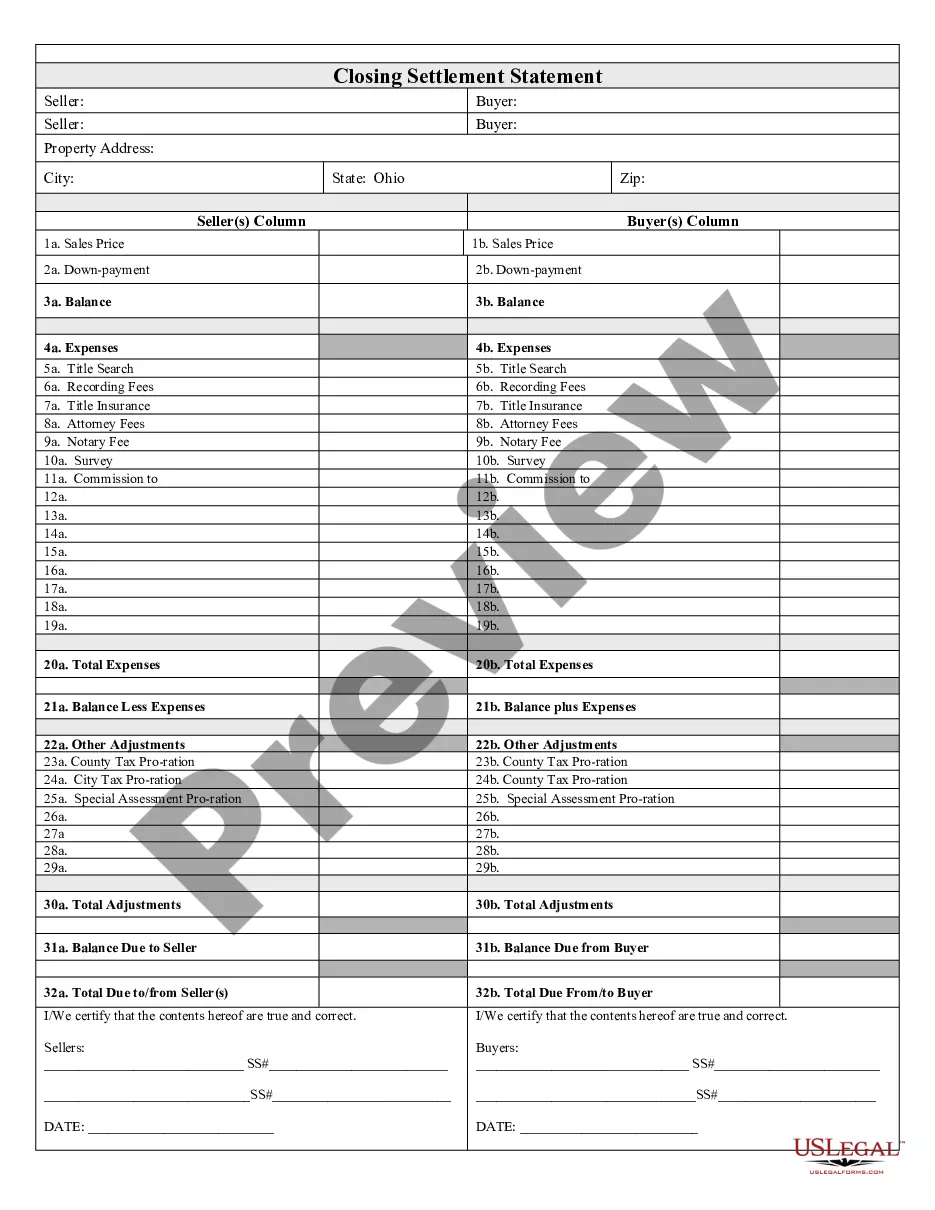

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

Cincinnati Ohio Closing Statement

Description

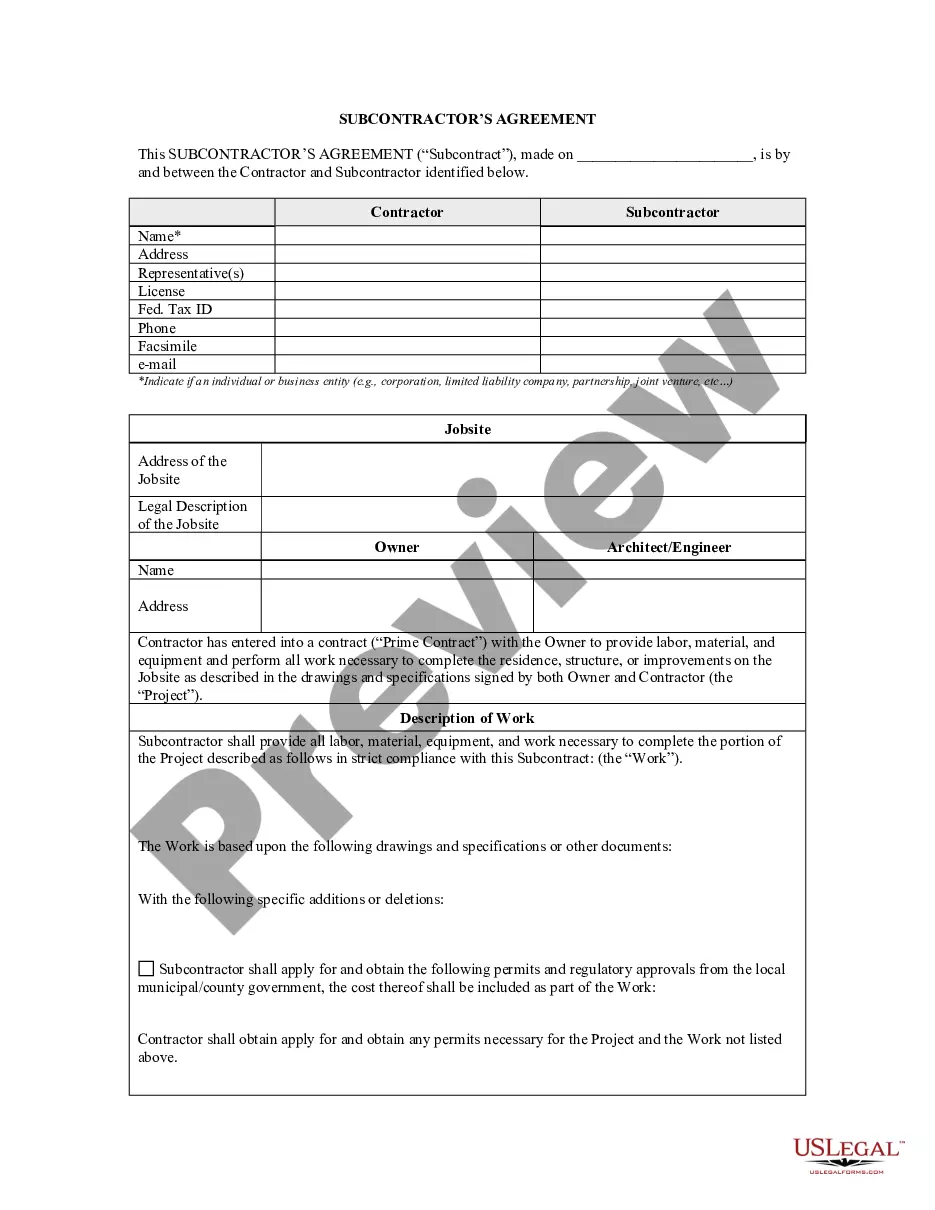

How to fill out Ohio Closing Statement?

Finding validated models tailored to your regional regulations can be difficult unless you utilize the US Legal Forms repository.

It’s a digital archive containing over 85,000 legal documents for both personal and professional use and various real-world situations.

All the papers are properly categorized by usage area and jurisdictional regions, so finding the Cincinnati Ohio Closing Statement becomes as fast and straightforward as 1-2-3.

Enter your credit card information or utilize your PayPal account to finance the subscription. Download the Cincinnati Ohio Closing Statement. Store the template on your device to continue with its completion and access it in the My documents section of your profile whenever you require it again.

- Examine the Preview mode and form details.

- Ensure you’ve chosen the correct one that fulfills your needs and entirely aligns with your local jurisdiction criteria.

- Search for another template, if necessary.

- If you identify any discrepancies, use the Search tab above to locate the appropriate one. If it meets your requirements, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

Closing a business can significantly impact your tax responsibilities. You must file the final tax return and settle all outstanding dues to avoid penalties. Proper documentation, including your Cincinnati Ohio Closing Statement, ensures compliance with tax regulations and helps to simplify your obligations during the closing process.

The current sales tax in Cincinnati, Ohio, is set at 7.8%. This rate includes both state and local taxes. Understanding this rate is important for compliance, especially when calculating taxes for your Cincinnati Ohio Closing Statement or when assessing any sales tax liabilities before closing your business.

To delete your Ohio Business Gateway account, log in to your account and look for the account settings or profile section. From there, you can follow prompts to delete your account. If you encounter difficulties, contacting customer support will provide the assistance needed to navigate this process smoothly, ensuring it aligns with any records on your Cincinnati Ohio Closing Statement.

