Gresham Oregon Probate Checklist

Description

How to fill out Oregon Probate Checklist?

If you have previously availed yourself of our service, Log In to your account and retrieve the Gresham Oregon Probate Checklist on your device by clicking the Download button. Ensure your subscription is current. If not, renew it per your payment plan.

If this is your inaugural experience with our service, follow these straightforward steps to acquire your document.

You have ongoing access to every document you have purchased: you can find it in your profile under the My documents menu whenever you wish to reuse it. Take advantage of the US Legal Forms service to swiftly locate and save any template for your personal or professional needs!

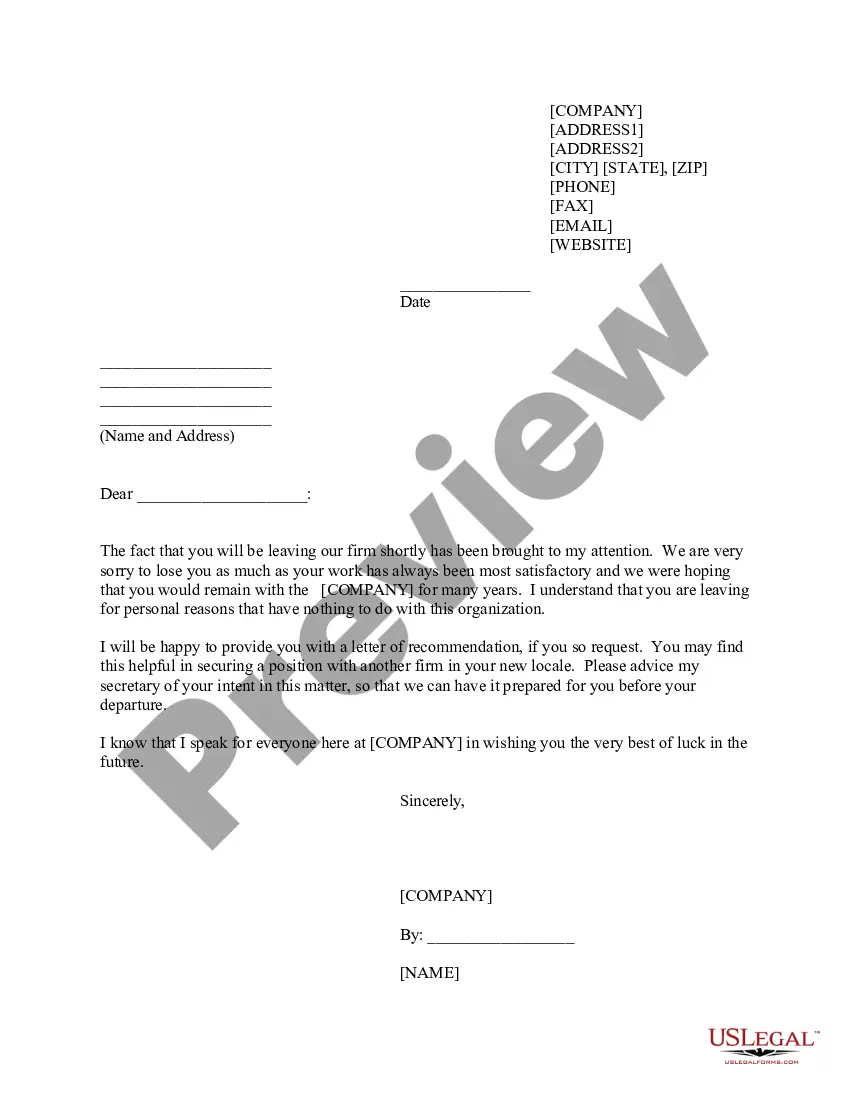

- Ensure you’ve located an appropriate document. Browse through the description and utilize the Preview option, if available, to verify if it matches your requirements. If it’s not suitable, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and process a payment. Utilize your credit card information or the PayPal option to finalize the transaction.

- Acquire your Gresham Oregon Probate Checklist. Choose the file format for your document and store it on your device.

