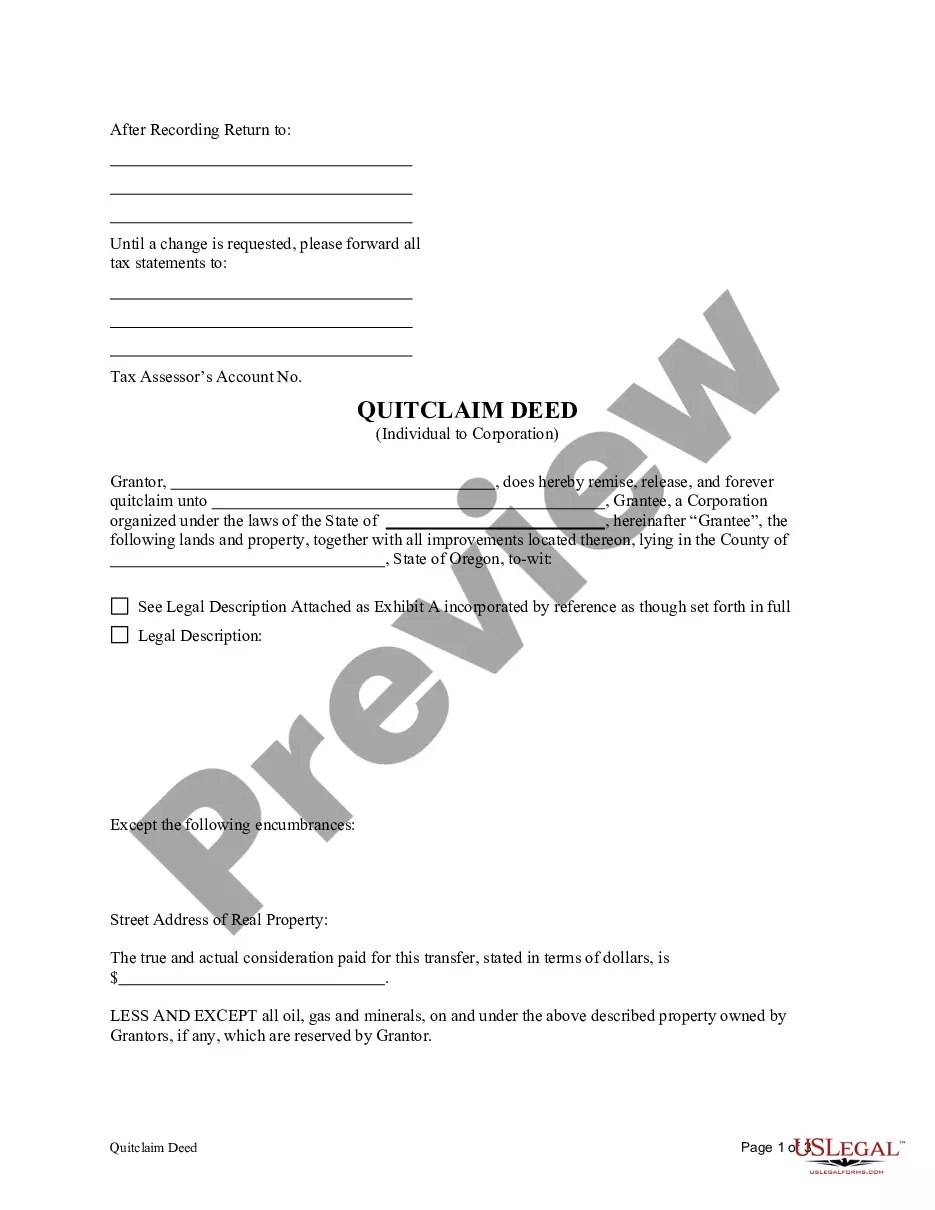

This Quitclaim Deed From an Individual To a Corporation form is a Quitclaim Deed where the grantor is an individual and the grantee is a corporation. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

Gresham Oregon Quitclaim Deed from Individual to Corporation

Description

How to fill out Oregon Quitclaim Deed From Individual To Corporation?

Utilize the US Legal Forms and gain instant access to any form template you require.

Our user-friendly website, featuring a vast array of document templates, streamlines the process of locating and acquiring nearly any document sample you need.

You can download, fill out, and authenticate the Gresham Oregon Quitclaim Deed from Individual to Corporation in just a few minutes rather than spending hours searching online for an appropriate template.

Using our collection is an excellent method to enhance the security of your document submissions. Our knowledgeable legal professionals routinely review all records to ensure that the forms are applicable for a specific state and comply with current laws and regulations.

If you haven’t created an account yet, follow the steps outlined below.

Visit the page with the template you require. Ensure that it is the document you were looking for: check its title and description, and use the Preview option if available. If not, utilize the Search bar to find the suitable one.

- How can you acquire the Gresham Oregon Quitclaim Deed from Individual to Corporation.

- If you already possess an account, simply Log In to your account. The Download button will appear on all the templates you view.

- In addition, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

To file a quitclaim deed in Oregon, you must first complete the deed with accurate information. After that, submit the Gresham Oregon Quitclaim Deed from Individual to Corporation to the county recorder’s office where the property is located. This process ensures that the deed is officially recorded, thus protecting your property rights and streamlining future transactions.

