Broken Arrow Oklahoma Living Trust for Husband and Wife with One Child

Description

How to fill out Oklahoma Living Trust For Husband And Wife With One Child?

Locating authenticated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

It’s a digital collection of over 85,000 legal documents designed for both personal and professional purposes, accommodating various real-world scenarios.

All the paperwork is appropriately categorized by application area and jurisdiction sectors, making it straightforward to search for the Broken Arrow Oklahoma Living Trust for Husband and Wife with One Child.

Maintaining documentation organized and compliant with legal standards is vital. Take advantage of the US Legal Forms library to always have crucial document templates readily available for any requirements!

- For those already familiar with our database and who have navigated it previously, obtaining the Broken Arrow Oklahoma Living Trust for Husband and Wife with One Child requires just a few clicks.

- Simply Log In to your profile, select the document, and hit Download to save it on your device.

- This method will involve only a few extra steps for new users.

- Adhere to the instructions below to commence with the most comprehensive online form compilation.

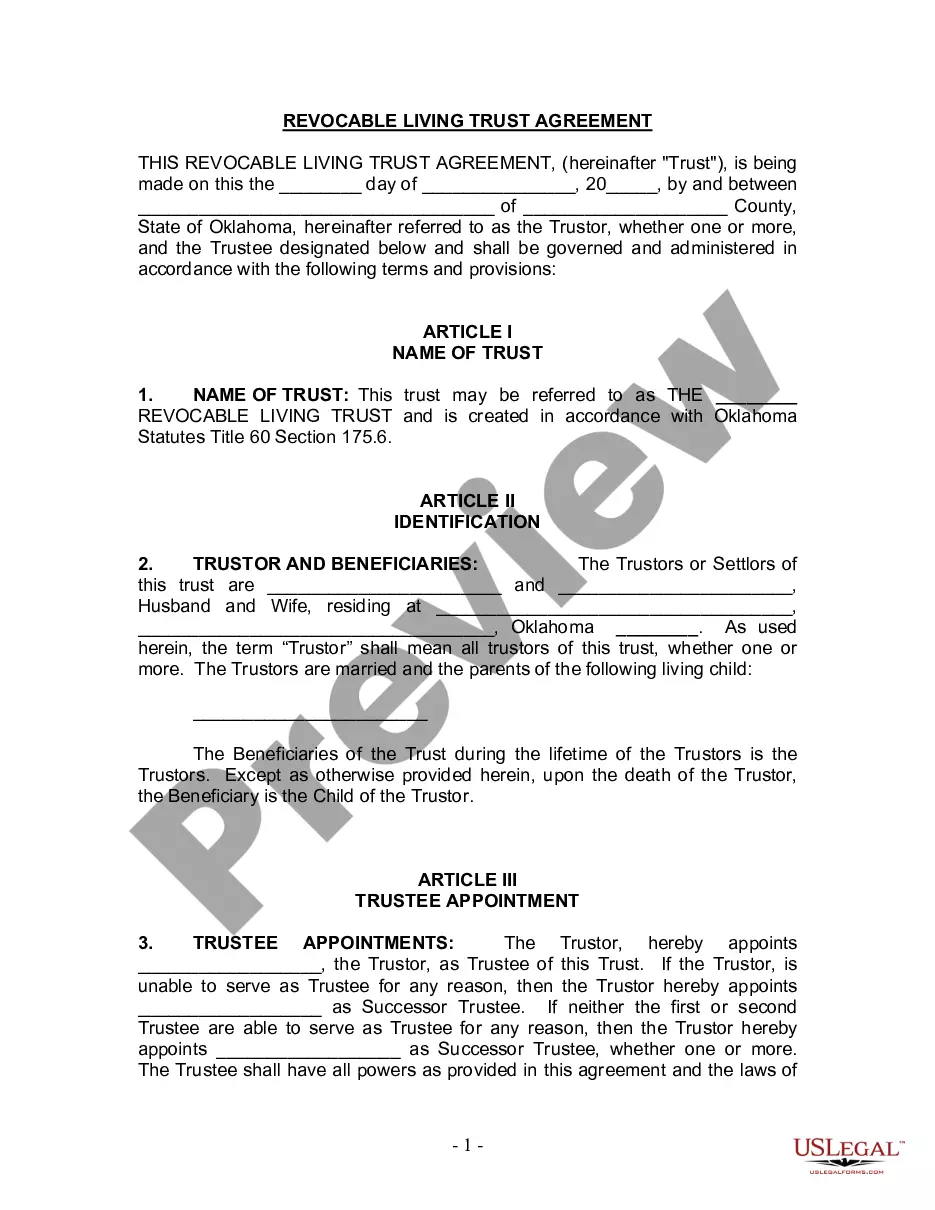

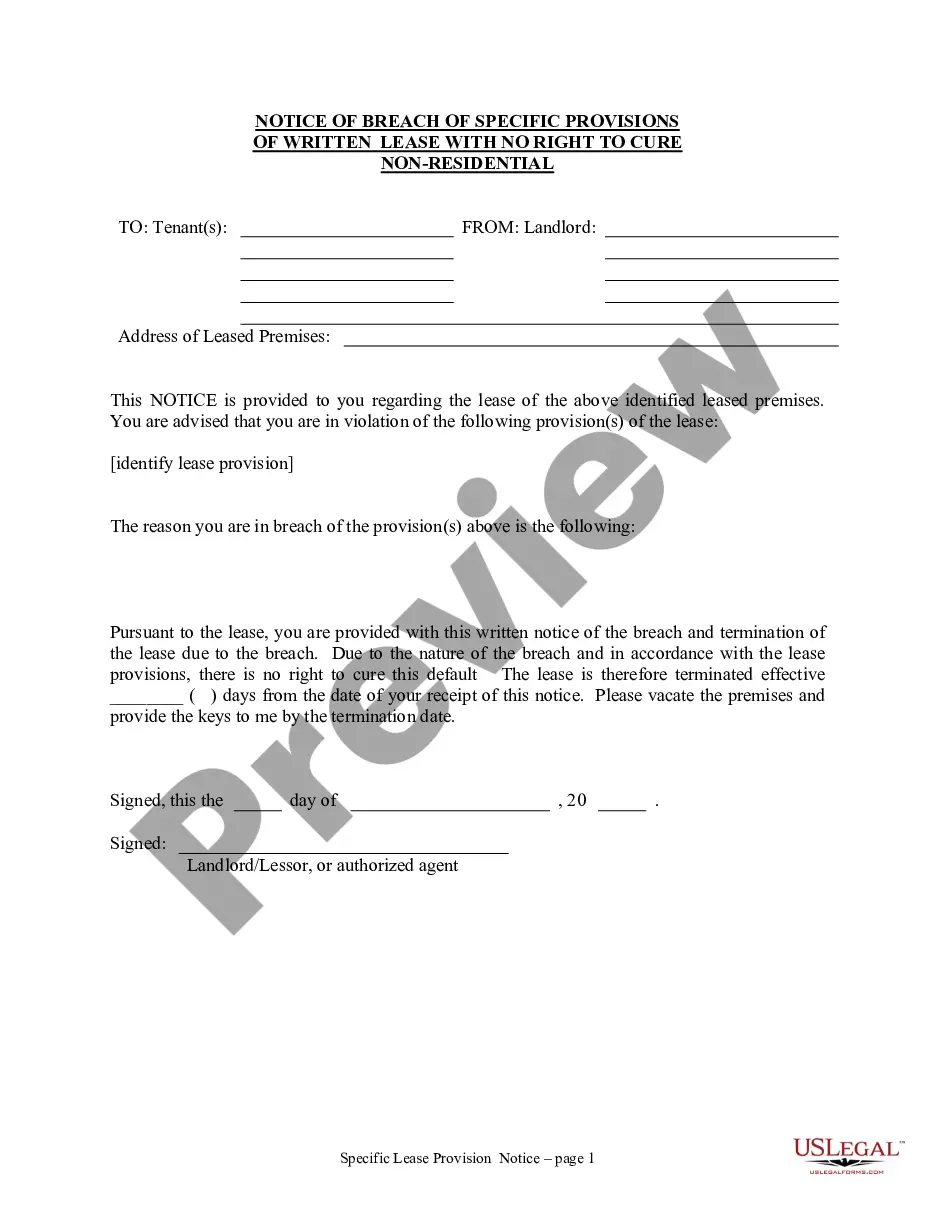

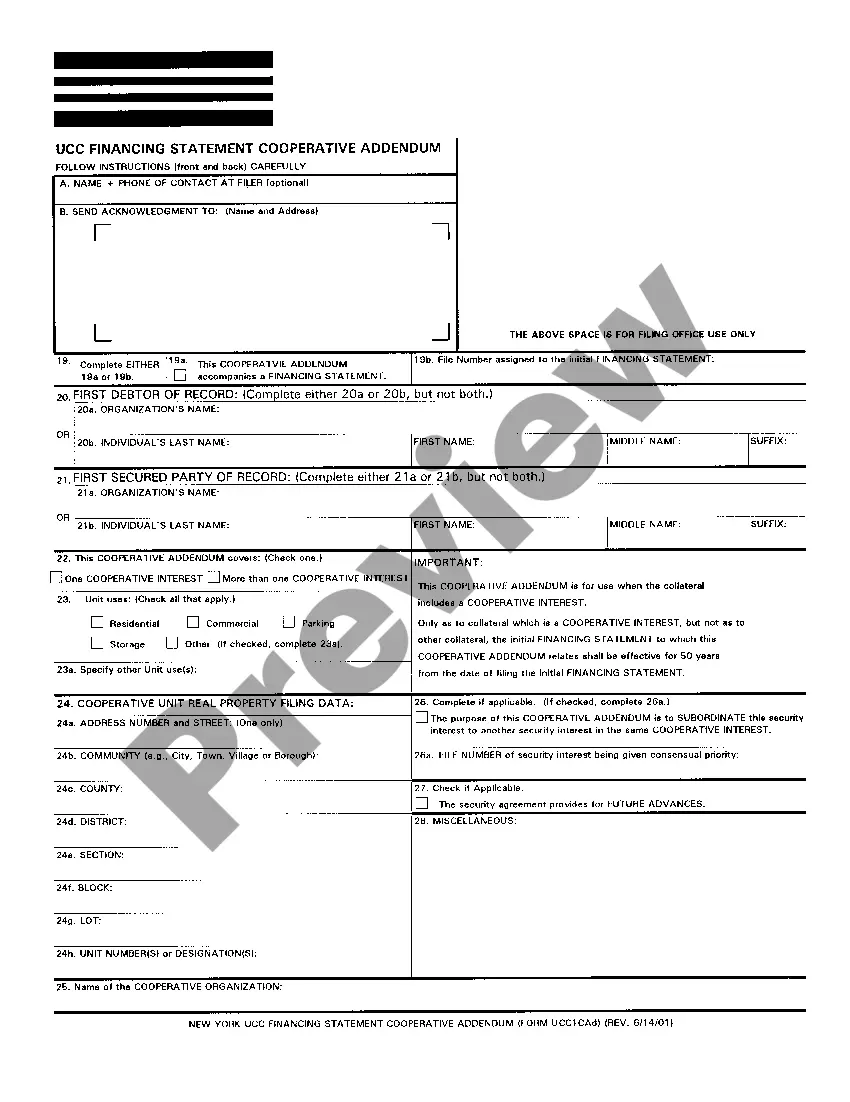

- Review the Preview mode and form description. Ensure you’ve selected the right one that fulfills your needs and completely aligns with your local jurisdiction prerequisites.

Form popularity

FAQ

While joint living trusts are common, separate living trusts may suit some couples. This arrangement can offer flexibility and individualized control over distinct assets. It can also be beneficial for estate tax planning and unique family situations. Ultimately, assessing your family's specific needs will help you decide if a Broken Arrow Oklahoma Living Trust for Husband and Wife with One Child is the best fit for you.

