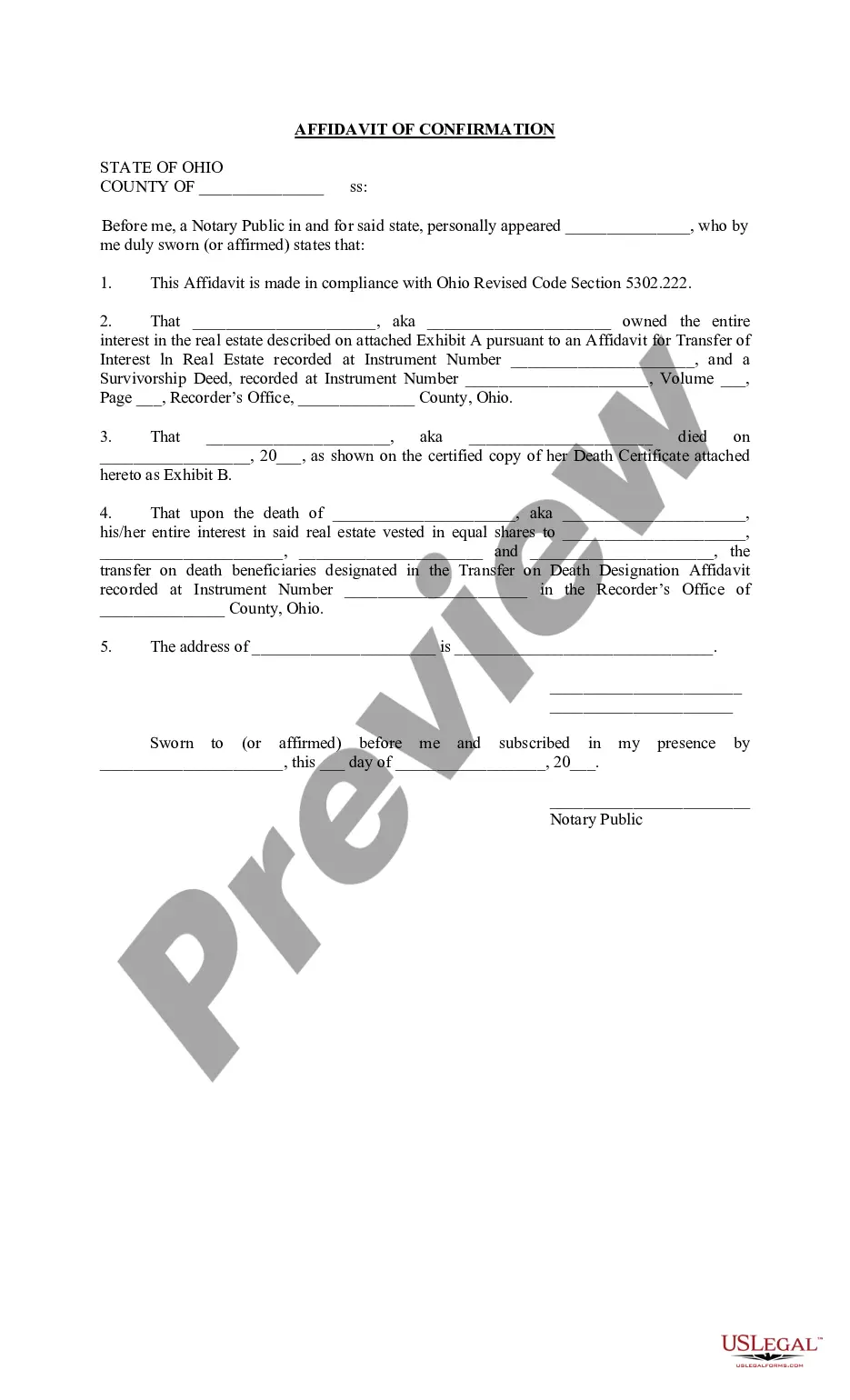

Cuyahoga Ohio Affidavit of Confirmation

Description

How to fill out Ohio Affidavit Of Confirmation?

If you are looking for a legitimate form, it’s challenging to discover a superior service than the US Legal Forms website – one of the most extensive online collections.

Here you can acquire a vast array of templates for business and personal use by categories and states, or keywords.

Utilizing our premium search function, locating the latest Cuyahoga Ohio Affidavit of Confirmation is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Receive the form. Select the file format and download it to your device.

- Moreover, the applicability of each document is validated by a group of proficient lawyers who regularly inspect the templates on our site and amend them according to the latest state and county requirements.

- If you are already familiar with our platform and possess an account, all you need to obtain the Cuyahoga Ohio Affidavit of Confirmation is to Log In to your profile and select the Download option.

- If you are using US Legal Forms for the first time, just follow the instructions below.

- Ensure you have located the form you require. Review its description and utilize the Preview feature to view its contents. If it doesn’t fit your requirements, utilize the Search option at the top of the page to find the necessary document.

- Verify your selection. Choose the Buy now option. After that, select your desired pricing plan and provide your information to create an account.

Form popularity

FAQ

An affidavit of confirmation is a written declaration that attests to the accuracy of certain facts, often related to personal identity. In the case of a Cuyahoga Ohio Affidavit of Confirmation, it specifically addresses the confirmation of an individual's name. This legal document is essential in various situations to maintain clarity and legitimacy in identification.

A confirmation affidavit is a legal document that confirms specific information about an individual, typically regarding their identity or name. In the context of a Cuyahoga Ohio Affidavit of Confirmation, it serves to affirm that the individual is recognized by their current name in legal matters. This affidavit ensures transparency and reduces confusion in legal transactions.

