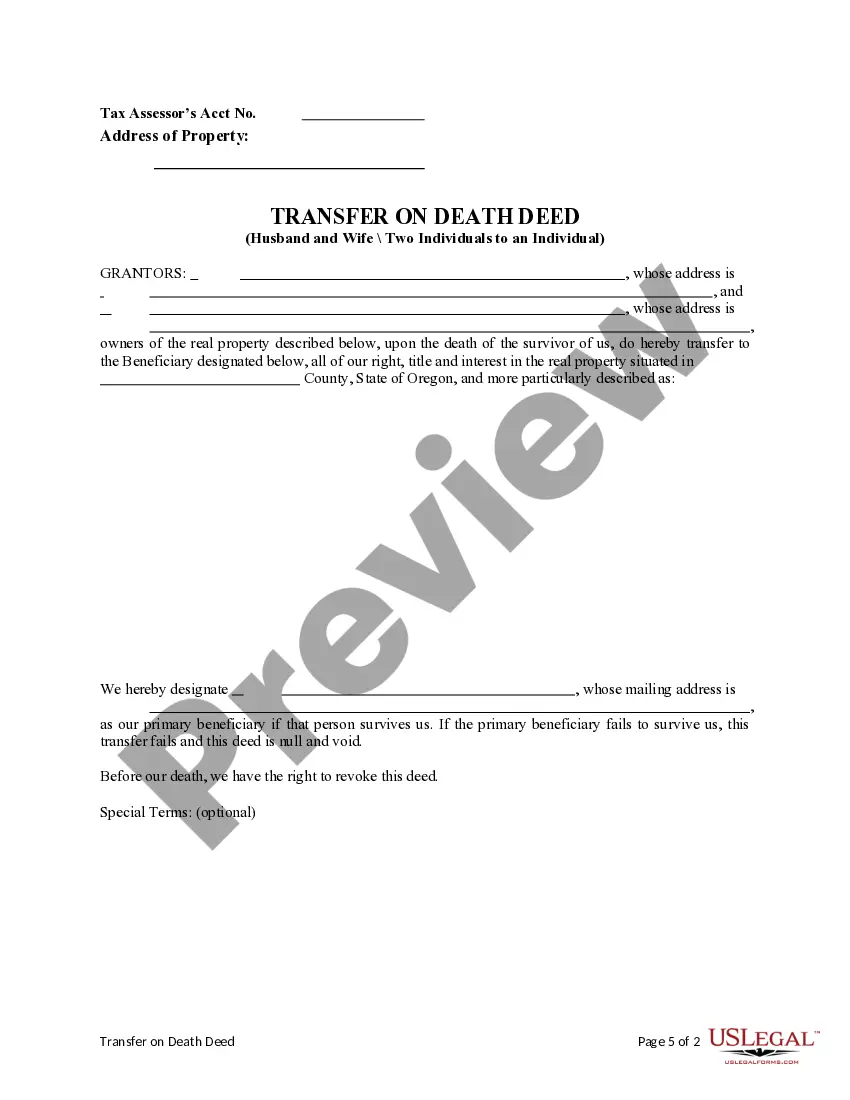

This form is a Transfer on Death Deed where the Grantors are husband and wife and the Grantee / Beneficiary is an individual. This transfer is revocable until Grantor's death and effective only upon the death of the last surviving Grantor. The primary beneficiary / Grantee takes the property if the primary beneficiary survives the Grantors. There is no provision for an alternate beneficiary. If the primary beneficiary does not qualify, the deed is null and void. This deed complies with all state statutory laws.

Hillsboro Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary.

Description

How to fill out Oregon Transfer On Death Deed From Two (2) Individuals Or Husband And Wife To An Individual WITHOUT Provision For Appointment Of Alternate Beneficiary.?

We consistently aim to reduce or evade legal repercussions when managing intricate legal or financial issues.

To achieve this, we enlist attorney services, which are typically very expensive.

Nevertheless, not every legal issue is equally intricate.

Most of them can be handled by ourselves.

Make use of US Legal Forms whenever you need to locate and download the Hillsboro Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary or any other form securely and conveniently.

- US Legal Forms is an online repository of updated DIY legal documents covering various topics from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our platform empowers you to manage your affairs independently without consulting an attorney.

- We offer access to legal form templates that are not always publicly accessible.

- Our templates are tailored to specific states and areas, which significantly eases the search process.