The best living trust for a married couple often combines both spouses' assets under one agreement, providing simplicity and direct management. A revocable living trust that addresses family and financial goals is typically ideal. This living trust allows for adjustments over time, accommodating the couple's evolving needs. Opting for a Broken Arrow Oklahoma Living Trust for Husband and Wife with One Child guarantees a smooth plan for asset distribution tailored to your family situation.

To place your home in a trust in Oklahoma, you must first create a living trust and clearly define your property within that document. After drafting the trust, execute a new deed transferring ownership from yourself to the trust. Remember to record the new deed with the county clerk to ensure the change is recognized legally. Utilizing a Broken Arrow Oklahoma Living Trust for Husband and Wife with One Child simplifies this process and ensures your home is handled per your wishes.

Husbands and wives may choose to establish separate trusts for various reasons. Individual trusts can provide tailored estate plans that fit distinct financial goals, such as protecting separate assets. Additionally, separate trusts can help in managing tax implications more effectively. Ultimately, pursuing a Broken Arrow Oklahoma Living Trust for Husband and Wife with One Child can ensure optimal asset distribution while respecting each partner's wishes.

In Oklahoma, a trust can be established to manage assets effectively for you and your loved ones. When creating a Broken Arrow Oklahoma Living Trust for Husband and Wife with One Child, couples must ensure the trust complies with state laws. This means that the trust document should be in writing, signed, and notarized. Additionally, it’s essential to specify how assets will be distributed to your child, providing clarity and protection for future generations.

