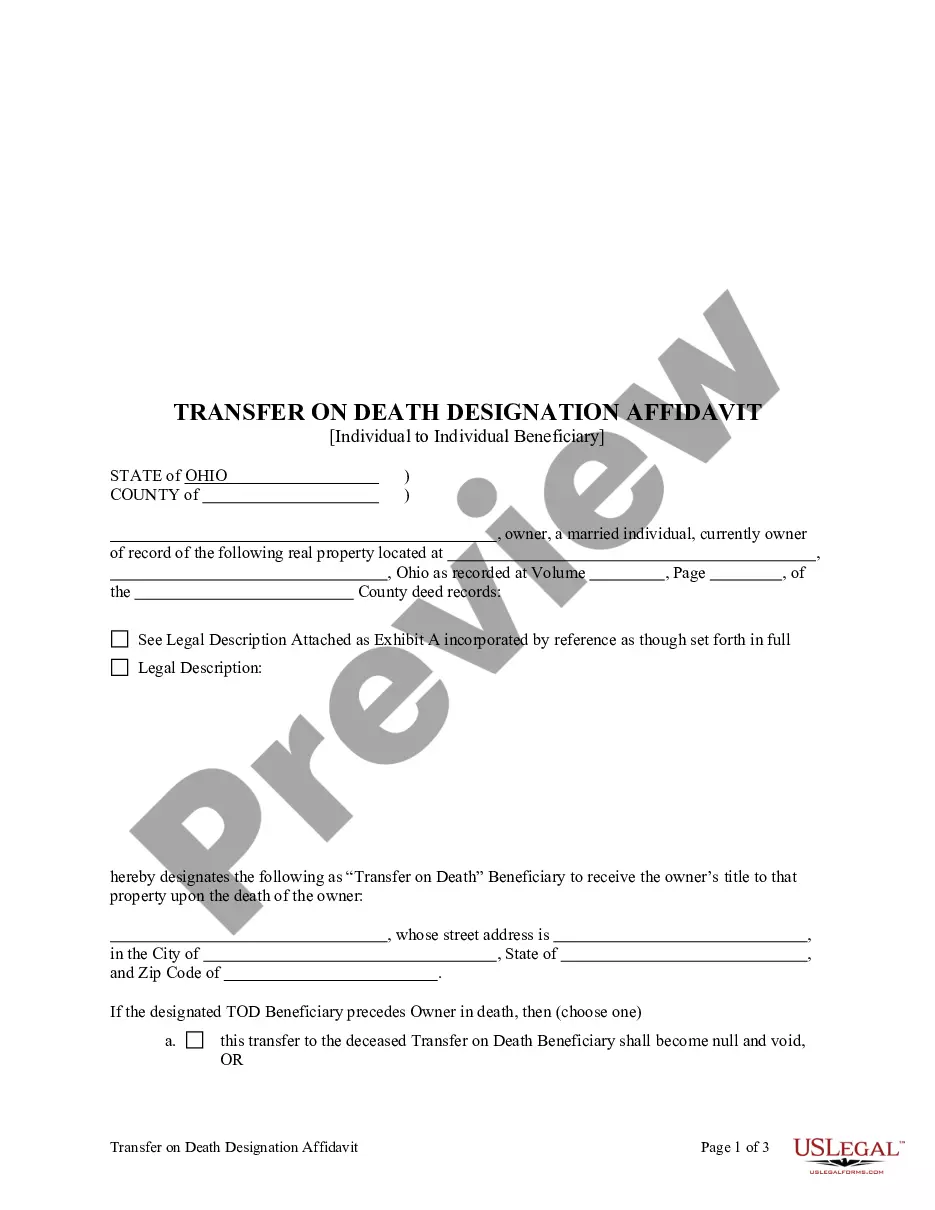

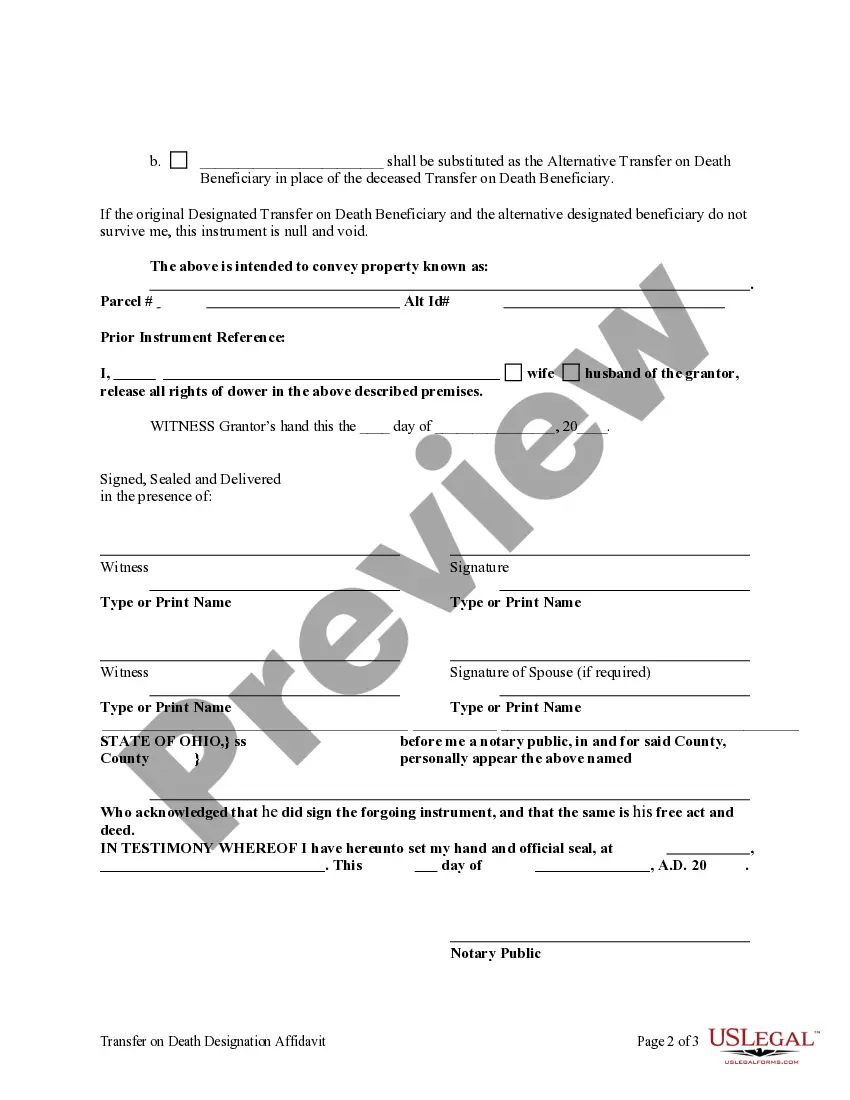

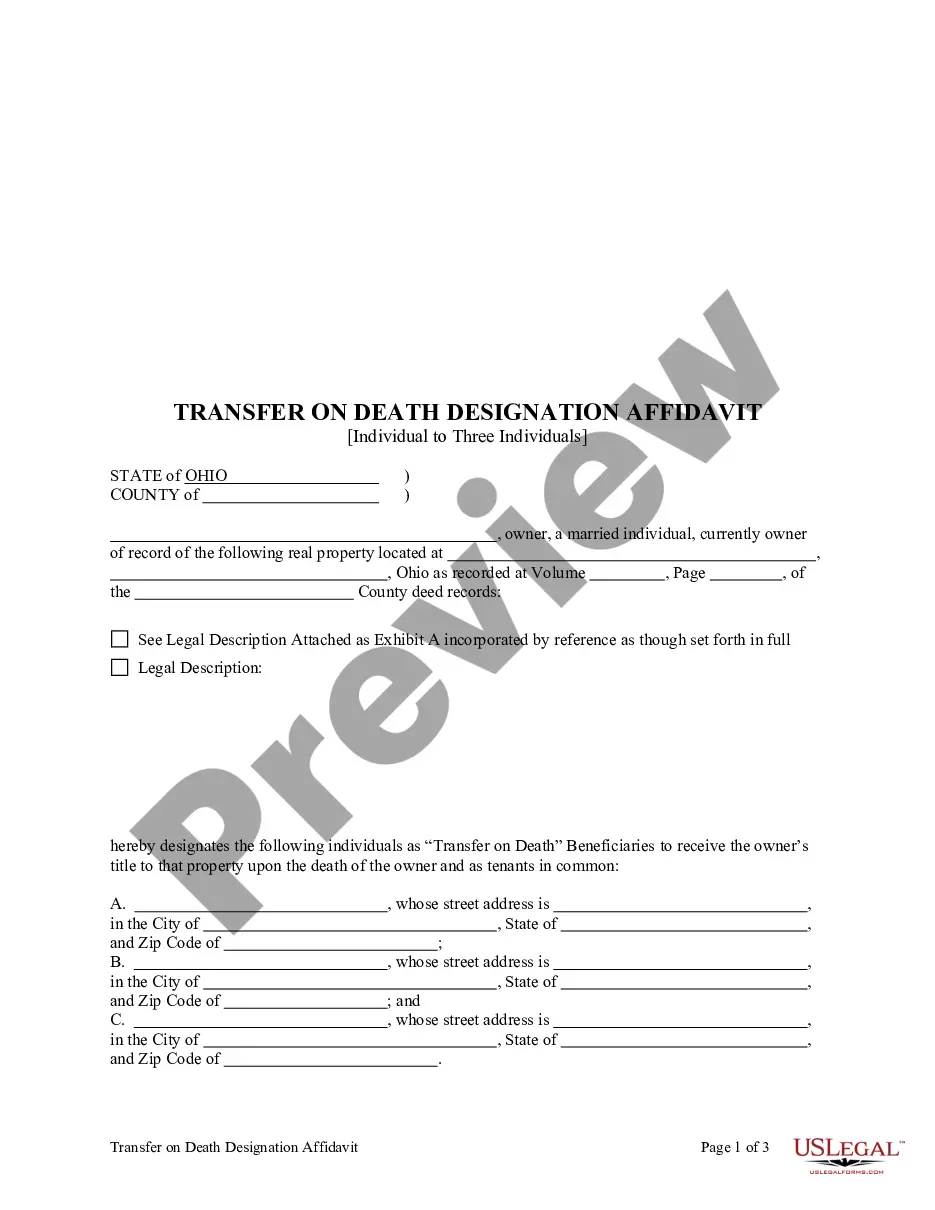

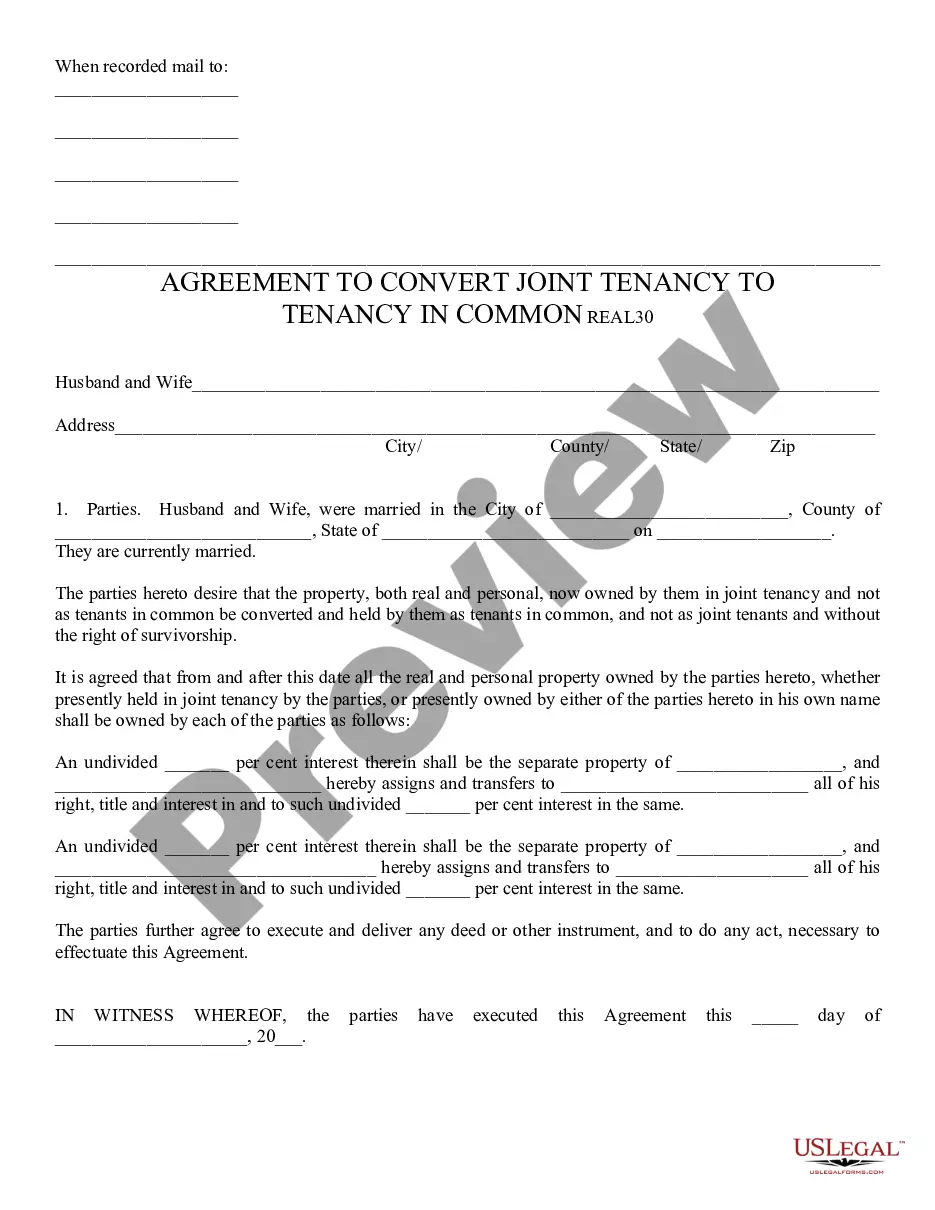

Transfer on Death Designation Affidavit from Individual to Individual: This affidavit is used to transfer the title of a parcel of land, attaching any existing covenants, upon the death of the Affiant/Owner to the designated Beneficiary. It should be signed in front of a Notary Public. The form includes provision for an contingent beneficiary in the event the designated beneficiary predeceases the affiant/owner. The designation of the beneficiary in an affidavit of transfer on death may be revoked or changed at any time, without the consent of that designated transfer on death beneficiary, by the affiant/owner of the interest by executing in accordance with Chapter 5301. of the Ohio Revised Code and recording a transfer on death designation affidavit conveying the affiant's entire, separate interest in the real property to one or more persons, including the affiant, with or without the designation of another transfer on death beneficiary.

Cincinnati Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual with Contingent Beneficiary

Description

How to fill out Ohio Transfer On Death Designation Affidavit - TOD From Individual To Individual With Contingent Beneficiary?

If you are in search of a legitimate form template, it’s unfeasible to discover a more user-friendly platform than the US Legal Forms site – likely the most extensive online libraries.