Form popularity

FAQ

One challenge with transfer on death accounts, including the Hillsboro Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary, is the potential for disputes among heirs. If not structured correctly, this can lead to confusion over ownership. Additionally, these accounts may not address other aspects of estate planning, such as tax implications or the needs of alternate beneficiaries, making it wise to seek guidance from an expert like uslegalforms.

Yes, you can have more than one individual named on a Hillsboro Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary. This means that both parties can transfer their property seamlessly to a chosen recipient. However, it is essential to ensure that the deed clearly specifies the names and the intent of both individuals. For a smoother process, consider using platforms like US Legal Forms that specialize in creating compliant legal documents.

One notable disadvantage of a Hillsboro Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary is the lack of flexibility. If the beneficiary predeceases you, the property does not automatically transfer to another person. Additionally, this type of deed does not provide any control over how the property will be managed while you are still alive. It’s always best to consult a legal expert to ensure it meets your needs.

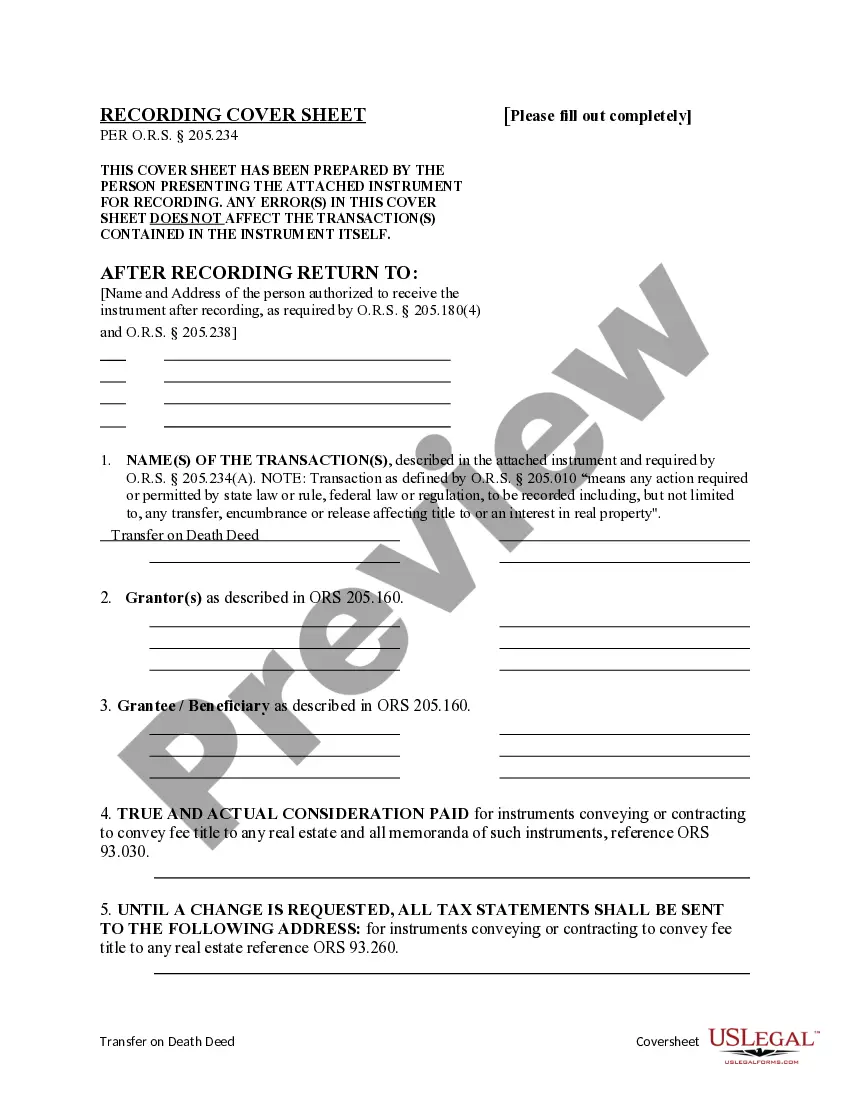

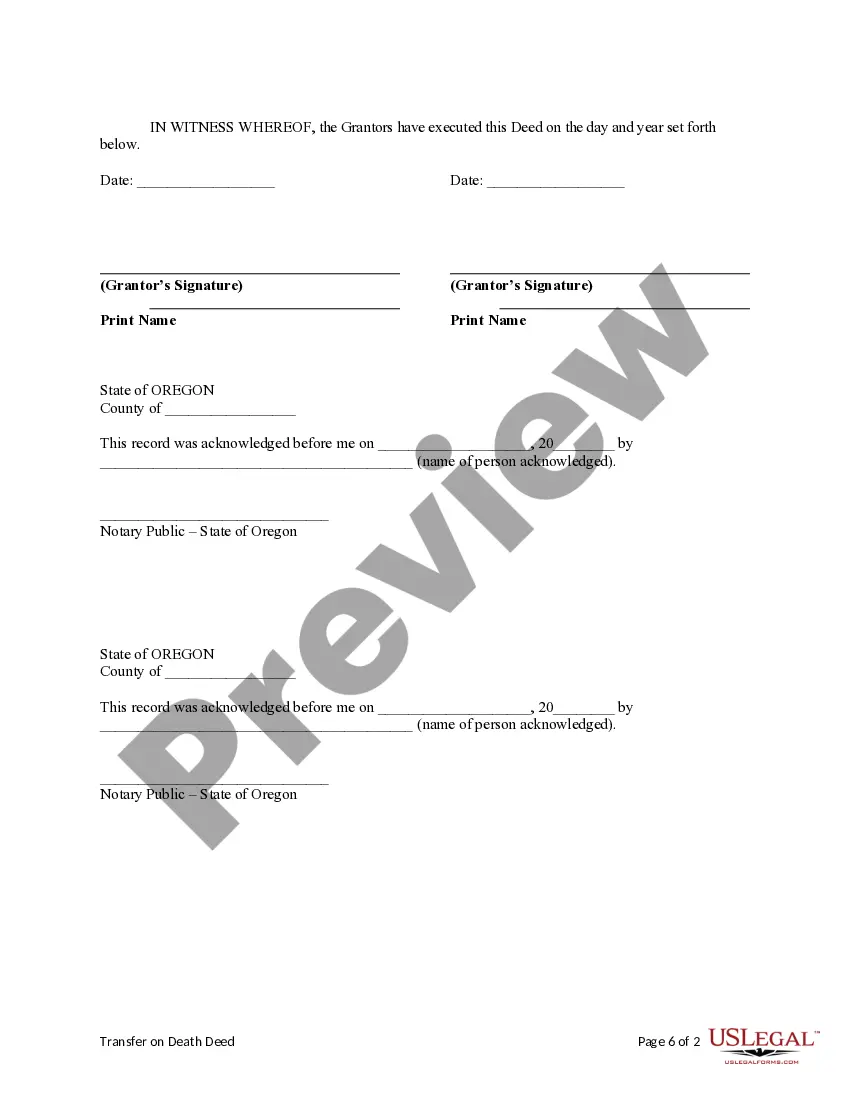

To complete a Hillsboro Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary, you must fill out the appropriate form, which you can find on the UsLegalForms platform. You need to provide details such as the names of the individuals, the property description, and the beneficiary. After completing the form, submit it to the county recorder for official recording. This action will ensure that the property is transferred to the beneficiary upon your passing.

