Syracuse New York Last Will and Testament with All Property to Trust called a Pour Over Will

Description

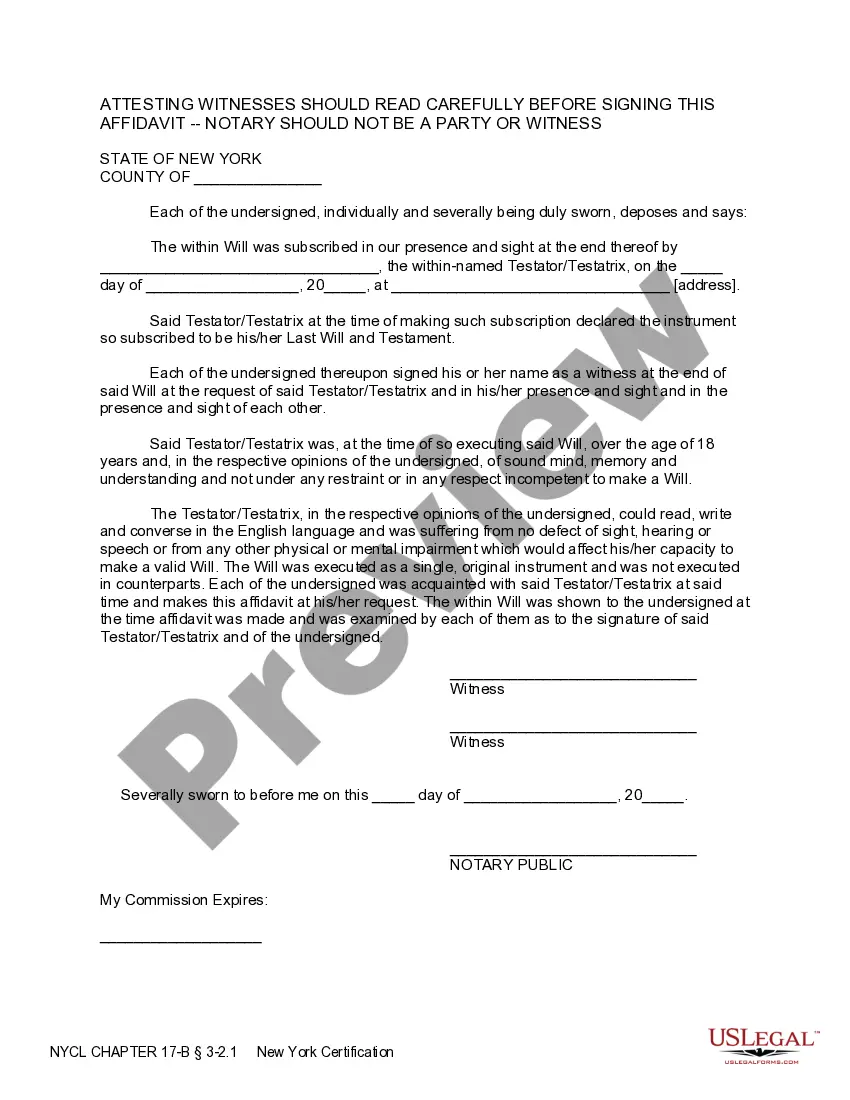

How to fill out New York Last Will And Testament With All Property To Trust Called A Pour Over Will?

If you’ve previously utilized our service, Log In to your account and store the Syracuse New York Legal Last Will and Testament Form with All Property to Trust known as a Pour Over Will on your device by clicking the Download button. Ensure your subscription is active. If not, renew it based on your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have ongoing access to each document you have acquired: you can locate it in your profile within the My documents menu whenever you need to use it again. Utilize the US Legal Forms service to quickly find and save any template for your personal or business requirements!

- Ensure you’ve found an appropriate document. Browse through the details and use the Preview option, if available, to verify if it satisfies your needs. If it doesn’t meet your expectations, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and finalize the payment. Input your credit card information or choose the PayPal option to complete the transaction.

- Acquire your Syracuse New York Legal Last Will and Testament Form with All Property to Trust referred to as a Pour Over Will. Select the file format for your document and save it to your device.

- Fill out your template. Print it or use professional online editors to populate it and sign it digitally.

Form popularity

FAQ

Choosing a trust instead of a will offers several advantages, such as avoiding probate and providing privacy for your estate. A trust allows for direct asset transfer upon your passing, offering efficiency and peace of mind. Additionally, if you use a Syracuse New York Last Will and Testament with All Property to Trust called a Pour Over Will, you can ensure that any assets not placed in the trust during your lifetime will still be added seamlessly. This strategy combines the benefits of both a trust and a will for your overall estate planning.

In most cases, beneficiaries named in a trust do take precedence over the terms of a Last Will and Testament. However, the specific design and language of the trust can affect how assets are distributed. It’s essential to ensure that your Syracuse New York Last Will and Testament with All Property to Trust called a Pour Over Will clearly outlines your intentions. This prevents any conflicts and ensures that your wishes are honored.

To transfer property into a trust in New York, you must follow legal procedures for each type of asset. For real estate, you will need to execute a new deed that names the trust as the owner. Personal property transfers can often be handled with a simple assignment form. For more complex transfers, especially related to a Syracuse New York Last Will and Testament with All Property to Trust called a Pour Over Will, US Legal Forms can provide essential tools and resources, simplifying the process for you.

Assets can be moved into a trust by formally transferring ownership from the individual to the trust. Common methods include changing titles of property, accounts, and investments to the name of the trust. In the case of a Syracuse New York Last Will and Testament with All Property to Trust called a Pour Over Will, this process ensures that any assets not already in the trust at the time of death can be directed into the trust seamlessly. Utilizing platforms like US Legal Forms can guide you through the documentation needed for a smooth transfer.

In New York, certain assets are exempt from probate. These typically include jointly owned property, retirement accounts with designated beneficiaries, and life insurance policies. By incorporating a Syracuse New York Last Will and Testament with All Property to Trust called a Pour Over Will, you can further simplify asset distribution and potentially reduce the number of assets needing to go through probate.

Transferring property to a trust in New York typically involves executing a deed. This deed should clearly indicate the trust as the new owner of the property. After creating your Syracuse New York Last Will and Testament with All Property to Trust called a Pour Over Will, it’s vital to fund your trust by appropriately transferring assets to ensure your estate plan functions as intended.

In New York, a standard will generally cannot avoid probate. However, a Syracuse New York Last Will and Testament with All Property to Trust called a Pour Over Will guides your assets into a trust, which may simplify the probate process. While the trust itself avoids probate, any assets not placed in the trust beforehand will still need to go through this legal procedure.

When you create a Syracuse New York Last Will and Testament with All Property to Trust called a Pour Over Will, it acts as a safety net for your assets. Any property not previously transferred to your trust is 'poured over' into it upon your passing. This streamlined process ensures that all your assets are managed according to your wishes, providing clarity and efficiency in your estate plan.

over will, while beneficial, does have some drawbacks. Primarily, assets transferred through this will still need to go through probate, which can be a lengthy process. Additionally, if the trust is not properly funded during your lifetime, the intended property might not be distributed as you wished. It's essential to consider these factors when creating your Syracuse New York Last Will and Testament with All Property to Trust called a Pour Over Will.

Wills do not supersede trusts; in most cases, trusts take priority. If you have both documents and they conflict, the trust's terms will prevail. It’s essential to design your estate plan thoughtfully, perhaps by utilizing a Syracuse New York Last Will and Testament with All Property to Trust called a Pour Over Will. This strategy ensures that all your assets are directed according to your preferences.