- Complete your sample. Print it out or use professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

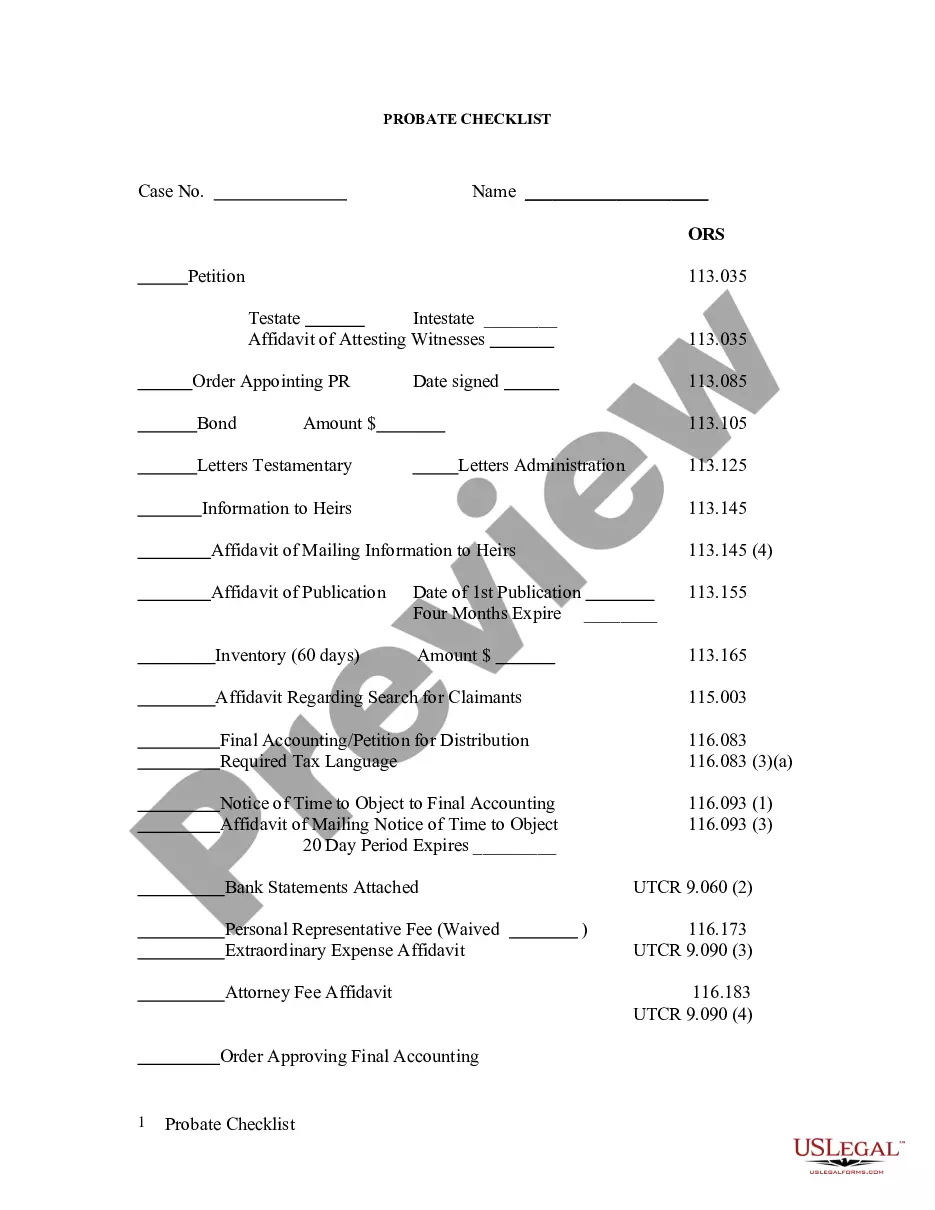

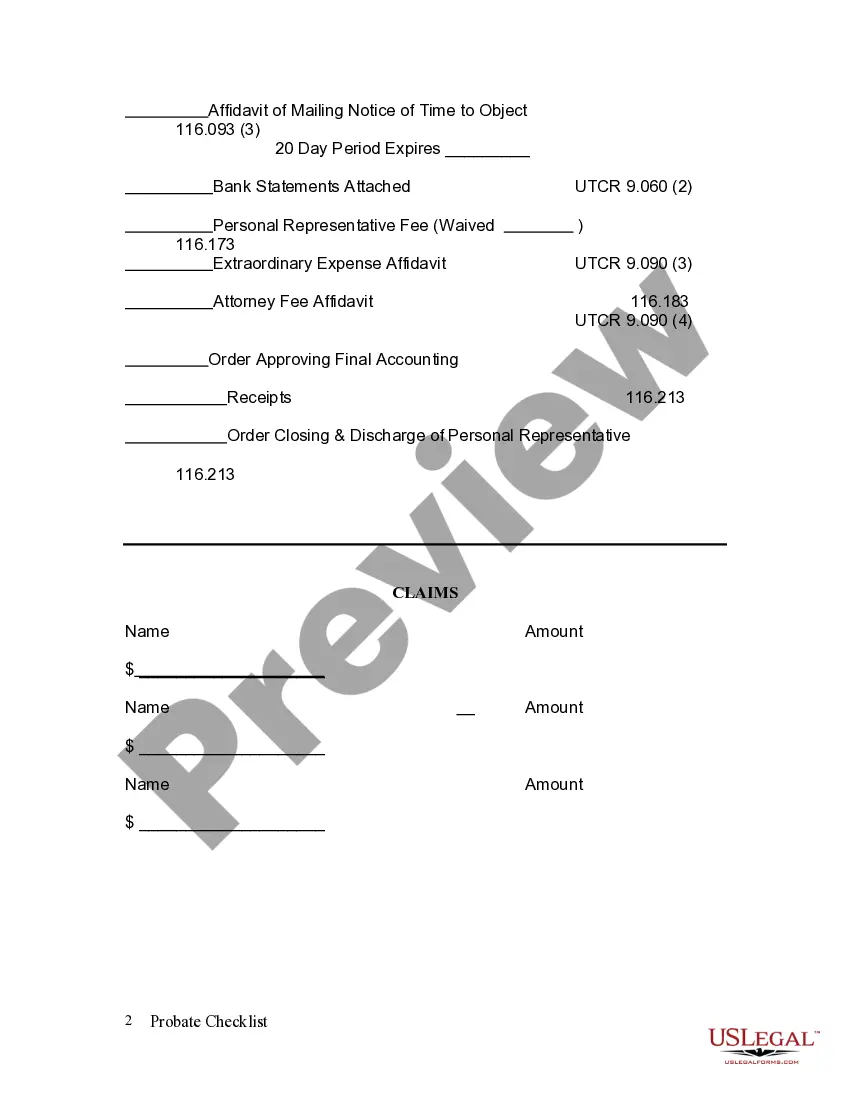

The steps of probate in Oregon include filing the will with the court, notifying heirs and beneficiaries, appraising the estate, paying debts, and distributing assets. Each step involves careful consideration and documentation. Following the Gresham Oregon Probate Checklist can streamline your probate journey and help avoid common pitfalls. For additional support, consider resources like uslegalforms, which offer helpful forms and guidance.

While most wills do enter the probate process in Oregon, some exceptions apply based on the estate's value and assets. If certain criteria are met, you may not need to go through formal probate. The Gresham Oregon Probate Checklist serves as a valuable resource to determine if your will needs to be probated. Understanding this can save you time and simplify the process.

The threshold for probate in Oregon is generally set at $275,000. This amount is determined by the total value of the estate, and anything under this limit may qualify for simplified procedures. Utilizing the Gresham Oregon Probate Checklist will ensure that you know where your estate stands with respect to this threshold. It is an essential tool for effective estate management.

Most real estate, bank accounts solely in the decedent's name, and personal belongings fall under the probate process in Oregon. If these assets belong to someone who has passed away, their estate likely requires probate. The Gresham Oregon Probate Checklist can guide you through identifying which of your assets need to go through probate. Understanding this will help you make informed decisions.

