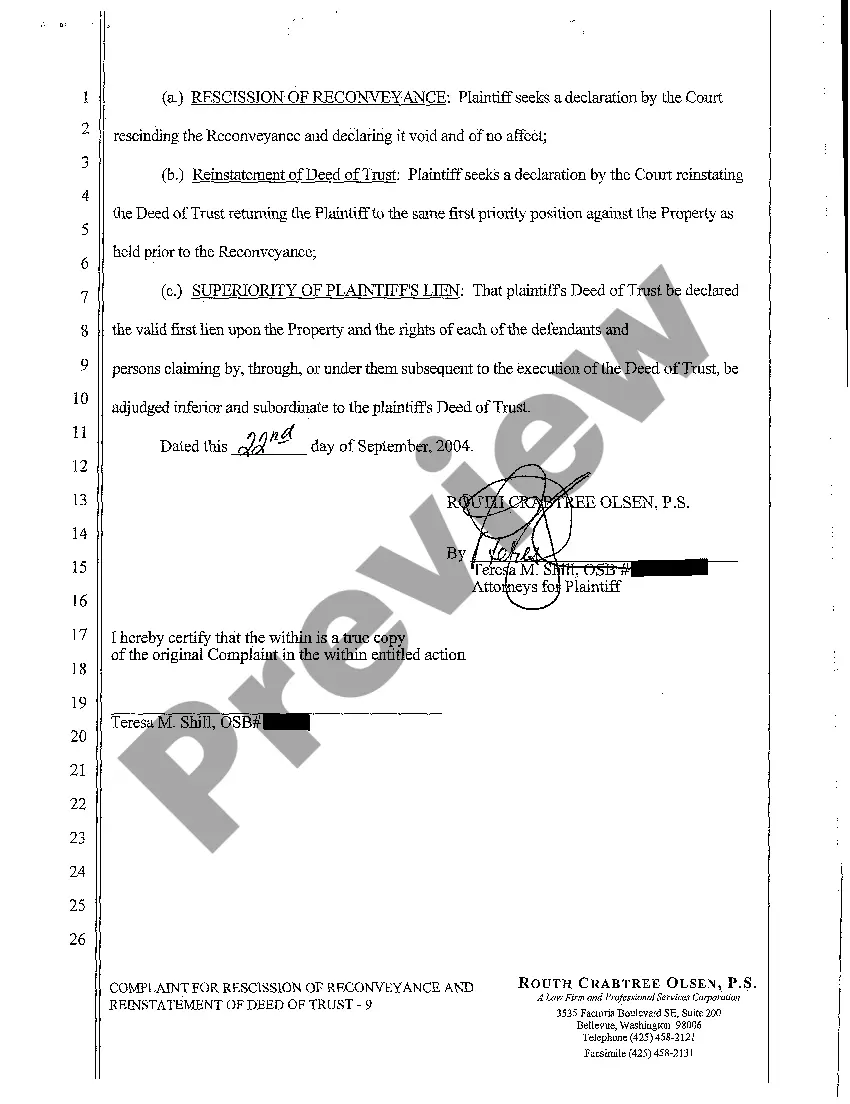

Bend Oregon Complaint for Rescission of Reconveyance and Reinstatement of Deed of Trust Declaratory Relief