Here you can obtain a vast array of document samples for organizational and personal uses by categories and regions, or keywords.

With the excellent search functionality, locating the latest Cincinnati Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual with Contingent Beneficiary is as simple as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Specify the file format and download it to your device.

- Additionally, the relevance of every document is validated by a group of experienced attorneys who regularly examine the templates on our site and refresh them per the latest state and county regulations.

- If you are already acquainted with our system and hold an account, all you need to do to obtain the Cincinnati Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual with Contingent Beneficiary is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the directions below.

- Ensure you have selected the form you desire. Review its description and use the Preview option (if available) to view its content. If it does not meet your requirements, utilize the Search field at the top of the page to find the suitable document.

- Validate your choice. Hit the Buy now button. Subsequently, choose your preferred subscription plan and enter details to create an account.

Form popularity

FAQ

Utilizing a Cincinnati Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual with Contingent Beneficiary can be a smart strategy for many individuals. It allows for a seamless transfer of assets without the complexities of probate, preserving both time and resources for your beneficiaries. However, it's vital to consider your specific situation and goals, ensuring that a TOD aligns with your overall estate plan.

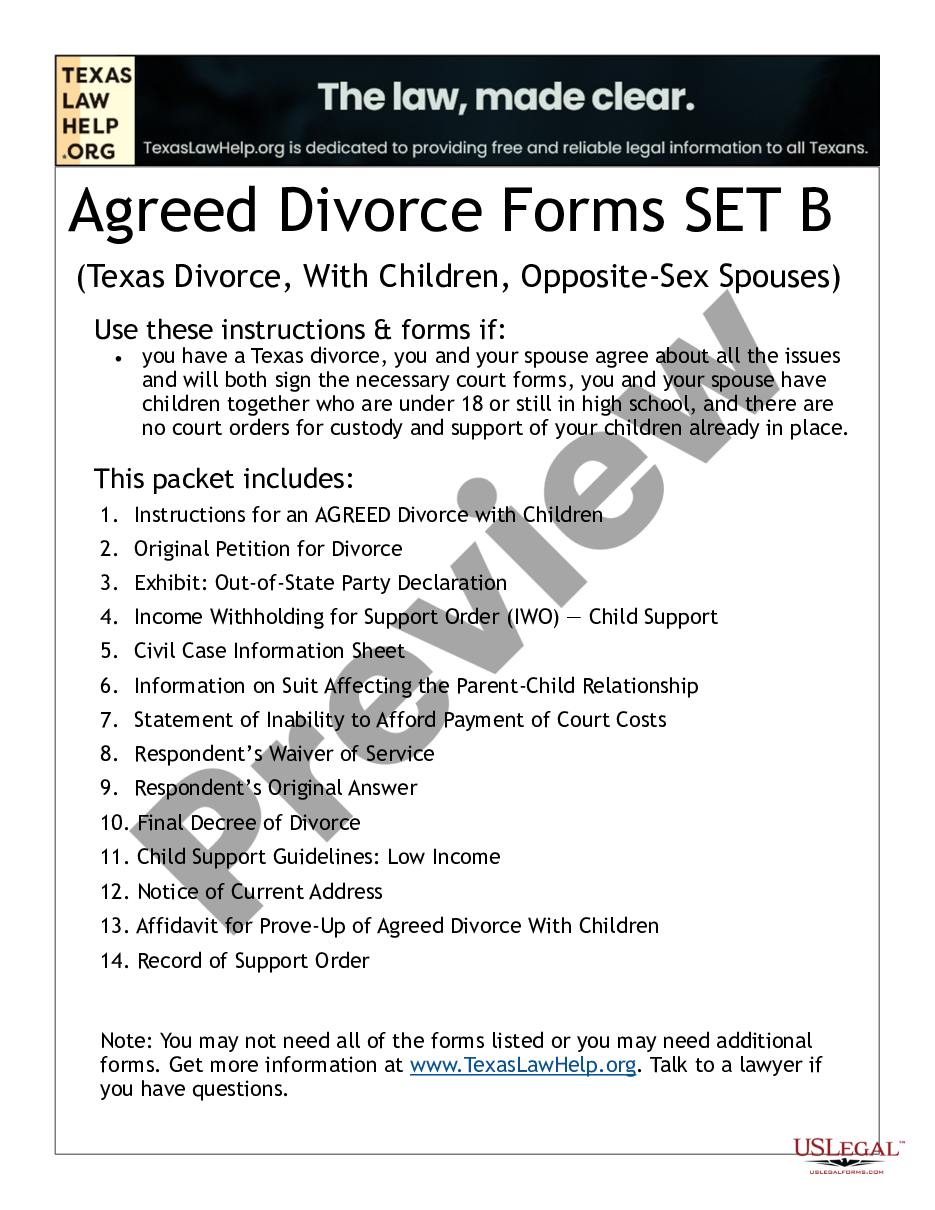

To obtain a Cincinnati Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual with Contingent Beneficiary, start by completing the appropriate form, which can be found on uslegalforms. After filling it out, you will need to sign it in front of a notary and then file it with your county's recorder's office. This process helps ensure your wishes are documented correctly and helps facilitate a smoother transfer of assets.

Yes, a Cincinnati Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual with Contingent Beneficiary can indeed have contingent beneficiaries. This means you can designate secondary beneficiaries who will receive the assets if the primary beneficiaries cannot. This flexibility allows you to ensure your estate plan reflects your wishes, providing peace of mind for you and your loved ones.

A Cincinnati Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual with Contingent Beneficiary does not inherently avoid capital gains tax. Instead, the recipient of the asset inherits it at its fair market value at the time of death, which may be subject to capital gains tax when they decide to sell. Understanding this can help you plan better for taxes and ensure beneficiaries are aware of any financial implications.