One downfall of establishing a trust is the potential for inflexibility in asset management and distribution. A Broken Arrow Oklahoma Living Trust for Husband and Wife with One Child can restrict how and when assets are distributed, which could create issues if family circumstances change. It’s crucial to consider these limitations and plan carefully.

Yes, it is possible to set up a trust without an attorney in Oklahoma, but it may pose risks of errors or omissions. Using resources like US Legal Forms can simplify the process of establishing a Broken Arrow Oklahoma Living Trust for Husband and Wife with One Child, ensuring that all legal requirements are met properly. However, consulting with a legal expert is advisable for complex situations.

Whether your parents should place their assets in a trust depends on their specific financial goals and family dynamics. A Broken Arrow Oklahoma Living Trust for Husband and Wife with One Child can provide benefits like asset protection and streamlined wealth transfer. It’s best to explore this option together to determine if it aligns with their needs.

One significant mistake parents make is failing to communicate their intentions and trust details with their children. In the context of a Broken Arrow Oklahoma Living Trust for Husband and Wife with One Child, this lack of transparency can lead to confusion or disputes later on. Clear discussions can ensure that the family understands the trust’s purpose and operations.

Placing assets in a trust can limit your control over those assets. With a Broken Arrow Oklahoma Living Trust for Husband and Wife with One Child, you might face challenges if circumstances change, as you may need legal guidance to modify the trust. This situation can make flexibility more difficult than anticipated.