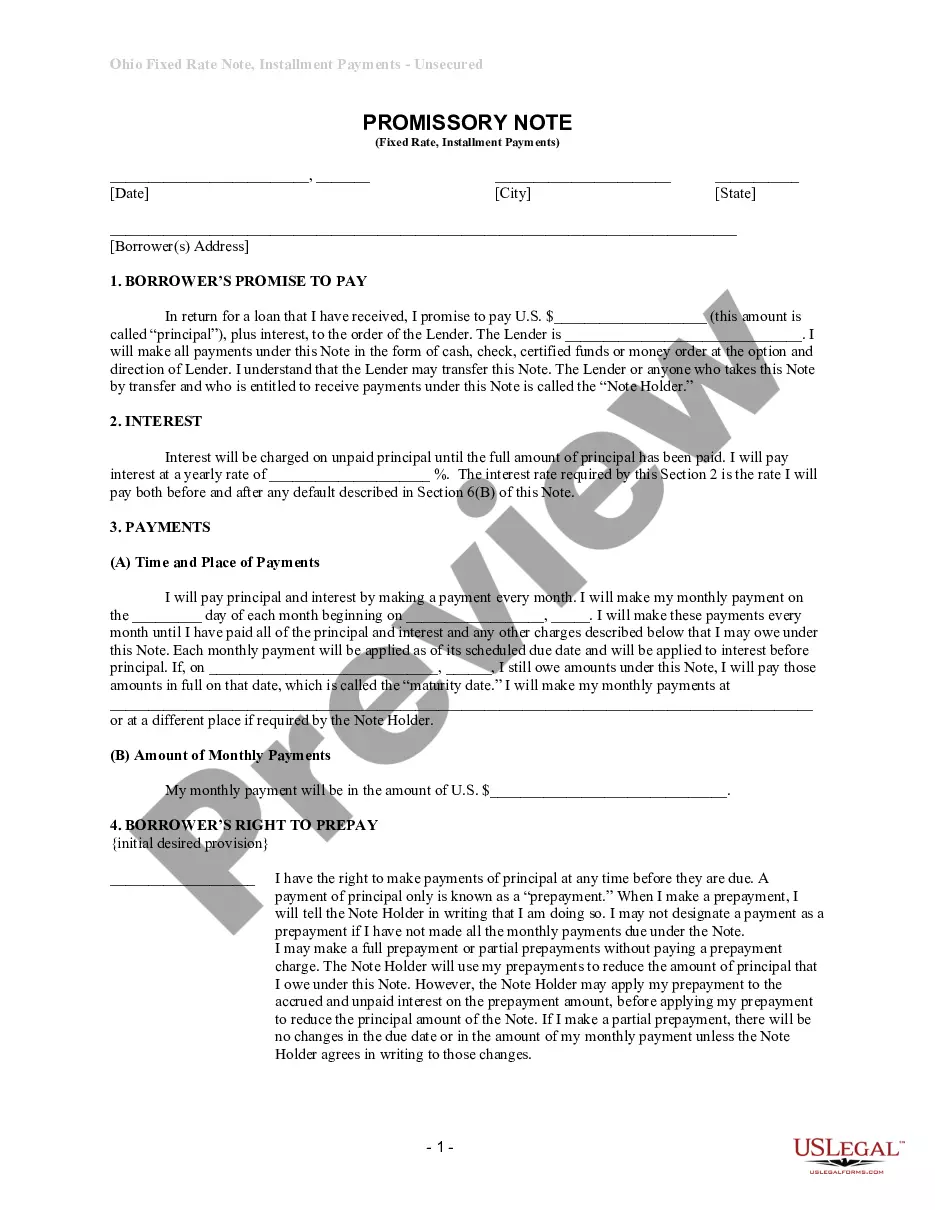

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Columbus Ohio Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Ohio Unsecured Installment Payment Promissory Note For Fixed Rate?

Regardless of social or occupational standing, filling out legal documents is a regrettable obligation in today’s work landscape. Oftentimes, it is nearly impossible for an individual without any legal training to draft such papers from scratch, largely due to the intricate language and legal nuances they entail. This is where US Legal Forms steps in to help.

Our platform provides a vast assortment of more than 85,000 ready-to-use state-specific forms suitable for almost any legal circumstance. US Legal Forms is also a valuable resource for associates or legal advisors who want to maximize their efficiency by using our DYI forms.

