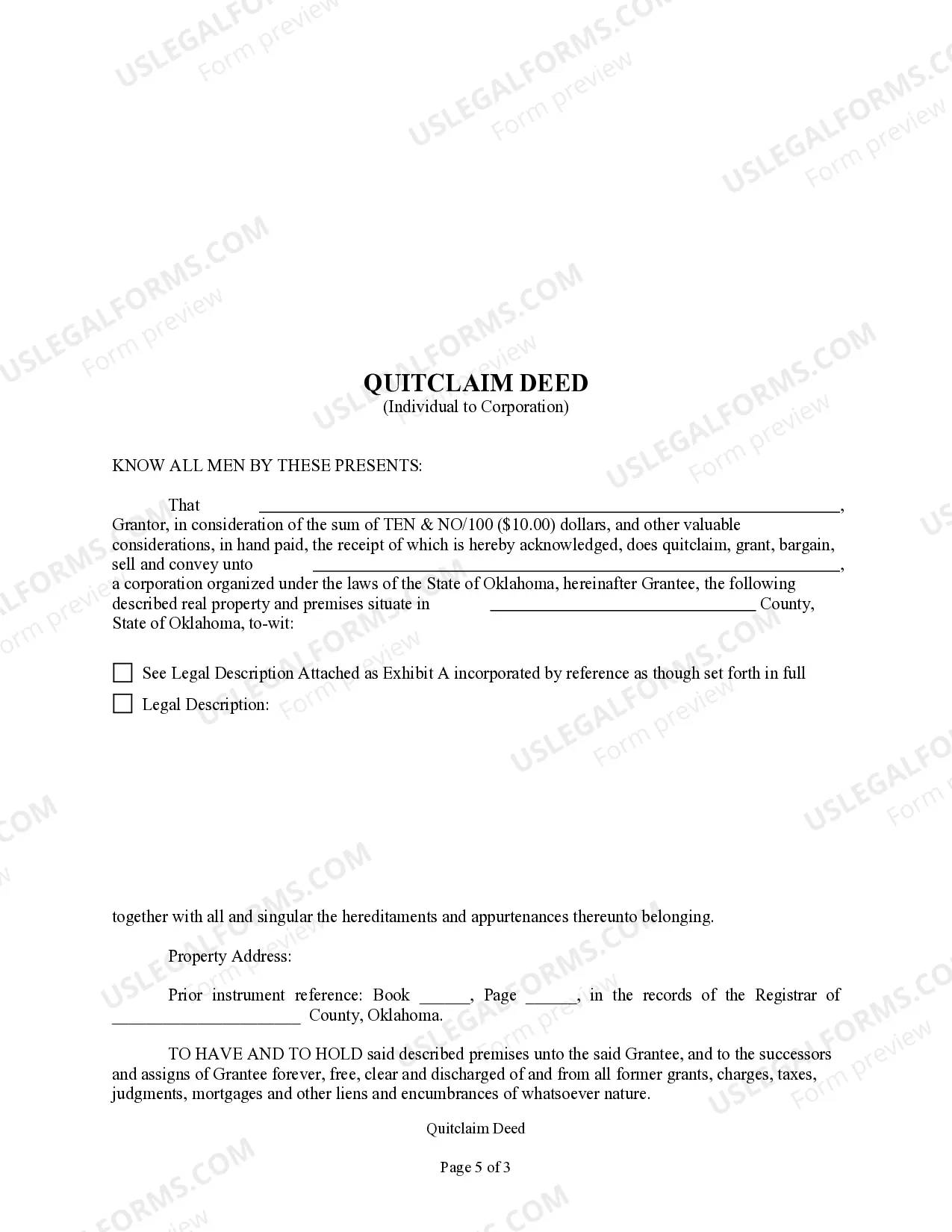

Oklahoma City Oklahoma Quitclaim Deed from Individual to Corporation

Description

How to fill out Oklahoma Quitclaim Deed From Individual To Corporation?

Obtaining validated templates tailored to your local regulations can be difficult unless you utilize the US Legal Forms repository.

It’s an online compilation of over 85,000 legal documents for both individual and business purposes and various real-world circumstances.

All forms are correctly categorized by area of application and jurisdiction, making it simple and swift to find the Oklahoma City Oklahoma Quitclaim Deed from Individual to Corporation.

Maintaining documentation organized and compliant with legal standards holds significant importance. Make use of the US Legal Forms library to always have crucial document templates readily available for any requirements!

- Examine the Preview mode and document description. Ensure you’ve selected the appropriate one that aligns with your requirements and adheres to your local jurisdiction's stipulations.

- Look for an alternative template, if necessary. If you detect any discrepancies, utilize the Search tab above to find the correct one. If it meets your needs, proceed to the following step.

- Buy the document. Click on the Buy Now button and choose the subscription option you wish. Creating an account is necessary to access the library's offerings.

- Complete your purchase. Provide your credit card information or utilize your PayPal account to pay for the service.