Description

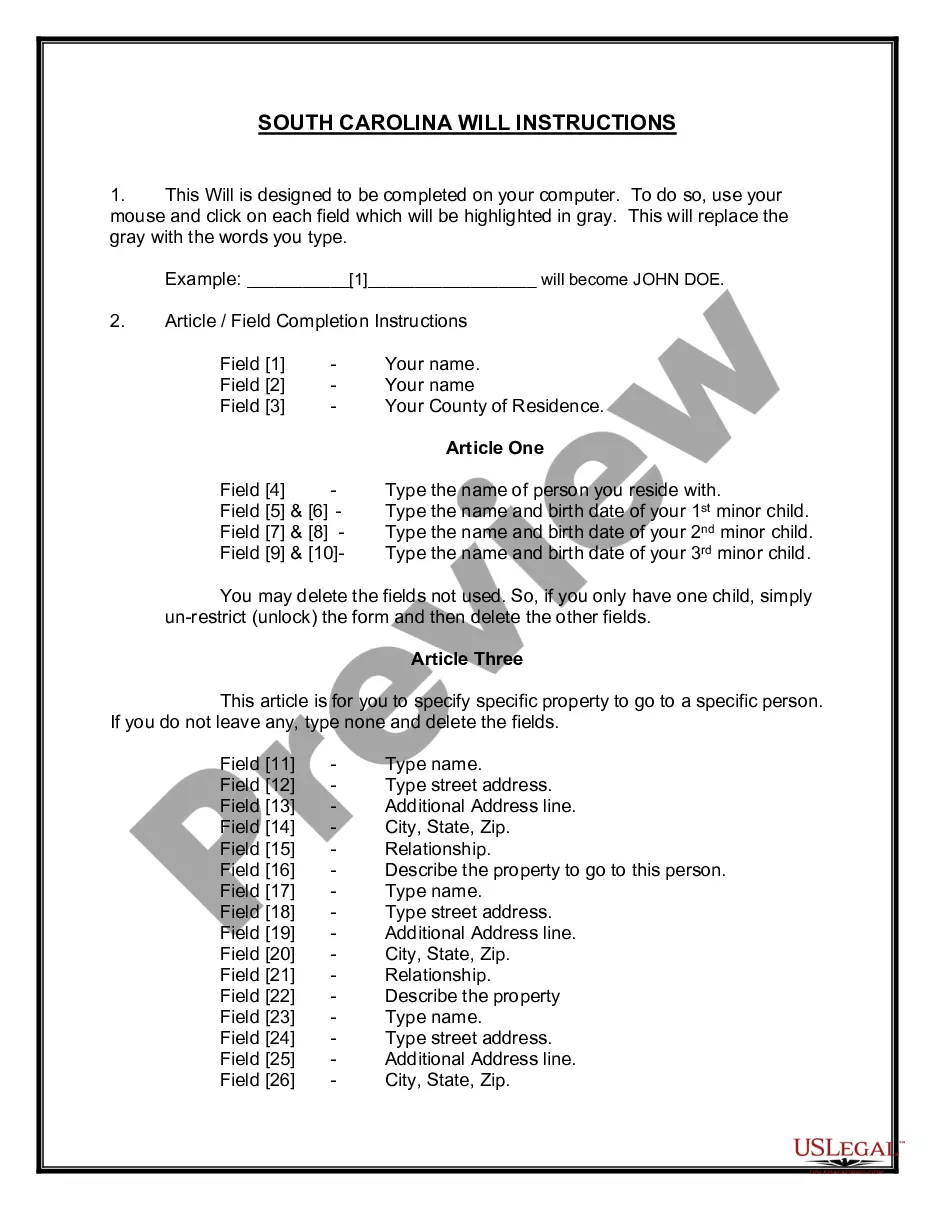

How to fill out Oregon Complaint For Rescission Of Reconveyance And Reinstatement Of Deed Of Trust Declaratory Relief?

Irrespective of social or professional position, filling out legal documents is a regrettable obligation in today's society.

Often, it’s nearly impossible for an individual without legal education to create such documents from scratch, primarily because of the intricate vocabulary and legal subtleties they contain.

This is where US Legal Forms becomes useful.

Ensure the form you have selected is relevant to your area since the laws of one state or county may not be applicable to another state or county.

Examine the form and read a brief overview (if available) of situations the document can be utilized for.

- Our service offers an extensive array of over 85,000 ready-to-use state-specific forms applicable for nearly any legal circumstance.

- US Legal Forms also serves as an excellent tool for associates or legal advisors who aim to conserve time with our DIY documents.

- Whether you require the Bend Oregon Complaint for Rescission of Reconveyance and Reinstatement of Deed of Trust Declaratory Relief or any other document appropriate for your state or county, with US Legal Forms, everything is at your disposal.

- Here’s how you can obtain the Bend Oregon Complaint for Rescission of Reconveyance and Reinstatement of Deed of Trust Declaratory Relief in minutes by utilizing our reliable service.

- If you are already a registered customer, you can proceed to Log In to your account to retrieve the necessary form.

- However, if you are a newcomer to our platform, be sure to follow these steps before obtaining the Bend Oregon Complaint for Rescission of Reconveyance and Reinstatement of Deed of Trust Declaratory Relief.

Form popularity

FAQ

To reconvey a deed, you initiate the process by completing a deed of reconveyance, which formally transfers the title back to the borrower. It is important to file this document with the appropriate county recorder's office, especially when dealing with a Bend Oregon Complaint for Rescission of Reconveyance and Reinstatement of Deed of Trust Declaratory Relief. This action not only removes the lien but also clarifies ownership. For assistance in preparing and filing these documents, US Legal Forms offers resources that can help streamline the process.