Whether you require the Columbus Ohio Unsecured Installment Payment Promissory Note for Fixed Rate or any other document appropriate for your state or region, US Legal Forms makes everything easily accessible. Here’s how to swiftly obtain the Columbus Ohio Unsecured Installment Payment Promissory Note for Fixed Rate using our reliable platform. If you are currently an existing client, feel free to Log In to your account to download the necessary form.

You're all set! Now you can print the document or fill it out online. If you encounter any issues finding your purchased documents, you can easily locate them in the My documents section.

No matter what issue you're aiming to resolve, US Legal Forms has you covered. Try it out today and discover its benefits.

- Ensure that the form you have identified is tailored to your locale as the regulations of one state or area do not apply to another.

- Review the document and look over a brief summary (if available) of situations in which the document can be utilized.

- If the document you selected does not meet your requirements, you can restart your search for the correct form.

- Click Buy now and select the subscription plan that best fits your needs.

- Enter your account Log In details or register for a new account.

- Choose a payment method and proceed to download the Columbus Ohio Unsecured Installment Payment Promissory Note for Fixed Rate once payment is completed.

Form popularity

FAQ

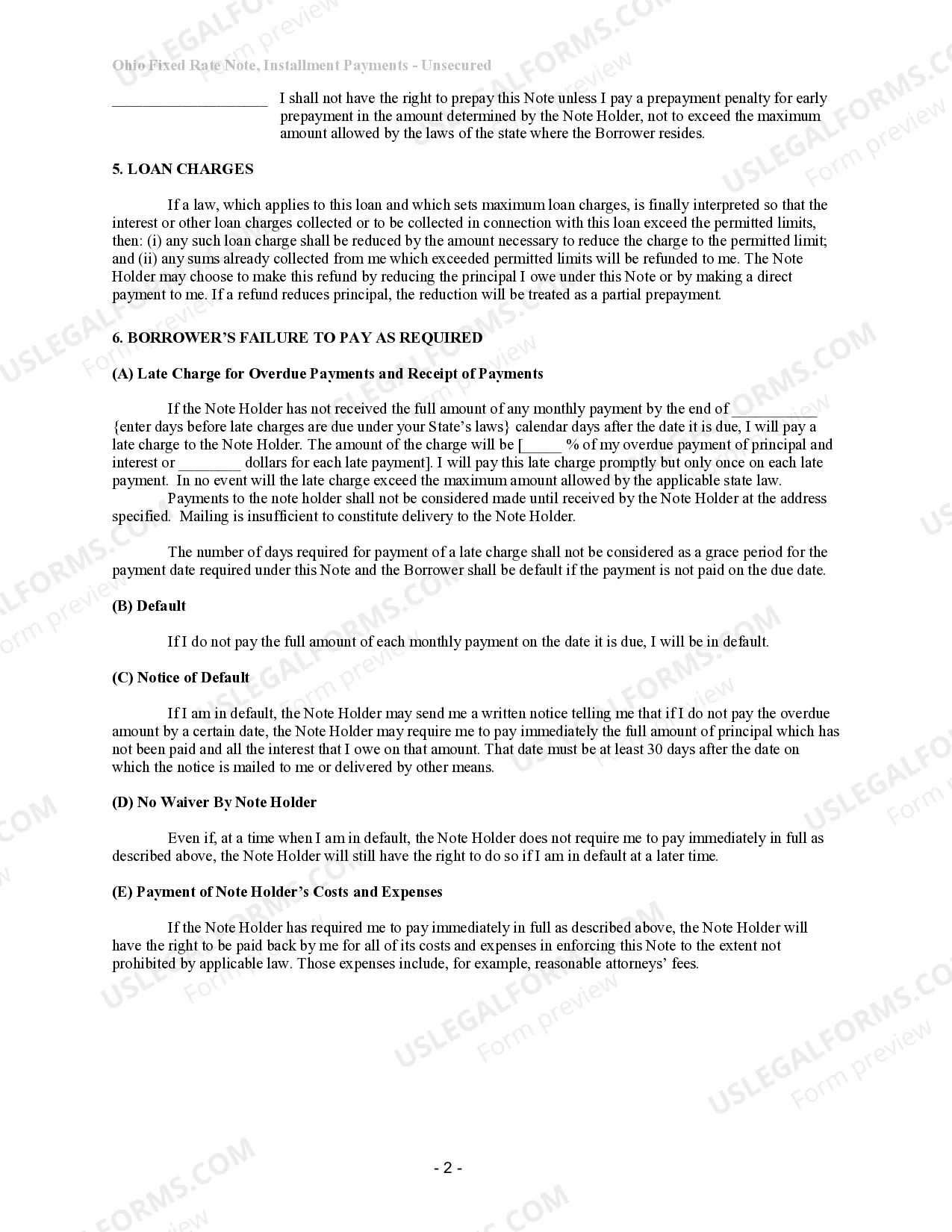

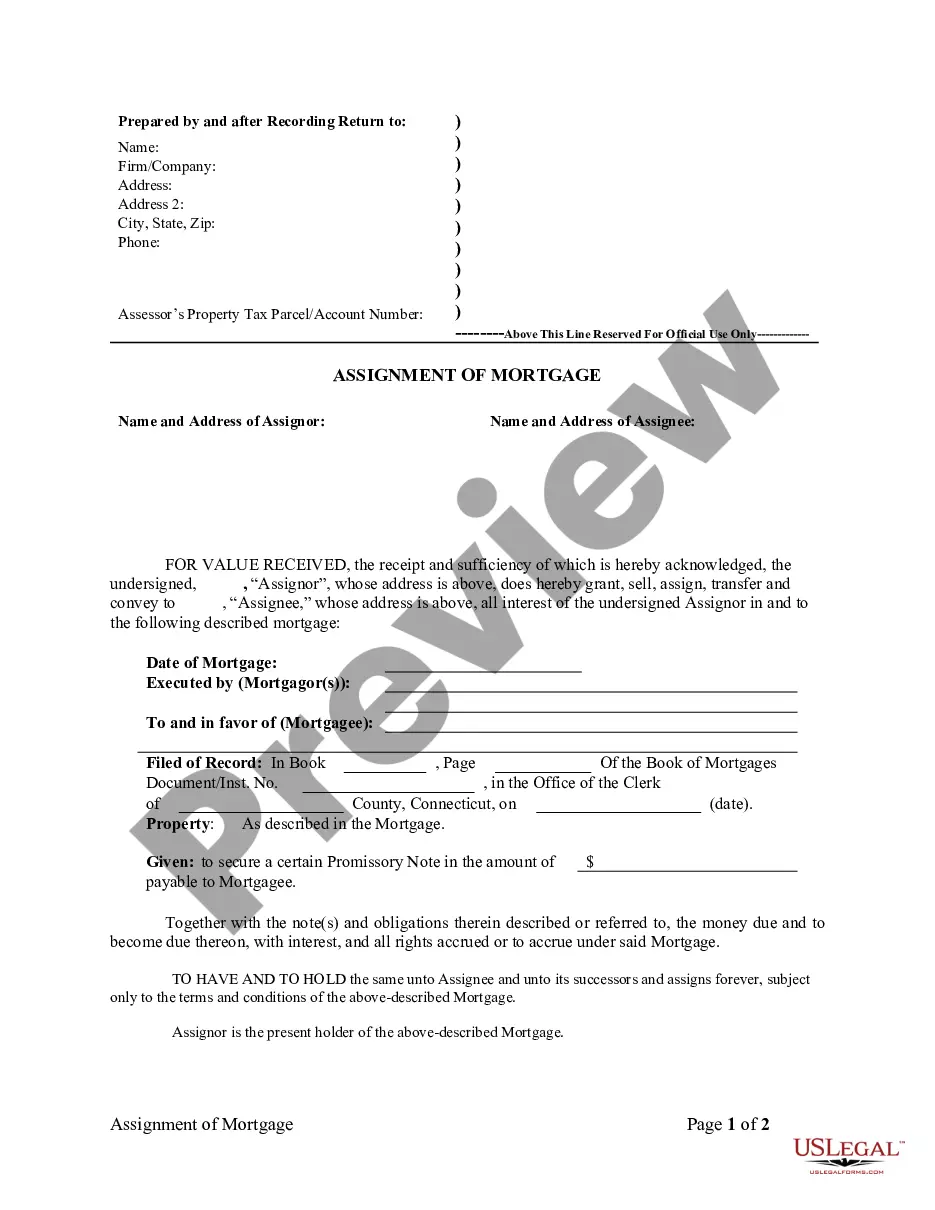

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.

