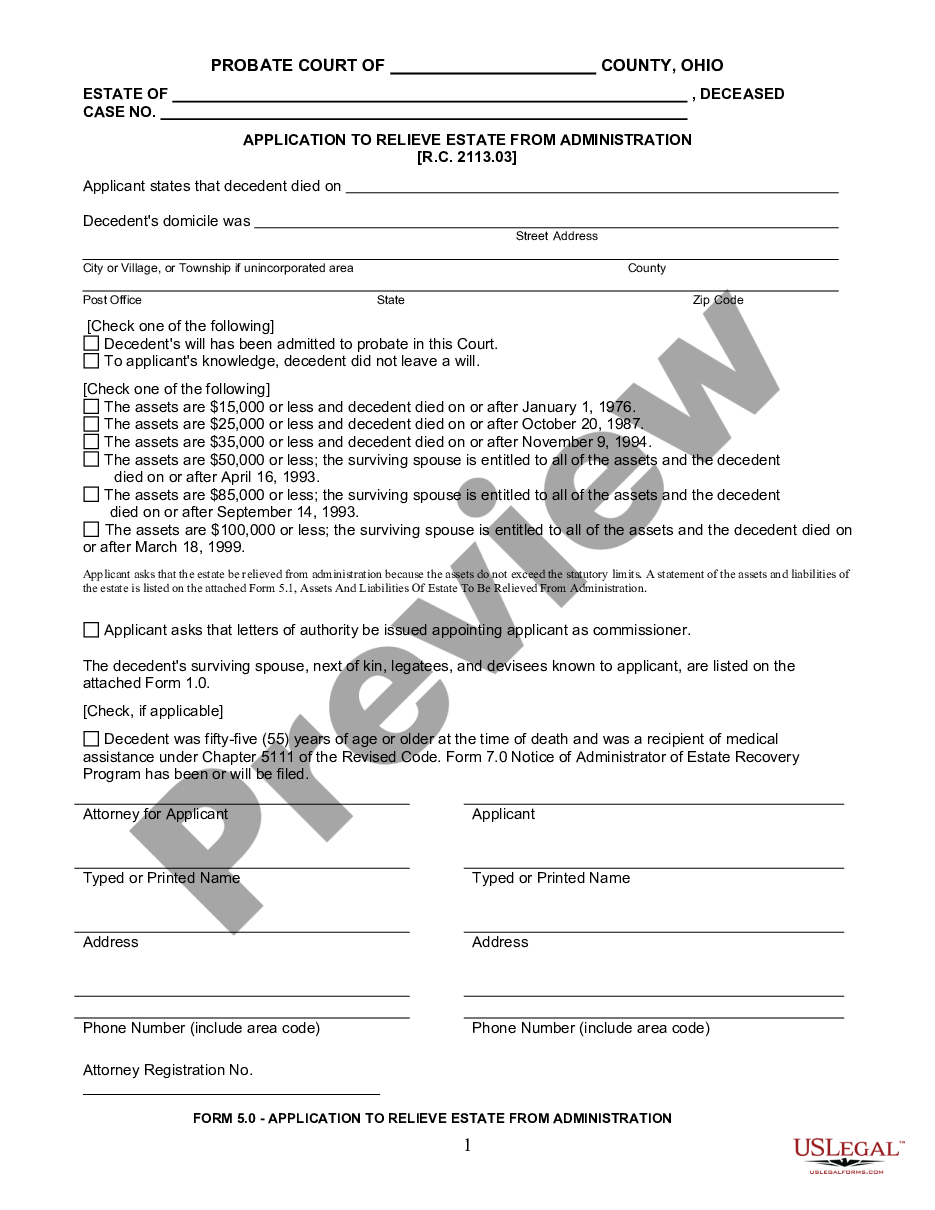

Dayton Ohio Small Estate Affidavit for Estates Not More Than $35,00, or $100,000 and Inherited Fully by Spouse

Description

How to fill out Ohio Small Estate Affidavit For Estates Not More Than $35,00, Or $100,000 And Inherited Fully By Spouse?

Utilize the US Legal Forms and gain immediate access to any document you need.

Our helpful platform with countless document templates simplifies locating and acquiring nearly any document sample you desire.

You can download, complete, and sign the Dayton Ohio Small Estate Affidavit for Estates Not Exceeding $35,000, or $100,000 and Inherited Entirely by Spouse in just a few minutes instead of spending hours online searching for a suitable template.

