Cuyahoga Ohio Conveyance of Overriding Royalty Interest

Description

How to fill out Ohio Conveyance Of Overriding Royalty Interest?

We consistently strive to diminish or avert legal repercussions when addressing intricate law-related or financial issues.

To achieve this, we seek out legal services that, as a standard, tend to be quite expensive.

Nonetheless, not all legal issues are similarly complicated. The majority of them can be managed by ourselves.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Simply Log In to your account and press the Get button adjacent to it. If you happen to misplace the form, you can always re-download it from the My documents tab. The procedure is just as simple if you’re unfamiliar with the website! You can establish your account in just a few minutes. Ensure to verify if the Cuyahoga Ohio Conveyance of Overriding Royalty Interest aligns with the laws and regulations of your state and area. Moreover, it’s essential that you review the form’s outline (if available), and if you observe any inconsistencies with what you were initially seeking, look for a different form. Once you’ve confirmed that the Cuyahoga Ohio Conveyance of Overriding Royalty Interest is appropriate for you, you can select the subscription plan and proceed to payment. Then you can download the form in any compatible format. For over 24 years of our existence in the market, we’ve assisted millions of individuals by providing ready-to-customize and current legal documents. Utilize US Legal Forms now to conserve effort and resources!

- Our platform enables you to take control of your issues without relying on legal advice.

- We offer access to legal document templates that are not always publicly available.

- Our templates are specific to states and regions, which significantly streamlines the search process.

- Benefit from US Legal Forms whenever you wish to locate and obtain the Cuyahoga Ohio Conveyance of Overriding Royalty Interest or any other document effortlessly and securely.

