Yonkers New York Assignment of Security Interest

Description

How to fill out Yonkers New York Assignment Of Security Interest?

If you’ve previously utilized our service, Log In to your account and store the Yonkers New York Assignment of Security Interest on your device by clicking the Download button. Ensure your subscription is active. Otherwise, renew it as per your payment plan.

If this is your introductory experience with our service, follow these straightforward instructions to obtain your file.

You have continual access to all documents you have purchased: you can locate it in your profile within the My documents menu whenever you need to use it again. Utilize the US Legal Forms service to swiftly find and save any template for your personal or professional requirements!

- Confirm you’ve located an appropriate document. Browse through the description and utilize the Preview option, if available, to verify if it suits your needs. If it doesn’t work for you, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Input your credit card information or choose the PayPal option to finalize the transaction.

- Obtain your Yonkers New York Assignment of Security Interest. Choose the file format for your document and save it to your device.

- Complete your form. Print it or use professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

The 14 day tax rule in New York allows individuals to spend up to 14 days in the state without being considered a non-resident for tax purposes. This rule is beneficial for those who travel frequently for work or leisure but maintain their primary residence elsewhere. If you have transactions involving the Yonkers New York Assignment of Security Interest, being aware of this rule can be crucial for your tax filings.

You can live in New York for up to 183 days in a calendar year without being classified as a resident. However, once you exceed this period, you may face tax implications as a resident. Properly managing your time and obligations, especially regarding the Yonkers New York Assignment of Security Interest, can help you avoid unintentional residency status.

The 14 day rule for non-residents in New York indicates that if you spend 14 days or less in the state during the tax year, you are not considered a resident for tax purposes. This rule is particularly relevant for individuals who travel to Yonkers but maintain residency in another state. Knowing your status can help you navigate the complexities of the Yonkers New York Assignment of Security Interest.

To calculate New York adjusted gross income, start with your federal adjusted gross income and make necessary modifications as required by New York state tax law. You may need to add or subtract certain types of income and deductions specific to Yonkers residents. This calculation is essential when filing your taxes, especially if you are dealing with assets tied into the Yonkers New York Assignment of Security Interest.

The 12 week rule for residency in New York states that individuals who spend more than 183 days in the state within a year are considered residents for tax purposes. This means that if you live in Yonkers, New York, and establish a physical presence, your income may be subject to New York taxes. Understanding these residency rules is crucial for managing documents related to the Yonkers New York Assignment of Security Interest.

The Yonkers tax form Y 203 is specifically designed for residents and non-residents who need to report income earned in Yonkers. It allows taxpayers to detail their income and calculate their Yonkers tax obligations. For those involved in transactions related to the Yonkers New York Assignment of Security Interest, it is crucial to use this form correctly. Consider accessing detailed resources on US Legal Forms to ensure you fill out the Y 203 accurately.

NY tax form 203 is the designated form used to report Yonkers nonresident income tax. This form is essential for individuals who earn income in Yonkers but reside in another location. Completing this form accurately is important to avoid penalties and ensure compliance with the Yonkers New York Assignment of Security Interest guidelines. You can find guidance and templates for this form on US Legal Forms.

The Yonkers tax is a local income tax imposed on residents and workers in Yonkers, New York. It complements the New York State income tax, and it contributes to the funding of local services. Familiarity with the Yonkers tax is essential for anyone engaging in business or residing in Yonkers, particularly regarding obligations linked to the Yonkers New York Assignment of Security Interest. Resources available through US Legal Forms can help you navigate these tax responsibilities.

