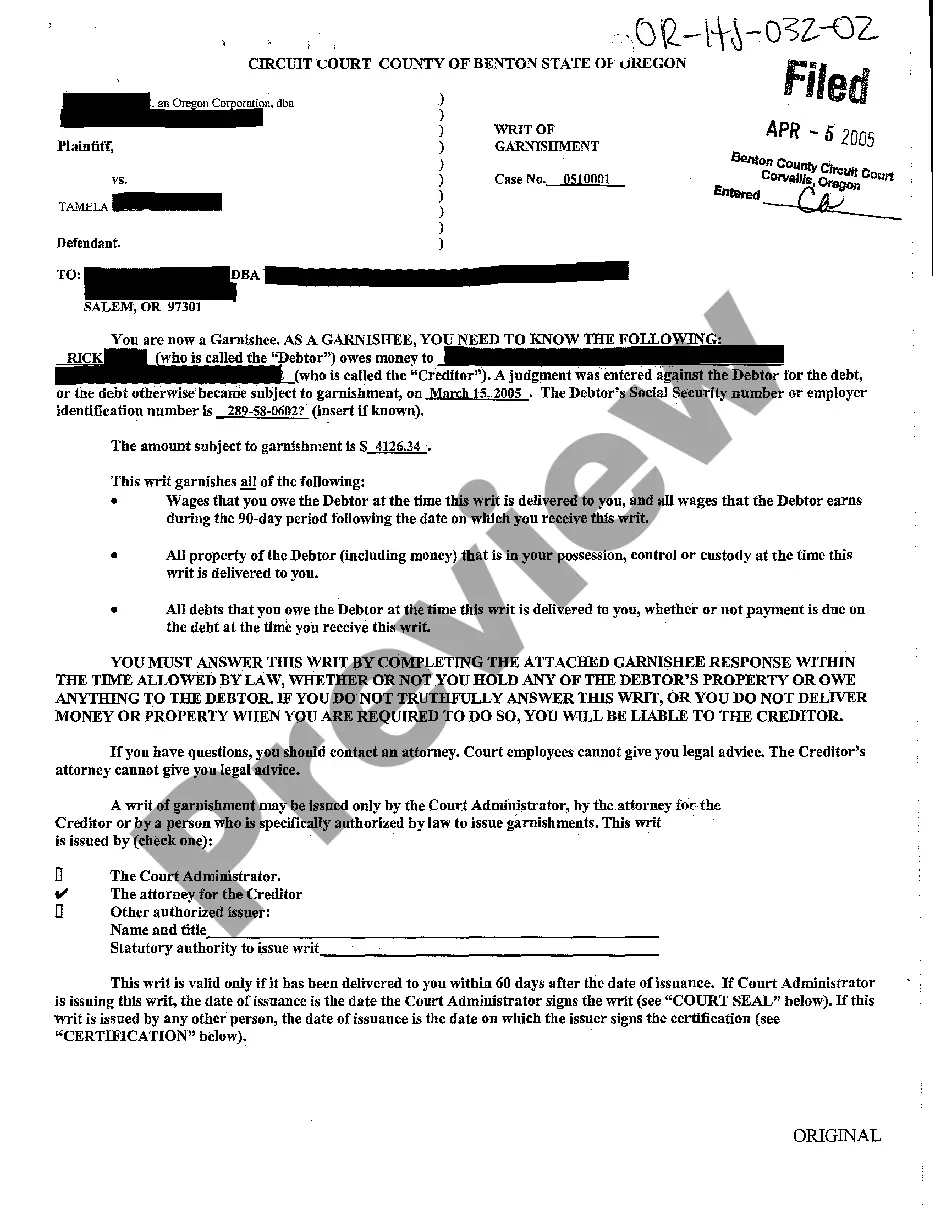

After 90 days of garnishment in Oregon, the court may review the situation. If you have not taken action to contest the garnishment, it might continue until the debt is settled. Individuals often seek a Bend Oregon Release of Garnishment to stop further deductions from their wages. Consulting resources like US Legal Forms can help you understand your options and initiate the necessary procedures.

When writing an objection letter for wage garnishment, start with a clear statement of your objection and the reasons behind it. Provide supportive documentation that reinforces your position, ensuring clarity throughout. Mentioning the Bend Oregon Release of Garnishment process can strengthen your case. For assistance, uslegalforms offers templates and guidance tailored to help you navigate this writing effectively.

To write a hardship letter for wage garnishment, begin by clearly stating your financial situation and how the garnishment affects your daily life. Use clear examples that illustrate your struggles, such as difficulties in meeting basic living expenses. Emphasizing the Bend Oregon Release of Garnishment may appeal to the creditor’s understanding of your situation. Consider using uslegalforms to find templates that can guide you in crafting a compelling letter.

Filling out a challenge to garnishment form requires specific details, such as your personal information and the reason for the challenge. Start by clearly explaining why the garnishment should be lifted, referring to the pertinent facts of your case. Utilizing the Bend Oregon Release of Garnishment resources on uslegalforms can streamline this process, ensuring you complete the form accurately and efficiently.

To negotiate a garnishment settlement, first, review your financial situation thoroughly. Consider reaching out to your creditor to discuss potential options. Remember, being proactive shows your willingness to resolve the matter while exploring the Bend Oregon Release of Garnishment solutions available to you. A platform like uslegalforms can provide the necessary resources and forms to facilitate this negotiation.

The process to release a garnishment in Oregon can vary, typically taking a few weeks. After you file the necessary paperwork with the court, it generally takes the court some time to review and approve your request. Once granted, you will receive a formal release of garnishment. Using uslegalforms might expedite this process by providing the requisite documents you need.

In Oregon, a garnishment typically lasts for 60 days unless the creditor requests an extension. After this period, the creditor must take further action to continue the garnishment. It's essential to understand that ongoing garnishments can strain your finances. If you're facing issues, look into options for a Bend Oregon Release of Garnishment through proper legal channels.

To remove a garnishment from your record in Bend, Oregon, you should first ensure that the debt has been satisfied or contested. After resolving the issue, file a motion with the court to obtain a release of garnishment. This legal action will allow the court to formally remove the garnishment from your credit report, helping you move forward financially. Consider using uslegalforms to simplify the process and access the necessary documentation.