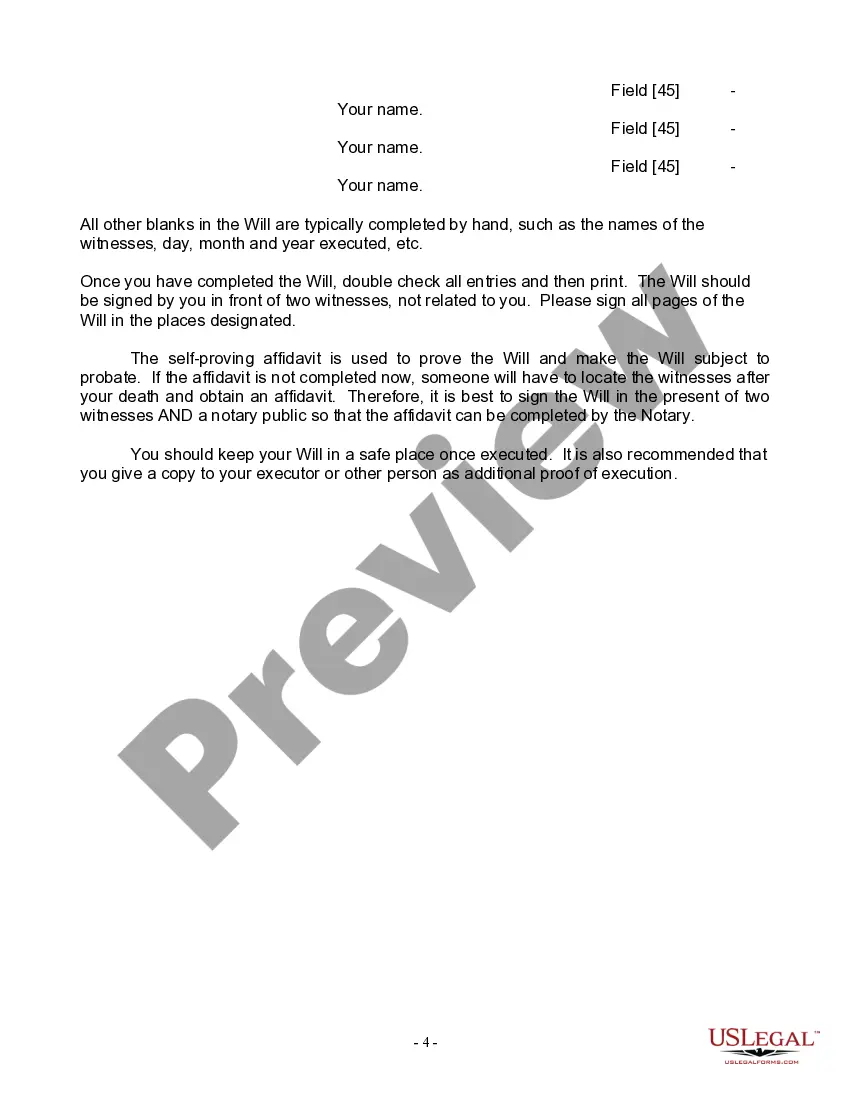

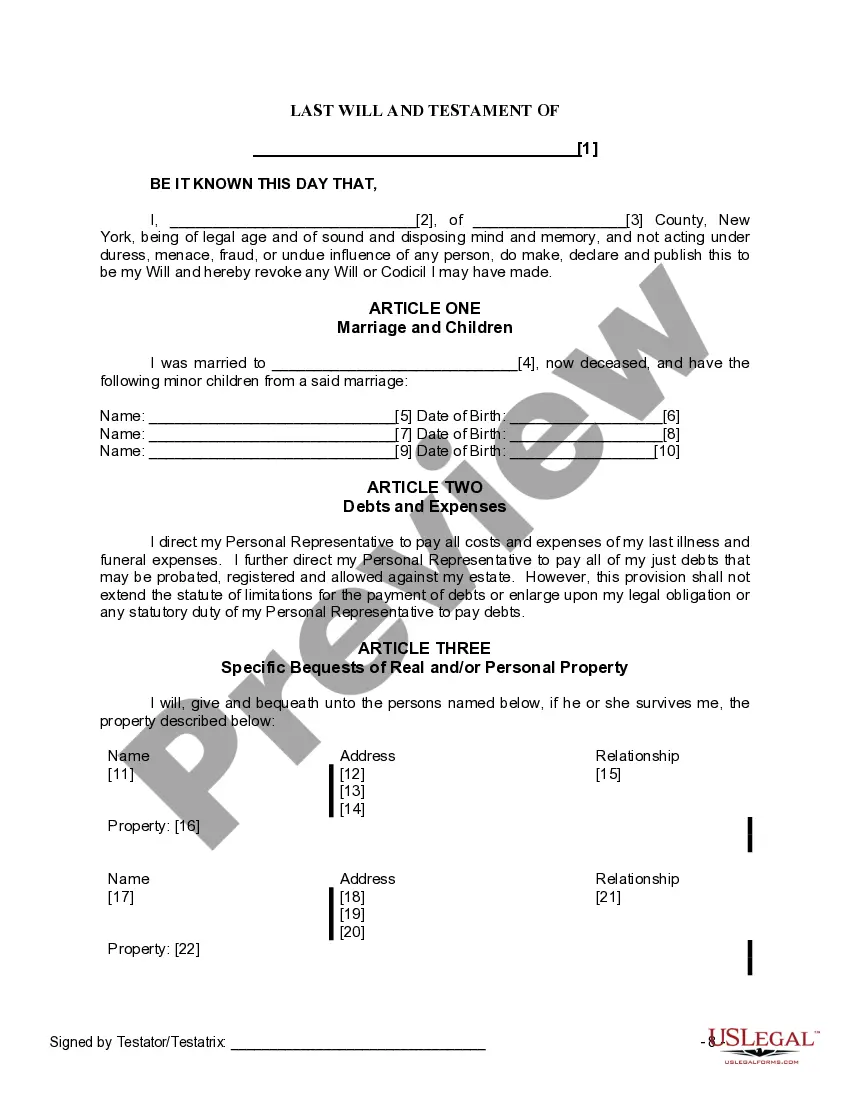

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