Certain assets are exempt from probate in Oregon, including joint tenancies, life insurance policies with beneficiaries, and retirement accounts. These assets pass directly to their intended recipients without going through formal probate. The Gresham Oregon Probate Checklist provides a detailed overview of such exemptions. It may assist you in planning your estate effectively.

Not all estates must go through probate in Oregon. Smaller estates may qualify for a simplified process, which can be less time-consuming and less expensive. The Gresham Oregon Probate Checklist can help you determine if your situation falls under these exemptions. Consulting with an expert can clarify what applies to your estate.

Not all estates in Oregon must go through probate. For instance, small estates under a certain value may qualify for a streamlined process or may even be exempt. The Gresham Oregon Probate Checklist outlines which situations require probate, helping you determine the best course of action for estate management.

To get a probate list, reach out to your local probate court or check their website for instructions on obtaining public records. Some jurisdictions even offer online access to probate case information. By using the Gresham Oregon Probate Checklist, you ensure that you request the right data in the most efficient manner.

You can ask for a probate list by contacting the probate court where the estate was filed. Many courts accept requests via phone, email, or in person, making it accessible for you to gather necessary information. The Gresham Oregon Probate Checklist provides tailored advice on which documents to request and how to present your inquiry effectively.

Finding a list of probates can involve checking with local probate courts or using online databases that track estate filings. Many counties maintain public records to help you locate probate cases. The Gresham Oregon Probate Checklist can guide you through these resources and streamline your search.