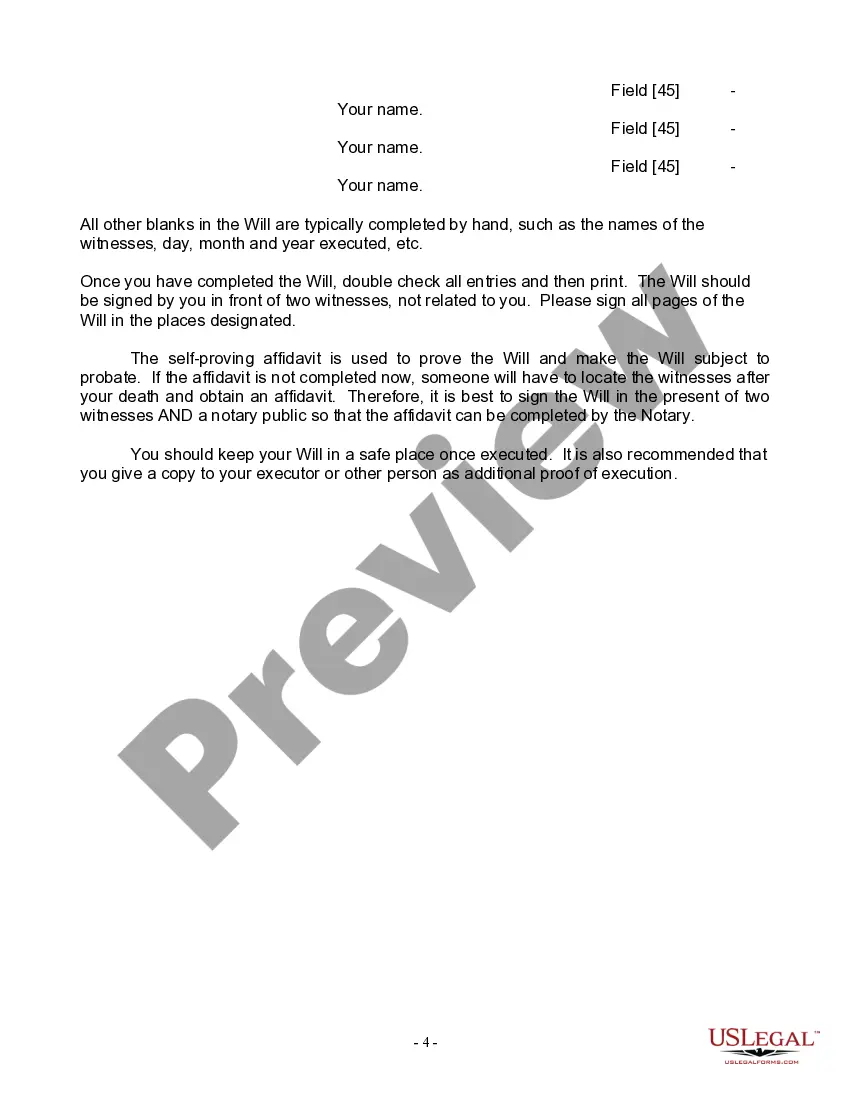

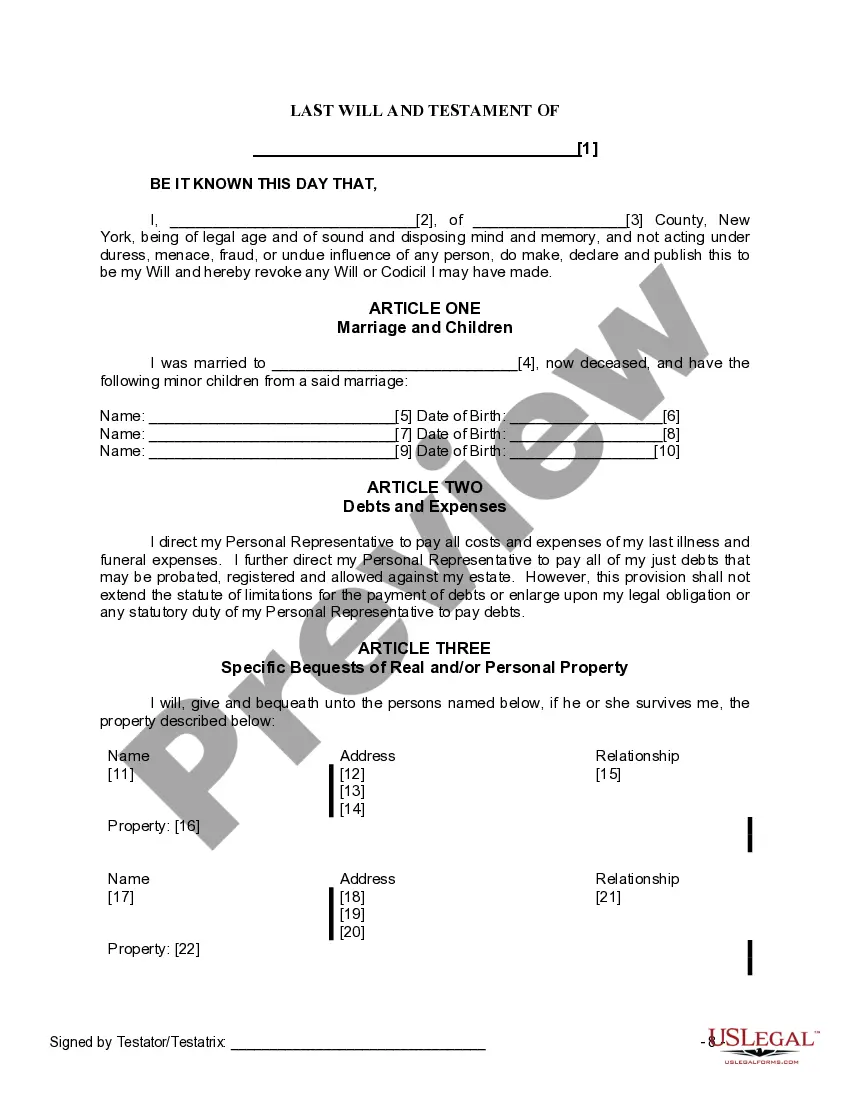

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

Bronx New York Last Will and Testament for