Form popularity

FAQ

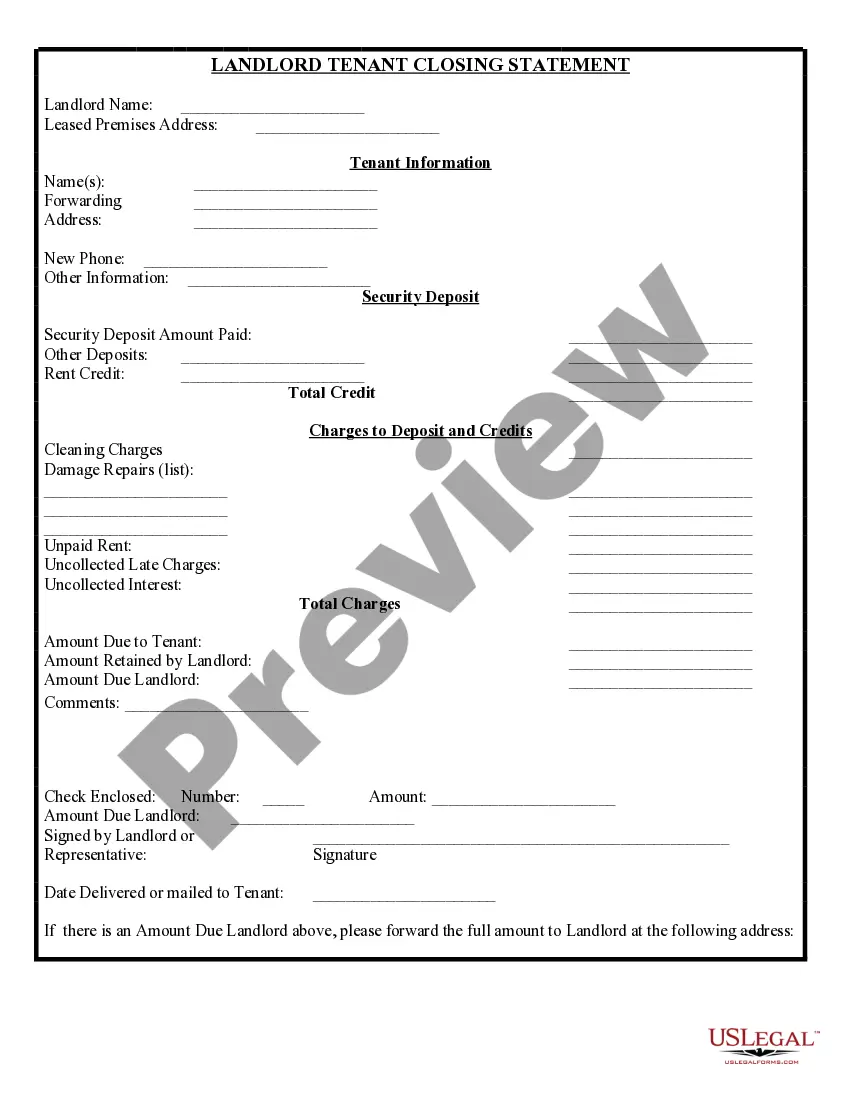

In Cuyahoga, Ohio, the seller typically pays the transfer tax at closing. However, both parties can negotiate this responsibility. Understanding who pays the transfer tax is crucial during the Cuyahoga Ohio Conveyance of Overriding Royalty Interest process. If you need assistance, our US Legal Forms platform provides resources to help you navigate these requirements smoothly.

The key difference between overriding royalty interest and royalty interest lies in ownership rights. Royalty interest is generally tied to ownership of the mineral rights, whereas overriding royalty interest is granted from another party's lease. Understanding this distinction is essential when dealing with the Cuyahoga Ohio Conveyance of Overriding Royalty Interest, as it impacts how revenue is shared. Leveraging resources like uslegalforms aids in clarifying these terms and crafting effective agreements.

An override interest refers to the right to receive a percentage of revenue from production, similar to a royalty but typically not linked to ownership of the mineral rights. When considering the Cuyahoga Ohio Conveyance of Overriding Royalty Interest, it is important to understand its function in allowing parties to benefit from extraction activities. This interest represents a financial investment and can significantly influence the profitability of energy ventures. Using uslegalforms can help you navigate these complex agreements effectively.

