Nassau New York Pay Notice for Prevailing Rate and Other Jobs - Notice and Acknowledgement of Pay Rate and Payday

Description

How to fill out New York Pay Notice For Prevailing Rate And Other Jobs - Notice And Acknowledgement Of Pay Rate And Payday?

Utilize the US Legal Forms and gain instant access to any document you require.

Our valuable site with numerous templates streamlines the way to locate and obtain nearly any document sample you seek.

You can save, fill out, and sign the Nassau New York Pay Notice for Prevailing Rate and Other Jobs - Notice and Acknowledgement of Pay Rate and Payday within minutes, rather than spending hours browsing the Internet for the appropriate template.

Using our catalog is an excellent method to enhance the security of your form submissions. Our expert legal professionals consistently review all documents to ensure that the templates are pertinent to a specific area and compliant with current laws and regulations.

US Legal Forms is one of the largest and most dependable template repositories online. We are always here to assist you with any legal process, even if it is simply downloading the Nassau New York Pay Notice for Prevailing Rate and Other Jobs - Notice and Acknowledgement of Pay Rate and Payday.

Feel free to take advantage of our form catalog and make your document experience as productive as possible!

- How can you acquire the Nassau New York Pay Notice for Prevailing Rate and Other Jobs - Notice and Acknowledgement of Pay Rate and Payday.

- If you have a subscription, simply Log In to your account. The Download button will be activated on all the samples you view. Additionally, you can access all your previously saved documents in the My documents section.

- If you haven’t yet created an account, follow the instructions provided below.

- Access the page with the form you require. Ensure that it is the template you intend to find: check its title and description, and use the Preview option if available. Otherwise, utilize the Search bar to locate the required one.

- Initiate the downloading process. Select Buy Now and choose your desired pricing plan. Then, create an account and complete your order using a credit card or PayPal.

- Download the document. Choose the format to acquire the Nassau New York Pay Notice for Prevailing Rate and Other Jobs - Notice and Acknowledgement of Pay Rate and Payday and modify and complete, or sign it according to your needs.

Form popularity

FAQ

In New York State, as part of the Wage Theft Prevention Act, employers are required to provide a Statement of Wages, also known as a Pay Stub, with each payment of wages.

All commissions earned by a commission salesperson are legally considered wages and must be paid to the salesperson even if the employment relationship with the employer has ended.

If you are required or permitted to report to work, even if you are not assigned actual work, you may be entitled to ?call-in pay.? Usually, restaurant or hotel workers are entitled to three hours' pay at the applicable minimum rate, and employees in other private workplaces are entitled to four hours' pay at the

As with any nonexempt employee, federal law requires that on-call, nonexempt employees must still be compensated at or above the minimum wage and must be paid overtime for all hours worked in excess of 40 in any given workweek. Also, employers should make sure to check state laws on minimum wage and overtime.

A wage statement (sometimes called a pay stub) is a document employers give their employees every pay period that explains how their paycheck was calculated. ?1 California has specific laws that govern the information that employees are entitled to receive when they are paid.

In California, ?on call? employees should be paid for the time they wait to learn if they are working or not. If you haven't been adequately compensated for hours you've spent ?on call? you may be owed money.