Widow or Widower with Minor Children

Description

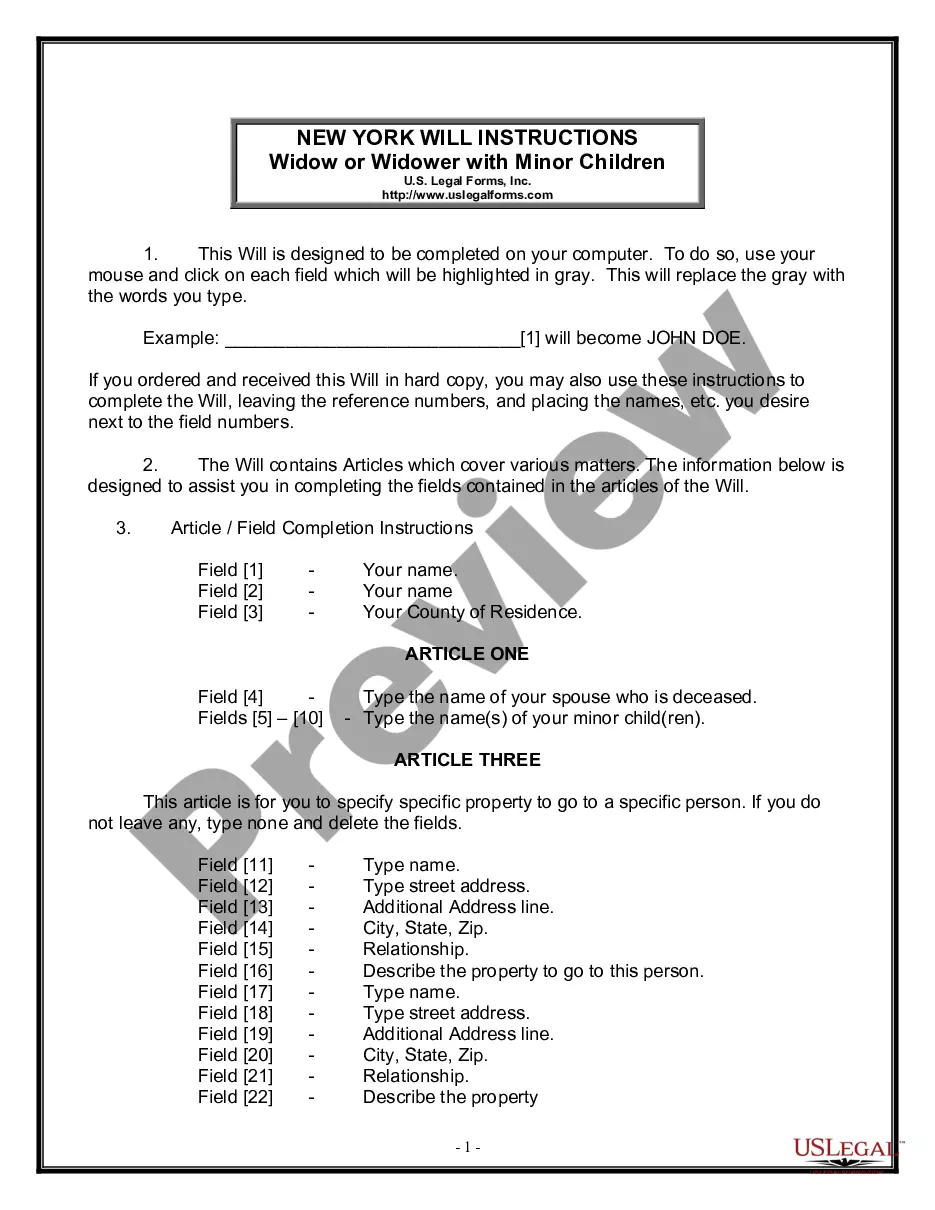

How to fill out New York Last Will And Testament For Widow Or Widower With Minor Children?

