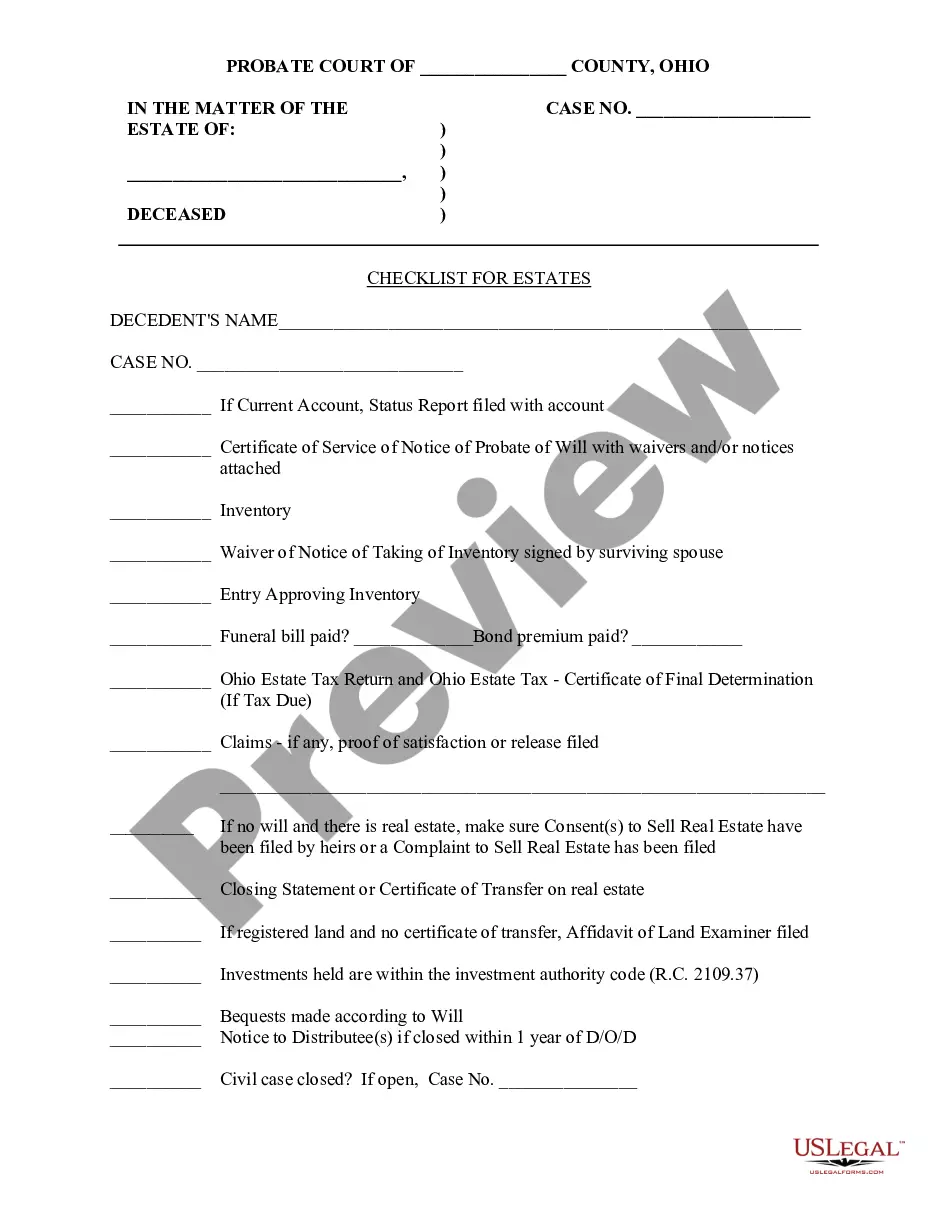

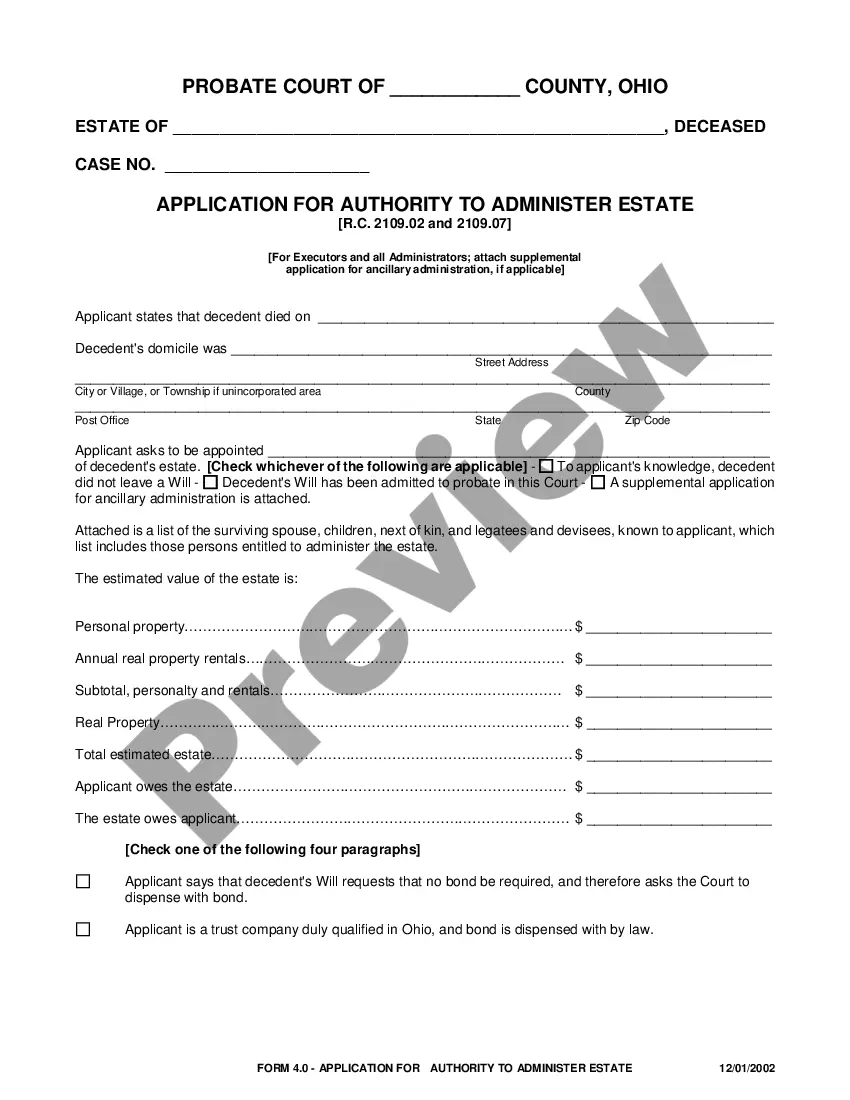

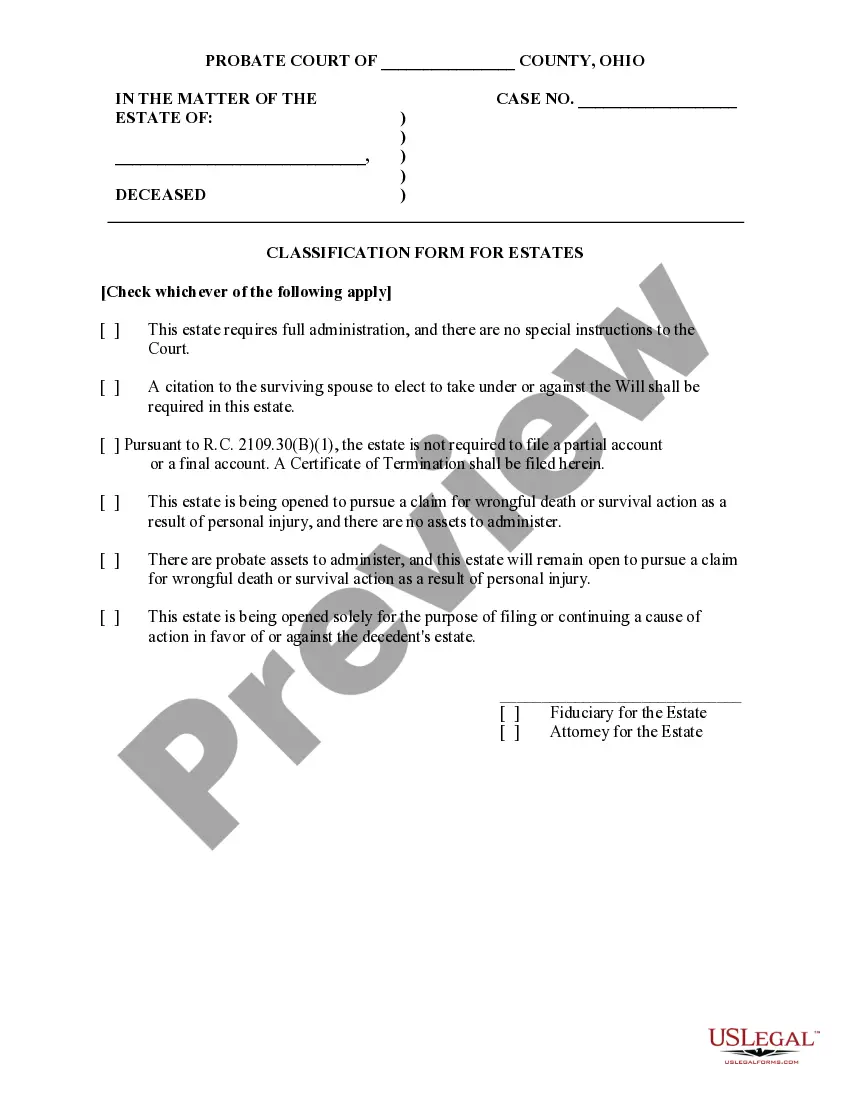

This sample form is a Classification Form for Estates document for use in the administration of a decendent's estate in Ohio. Adapt to fit your circumstances. Available in Word, Wordperfect, Rich Text and ASCII formats.

Columbus Ohio Classification Form for Estates

Description

How to fill out Ohio Classification Form For Estates?

Utilize the US Legal Forms and gain instant access to any document you need.

Our helpful website with numerous templates enables you to discover and acquire nearly any document sample you require.

You can save, complete, and validate the Columbus Ohio Classification Form for Estates in just a few minutes rather than searching the internet for hours looking for a suitable template.

Using our catalog is an excellent method to enhance the security of your form submissions.

If you haven’t created a profile yet, follow the steps outlined below.

Access the page with the template you need. Verify that it is the template you intended to find: check its title and description, and utilize the Preview option when available.

