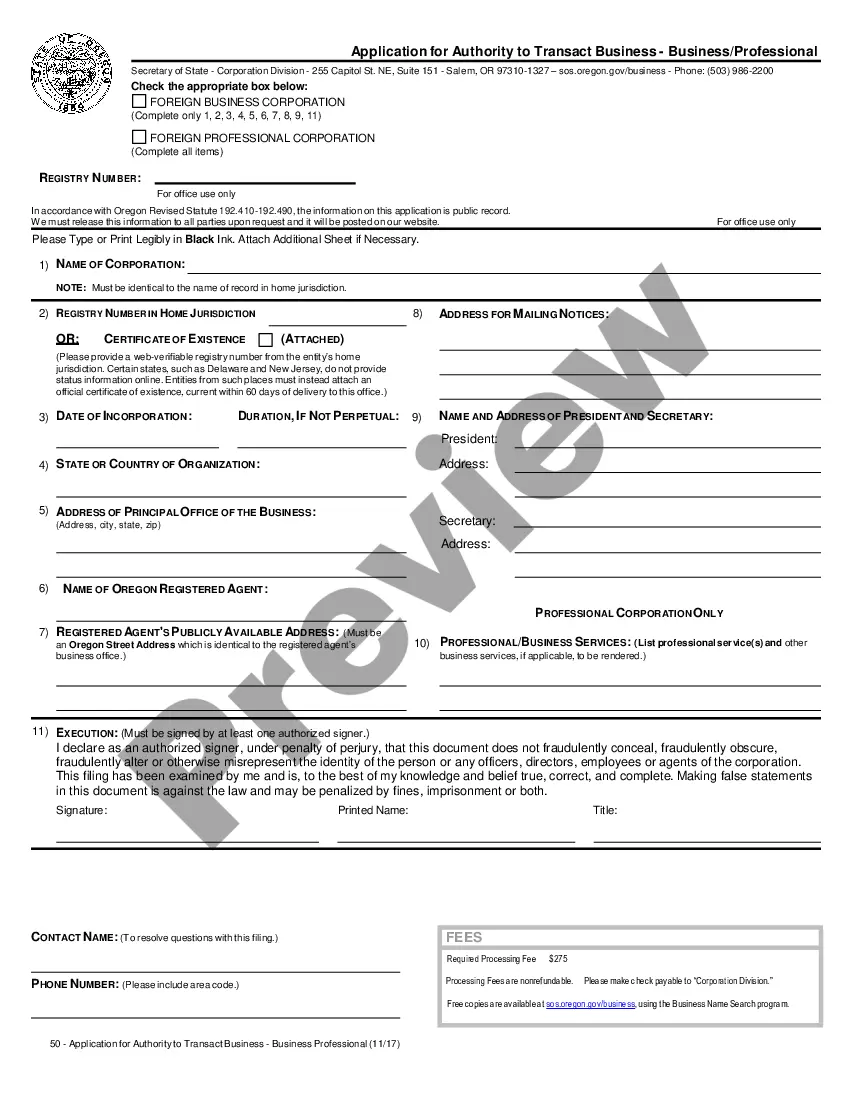

This form allows you to register a corporation for doing business in Oregon.

Portland Oregon Registration of Foreign Corporation

Description

How to fill out Oregon Registration Of Foreign Corporation?

Regardless of social or professional standing, completing legal documents is a regrettable requirement in the current professional landscape.

Frequently, it's nearly unattainable for an individual without a legal background to generate such documentation from scratch, primarily due to the complex terminology and legal subtleties involved.

This is where US Legal Forms can come to your rescue.

Ensure that the template you have found is suitable for your area since the regulations of one state or region do not apply to another.

Review the document and read a brief overview (if available) of scenarios for which the document can be utilized.

- Our platform provides an extensive library with over 85,000 ready-to-use state-specific documents suitable for nearly any legal circumstance.

- US Legal Forms is also a fantastic resource for associates or legal advisors seeking to enhance their efficiency by utilizing our DIY templates.

- Regardless of whether you need the Portland Oregon Registration of Foreign Corporation or any other document valid in your jurisdiction, US Legal Forms has everything you need.

- Here’s how you can quickly obtain the Portland Oregon Registration of Foreign Corporation using our trustworthy platform.

- If you are already a subscriber, you can proceed to Log In to your account to access the required form.

- If you are not acquainted with our library, make sure to follow these steps before acquiring the Portland Oregon Registration of Foreign Corporation.

Form popularity

FAQ

To register a foreign corporation in Oregon, you must file an Oregon Application for Authority with the Oregon Secretary of State, Corporation Division. You can submit this document by mail, by fax, or in person. The Application for Authority for a foreign Oregon corporation costs $275 to file.

A foreign Oregon Corporation is an INC originally formed in another state that registers to do business in Oregon. The process of registering a foreign Corporation in Oregon is called foreign qualification.

You may file online or through the U.S. mail. The filing fee is $100. An individual authorized to sign on behalf of the company must sign the application as the organizer. After submitting your registration forms, you need to learn about any required state or local licenses, such as a business license.

To start a corporation in Oregon, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Secretary of State, Corporation Division. You can file this document online or by mail. The articles cost $100 to file.

You can register a foreign (out-of-state) corporation in California by filing a Statement and Designation by Foreign Corporation (Form S&DC-S/N), along with a Certificate of Good Standing, to the Secretary of State's office. Through June 2023, there is no filing fee, so now is the time to register.

If your city or county requires an Oregon business license, it may cost anywhere from $50 to a few hundred dollars or it may be a percent of your net business income. This fee will vary wildly depending on the locality you are licensing in and sometimes on the type of business you operate.

For Oregon purposes, if your LLC is formed in another state, then it is known as a foreign LLC in Oregon. In other words, foreign doesn't mean from another country. Instead, it means your business was organized under the laws of another state.

It sure is possible! A foreign company that wishes to set up a US branch or subsidiary will want to create a business entity in the United States. We recommend either forming a corporation or an LLC because both entities offer excellent liability protection from any potential bankruptcies or lawsuits.

How much does it cost to form a corporation in Oregon? You can register your business name with the Oregon Secretary of State for $100. To file your Articles of Incorporation, the Oregon Secretary of State charges a $100 filing fee.