Queens New York Last Will and Testament for Widow or Widower with Minor Children

Description

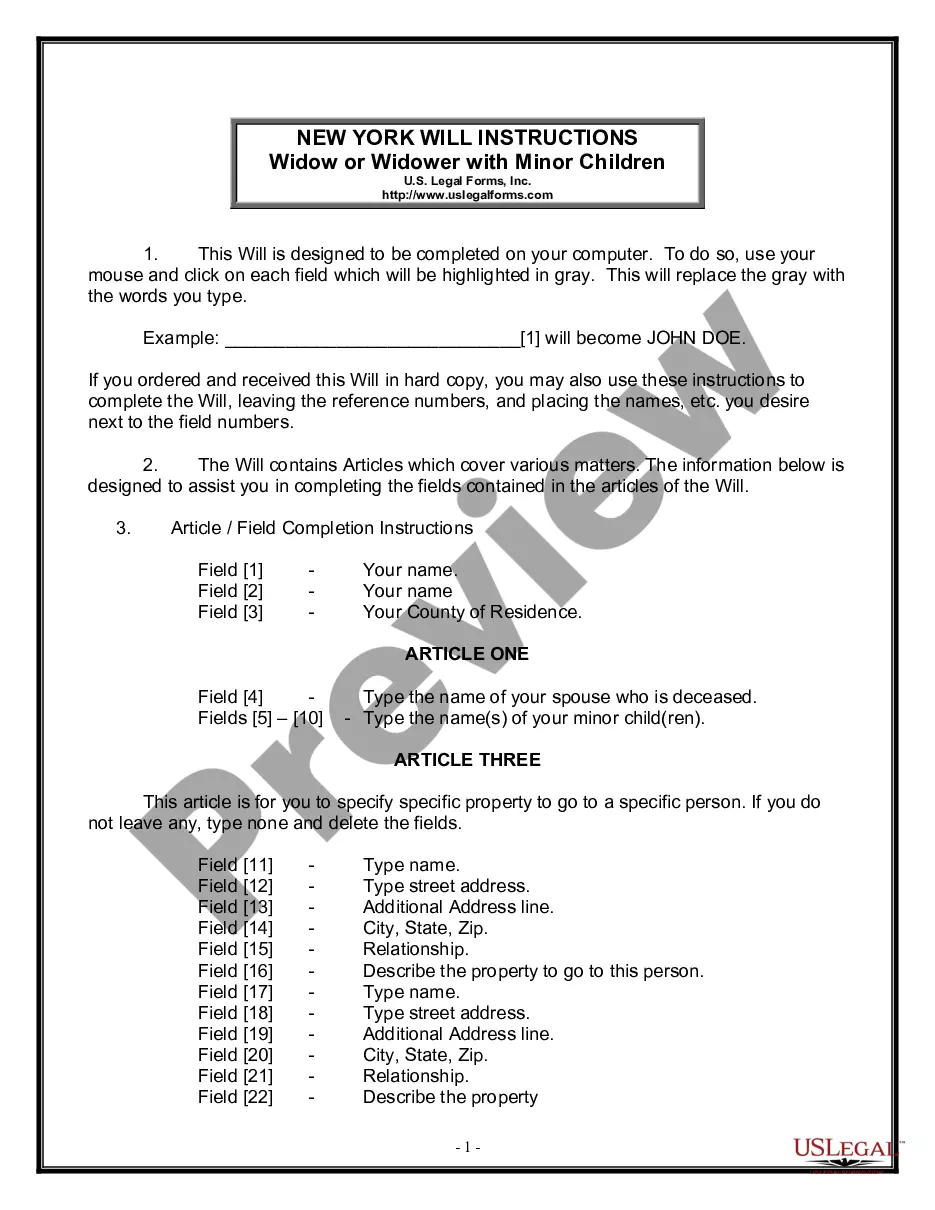