- Our knowledgeable attorneys routinely review all the documents to guarantee that the templates are suitable for a specific area and comply with new laws and regulations.

- How can you access the Columbus Ohio Classification Form for Estates? If you already possess a profile, simply Log In to your account.

- The Download button will be available on all the samples you examine.

- Also, you can retrieve all your previously saved documents in the My documents section.

Form popularity

FAQ

It must occur either six months after the decedent's death or two months after the cause of the action ensues, whichever is later.

How Are Claims Against Ohio Estates Made? To the administrator or executor of the estate in a writing; To the administrator or executor of the estate in a writing and to the probate court by filing a copy of the writing with the court; or.

Executor fees in Ohio are set by statute.: 4% of the first $100,000 of probate assets; 3% of the next $300,000; and 2% of the assets above $400,000. In addition, there may be a fee of 1% on non-probate assets (except assets in survivorship, for which there can be no fee).

No probate at all is necessary if the estate is worth less than $5,000 or the amount of the funeral expenses, whichever is less. In that case, anyone (except the surviving spouse) who has paid or is obligated to pay those expenses may ask the court for a summary release from administration.

Starting from the date of death, the executors have 12 months before they have to start distributing the estate. This allows time to gather information on the estate and check for potential claims. The executors have no obligation to distribute the estate before the end of the year.

If the executor or administrator distributes any part of the assets of the estate within three months after the death of the decedent, the executor or administrator shall be personally liable only to those claimants who present their claims within that three-month period.

Claims must be filed within 3 months of the decedent's death. 2117.06(B): If any creditors (people to whom the decedent owed money) want to make a claim against the estate, this code explains that they must present them within six months after the decedent's death.

Claims against the estate may be made up to six months from the date of death. A small estate that does not require the filing of a federal estate tax return and has no creditor issues often can be settled within six months of the appointment of the executor or administrator.