To close an LLC in Ohio, you will need to file a Document of Dissolution with the Ohio Secretary of State. Before doing so, settle all pending debts and tax obligations to avoid complications. Additionally, you will want to properly address your Cincinnati Ohio Closing Statement to reflect this change, ensuring all formalities are observed to prevent future liabilities.

To back out of sales tax in Cincinnati, Ohio, you must first evaluate the reasons for your withdrawal. If you made an error during your sales tax reporting, you could file an amended return. If you wish to cancel your sales tax registration altogether, ensure that all your tax liabilities are settled, and reach out to the Ohio Department of Taxation for guidance on the steps to officially withdraw from sales tax obligations.

The statute of limitations for city taxes in Ohio is generally four years, but this can vary based on specific circumstances. If you receive a notice or have questions about your tax obligations, consult documentation like your Cincinnati Ohio Closing Statement for clarity. It's advisable to address any issues promptly.

Yes, if you earn income in Ohio, you typically need to file a state tax return. This applies to both residents and non-residents earning income in the state. Making sure your Cincinnati Ohio Closing Statement is accurate will facilitate the tax filing process.

Most residents and businesses that generate income in Ohio cities must file a city tax return. Each city may have different rules, so check with local regulations. Keeping your Cincinnati Ohio Closing Statement in order allows you to stay compliant while filing your taxes.

If you fail to file city taxes in Ohio, you may incur penalties, interest, and legal repercussions. Unfiled taxes can lead to a tax lien against your property. Keep track of your records, especially the Cincinnati Ohio Closing Statement, to avoid complications.

Generally, you need to file city taxes in the city where you work, especially if the city has an income tax. Cincinnati has specific regulations, so be aware of your obligations. Your Cincinnati Ohio Closing Statement can help clarify your tax responsibilities if you relocate.