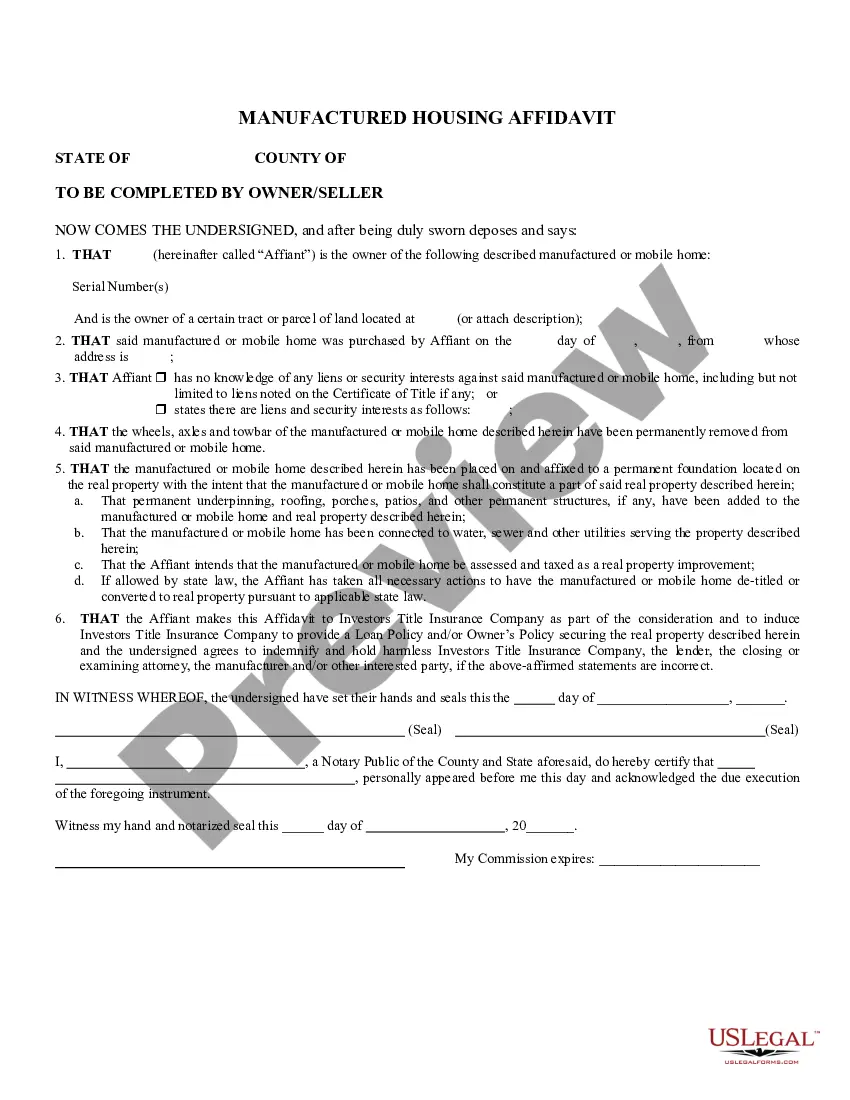

Yes, a deed of reconveyance typically requires notarization to ensure its authenticity and validity. In the context of a Bend Oregon Complaint for Rescission of Reconveyance and Reinstatement of Deed of Trust Declaratory Relief, it is crucial to have the document properly executed. Notarization verifies that the signatures on the deed are genuine and that the parties involved have acknowledged their intentions. For clarity and guidance, consider utilizing platforms like US Legal Forms to navigate the legal requirements effectively.

A recorded lien release document is an official record filed with the county that indicates the removal of a financial claim against a property. This document assures prospective buyers and lenders that no obligations remain on the property. For concerns around the integrity of such documents, consider pursuing a Bend Oregon Complaint for Rescission of Reconveyance and Reinstatement of Deed of Trust Declaratory Relief.

