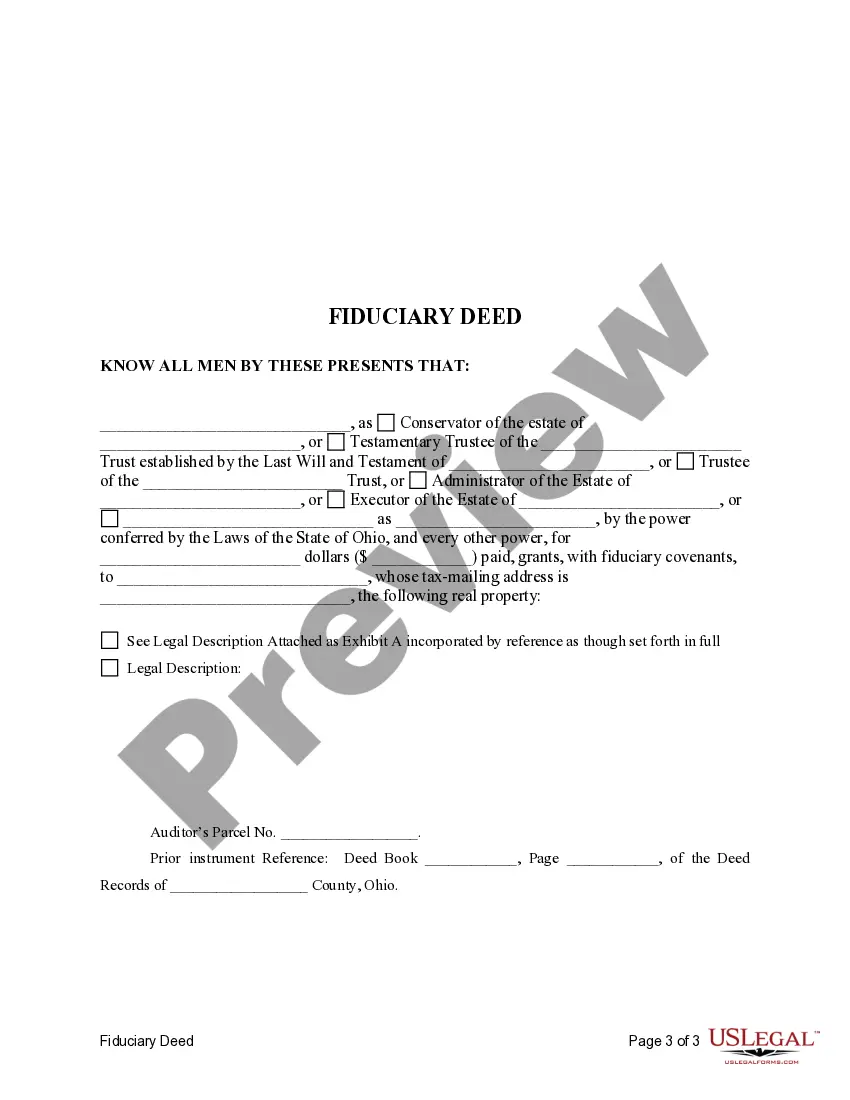

Franklin Ohio Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

How to fill out Ohio Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Regardless of your social or occupational position, finalizing legal documents is a regrettable requirement in the current professional landscape.

Frequently, it's almost unfeasible for someone without any legal education to produce this kind of documentation from the ground up, primarily due to the intricate jargon and legal nuances they involve.

This is where US Legal Forms proves to be beneficial.

Ensure the template you select is tailored to your jurisdiction since the regulations of one state or county may not apply to another.

Preview the document and read a brief overview (if available) of situations the form may be applicable to.

- Our platform provides an extensive collection of over 85,000 ready-made state-specific documents that are suitable for nearly any legal situation.

- US Legal Forms is also a valuable resource for associates or legal advisors who wish to save time by using our DYI forms.

- Whether you need the Franklin Ohio Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries or any other form that is recognized in your state or county, with US Legal Forms, everything is accessible to you.

- Here’s how you can acquire the Franklin Ohio Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries in minutes using our reliable platform.

- If you are already a registered user, you can simply Log In to your account to obtain the necessary document.

- However, if you are unfamiliar with our platform, be sure to follow these instructions before securing the Franklin Ohio Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries.

