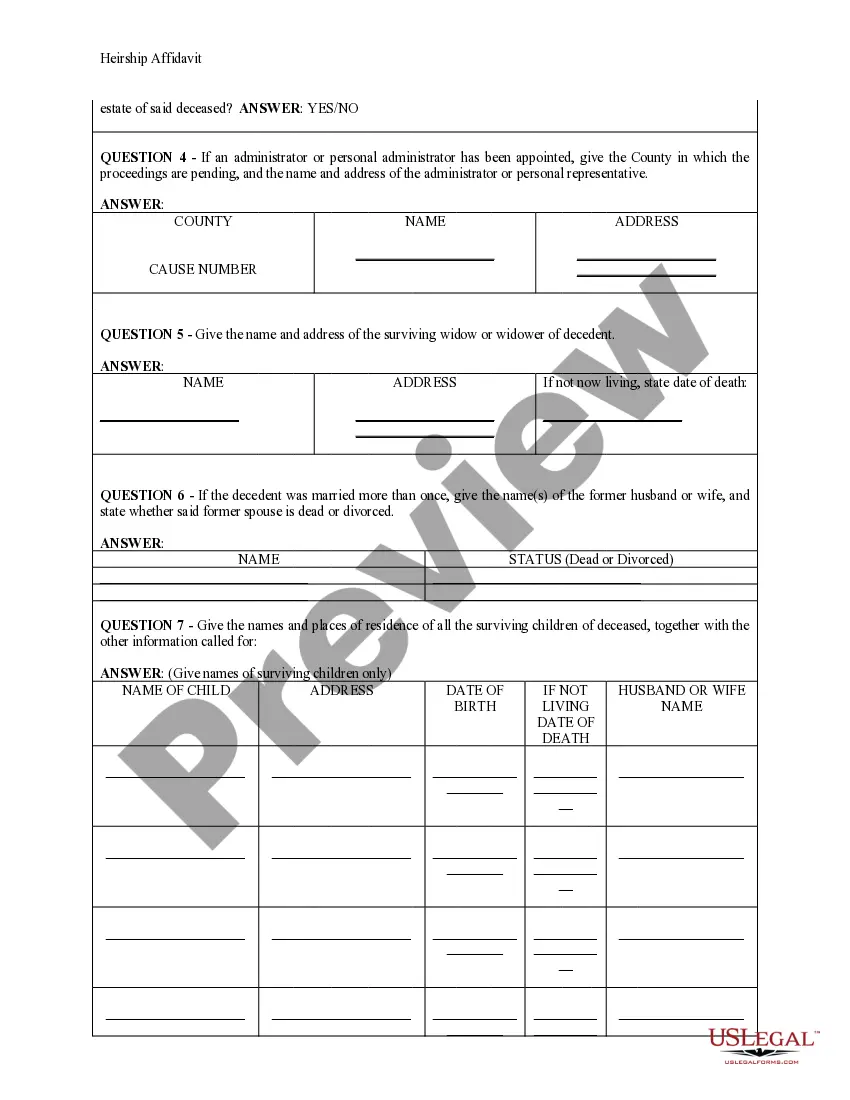

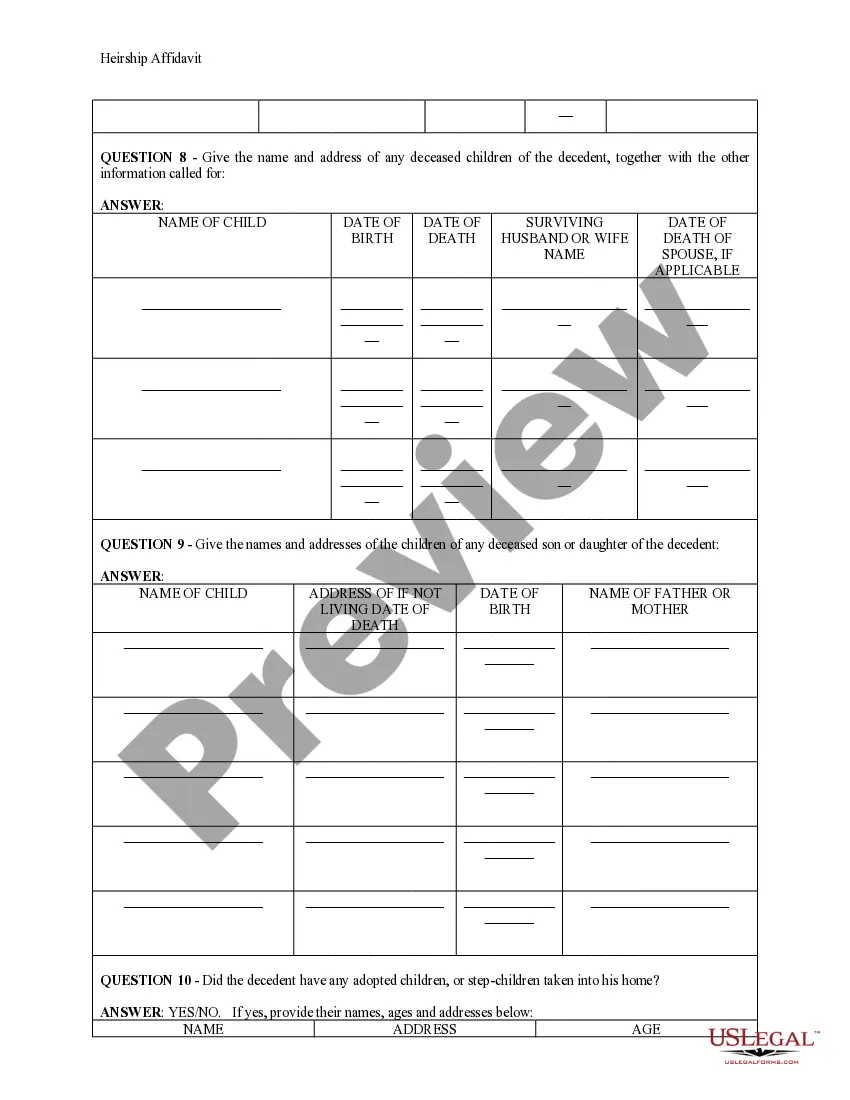

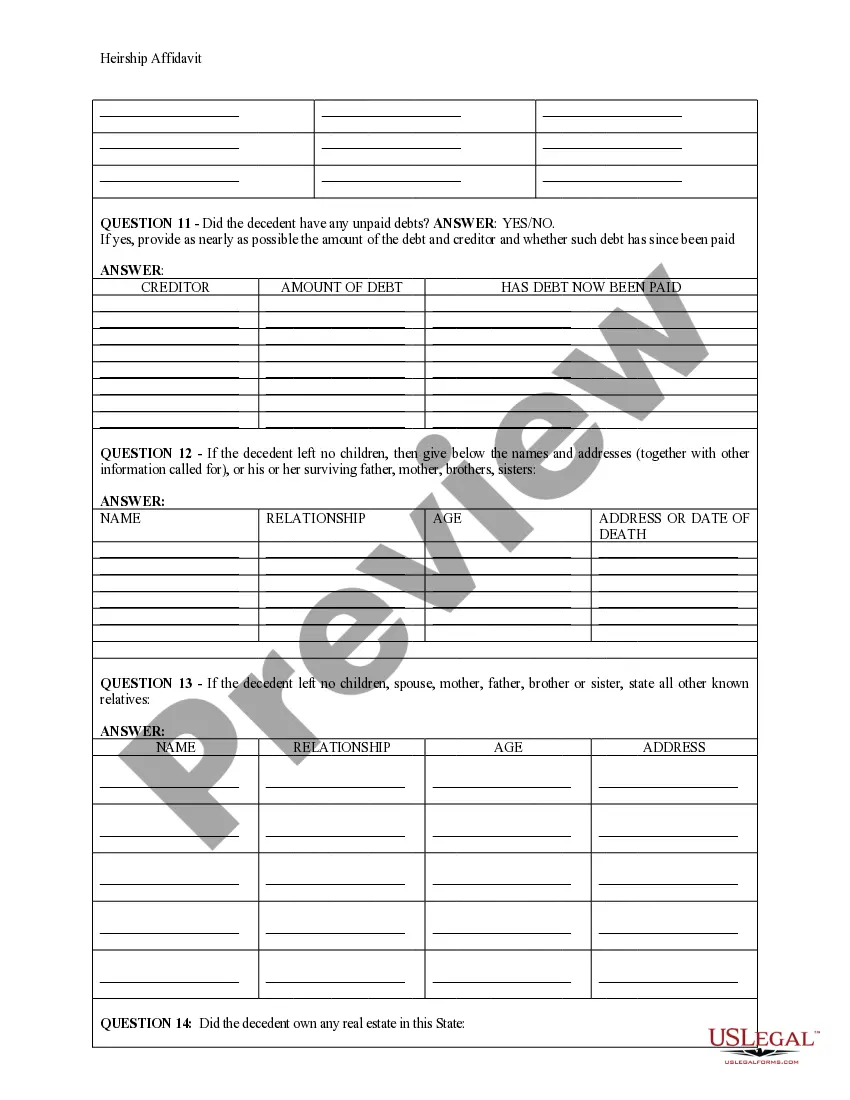

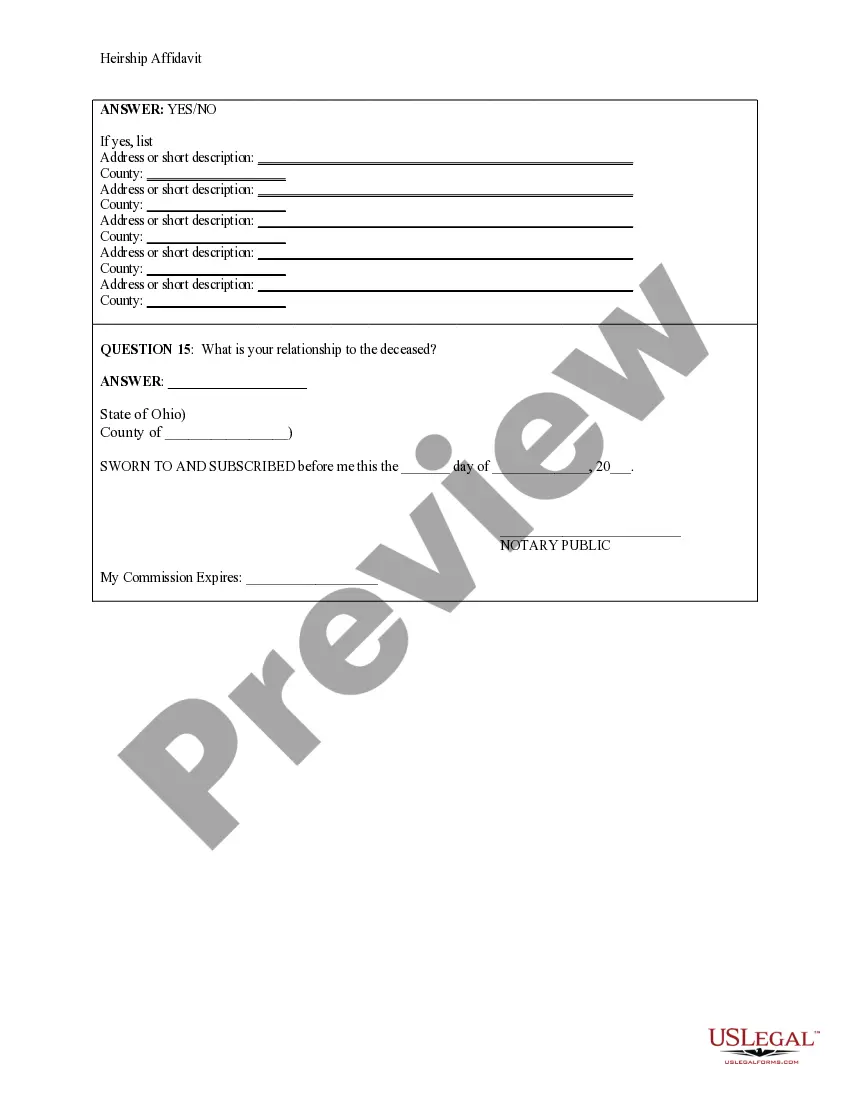

This Heirship Affidavit form is for a person to complete stating the heirs of a deceased person. The Heirship Affidavit is commonly used to establish ownership of personal and real property. It may be recorded in official land records, if necessary. Example of use: Person A dies without a will, leaves a son and no estate is opened. When the son sells the land, the son obtains an heirship affidvait to record with the deed. The person executing the affidavit should normally not be an heir of the deceased, or other person interested in the estate.

Cuyahoga Ohio Heirship Affidavit - Descent

Description

How to fill out Ohio Heirship Affidavit - Descent?

If you are looking for an authentic format, it's challenging to select a more user-friendly service than the US Legal Forms website – one of the most extensive online repositories.

Here you can obtain numerous templates for business and personal use by categories and states, or keywords.