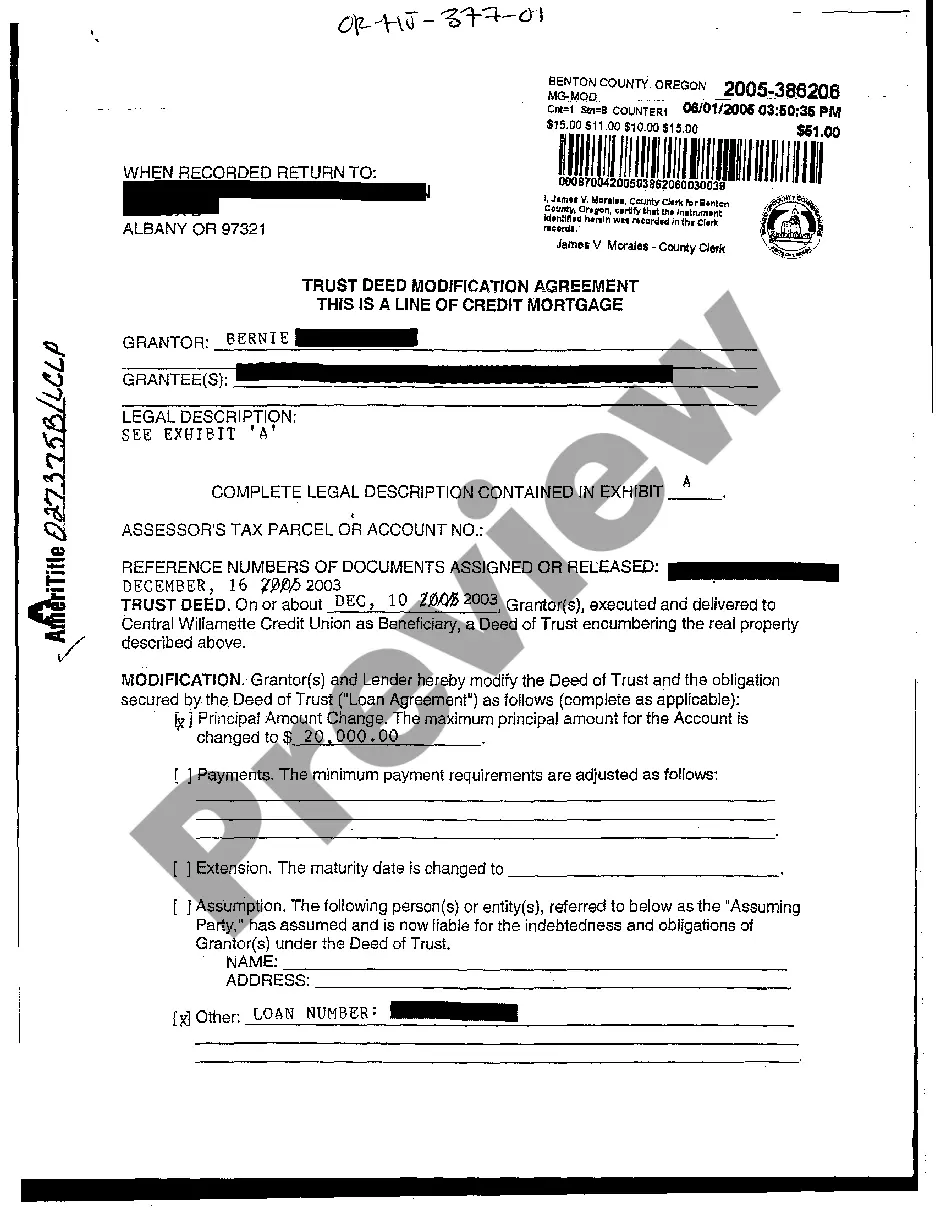

The Oregon Deed of Trust Act governs the use of deeds of trust in mortgage transactions in the state of Oregon. It provides the legal framework for creating, enforcing, and terminating these security instruments. Understanding this act can help property owners navigate issues like a Bend Oregon Complaint for Rescission of Reconveyance and Reinstatement of Deed of Trust Declaratory Relief.

The right of rescission of a trust allows a borrower to cancel or void the deed agreement under specific circumstances. This is particularly relevant when issues arise in the lending process or if misrepresentations occur. If you are facing challenges, understanding your rights in a Bend Oregon Complaint for Rescission of Reconveyance and Reinstatement of Deed of Trust Declaratory Relief can help you navigate the situation better.

Individuals often use a deed of trust because it offers a straightforward process for real estate transactions. This type of deed involves three parties: the borrower, the lender, and the trustee, which can provide additional security. Furthermore, in cases like a Bend Oregon Complaint for Rescission of Reconveyance and Reinstatement of Deed of Trust Declaratory Relief, having a deed of trust can simplify legal resolutions.

Whether you get a deed of reconveyance, a full reconveyance or a satisfaction of mortgage document, it means the same thing: your loan has been paid in full and the lender no longer has an interest in your property. With your mortgage or deed of trust paid off, you cannot be foreclosed on by a financial institution.

?Beneficiary? means a person named or otherwise designated in a trust deed as the person for whose benefit a trust deed is given, or the person's successor in interest, and who is not the trustee unless the beneficiary is qualified to be a trustee under ORS 86.713 (Qualifications of trustee) (1)(b)(D).

The Oregon Trust Deed Act (OTDA) requires lenders to record all deed of trust assignments before initiating nonjudicial foreclosures.

The relevant statute is the Oregon Trust Deed Act, ORS 86.705-86.795. A trust deed is similar to a mortgage but usually gives the security holder a ?right of sale.? This ?right of sale? allows the security holder to foreclose on the property without having to file a lawsuit in court.