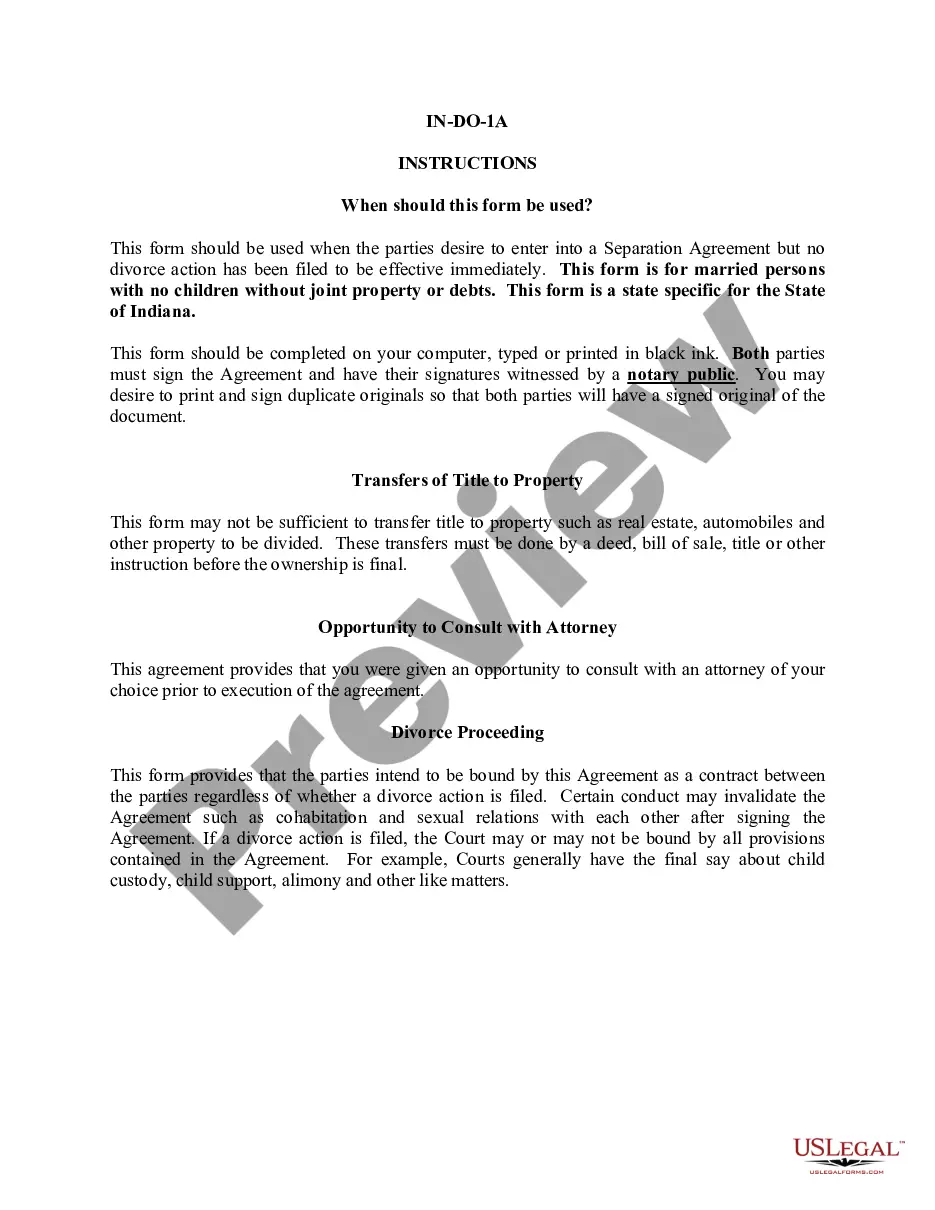

This Registration of Foreign Corporation form includes Step by Step Instructions. Required to register your non-Ohio corporation in Ohio.

Columbus Ohio Registration of Foreign Corporation

Description

How to fill out Ohio Registration Of Foreign Corporation?

If you are looking for a legitimate form template, it’s challenging to discover a superior platform than the US Legal Forms site – one of the most comprehensive libraries online.

Here you can obtain thousands of document samples for organizational and personal uses categorized by types and states, or search terms.

Utilizing our sophisticated search capability, obtaining the latest Columbus Ohio Registration of Foreign Corporation is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finish the registration process.

Obtain the form. Specify the file format and download it to your device.

- Moreover, the validity of each and every document is confirmed by a team of professional lawyers who regularly review the templates on our site and update them according to the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Columbus Ohio Registration of Foreign Corporation is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the guidelines below.

- Ensure you have located the form you need. Read its description and utilize the Preview feature (if available) to view its content. If it does not satisfy your needs, use the Search field at the top of the page to find the required document.

- Verify your choice. Click the Buy now button. After that, select your preferred pricing option and provide credentials to register for an account.

Form popularity

FAQ

Ohio Foreign LLCs are LLCs that were originally formed outside of the state but have registered to do business in Ohio. All foreign LLCs operating in Ohio must submit a Registration of a Foreign Limited Liability Company application to the Ohio Secretary of State and pay the $99 filing fee ($199 for expedited filings).

(10) Transacting business in interstate commerce. (B) For purposes of section 1776.86 of the Revised Code, the ownership in this state of income-producing real property or tangible personal property, other than property excluded under division (A) of this section, constitutes transacting business in this state.

Any entity planning to transact business in Ohio using a name other than their personal name must register with the Secretary of State. For a sole proprietor, the legal name of the business is your personal full legal name.

A foreign corporation is a corporation which is incorporated or registered under the laws of one state or foreign country and does business in another. In comparison, a domestic corporation is a corporation which is incorporated in the state it is doing business in.

To register a foreign corporation in Ohio, you must file an Ohio Foreign Corporation Application for License with the Ohio Secretary of State, Business Services Division. You can submit this document by mail, online, or in person. The Foreign Corporation Application for a foreign Ohio corporation costs $99 to file.

1. First, register with the Ohio Secretary of State. Registration information as well as forms are available online or at (877) SOS-FILE.

Who is required to register with the Ohio Secretary of State? Any business entity, domestic or foreign, planning to transact business within Ohio, using a name other than their own personal name, must register with this office. Business entities must file the appropriate formation documents to register their business.

Please review the Secretary of State's publication entitled Start a Nonprofit Organization in Ohio for more detailed information on nonprofit corporations. Foreign Corporations. A foreign corporation is a corporation organized under the laws of another state or foreign country.