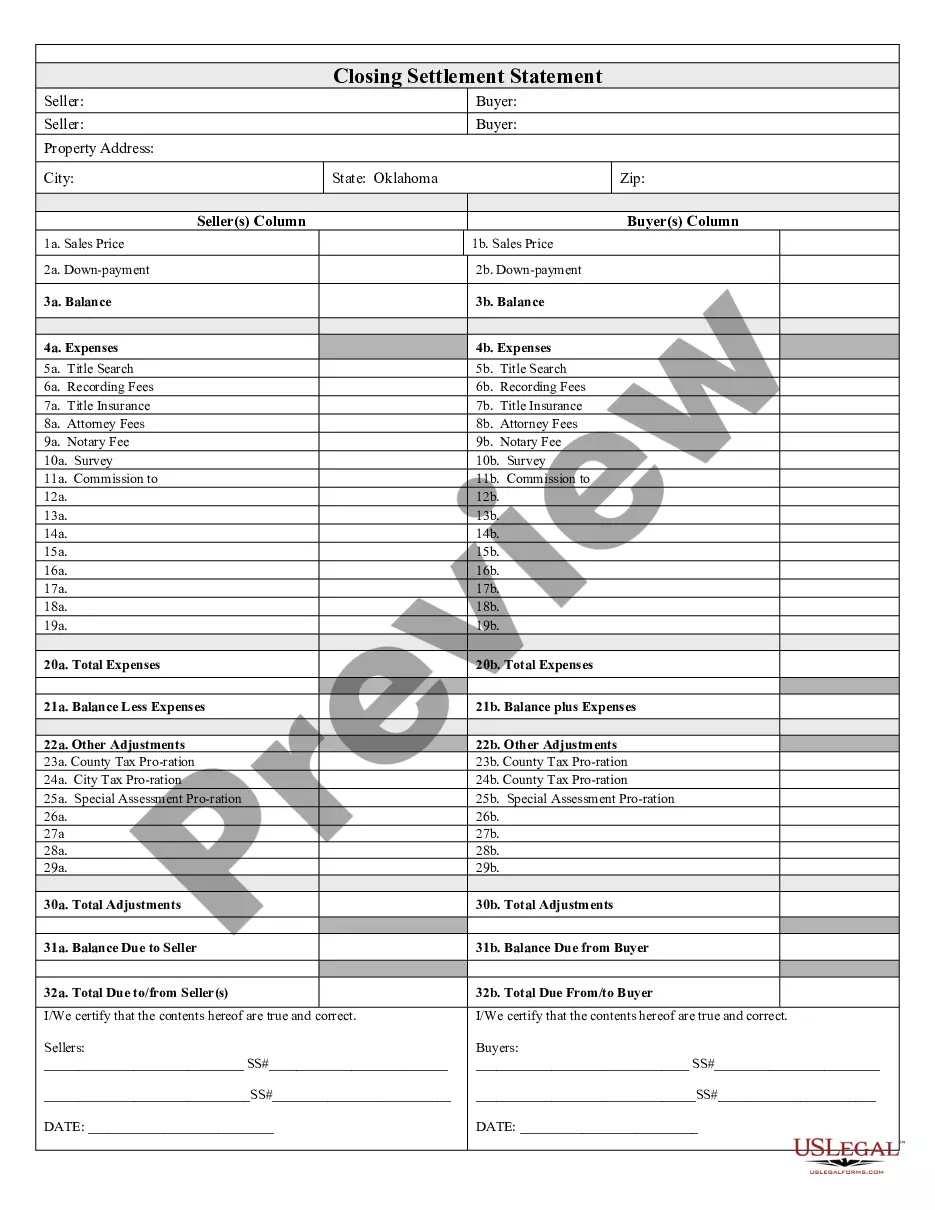

Oklahoma City Oklahoma Closing Statement

Description

How to fill out Oklahoma Closing Statement?

Regardless of your social or professional standing, completing legal forms is an unfortunate requirement in today’s society.

Too frequently, it’s nearly impossible for someone lacking any legal training to create this type of document from the ground up, primarily due to the intricate vocabulary and legal subtleties they contain.

This is where US Legal Forms proves to be useful.

However, if you are new to our service, please ensure to follow these instructions before obtaining the Oklahoma City Oklahoma Closing Statement.

Ensure that the template you choose is tailored to your locality as the regulations of one region are not applicable to another.

- Our platform provides an extensive selection with over 85,000 ready-to-utilize state-specific documents suitable for nearly any legal situation.

- US Legal Forms is also a valuable resource for associates or legal advisors seeking to enhance their efficiency using our DIY forms.

- Whether you need the Oklahoma City Oklahoma Closing Statement or any other documentation that is applicable in your region, US Legal Forms has all you need.

- Here's how to swiftly acquire the Oklahoma City Oklahoma Closing Statement using our reliable platform.

- If you’re already a member, you can simply Log In to your account to retrieve the required form.

Form popularity

FAQ

Initial Escrow Payment at Closing Initial Escrow Payment = 2-months of homeowner's insurance + 2-months property taxes.

A closing statement is a form used in a real estate transaction that includes an itemized list of all the buying or selling costs associated with that transaction. It's a standard element of home sales, especially those that involve mortgages, and refinancings.

Oklahoma: Oklahoma Law requires a real estate attorney to conduct your title examination, but that is only one small aspect of the transaction and will be included as part of your closing services. They are welcome but not required for all other aspects of the transaction.

Average Closing Price means the average of the closing market prices of the Units over the last five Market Days, on which transactions in the Units were recorded, immediately preceding the date of the Market Repurchase or, as the case may be, the date of the making of the offer pursuant to the Off-Market Repurchase,

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

According to data from ClosingCorp, the average closing cost in Oklahoma is $2,942.99 after taxes, or approximately 1.47% to 2.94% of the final home sale price....Closing cost stats in Oklahoma. DataValueAverage home sale price$100,000 to $200,000Average total closing cost$2,942.992 more rows ?

Closing costs in Oklahoma run, on average, $2,511 for a home loan of $134,618, according to a 2021 report by ClosingCorp, which provides research on the U.S. real estate industry. That price tag makes up 1.87 percent of the home's price tag.

Closing arguments are the opportunity for each party to remind jurors about key evidence presented and to persuade them to adopt an interpretation favorable to their position.

What Is a Closing Statement? A closing statement is a document that records the details of a financial transaction. A homebuyer who finances the purchase will receive a closing statement from the bank, while the home seller will receive one from the real estate agent who handled the sale.

Closing costs you can deduct in the year they're paid. Origination fees or points paid on a purchase. The IRS considers ?mortgage points? to be charges paid to take out a mortgage. They may include origination fees or discount points, and represent a percentage of your loan amount.