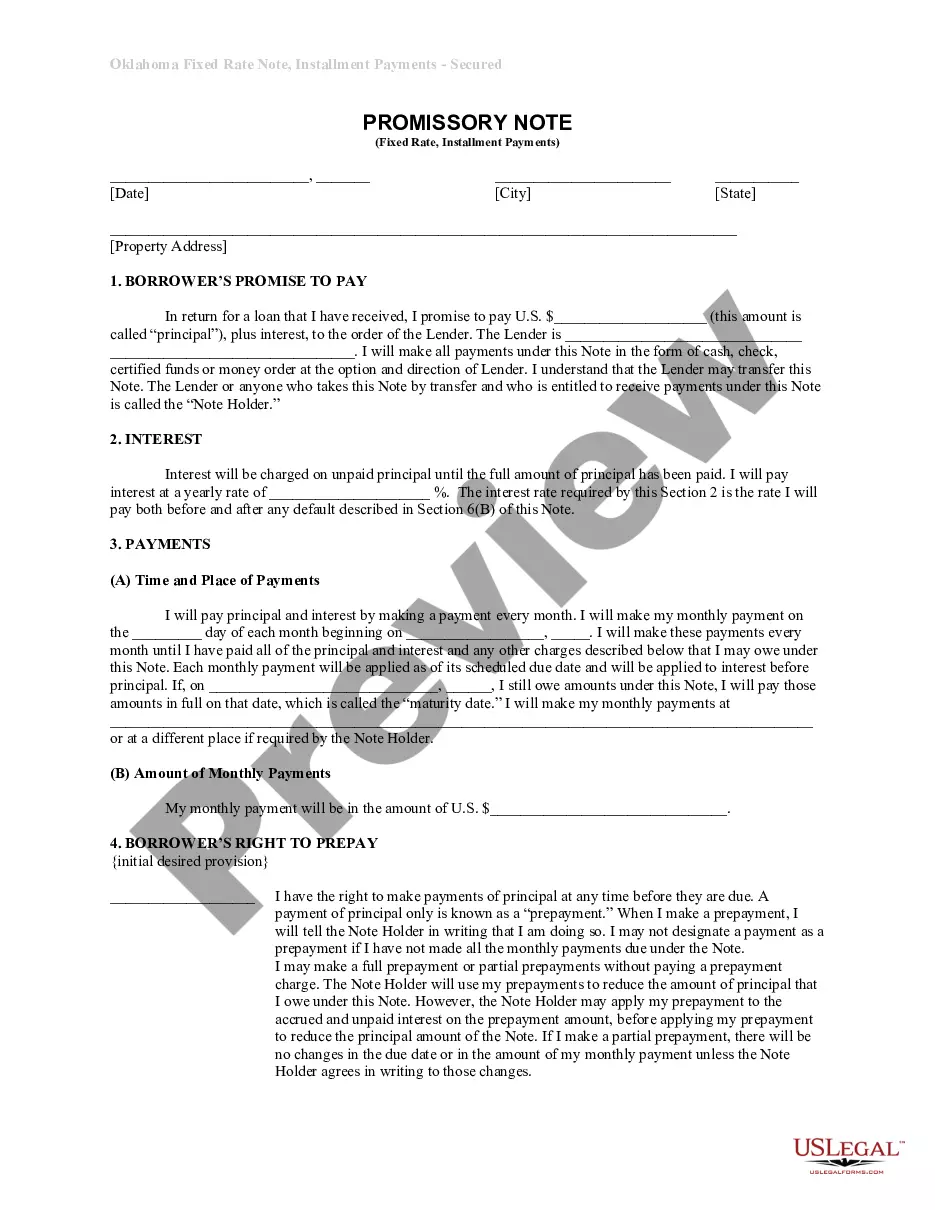

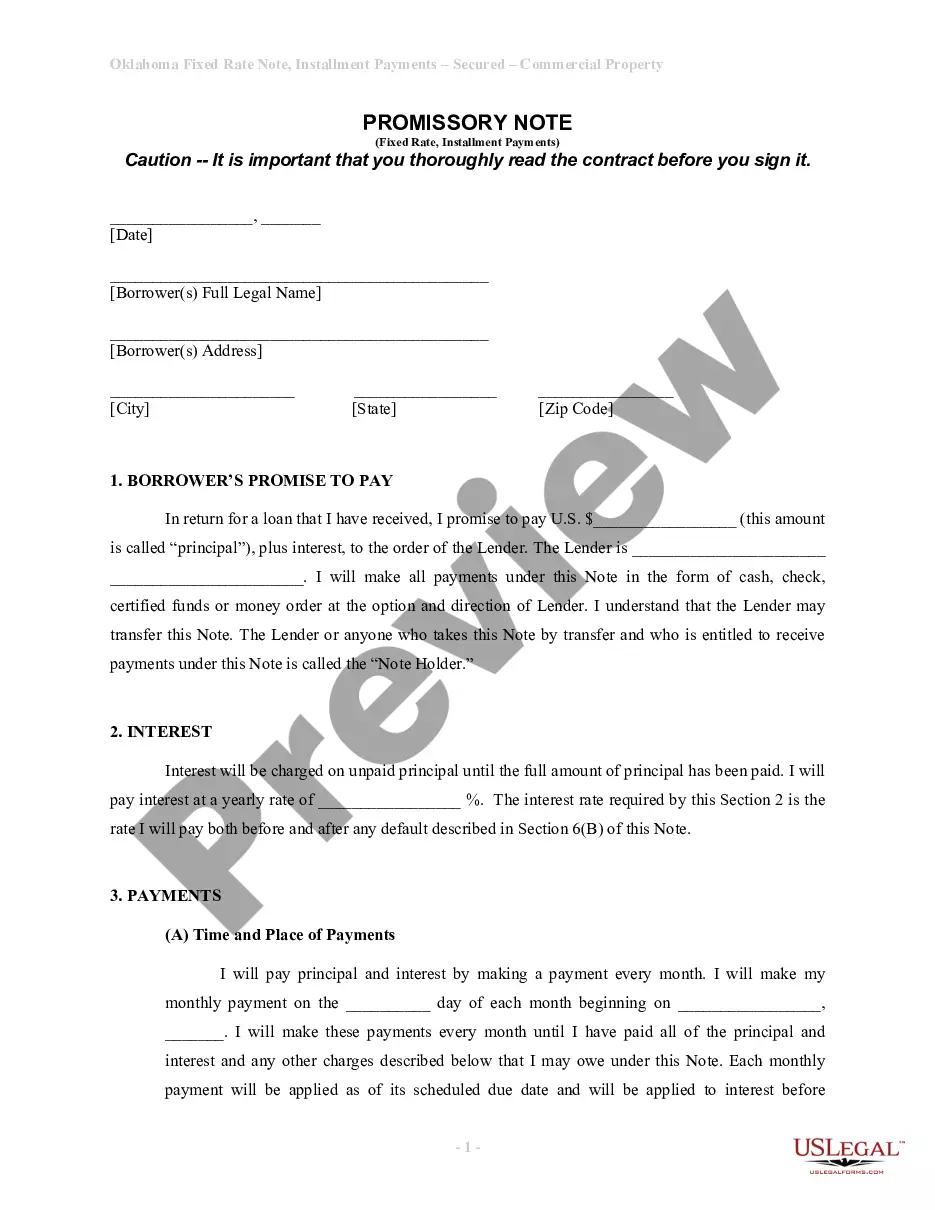

Oklahoma City Oklahoma Installments Fixed Rate Promissory Note Secured by Personal Property

Description

How to fill out Oklahoma Installments Fixed Rate Promissory Note Secured By Personal Property?

Do you require a dependable and affordable provider of legal forms to obtain the Oklahoma City Oklahoma Installments Fixed Rate Promissory Note Secured by Personal Property? US Legal Forms is your best choice.

Whether you need a straightforward agreement to establish guidelines for living together with your partner or a collection of documents to facilitate your separation or divorce through the legal system, we have you covered. Our platform offers over 85,000 current legal document templates for personal and business use. All templates we provide are tailored to meet the specific needs of particular states and counties.

To acquire the document, you must Log In to your account, locate the necessary form, and click the Download button adjacent to it. Please be aware that you can download your prior purchases of form templates at any time from the My documents section.

Is this your first time visiting our site? No need to worry. You can create an account with great ease, but before proceeding, ensure that you.

Now you can complete your account registration. Then, choose your subscription plan and continue to checkout. Once the payment is confirmed, download the Oklahoma City Oklahoma Installments Fixed Rate Promissory Note Secured by Personal Property in any of the provided formats. You can revisit the website anytime to redownload the document at no additional cost.

Discovering current legal documents has never been more straightforward. Try US Legal Forms today, and say goodbye to spending countless hours researching legal forms online once and for all.

- Verify if the Oklahoma City Oklahoma Installments Fixed Rate Promissory Note Secured by Personal Property adheres to the laws of your state and locality.

- Review the form’s description (if available) to understand who it's for and its purpose.

- Restart the search if the form does not meet your particular circumstances.

Form popularity

FAQ

A promissory note and deed of trust have one simple function to secure the repayment of a loan by placing a lien on the property as collateral. If the loan is not paid, then the lender has the right to sell the property. Both documents are used to make sure the seller secures the repayment of the loan.

In California, loans can be secured by real property through a deed of trust. Accordingly, a deed of trust is a security instrument that functions like a mortgage.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

Most commonly, a promissory note will be secured by the home you are purchasing, which also serves as collateral for the mortgage itself.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

As part of the home loan mortgage process, you can expect to execute both a legally binding mortgage and mortgage promissory note, which work toward complementary purposes.