- Download the Oklahoma City Oklahoma Quitclaim Deed from Individual to Corporation. Store the template on your device to continue with its completion and have access to it in the My documents section of your profile whenever you need it again.

Form popularity

FAQ

A quitclaim deed effectively transfers whatever interest the current owner can transfer when signing the deed?including any interest that vests in the future. The new owner, though, cannot sue the current owner for breach of warranty if the transferred interest ends up being invalid or flawed.

§ 16) ? A quit claim deed must be filed with the local County Clerk's Office along with the required filing fee (varies by location). Signing (16 Okl.

What is the cost to file an Oklahoma deed? County clerks in Oklahoma charge $18.00 for recording a deed's first page and $2.00 for each additional page. Oklahoma also assesses a transfer fee?called a documentary stamp tax?that must be paid before the clerk will accept a non-exempt deed for recording.

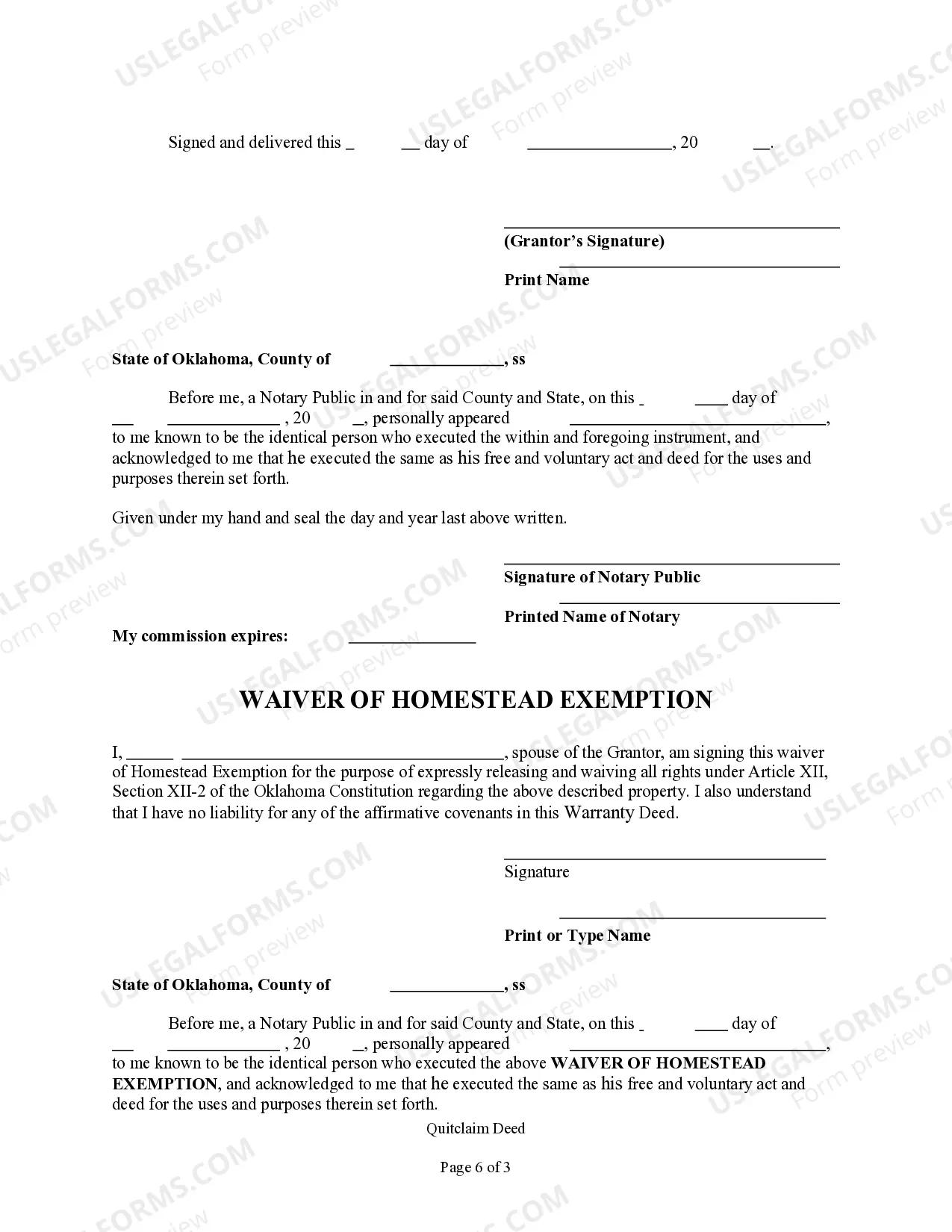

Per state law, an Oklahoma quitclaim deed must be in writing, describe the property, and be signed by the grantor. The grantor's signature must be acknowledged and the deed must be recorded. When recording the deed, you will need to pay a recording fee and a documentary stamp tax, which is a transfer tax.