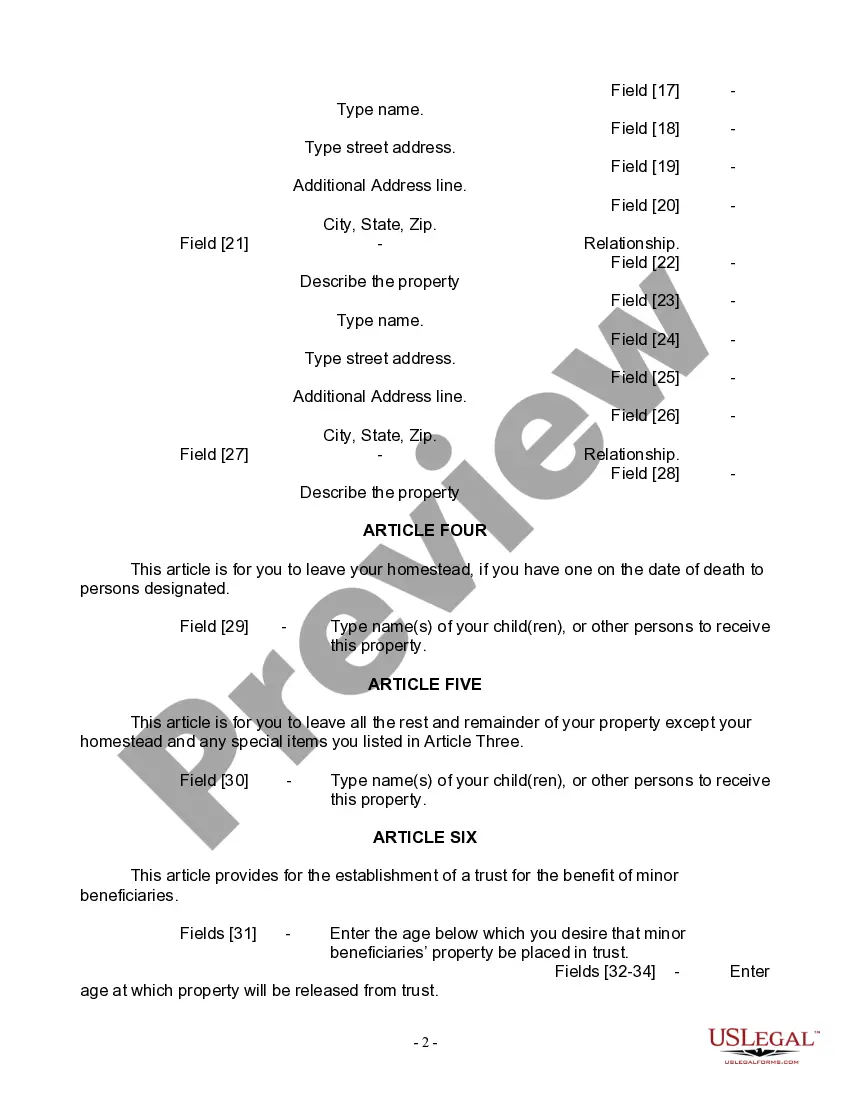

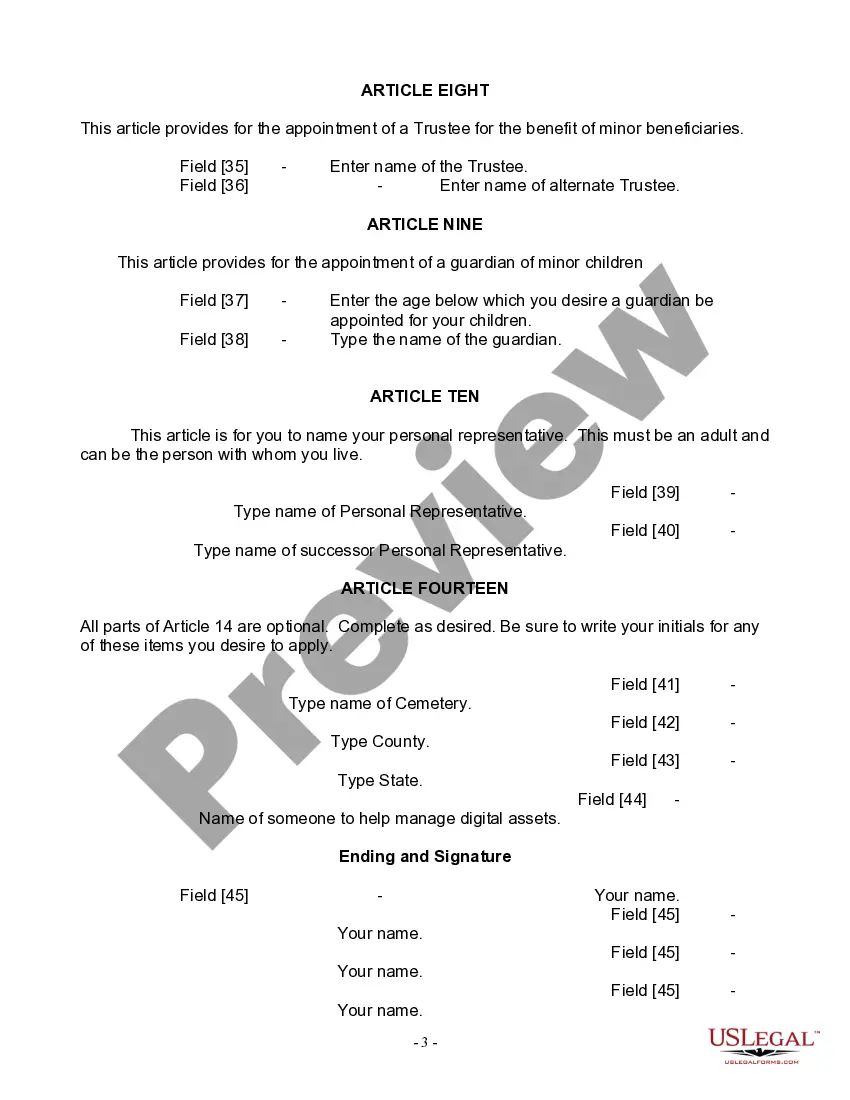

How to fill out New York Last Will And Testament For Widow Or Widower With Minor Children?

Regardless of one's social or professional standing, executing legal documents is a regrettable requirement in today's society.

