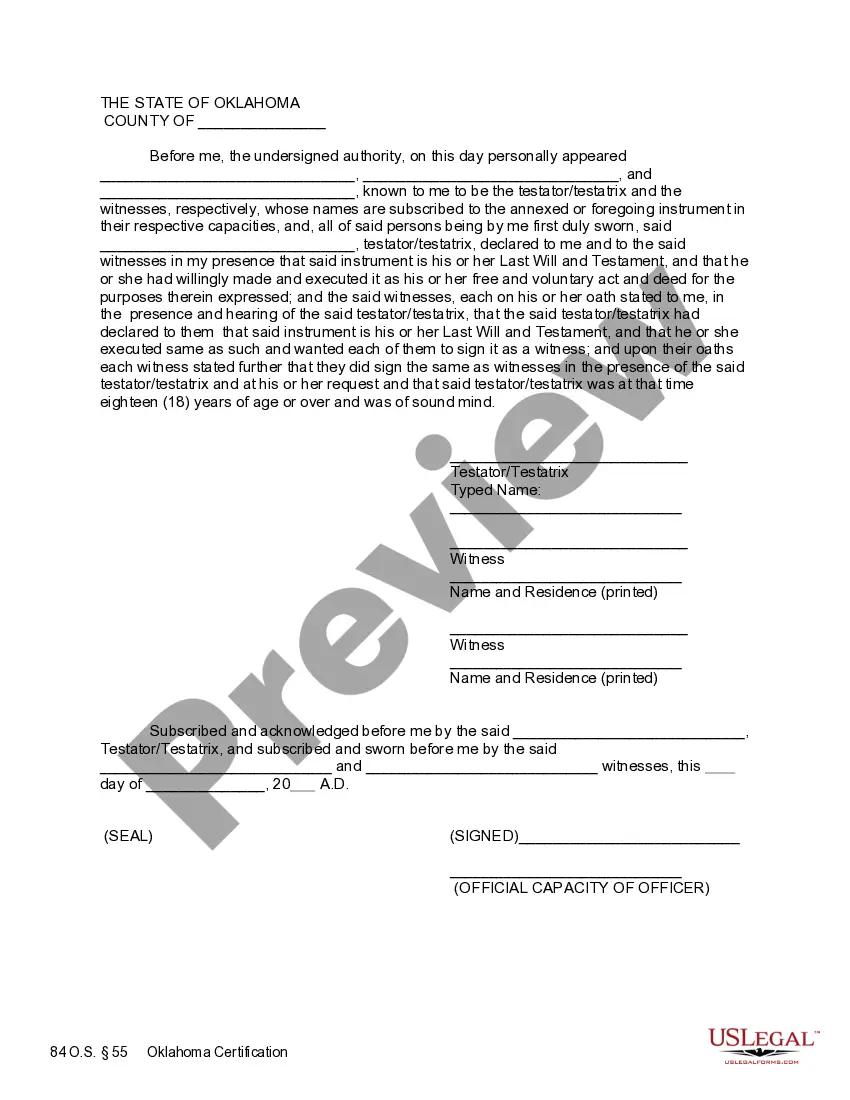

Oklahoma City Oklahoma Last Will and Testament with All Property to Trust called a Pour Over Will

Description

How to fill out Oklahoma Last Will And Testament With All Property To Trust Called A Pour Over Will?

If you have previously made use of our service, Log In to your account and download the Oklahoma City Oklahoma Legal Last Will and Testament Form with All Property to Trust known as a Pour Over Will to your device by clicking the Download button. Ensure your subscription remains valid. If it is not, renew it as per your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your file.

You have perpetual access to every document you have purchased: you can find it in your profile within the My documents section whenever you need to access it again. Utilize the US Legal Forms service to effortlessly identify and save any template for your personal or professional requirements!

- Ensure you have located an appropriate document. Review the description and utilize the Preview feature, if available, to verify it aligns with your requirements. If it does not fit your needs, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription option.

- Establish an account and process your payment. Employ your credit card information or the PayPal alternative to finalize the transaction.

- Retrieve your Oklahoma City Oklahoma Legal Last Will and Testament Form with All Property to Trust referred to as a Pour Over Will. Select the file format for your document and save it to your device.