With the superior search functionality, locating the most up-to-date Cuyahoga Ohio Heirship Affidavit - Descent is as simple as 1-2-3.

Complete the payment process. Utilize your credit card or PayPal account to finalize the registration method.

Acquire the template. Specify the file format and save it to your device.

- Additionally, the validity of each document is verified by a group of qualified attorneys who consistently review the templates on our site and refresh them according to the latest state and county laws.

- If you are already familiar with our system and possess a registered account, all you need to do to acquire the Cuyahoga Ohio Heirship Affidavit - Descent is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the instructions listed below.

- Ensure you have selected the sample you require. Review its details and use the Preview feature to investigate its contents. If it doesn’t satisfy your needs, utilize the Search function at the top of the page to find the desired file.

- Confirm your selection. Click the Buy now button. Following that, choose your preferred pricing option and enter the information to create an account.

Form popularity

FAQ

Yes, Ohio does have a small estate affidavit, allowing individuals to settle estates without formal probate. This affidavit is particularly useful for heirs to transfer assets when the total value falls below a certain threshold. In Cuyahoga County, the Cuyahoga Ohio Heirship Affidavit - Descent can facilitate the process of claiming property and settling debts without extensive legal procedures. Using platforms like USLegalForms, individuals can easily obtain the necessary documents and guidance to streamline their estate administration.

An executor in Ohio generally has six months to file an inventory of the estate and settle all claims against it, though this time can vary based on the complexity of the estate. Executors should aim to finalize all matters expediently to facilitate the distribution of assets, especially with the Cuyahoga Ohio Heirship Affidavit - Descent involved. Failing to act within the timeframe can result in complications, so utilizing resources like US Legal Forms can aid in maintaining compliance and organization.

There is no set minimum value for an estate to go through probate in Ohio; however, if an estate exceeds $35,000 in total value, it typically requires a formal probate process. This threshold determines whether the estate can utilize a simpler administration process. In situations involving a Cuyahoga Ohio Heirship Affidavit - Descent, understanding the estate's value is crucial. It helps identify the needed procedures to ensure a smooth transition for heirs.

In Ohio, certain assets are exempt from probate, including jointly held property, life insurance policies, and retirement accounts with designated beneficiaries. Additionally, property held in a trust typically bypasses the probate process. Knowing which assets are exempt can simplify the management of your estate, particularly when preparing a Cuyahoga Ohio Heirship Affidavit - Descent. Using platforms like US Legal Forms can assist you in this area, ensuring clarity and correctness.

To file as the executor of an estate in Ohio, you must submit a petition for probate to the local probate court where the deceased lived. This process involves providing necessary documents, including a death certificate, the will, and the application for appointment as executor. By following these steps, you can streamline the handling of the Cuyahoga Ohio Heirship Affidavit - Descent if applicable. It’s advisable to consult a legal professional or resources like US Legal Forms to ensure proper compliance.

Rule 71.1 in the Cuyahoga County probate court outlines the procedures for filing an heirship affidavit related to the descent of property. This rule clarifies the legal requirements and documentation needed to establish rightful heirs. Understanding this rule is crucial for anyone involved in estate matters, especially with the Cuyahoga Ohio Heirship Affidavit - Descent. This ensures a smoother process in proving heirs' identities under Ohio law.

While there is no strict minimum estate value for probate in Ohio, estates valued at or above $35,000 typically must go through this legal process. However, smaller estates may also require court involvement, depending on the circumstances. Leveraging resources like US Legal Forms can help simplify the filing of a Cuyahoga Ohio Heirship Affidavit - Descent if probate is necessary.

In Ohio, assets such as real estate, bank accounts, and personal property owned solely by the deceased usually require probate. Jointly owned assets or accounts with designated beneficiaries often bypass this process. Knowing which assets are subject to probate is crucial for effective estate planning and can guide you when preparing the Cuyahoga Ohio Heirship Affidavit - Descent.

An estate in Ohio must typically be worth over $35,000 to trigger the probate process. This threshold helps determine whether the estate holders need to undergo formal probate proceedings. By understanding these financial specifics, you can better prepare to handle matters concerning the Cuyahoga Ohio Heirship Affidavit - Descent when necessary.

In Ohio, there isn’t a strict minimum value defined for estates that must be probated. However, all estates that include assets exceeding certain thresholds generally require probate. If you find yourself in this situation, consider how the Cuyahoga Ohio Heirship Affidavit - Descent can streamline asset transfer without lengthy legal procedures.