If you have previously used our service, Log In to your account and download the Bronx New York Legal Last Will and Testament Form for Widow or Widower with Minor Children onto your device by clicking the Download button. Make sure your subscription is active. If not, renew it based on your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have continuous access to every document you have purchased: you can locate it in your profile under the My documents section whenever you need to reference it again. Utilize the US Legal Forms service to swiftly find and store any template for your personal or professional requirements!

- Verify that you have found the correct document. Review the description and utilize the Preview feature, if available, to see if it aligns with your needs. If it does not suit you, use the Search tab above to discover the suitable one.

- Acquire the template. Hit the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and proceed with payment. Enter your credit card information or opt for the PayPal method to finalize the purchase.

- Retrieve your Bronx New York Legal Last Will and Testament Form for Widow or Widower with Minor Children. Select the file format for your document and save it to your device.

- Complete your document. Print it or utilize online professional editors to fill it out and sign it electronically.

Form popularity

FAQ

Yes, you can disinherit your child in New York, but you must clearly state your intentions in your will. A Bronx New York Last Will and Testament for Widow or Widower with Minor Children should explicitly mention the disinheritance to avoid any confusion. In some cases, children may still have rights to a statutory share, so consulting with a legal expert or using resources from uslegalforms can help clarify your specific situation.

In New York, you are not required to hire a lawyer to create a will. However, having legal assistance can be beneficial, especially when drafting a Bronx New York Last Will and Testament for Widow or Widower with Minor Children. A lawyer can help ensure your wishes are clearly stated and that the document adheres to state laws. Using uslegalforms can simplify this process by providing templates and guidance that reflect your needs.

To create a will, you'll need several key papers such as identification documents, a list of your assets, and a clear outline of your wishes regarding guardianship, especially if you have minor children. Additional paperwork may include beneficiary forms and any previous wills or codicils. Having the right documents is crucial when preparing your Bronx New York Last Will and Testament for Widow or Widower with Minor Children, and UsLegalForms simplifies this process by providing essential templates.

The document attached to a will is often called a codicil, which amends the existing will without needing to create a new one. This is important for making updates regarding beneficiaries or asset distribution. If you're drafting a Bronx New York Last Will and Testament for Widow or Widower with Minor Children, consider including a codicil to address any future changes in your plans.

The essential documents to file a will include the original will, a certified copy of the death certificate, and the probate petition. You may also need an Executor’s oath if appointed, and a list of beneficiaries. To ensure everything is correctly filed, using resources from UsLegalForms can provide the templates necessary for your Bronx New York Last Will and Testament for Widow or Widower with Minor Children.

To file a will in New York, you typically need the original will, an application for probate, and a death certificate. Additionally, you may need to provide information about the deceased’s assets and debts. For those considering a Bronx New York Last Will and Testament for Widow or Widower with Minor Children, preparing these documents in advance can streamline the process and reduce stress during a difficult time.

Yes, you can write your own will and have it notarized in New York, but it's important to ensure that it follows legal guidelines. A hand-written will, also known as a holographic will, may not be valid in New York, so using a template is often recommended. Utilizing tools from UsLegalForms can help you craft a Bronx New York Last Will and Testament for Widow or Widower with Minor Children that meets all necessary legal criteria.

The process of probating a will in Tennessee generally involves filing the will in the probate court located in the county where the deceased lived. After filing, the court will validate the will, appoint an executor, and manage the estate's assets. Following this, creditors may be notified, and an inventory of the estate will be made. If you're navigating these steps while planning your Bronx New York Last Will and Testament for Widow or Widower with Minor Children, understanding the local laws is essential.

While a last will and testament does not legally need to be notarized in New York, doing so may enhance its credibility. This is particularly beneficial for a Bronx New York Last Will and Testament for Widow or Widower with Minor Children, as it adds a layer of assurance against disputes. If you choose to use a platform like USLegalForms, you can easily find options that help with notarization needs.

Yes, you can create a will without a lawyer in New York. Many individuals opt to draft a Bronx New York Last Will and Testament for Widow or Widower with Minor Children on their own, using online resources or templates. However, if your situation is complex, consider consulting a legal expert to ensure all details are addressed correctly.