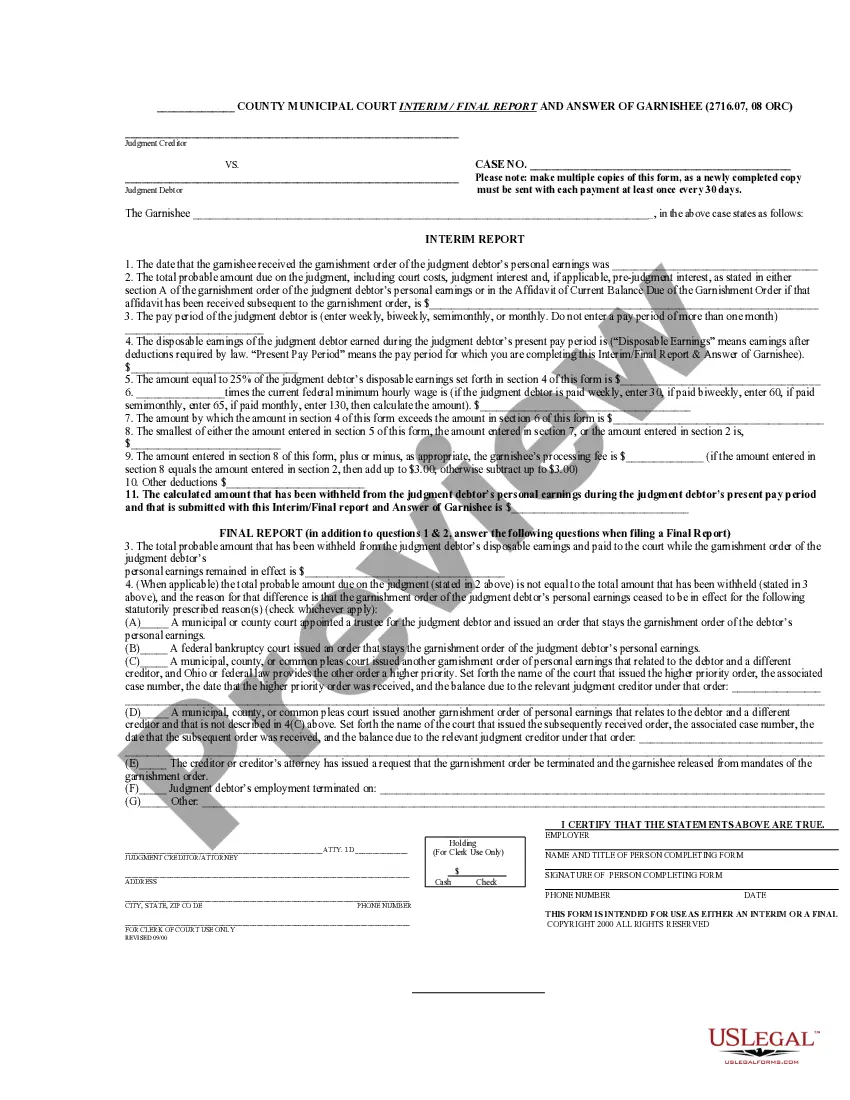

This sample form, an Interim/Final Report and Answer of Garnishee, is for use in Ohio garnishment cases. It is available in Word or Rich Text format.

Akron Ohio Interim - Final Report and Answer of Garnishee

Description

How to fill out Ohio Interim - Final Report And Answer Of Garnishee?

Finding authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms repository.

It’s a digital collection of over 85,000 legal documents for both personal and professional requirements as well as various real-life scenarios.

All the files are neatly sorted by usage area and jurisdiction types, making it simple and quick to find the Akron Ohio Interim - Final Report and Answer of Garnishee.

Organizing documents correctly and ensuring compliance with legal standards is crucial. Utilize the US Legal Forms library to always have vital document templates accessible whenever required!

- Check the Preview mode and document description.

- Ensure you've selected the appropriate one that satisfies your needs and fully aligns with your local jurisdiction criteria.

- Look for an alternative template, if necessary.

- If you notice any discrepancies, use the Search tab to find the correct one.

- If it meets your criteria, continue to the next step.

Form popularity

FAQ

The interim report and answer of garnishee is a preliminary document responding to a court's garnishment order. It details the status of any funds or property belonging to the debtor that the garnishee may hold. This report is crucial as it helps courts determine the next steps in the garnishment process. For the Akron Ohio Interim - Final Report and Answer of Garnishee, UsLegalForms offers user-friendly resources to simplify document preparation.

To stop a garnishment, you should first understand your rights and options. Filing a motion with the court can halt the process while your situation is being reviewed. Additionally, negotiating with your creditor might lead to an alternative payment arrangement. For guidance on Akron Ohio Interim - Final Report and Answer of Garnishee, consider using UsLegalForms, which provides relevant forms and instructions.

Garnishment rules in Ohio dictate how creditors can collect debts from your wages. Creditors must obtain a court order and provide you with proper notification before garnishing your earnings. Your employer must comply with this order, but there are limits on how much can be garnished from each paycheck. Familiarizing yourself with the Akron Ohio Interim - Final Report and Answer of Garnishee can help you navigate these rules effectively.

To stop a wage garnishment immediately in Ohio, you can file a motion with the court to contest the garnishment. It's important to present valid reasons why the garnishment should be halted, such as a financial hardship or improper notification. Additionally, if you have an Akron Ohio Interim - Final Report and Answer of Garnishee, it may contain critical information to support your case. Always consider consulting with a legal expert to ensure you follow the correct procedures.

A 15-day notice for garnishment in Ohio informs the debtor that their wages will be garnished unless they respond or contest the action. This notice is a crucial step in the garnishment process, giving individuals a chance to address the debt before funds are deducted. Utilizing resources from the Akron Ohio Interim - Final Report and Answer of Garnishee can help you navigate your response timely.

In Ohio, the maximum amount that can be garnished from your paycheck is generally 25% of your disposable earnings or the amount by which your wages exceed 30 times the federal minimum wage, whichever is less. It’s important to understand these limits to protect your income. The Akron Ohio Interim - Final Report and Answer of Garnishee can provide clarity if you face a garnishment.

In Ohio, making a payment plan with your creditor can often help you avoid garnishment altogether. You must commit to regular payments that align with your income and expenses. You may find useful templates and guidance in the Akron Ohio Interim - Final Report and Answer of Garnishee to assist in these payment arrangements.

The best way to stop wage garnishment is to address the underlying debt by negotiating directly with your creditor. If that is not successful, you may consider filing for bankruptcy or filing a motion to quash the garnishment. Consulting the Akron Ohio Interim - Final Report and Answer of Garnishee can guide you through these options effectively.

Ohio law protects certain types of income from garnishment, such as Social Security benefits, specific retirement funds, and a portion of wages. Moreover, some personal property may also be exempt. When reviewing your situation, it's essential to consult the Akron Ohio Interim - Final Report and Answer of Garnishee to fully understand which assets you can protect.

To get out of a garnishment in Ohio, you can challenge the garnishment in court or negotiate a payment plan with your creditor. Another option is to claim exemptions if your income falls within certain limits. Utilizing an Akron Ohio Interim - Final Report and Answer of Garnishee can provide you with the insights you need to handle garnishments effectively.