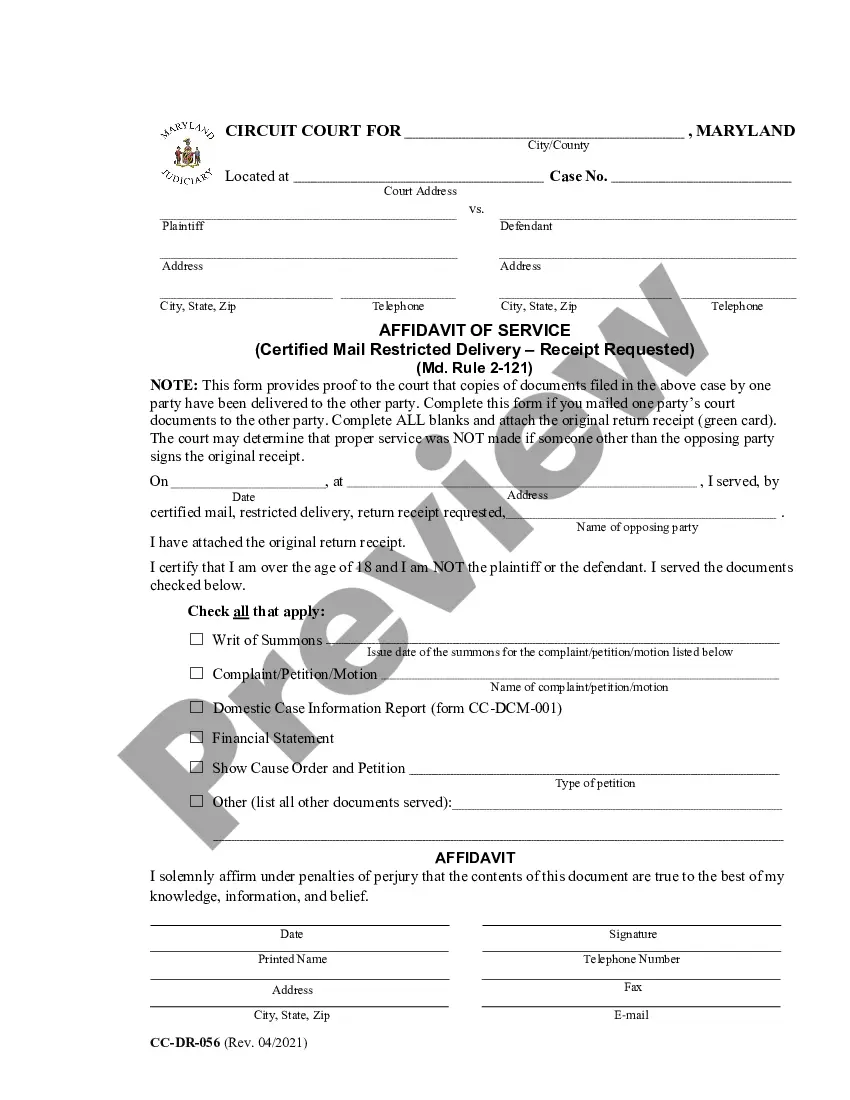

You can obtain a Transfer on Death (TOD) form in Ohio from several sources, including your local county recorder's office or through legal service providers. It is often advisable to use platforms like USLegalForms, which offer easy access to forms specific to your needs, such as the Cuyahoga Ohio Affidavit of Confirmation. Ensure you check the latest regulations and requirements when acquiring your forms.

The primary purpose of the Cuyahoga Ohio Affidavit of Confirmation is to provide clarity and verification regarding a person's name. This document is crucial in legal situations, such as court proceedings or financial transactions, where proper identification is required. By having this affidavit, individuals can avoid potential disputes related to their identity.

A Cuyahoga Ohio Affidavit of Confirmation is a legal document that verifies an individual's name. It is often used in various legal settings to confirm identity, especially when there are changes or discrepancies in names. The affidavit serves as a formal declaration, ensuring that all relevant parties recognize the individual by their confirmed name.

You do not necessarily need a lawyer to execute a transfer on death deed in Ohio, as the process is designed to be straightforward. However, consulting a legal professional can provide clarity and ensure that all documents, including the Cuyahoga Ohio Affidavit of Confirmation, are completed accurately. This extra step can save time and prevent potential issues in the future.

Filling out an Affidavit of inheritance involves providing details about the deceased and the heirs. You will need to gather information such as names, addresses, and relationship to the deceased. The Cuyahoga Ohio Affidavit of Confirmation can be a helpful tool in ensuring that you complete the affidavit correctly and meet all legal requirements.

To file an affidavit of survivorship in Ohio, you need to prepare the document that identifies the deceased owner and the survivor(s). This affidavit should then be filed with the county recorder where the property is located. Utilizing the Cuyahoga Ohio Affidavit of Confirmation can streamline this process and verify ownership effectively.

Filling out a transfer on death affidavit requires personal information about the deceased and the beneficiary. You will need to specify the property being transferred and provide necessary legal documentation. Using the Cuyahoga Ohio Affidavit of Confirmation, you can simplify the process and ensure all details are correct, making it easier to manage the asset transfer.

Yes, a transfer on death designation typically allows assets to transfer directly to a beneficiary without triggering inheritance tax in Ohio. By utilizing a TOD arrangement, you simplify the process of asset distribution following a passing. However, it's crucial to consult a tax professional to understand specific implications for your situation.