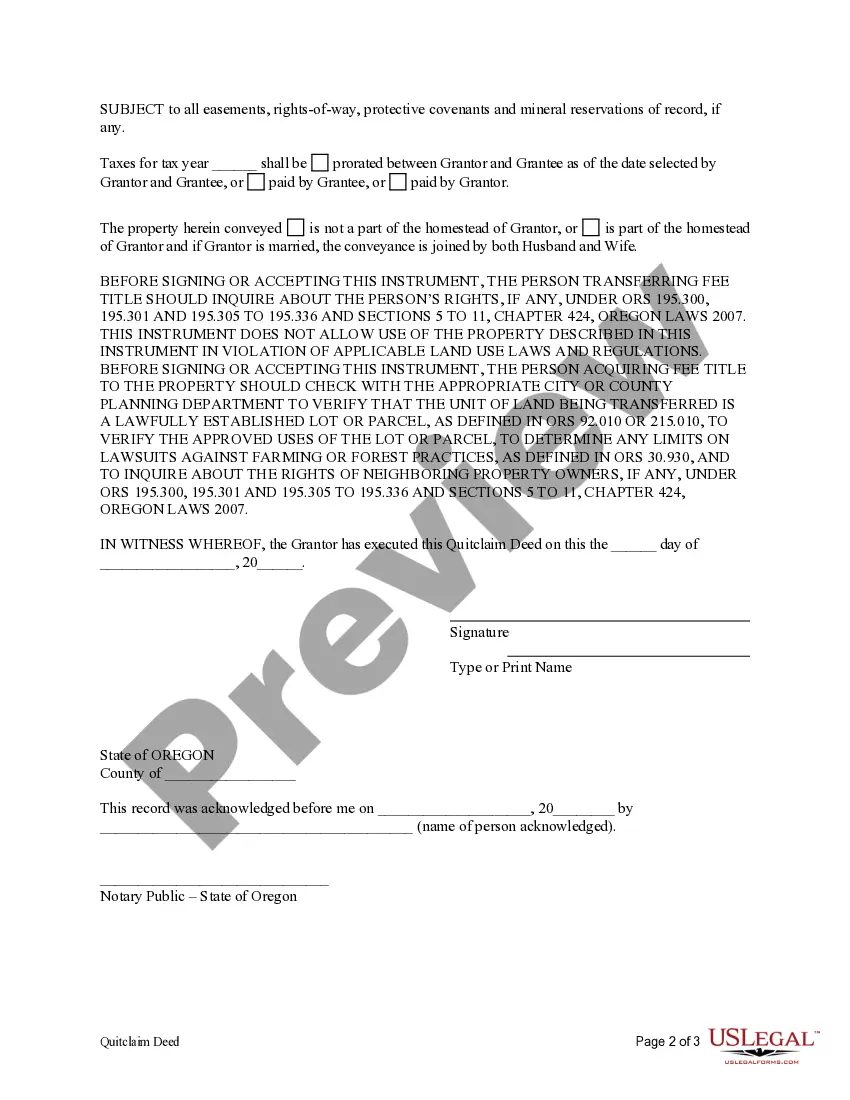

In Oregon, a quitclaim deed must be signed in the presence of a notary. This is essential for your Gresham Oregon Quitclaim Deed from Individual to Corporation to be valid. Notarization provides an extra layer of authenticity and helps ensure that the transfer of property rights is recognized by local authorities.

Yes, a title company can prepare a quitclaim deed for you. They have the expertise and knowledge to create a quitclaim deed, especially for a Gresham Oregon Quitclaim Deed from Individual to Corporation. Additionally, using a title company ensures the document meets all legal requirements, thus reducing future disputes.

To properly fill out a quit claim deed, ensure clarity and accuracy throughout the document. Begin by indicating the names and addresses of the individuals or corporations involved. Clearly describe the property being transferred, including its exact location in Gresham, Oregon. Complete the required signatures and have the deed notarized before you submit it to the appropriate local authority for recording.

Filling out a quit claim deed in Oregon involves specific steps. Start by obtaining the correct form, available on various platforms, including UsLegalForms. Next, accurately fill in the grantor's and grantee's names, the property description, and the reason for the transfer, ensuring you mention Gresham, Oregon, as the location. Finally, to finalize the process, obtain notarization and record the deed with your local office.

To fill out a quitclaim deed form, begin by entering the names of the individuals or entities involved in the transaction. Include specific property details, such as the address and legal description, making it clear that you are transferring ownership to a corporation in Gresham, Oregon. Both parties should sign the form in front of a notary. After signing, ensure to file the signed quitclaim deed with your local county recorder's office.

A quitclaim deed is a legal document used to transfer property rights. For instance, if John owns a piece of land in Gresham, Oregon, and wishes to transfer his rights to a corporation he owns, he would use a quitclaim deed. This type of deed conveys whatever interest John has in the property without guaranteeing clear title. Therefore, it’s important for both individuals and corporations to carefully evaluate the property before proceeding.

Filing a quitclaim deed in Oregon involves several steps. First, complete your Gresham Oregon Quitclaim Deed from Individual to Corporation form accurately. Once completed, you must sign the deed in front of a notary public and then file it with the county clerk's office. Utilizing resources like US Legal Forms can guide you through these steps and ensure your deed is filed properly, helping you avoid common mistakes.

Yes, you can create a quitclaim deed yourself, but it requires attention to detail. When managing a Gresham Oregon Quitclaim Deed from Individual to Corporation, you must ensure that all necessary information is accurately filled out to avoid future issues. Using an online platform like US Legal Forms can simplify the process, providing you with the correct templates and guidance to ensure your deed meets state requirements. This way, you can confidently complete the deed on your own.

To obtain a copy of your quit claim deed, especially for a Gresham Oregon Quitclaim Deed from Individual to Corporation, you should first check with the local county recorder's office. They maintain all real estate documents, including deeds, and can provide certified copies upon request. You can also access these documents through online platforms like USLegalForms, which simplifies the process of finding and obtaining important legal documents. Just ensure you have the necessary information regarding the property to expedite your request.