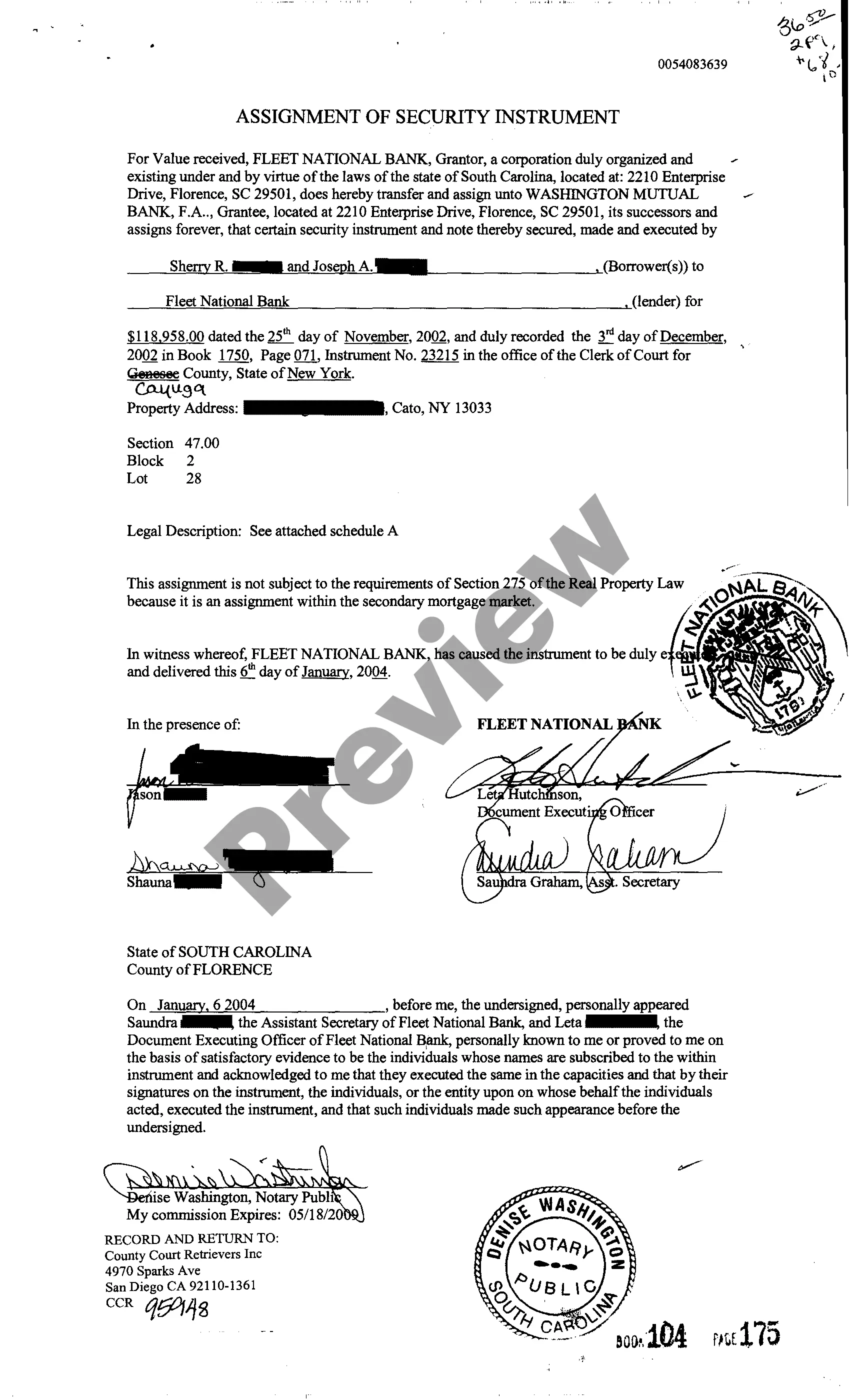

An assignment of security interest involves transferring a lender's claim against a borrower's collateral to another party. This process is crucial in finance, as it ensures that the new party has rights to the collateral outlined in the original agreement. In the context of Yonkers New York Assignment of Security Interest, understanding this process can provide clarity on your rights and obligations regarding security interests. Utilizing platforms like US Legal Forms can simplify this complex procedure for you.

A security interest under the Uniform Commercial Code (UCC) constitutes a legal claim granted by a debtor to a secured party over personal property. This interest allows the secured party to repossess the collateral if the debtor defaults. In Yonkers New York, understanding the UCC's provisions can significantly impact your financial transactions and asset management. Utilizing platforms like USLegalForms can help you navigate these regulations effectively.