Bronx New York Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out New York Unsecured Installment Payment Promissory Note For Fixed Rate?

Obtaining validated templates tailored to your regional laws can be difficult unless you utilize the US Legal Forms library.

This is an online collection of over 85,000 legal documents catering to both personal and professional requirements across various real-world scenarios.

All the documents are well organized by usage type and legal jurisdictions, making it as straightforward as pie to find the Bronx New York Unsecured Installment Payment Promissory Note for Fixed Rate.

Maintaining organized paperwork that adheres to legal standards is crucial. Leverage the US Legal Forms library to always have crucial document templates readily available for any requirements!

- Familiarize yourself with our service and if you've used it previously, retrieving the Bronx New York Unsecured Installment Payment Promissory Note for Fixed Rate involves just a few clicks.

- Simply Log In to your account, select the document, and hit Download to store it on your device.

- For new users, the process will require just a couple of additional steps.

- Follow the instructions below to start using the largest online form collection.

- Review the Preview mode and form description. Ensure you’ve selected the correct one that fulfills your specifications and aligns entirely with your local jurisdiction demands.

Form popularity

FAQ

You may not need a lawyer for every promissory note, but hiring one can help navigate complexities. For critical agreements like a Bronx New York Unsecured Installment Payment Promissory Note for Fixed Rate, having legal guidance can provide valuable insights and assist in making the document enforceable. Platforms like Uslegalforms can offer templates, but consulting a lawyer ensures completeness and clarity in your note.

While it is not mandatory to have a lawyer draft a promissory note, consulting one can be beneficial. A legal expert can help ensure your Bronx New York Unsecured Installment Payment Promissory Note for Fixed Rate complies with state regulations and protect your interests. Uslegalforms provides resources to assist you in creating a compliant document, but legal advice offers peace of mind.

In New York, a promissory note does not typically require notarization to be legally binding. However, having your Bronx New York Unsecured Installment Payment Promissory Note for Fixed Rate notarized can provide an added layer of security and may help in enforcing the note if disputes arise. It's a good idea to consult with a legal expert to ensure your document meets all necessary requirements.