Frequently, it’s nearly unfeasible for an individual without a legal background to formulate such paperwork from scratch, primarily due to the intricate terminology and legal nuances they entail.

This is where US Legal Forms proves to be beneficial.

Make certain that the form you've located is tailored to your area, as the laws of one state or county do not apply in another.

Examine the document and review a brief description (if available) regarding the types of cases the document applies to.

- Our platform provides an extensive repository with over 85,000 ready-to-use state-specific documents suitable for almost any legal situation.

- US Legal Forms is also an excellent tool for associates or legal advisors seeking to enhance their efficiency by utilizing our DYI forms.

- Whether you need the Queens New York Legal Last Will and Testament Form for a Widow or Widower with Minor Children or any other document valid in your jurisdiction, US Legal Forms ensures everything is readily accessible.

- Here’s how to obtain the Queens New York Legal Last Will and Testament Form for Widow or Widower with Minor Children in minutes using our trusted platform.

- If you are already a subscriber, you can go ahead and Log In to your account to access the required form.

- If you are new to our library, follow these steps before acquiring the Queens New York Legal Last Will and Testament Form for Widow or Widower with Minor Children.

Form popularity

FAQ

Inheritance laws in New York dictate how an estate is divided among heirs, especially if there is no valid will. Under the framework of a Queens New York Last Will and Testament for Widow or Widower with Minor Children, these laws ensure that your intended heirs receive their rightful share. It is beneficial to consult legal resources or professionals to fully understand these laws.

If a beneficiary does not claim their inheritance, it may remain unclaimed in the estate until the estate is settled. In the context of a Queens New York Last Will and Testament for Widow or Widower with Minor Children, unclaimed assets can complicate the distribution process. It is advisable for beneficiaries to stay informed and actively engage in the probate proceedings.

In New York, you can generally keep an estate open for several months, or even years, depending on the complexity of the estate. If you are managing a Queens New York Last Will and Testament for Widow or Widower with Minor Children, it is crucial to ensure all debts and taxes are settled before finalizing the estate. Consulting with a legal professional can help navigate this process effectively.

In New York, when a husband passes away, the wife is entitled to a share of the estate, varying based on whether there are children. Specifically, if there are minor children involved, under a Queens New York Last Will and Testament for Widow or Widower with Minor Children, she may be entitled to the entire estate or a significant portion of it, depending on individual circumstances.

Yes, you can disinherit a child in New York, but this must be clearly stated in your will. If you choose to create a Queens New York Last Will and Testament for Widow or Widower with Minor Children, be explicit in your intentions to avoid potential disputes in the future. It's advisable to include a statement indicating your wishes directly.

Heirs in New York generally have up to seven months to claim an inheritance after the executor has begun administering the estate. This timeline can vary if you are navigating a Queens New York Last Will and Testament for Widow or Widower with Minor Children, so it is wise to consult with an attorney to ensure you meet all deadlines and requirements.

In New York, there is indeed a time limit to claim an inheritance. Typically, heirs must file a claim within seven months of the executor starting the estate process. If you are dealing with a Queens New York Last Will and Testament for Widow or Widower with Minor Children, it is essential to act promptly to understand your rights.

If someone passes away without a will in New York, the estate is distributed according to state intestacy laws. Generally, a widow or widower with minor children would inherit a share, alongside the children. This situation highlights the importance of a Queens New York Last Will and Testament for Widow or Widower with Minor Children, as it allows individuals to dictate how their assets are managed and who benefits, preventing complications during a trying time.

While it is not necessary to hire a lawyer to create a will in New York, doing so can provide valuable guidance. A Queens New York Last Will and Testament for Widow or Widower with Minor Children can be straightforward, but a legal expert can help ensure that your will meets all legal requirements and accurately reflects your wishes. Using platforms like USLegalForms can simplify the process, but professional advice can be advantageous.

In New York State, a spouse does not automatically inherit everything if there are children involved. Instead, under the law, a widow or widower with minor children typically receives the first $50,000 plus half of the remaining estate. This division is particularly important when considering a Queens New York Last Will and Testament for Widow or Widower with Minor Children, as it ensures that both the spouse and children receive a fair share.