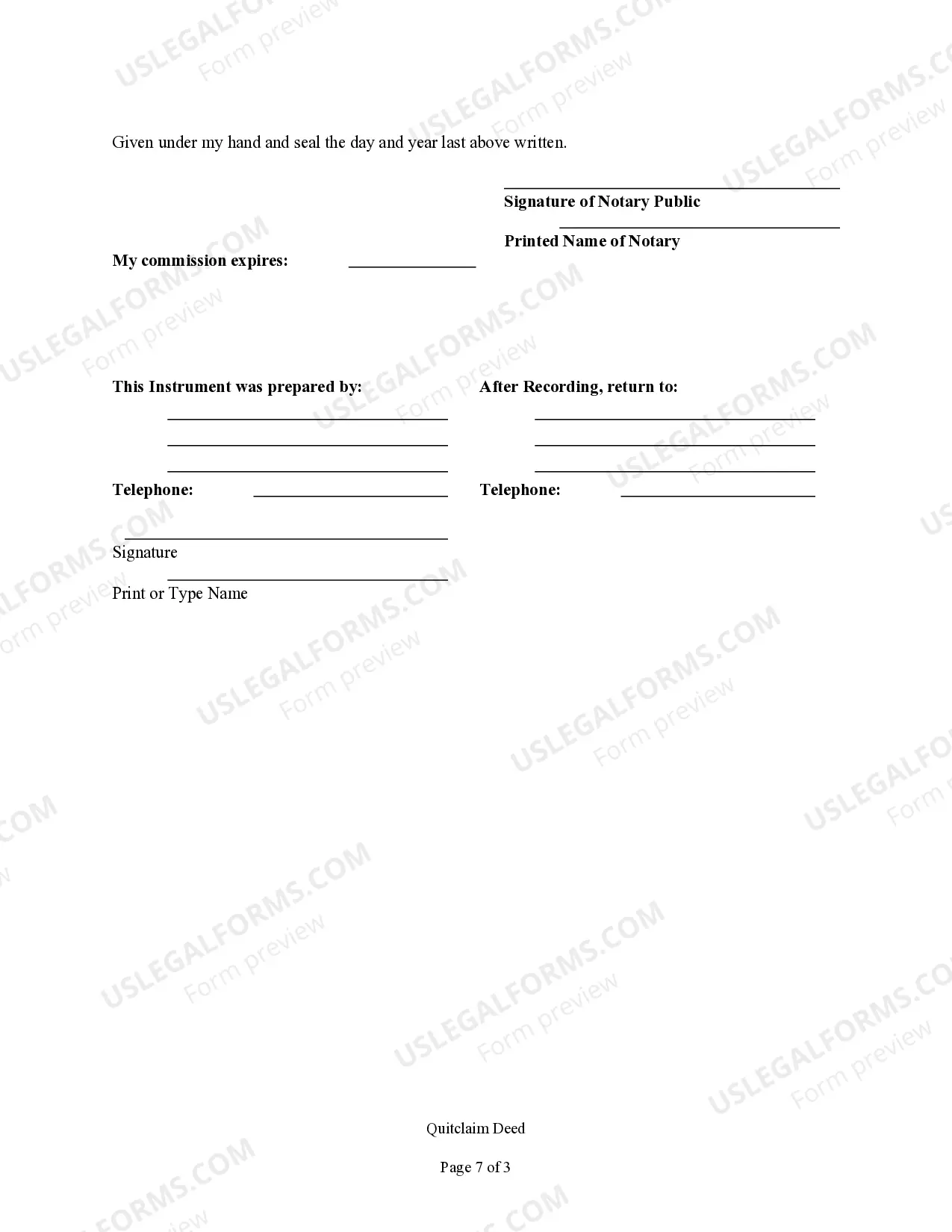

Recording. Oklahoma deeds are recorded with the registrar of deeds?part of the county clerk's office?of the county where the real estate is situated. If a parcel rests in more than one county, a certified copy of a deed recorded in one county may be recorded in other counties. Recording Fees.

Per state law, an Oklahoma quitclaim deed must be in writing, describe the property, and be signed by the grantor. The grantor's signature must be acknowledged and the deed must be recorded. When recording the deed, you will need to pay a recording fee and a documentary stamp tax, which is a transfer tax.

How to File a Quitclaim Deed Obtain a quitclaim deed form. Your very first step is obtaining your quitclaim deed.Fill out the quitclaim deed form.Get the quitclaim deed notarized.Take the quitclaim deed to the County Recorder's Office.File the appropriate paperwork.

Signing - According to Oklahoma State Law, the quitclaim deed must be signed by the selling party in the presence of a Notary Public (§ 16-26). Recording - All quitclaim deeds that have been notarized should be filed with the County Clerk's Office within the jurisdiction that the property falls under.

If the quitclaim deed has legal defects, those defects can invalidate the deed. If there's no challenge in the five years after the deed is filed, however, the defects no longer affect the deed's validity.