An installment note is a form of promissory note calling for payment of both principal and interest in specified amounts, or specified minimum amounts, at specific time intervals. This periodic reduction of principal amortizes the loan.

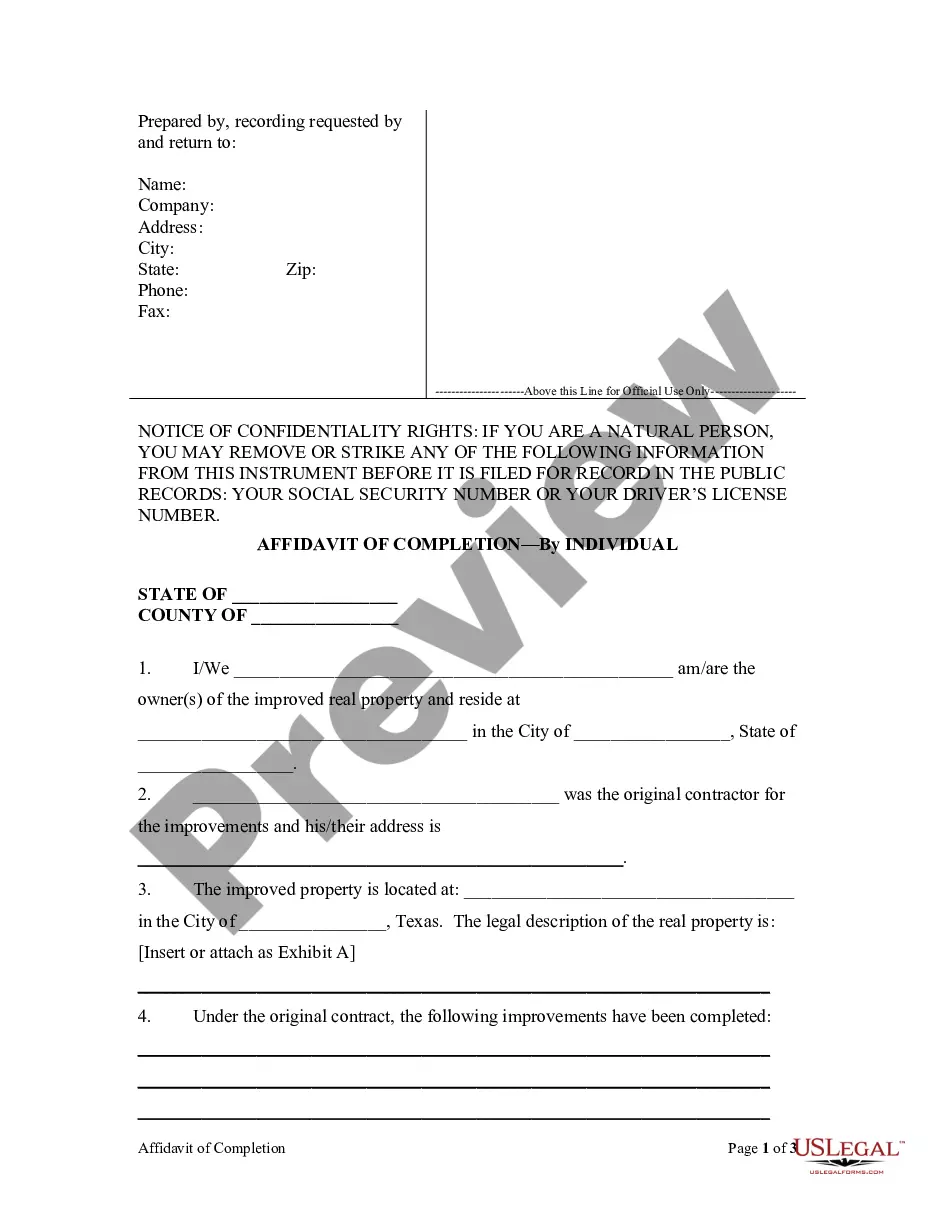

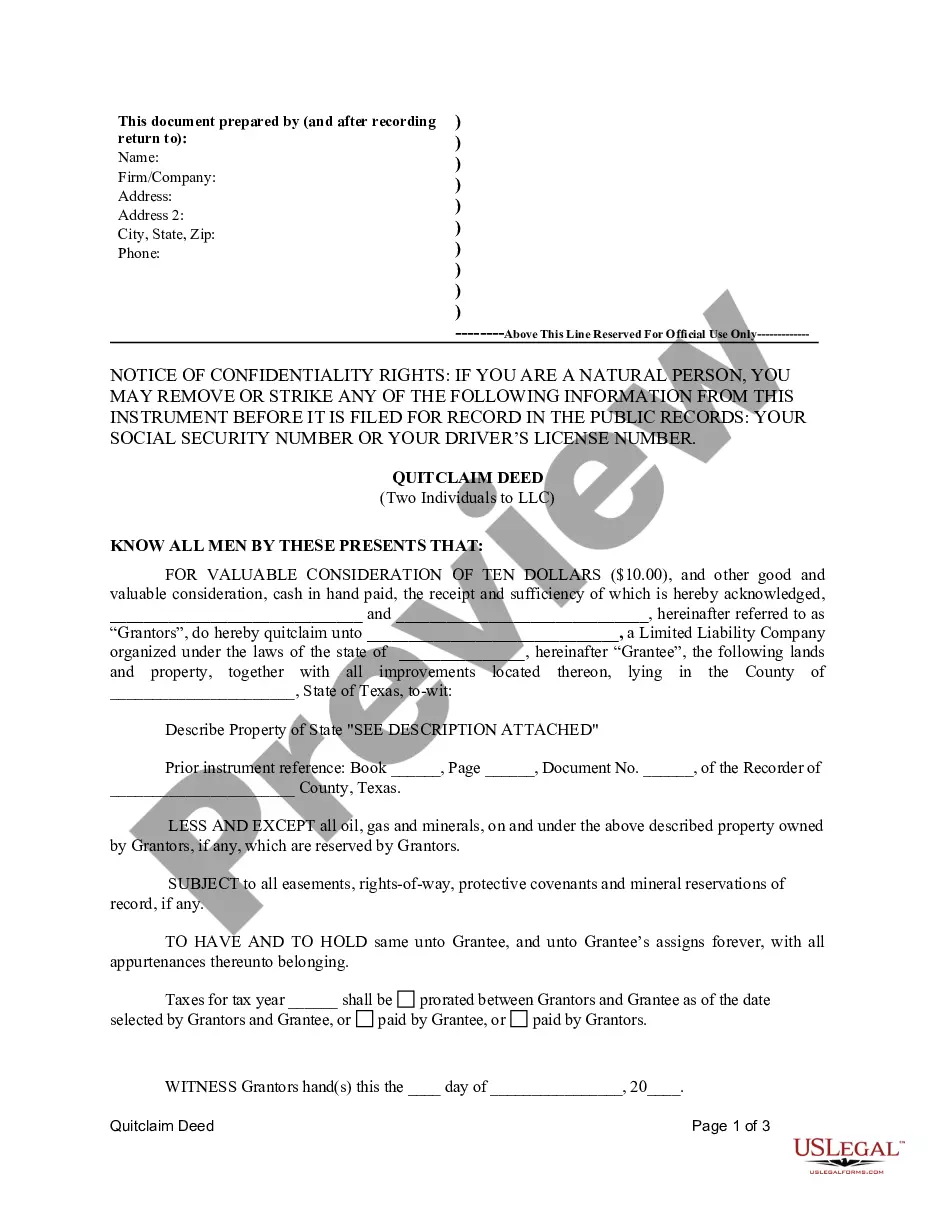

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

Collecting on an unsecured promissory note through the courts is a two-step process. First, you need to go through the court process to obtain a judgment against the borrower. Then you need to try to attach the borrower's wages, bank accounts, or other assets in order actually get paid.

Based on discussions with professionals who buy and sell notes, the market rate of return for a privately held note typically ranges from 12% for a well collateralized note with a strong payment history to 25% for an uncollateralized note.

If you are borrowing money from a lending institution, they will have someone on staff who creates a promissory note. However, if you need a promissory note for a personal loan or a loan between friends and family, you can contact a lawyer or financial professional to help you create a promissory note.

Unsecured Promissory Notes An unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.

Anyone lending money can issue a promissory note (like home sellers, credit unions, FinTech solutions, and nonmortgage-related banks, for instance) but specific to real estate and the mortgage process, promissory notes serve as an agreement that the borrower will repay their mortgage loan by the maturity date.

An unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan. If the payor does not have sufficient assets, the payee is out of luck.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.