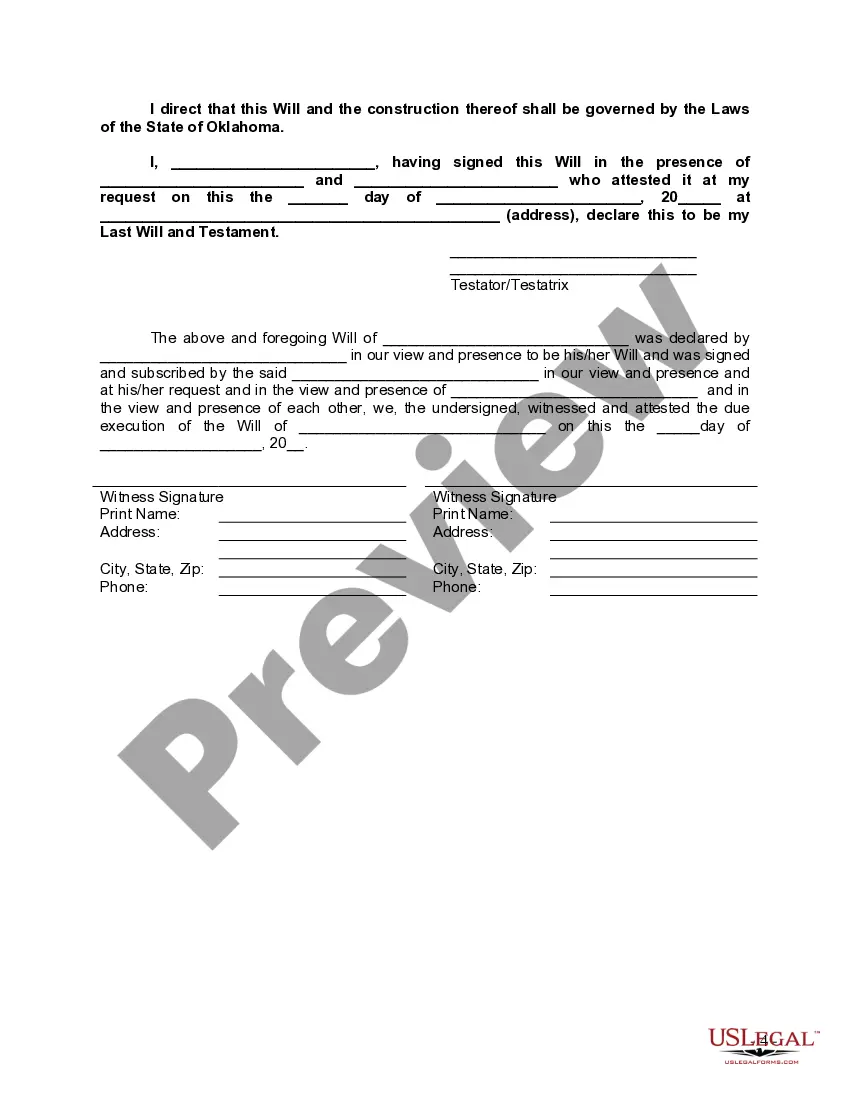

- Finalize your sample. Print it or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Probate property generally includes any property owned by the deceased person in their name alone that does not have a named beneficiary (i.e., real estate and solely owned bank accounts and securities accounts). Probate property must go through probate court.

Having a will allows you to choose your personal representative. Without a will, the court could appoint someone as personal representation other than a person you would choose. Having a trust allows you to avoid the probate court system altogether if your trust is created and funded properly.

over will is a will used alongside a living trust. You can use it to transfer assets not already held in your trust before you die into your trust after your death.

One of the biggest advantages of trusts is that they prevent your family from having to undergo the lengthy and costly process of probate at the time of your passing. However, they are initially a larger investment and require more information at the planning stage than a last will.

This is because a valid will allows the decedent (the person who passed away) the ability to tell the Oklahoma County Probate Court how they wanted their assets distributed. They could also use their will to name a guardian for their minor child.

The beneficiaries you name in your living trust receive the trust property when you die. You could instead use a will, but wills must go through probate?the court process that oversees the transfer of your property to your beneficiaries. Many people create a revocable living trust as part of their estate plan.

A will does not go into effect until after you die, whereas a living trust is active once it is created and funded. This means that a trust can provide protection and direct your assets if you become mentally incapacitated, something a will is unable to do.

The main downside to pour-over wills is that (like all wills), the property that passes through them must go through probate. That means that any property headed toward a living trust may get hung up in probate before it can be distributed by the trust.

Deciding between a Will and a Trust depends on your circumstances; there are pros and cons of each. For example, a Trust can be used to avoid probate and reduce Estate Taxes, whereas a Will cannot.

Probate. If you are named in someone's will as an executor, you may have to apply for probate. This is a legal document which gives you the authority to share out the estate of the person who has died according to the instructions in the will. You do not always need probate to be able to deal with the estate.