Form popularity

FAQ

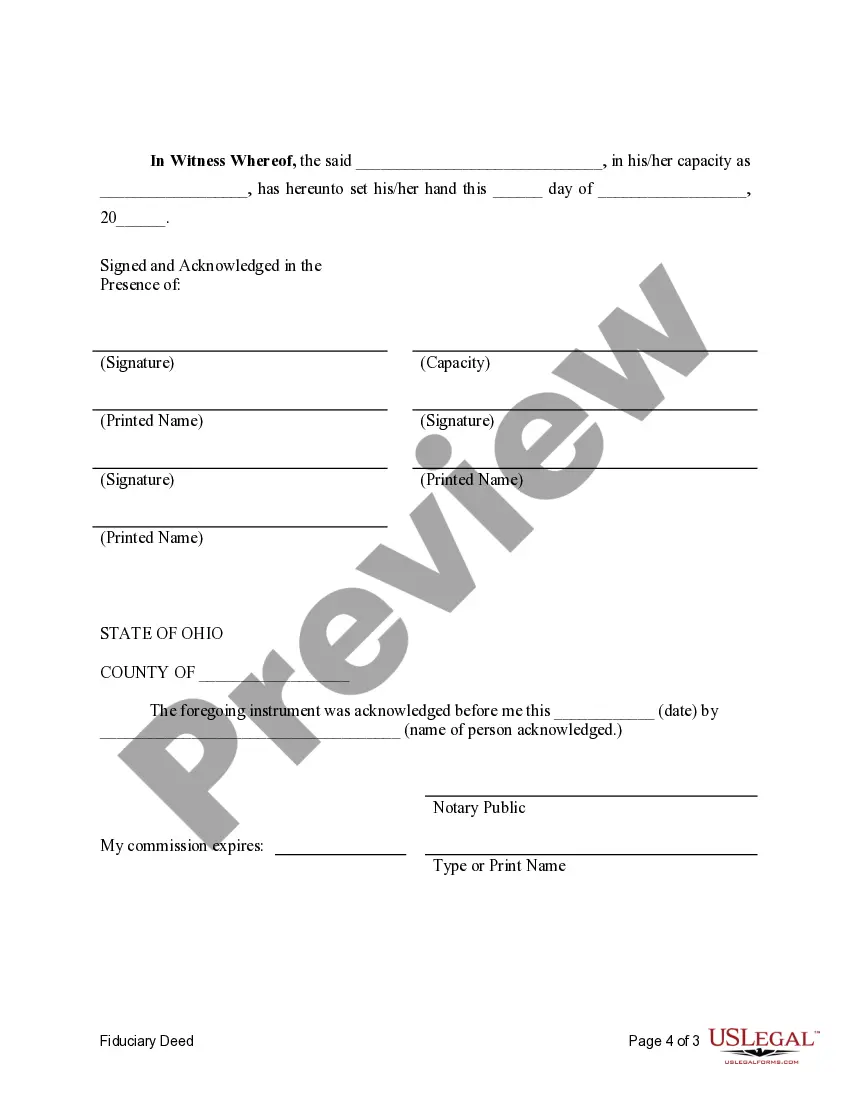

In Ohio, a deed must be recorded to provide official notice of its existence, which can protect the rights of the parties involved. While a Franklin Ohio Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries remains valid even if unrecorded, recording is essential for legal effectiveness. It helps prevent disputes over property ownership and secures your interests by creating a public record. To ensure proper handling of your fiduciary responsibilities, consider using USLegalForms to easily create and manage your Franklin Ohio Fiduciary Deed.

Transferring a property deed from a deceased relative in Ohio involves several steps, including locating the original deed and understanding the estate's status. First, you need to gather important documents, such as the death certificate and the will, if applicable. Then, you may need to fill out a Franklin Ohio Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries, which allows you to transfer property to beneficiaries. If you're unsure about the process, consider using platforms like USLegalForms to guide you through the necessary legal documents and ensure compliance with local laws.

A fiduciary deed in Ohio is a legal document that allows fiduciaries, such as executors or trustees, to transfer property on behalf of an estate or trust. This deed confirms the transfer is made under their authority and assures that duties are conducted transparently. It is important for fiduciaries to understand how to execute these deeds properly to avoid legal issues. If you need assistance, consider using uslegalforms to navigate the Franklin Ohio Fiduciary Deed process for Executors, Trustees, Trustors, Administrators, and other Fiduciaries.

In Ohio, an executor transfers property by following the instructions laid out in the deceased's will. They typically use an executor's deed to officially convey the property to the intended beneficiaries. This process often involves filing necessary documents with the county recorder's office to ensure proper legal standing. Utilizing resources like uslegalforms can provide valuable guidance on submitting the required forms for a Franklin Ohio Fiduciary Deed for Executors, Trustees, Trustors, Administrators, and other Fiduciaries.

An administrator's deed is used when a person dies without a will, allowing the appointed administrator to transfer property. In contrast, an executor's deed is issued by an executor named in a will to convey property according to the decedent's wishes. Both deeds serve crucial roles in the estate settlement process, but they differ based on whether a will exists. Understanding these differences is essential for anyone dealing with a Franklin Ohio Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries.

A fiduciary deed is a legal document that allows a fiduciary, such as an Executor, Trustee, or Administrator, to transfer property as part of their duties. In Franklin Ohio, this type of deed ensures that the property transfer is conducted in accordance with the law, providing a clear and efficient process. Understanding how fiduciary deeds function can help ensure that you meet all necessary legal obligations as you manage estates.

In Ohio, a quitclaim deed is often less reliable compared to other types of deeds, especially for transferring an interest in property. For fiduciaries looking to execute a property transfer, using a Franklin Ohio Fiduciary Deed is essential, as it is specifically designed to ensure legal clarity and validity. It’s important to know which deeds are recognized to avoid complications in estate transactions.

Yes, you can prepare your own deed in Ohio; however, it is advisable to understand the legal requirements involved. Using a Franklin Ohio Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries can ensure that all necessary provisions are met. If you are unsure, consider consulting with a legal expert or using a platform like uslegalforms to simplify the process.

Fiduciary ownership refers to a situation where one party, the fiduciary, holds legal title to property for the benefit of another party, the beneficiary. In Franklin Ohio, fiduciary deeds are commonly used by Executors, Trustees, Trustors, Administrators, and other Fiduciaries to efficiently manage and transfer property. It's crucial to understand this concept, as it impacts how property is handled in estate planning and administration.