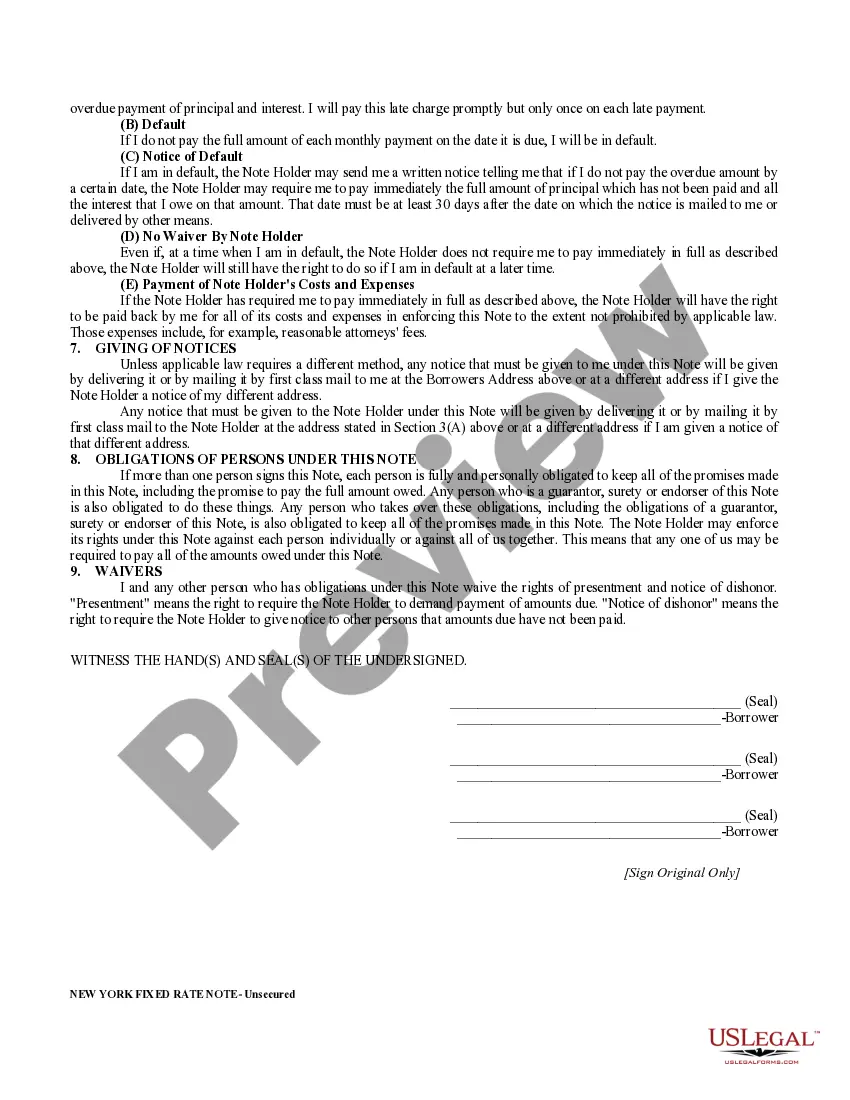

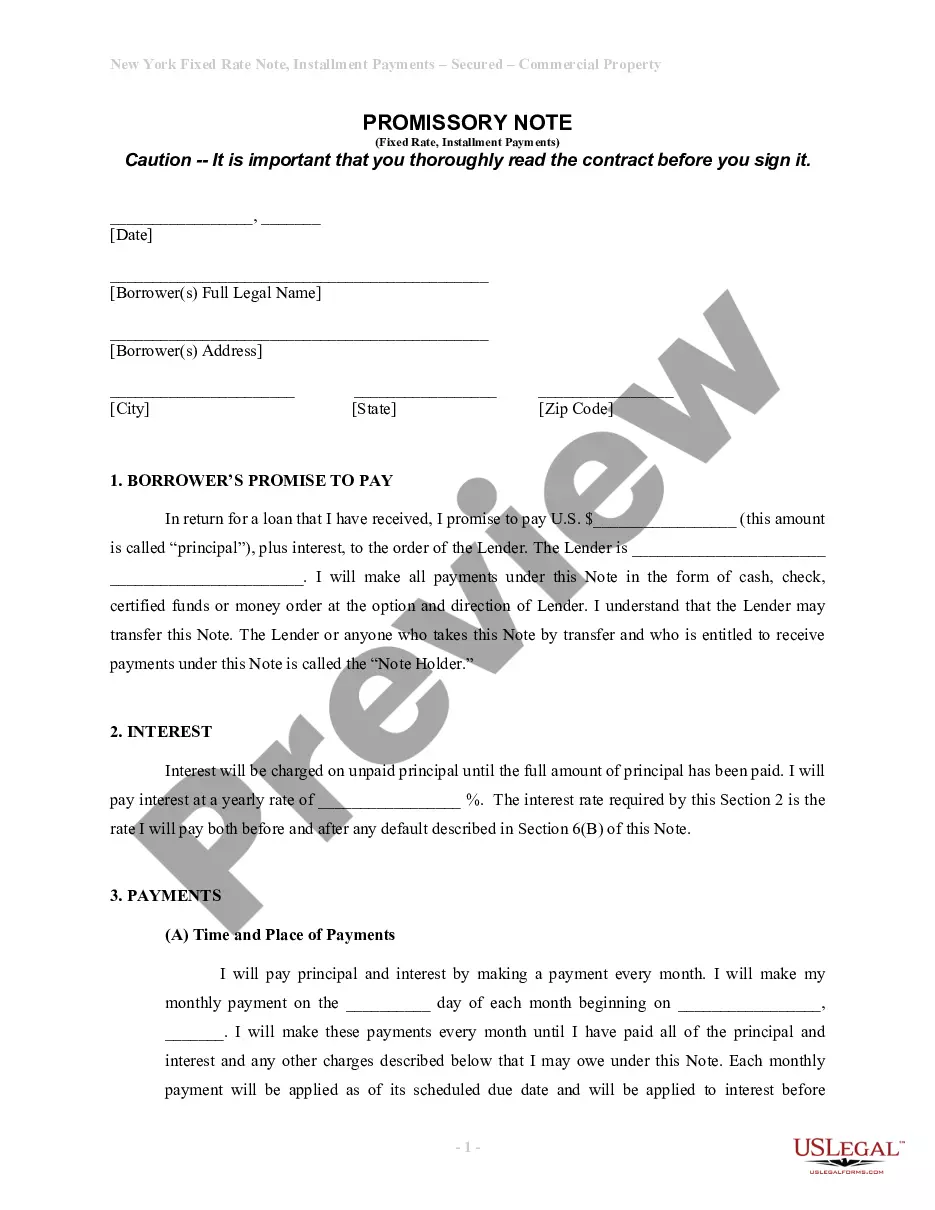

Filling out a promissory demand note involves a few key steps. Begin by clearly stating the names of the borrower and lender, along with their addresses. Next, specify the amount being borrowed and the repayment terms, including any interest rate associated with the Bronx New York Unsecured Installment Payment Promissory Note for Fixed Rate. Lastly, make sure to include the date and signatures of all parties involved.

An unsecured promissory note is a financial agreement promising repayment without asset backing. It relies solely on the borrower's creditworthiness and reputation. A Bronx New York Unsecured Installment Payment Promissory Note for Fixed Rate is an ideal option for individuals seeking loans based on trust rather than material possessions, thus simplifying the borrowing process.

The primary difference between secured and unsecured notes lies in collateral. A secured note is backed by assets, allowing creditors to claim the collateral if the borrower defaults. Conversely, a Bronx New York Unsecured Installment Payment Promissory Note for Fixed Rate does not require any assets, making it a riskier option for lenders but more accessible for borrowers who lack collateral.

Calculate interest for one year Next, calculate the interest charge for one year by multiplying the principal by the interest rate. In our example that math would yield $5,000 X 0.07 = $350. This is the annual interest charge for the note.

Promissory Notes, Interest, and Usury A promissory note must specify the percentage interest charged on the loan. All loans should carry some interest, even if it is between family members.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.