Using our directory is a fantastic method to improve the security of your record submission. Our skilled legal experts consistently review all documents to ensure that the templates are suitable for a specific region and adhere to new laws and regulations.

If you don’t possess an account yet, adhere to the guidelines listed below.

Access the page containing the form you require. Confirm that it is the template you were looking for: check its title and description, and utilize the Preview function if available. Otherwise, use the Search field to locate the suitable one.

- How can you acquire the Dayton Ohio Small Estate Affidavit for Estates Not Exceeding $35,000, or $100,000 and Inherited Entirely by Spouse.

- If you already have a subscription, simply Log In to your account. The Download option will show up on all the documents you review.

- Moreover, you can access all previously saved files through the My documents section.

Form popularity

FAQ

Writing a small estate affidavit involves several key steps. First, gather all pertinent information about the deceased, their assets, and the heirs. Next, complete the affidavit by including necessary declarations and ensuring it adheres to state law requirements, particularly for the Dayton Ohio Small Estate Affidavit for Estates Not More Than $35,000, or $100,000 and Inherited Fully by Spouse. Utilizing resources like USLegalForms can streamline this process by providing straightforward templates.

In Missouri, you generally do not need an attorney to handle a small estate affidavit if the estate meets the necessary criteria. However, legal guidance can be beneficial to ensure that everything is completed accurately and in compliance with local laws. For those simplifying the process, tools like USLegalForms can offer templates and instructions for completing the small estate affidavit efficiently.

To obtain a small estate affidavit in Ohio, you should start by checking with your local probate court for specific forms and instructions. The process typically involves completing the small estate affidavit and submitting it to the court along with any required documentation. It’s vital to ensure compliance with local laws, especially when dealing with cases like the Dayton Ohio Small Estate Affidavit for Estates Not More Than $35,000, or $100,000 and Inherited Fully by Spouse. USLegalForms can simplify this process with user-friendly templates.

To fill out an affidavit of inheritance, start by gathering essential information about the deceased and the heirs. This includes the names, addresses, and relationships of all related parties, along with the deceased’s asset details. Ensure that the affidavit meets Ohio state requirements, particularly for the Dayton Ohio Small Estate Affidavit for Estates Not More Than $35,000, or $100,000 and Inherited Fully by Spouse. If needed, consider using USLegalForms for guidance, as they offer templates and resources.

A small estates declaration, also known as a small estate affidavit, allows heirs to claim assets of a deceased person when the total value is not more than $35,000 or $100,000 and wholly inherited by a spouse. This process simplifies the transfer of assets without the need for formal probate proceedings. It provides a quicker, less costly way for families to access their loved one’s estate. With the Dayton Ohio Small Estate Affidavit for Estates Not More Than $35,000, or $100,000 and Inherited Fully by Spouse, heirs can more easily manage the estate.

The minimum estate value that triggers probate in Ohio is generally around $35,000. If an estate's value is below this amount, consider utilizing the Dayton Ohio Small Estate Affidavit for Estates Not More Than $35,000 or $100,000 and Inherited Fully by Spouse. This option significantly simplifies the process for spouses, allowing them to handle asset transfers without the need for extensive legal proceedings.

Not all estates in Ohio are required to go through probate. For example, if an estate qualifies for the Dayton Ohio Small Estate Affidavit for Estates Not More Than $35,000 or $100,000 and Inherited Fully by Spouse, it can bypass formal probate proceedings. This provision allows for a more streamlined approach to transferring assets, making it easier for surviving spouses.

In Ohio, several assets may be exempt from probate. These typically include jointly owned properties, certain retirement accounts, and life insurance policies where a beneficiary is designated. Additionally, under the Dayton Ohio Small Estate Affidavit for Estates Not More Than $35,000 or $100,000 and Inherited Fully by Spouse, spouses can often inherit property without navigating the probate process.

To file as executor of an estate in Ohio, you must present the last will and testament—if one exists—at the local probate court. You will also need to file a petition or application for authority to administer the estate. If you meet the requirements under the Dayton Ohio Small Estate Affidavit rules, the process can be much simpler and faster, allowing for a more efficient estate administration.

Filling out an affidavit of inheritance requires you to provide information about the deceased and the heirs. You need to detail your relationship to the deceased, along with any other beneficiaries entitled to inherit. Utilizing tools from US Legal Forms can guide you in preparing this affidavit effectively, helping ensure compliance with local regulations.