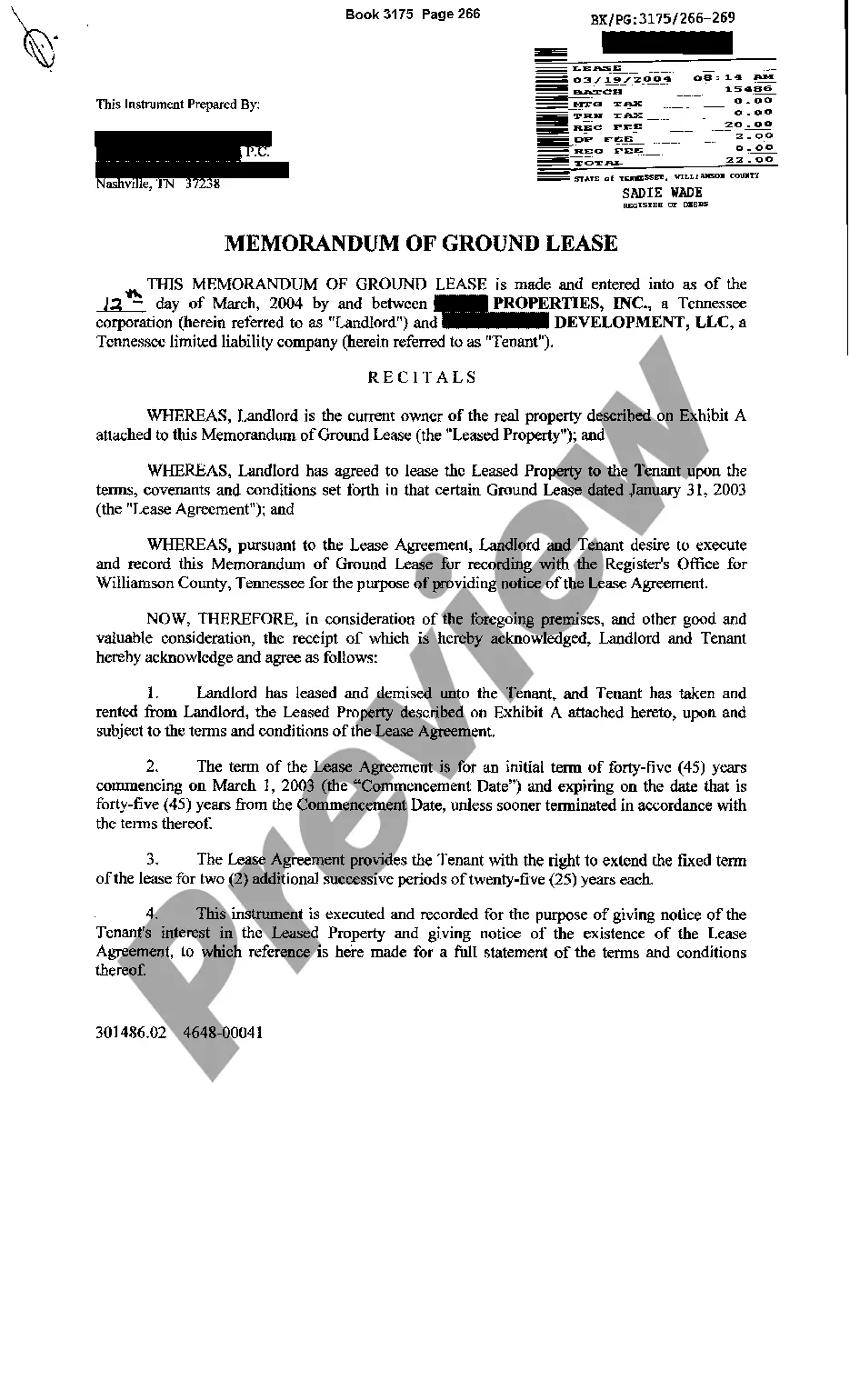

To file a deed in Cuyahoga County, you must go to the Cuyahoga County Recorder’s Office. This office manages all property-related documents, including those related to the Cuyahoga Ohio Conveyance of Overriding Royalty Interest. Make sure to bring your completed deed and any required identification and fees. For an easy and efficient filing experience, consider utilizing UsLegalForms, which provides the necessary templates and instructions.

In Ohio, quitclaim deeds are filed with the county recorder's office where the property is located. For those dealing with the Cuyahoga Ohio Conveyance of Overriding Royalty Interest, ensuring proper filing is vital for recording your interest legally. You can visit the office in person or submit the deed by mail in compliance with local guidelines. UsLegalForms can assist you with the required documentation and filing instructions.

Yes, generally, you receive a copy of your deed at closing. However, the original deed, which is important for the Cuyahoga Ohio Conveyance of Overriding Royalty Interest, is usually recorded with the county. It’s a good idea to request copies for your records to keep them with other important documents. If you need clarity on this process, UsLegalForms offers resources to help you navigate it efficiently.

In Ohio, anyone can draft a deed, but it’s often best to have a qualified attorney handle the preparation to ensure all legal requirements are met. This is especially important in cases involving the Cuyahoga Ohio Conveyance of Overriding Royalty Interest, as the correct terms and descriptions are crucial. Using a knowledgeable professional can help avoid potential issues down the line. If you're looking for assistance, UsLegalForms can provide templates and guidance.

A royalty override is a legal arrangement whereby a property owner permits another party to extract resources while retaining certain rights to royalties. This is especially relevant in Cuyahoga Ohio Conveyance of Overriding Royalty Interest, as it helps landowners benefit from resource activities without incurring upfront costs. This arrangement can create additional revenue streams while maintaining ownership of the underlying property. It's a practical approach for strategic financial planning.