While a Cincinnati Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual with Contingent Beneficiary offers convenient benefits, it also has drawbacks. For example, it does not provide protection from creditors, meaning debts can still affect the inherited assets. Moreover, if beneficiaries are not updated or clear instructions are not provided, conflicts may arise among heirs. It's essential to handle this process carefully to prevent complications down the road.

One significant disadvantage of the Cincinnati Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual with Contingent Beneficiary is that it does not provide control over the assets during the original owner’s lifetime. A beneficiary can only claim the asset after the owner’s death, which could be problematic if the owner needs to make decisions about that asset. It is crucial to weigh these considerations and understand the full implications before proceeding with a TOD deed.

While the Cincinnati Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual with Contingent Beneficiary offers benefits, it also has drawbacks. One of the primary disadvantages is that it may not avoid probate for certain assets or debts. Additionally, if you have changes in beneficiaries or assets, you’ll need to update the affidavit accordingly. This can lead to confusion if the documents are not maintained properly.

To obtain a Cincinnati Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual with Contingent Beneficiary, you first need to fill out the form accurately. You can typically find the form through the county recorder’s office or legal platforms, such as US Legal Forms, which simplifies the process. After completing the affidavit, you should sign it in front of a notary public. Finally, file the executed affidavit with the county recorder to make it effective.

While you can file a TOD deed without a lawyer, consulting with one can provide clarity and reduce errors. An attorney can guide you in ensuring that your deed complies with Ohio laws and encapsulates your intentions clearly. This support can be invaluable when preparing the Cincinnati Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual with Contingent Beneficiary.

Filing a transfer on death (TOD) in Ohio involves drafting a deed that includes the TOD language and naming the beneficiary. The completed deed must be filed with your county recorder’s office to ensure its validity. This step is essential to execute your wishes regarding the Cincinnati Ohio Transfer on Death Designation Affidavit - TOD from Individual to Individual with Contingent Beneficiary.