In Oregon, a transfer on death deed must meet several key requirements. You need to properly complete the Hillsboro Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary, ensuring it is signed and notarized. Additionally, recording the deed with the county is crucial to make the transfer effective. US Legal Forms can provide templates and instructions to help you navigate this process smoothly.

While hiring a lawyer is not strictly necessary for a transfer on death deed, it can be beneficial. The Hillsboro Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary has specific legal requirements. Consulting a professional can provide clarity and assurance that your paperwork meets Oregon regulations. Alternatively, you can utilize US Legal Forms for expert guidance.

While a transfer on death deed offers simplicity, it also has potential disadvantages. One major concern is that properties transferred through the Hillsboro Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary do not avoid creditors. Additionally, if you change your mind later, revoking the deed might involve legal processes. It’s important to weigh these factors before proceeding.

Yes, you can list two beneficiaries on a transfer on death deed. This is part of the structure allowed under the Hillsboro Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary. When you designate multiple beneficiaries, both share an equal interest in the property upon your passing. Be sure to understand how this division works in Oregon.

To transfer a transfer on death deed to two beneficiaries, you need to prepare the deed by naming both beneficiaries clearly. The Hillsboro Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary allows you to specify all involved parties. It's essential to follow Oregon's statutory requirements for signing and notarizing the document. Using US Legal Forms can help ensure that your deed meets all legal standards.