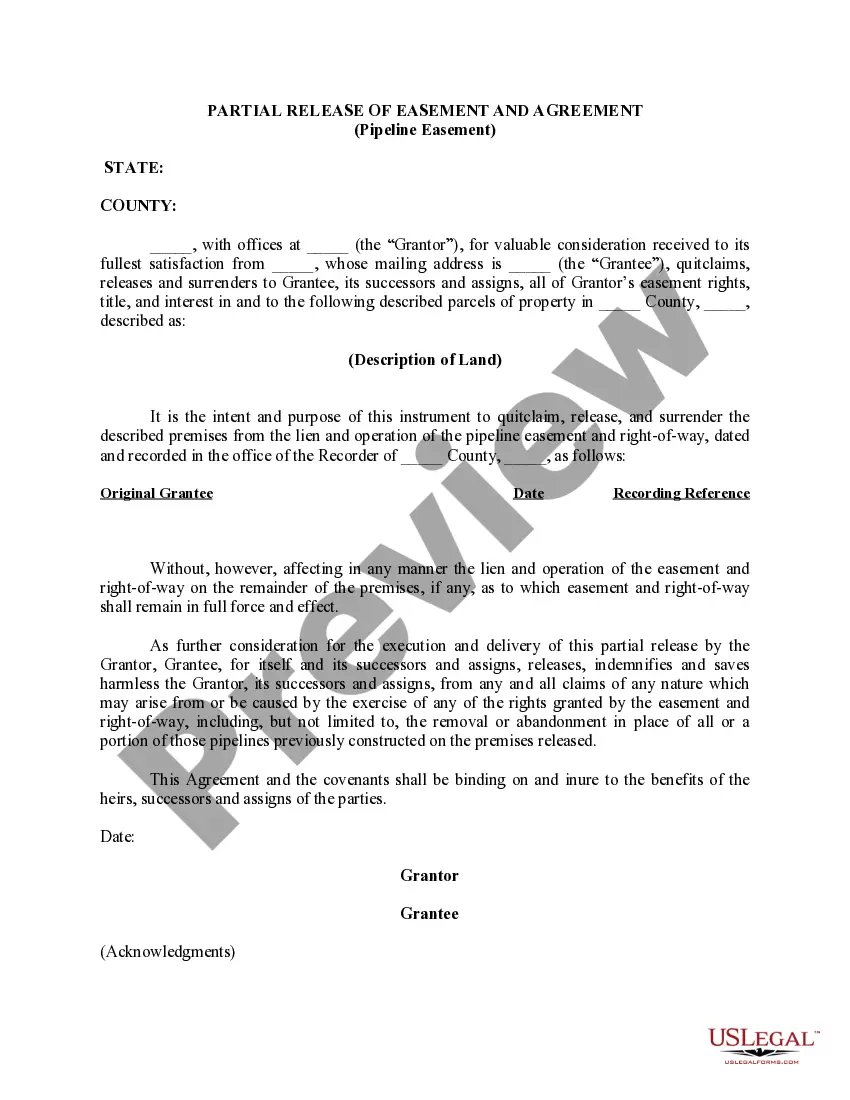

Transferring overriding royalty interest typically involves drafting a legal document that specifies the details of the transfer. In the context of Cuyahoga Ohio Conveyance of Overriding Royalty Interest, it's crucial to ensure all parties agree on the terms and that the transfer complies with local regulations. Platforms like USLegalForms can provide templates and guidance to help streamline this process. Clarity in this transfer protects everyone's rights and interests.

The gross overriding royalty refers to the total percentage of revenue allocated to the holder without deducting costs. It is calculated before any production expenses or costs are taken into account, which makes it a lucrative opportunity for those involved in Cuyahoga Ohio Conveyance of Overriding Royalty Interest. This type of royalty allows for potential higher payouts, especially when production is strong. Understanding its implications can enhance your financial strategy.