Rochester New York New Resident Guide

Description

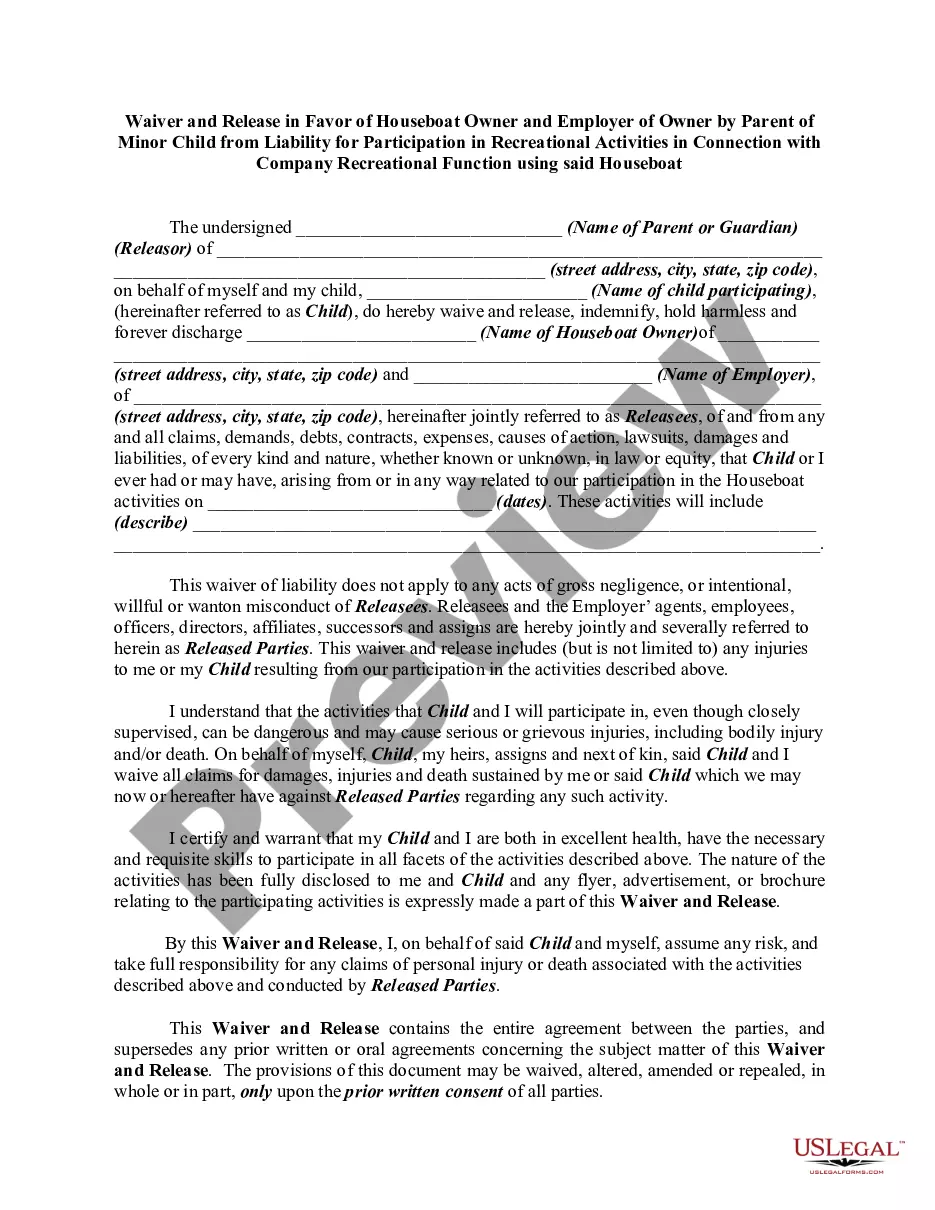

How to fill out New York New Resident Guide?

If you are looking for an appropriate form, it’s incredibly difficult to discover a superior platform than the US Legal Forms website – one of the most extensive online collections.

Here you can locate a vast array of templates for business and personal objectives categorized by types and states, or keywords.

With the enhanced search feature, locating the most recent Rochester New York New Resident Guide is as simple as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

Retrieve the form. Specify the file format and download it onto your device. Make modifications. Complete, edit, print, and sign the obtained Rochester New York New Resident Guide.

- Moreover, the significance of each document is confirmed by a group of professional lawyers who consistently evaluate the templates on our site and update them according to the latest state and county requirements.

- If you are already familiar with our platform and possess an account, all you need to acquire the Rochester New York New Resident Guide is to Log In to your user profile and hit the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the instructions outlined below.

- Ensure you have opened the document you desire. Review its details and use the Preview option to examine its content. If it does not fulfill your requirements, utilize the Search bar at the top of the page to find the appropriate document.

- Confirm your selection. Hit the Buy now button. After that, choose your preferred subscription plan and provide your details to create an account.

Form popularity

FAQ

The 10 month rule dictates that if you are in New York for at least ten months within a 12-month period, you may be deemed a resident. This rule is relevant for tuition and tax calculations. For more details about residency requirements, consult the Rochester New York New Resident Guide which provides essential information.

Similar to the NYC rule, the 183 day rule in New York State indicates that if you are physically present for 183 days or more, you may owe income taxes as a resident. This rule underscores the importance of how you track your time spent in New York. The Rochester New York New Resident Guide offers tips on managing your residency and tax responsibilities.

If you earn income in New York but do not meet residency requirements, you may be required to file a nonresident tax return. This ensures you comply with state tax laws, even if you are a resident of another state. Utilizing the Rochester New York New Resident Guide can help clarify your filing obligations.

Declaring residency in New York involves various steps, starting with obtaining a local driver's license and registering for local services. You should also file for in-state tuition if you are a student and provide proof of your living situation. For detailed guidance, refer to the resource of the Rochester New York New Resident Guide which outlines necessary actions for a smooth transition.

The 183 day rule means that if you spend 183 days or more in New York City, you may be considered a resident for tax purposes. Specifically, you must keep a meticulous log of your days spent in the city. This rule plays a significant role in your tax obligations, a topic also covered in detail by the Rochester New York New Resident Guide.

The 11 month rule refers to maintaining physical presence in New York for at least 183 days within a year, which can lead to residency classification. If you are outside the state for an extended period, ensure you develop ties to New York, like employment or property ownership. This rule is crucial for understanding residency implications as outlined in the Rochester New York New Resident Guide.

To be considered a resident for college in New York, you generally need to live in the state for at least 12 months prior to enrollment. During this period, you must demonstrate your intent to remain in New York, such as by securing housing and employment. Consulting the Rochester New York New Resident Guide may provide specific details relevant to various institutions.

To declare residency in New York, you should establish a physical presence in the state. This involves obtaining a New York driver's license, registering to vote, and filing your taxes as a resident. Additionally, consider providing evidence of your permanent address in Rochester. This process helps solidify your status as a resident according to the Rochester New York New Resident Guide.