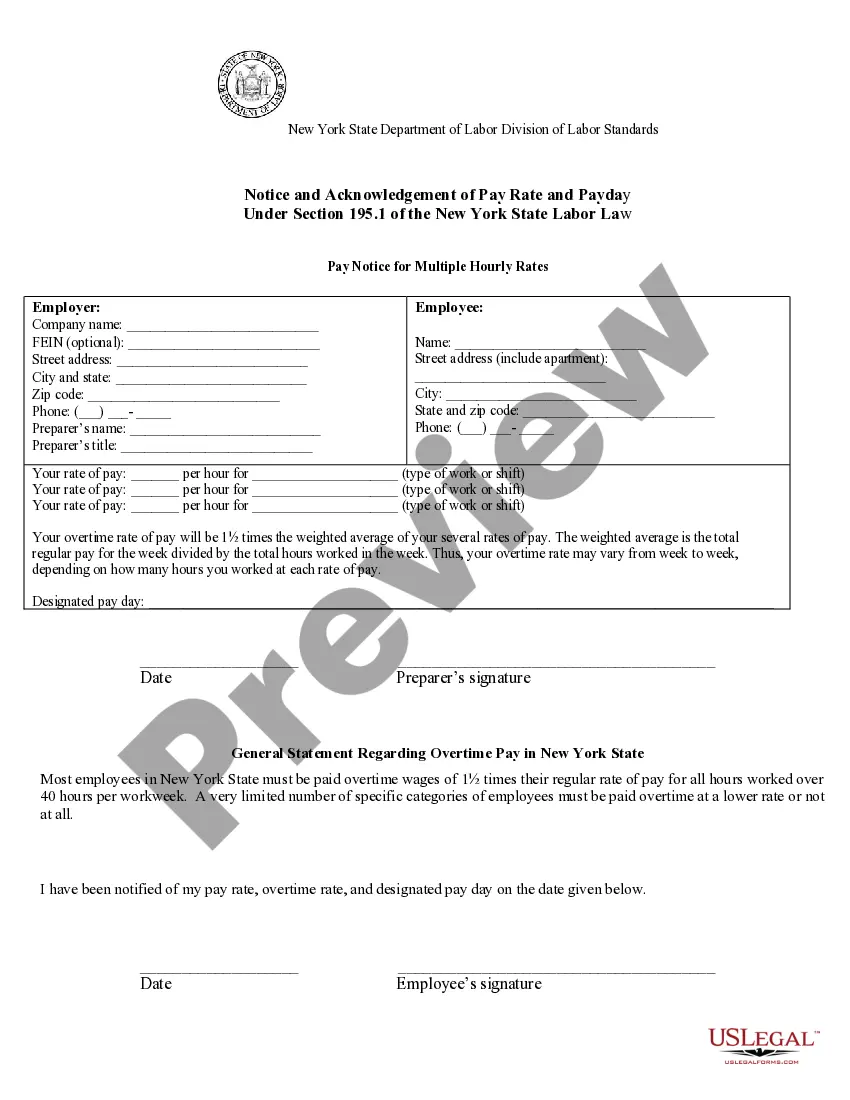

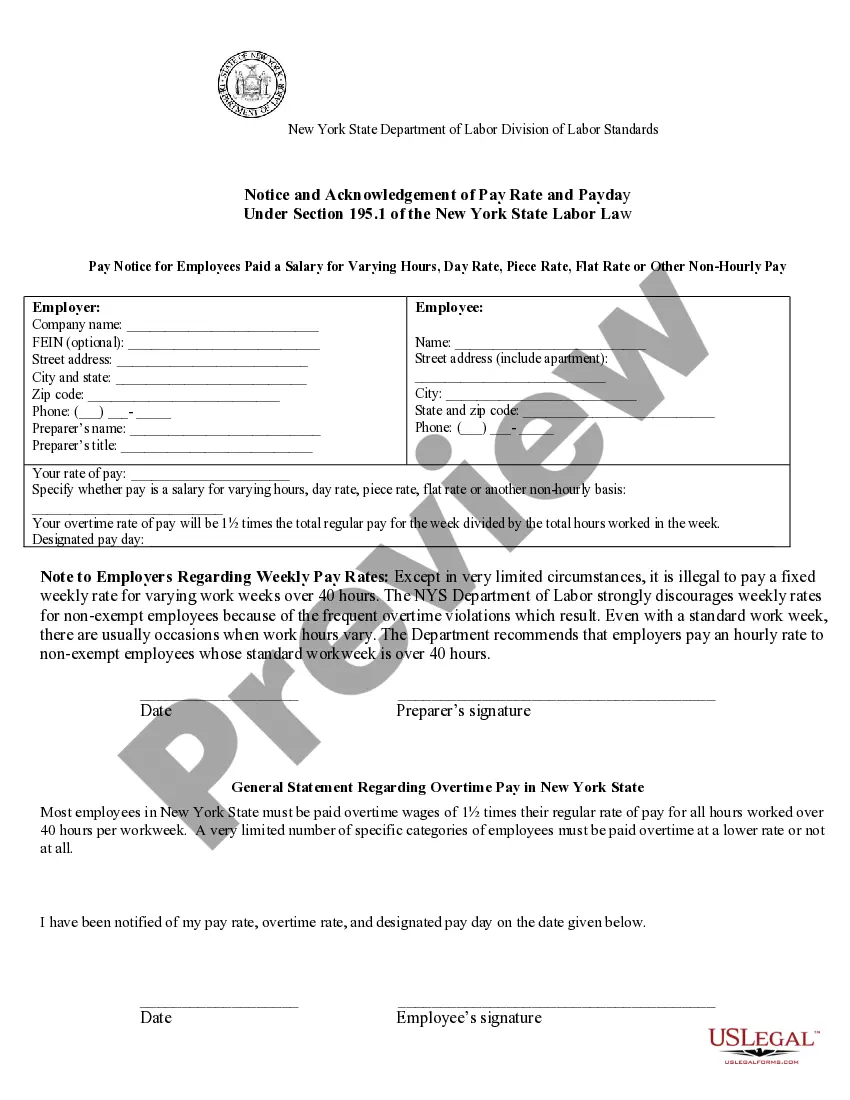

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies) How the employee is paid: by the hour, shift, day, week, commission, etc.

Review Solicitors An employment contract cannot be unilaterally varied by one party without the consent of the other. If an employer attempts to reduce an employee's salary without their consent, this will entitle the employee to take any of the following action: Resign from their position.

Section 193, subdivision 1(c), of the New York State Labor Law permits an employer to make deductions from an employee's wages for ?an overpayment of wages where such overpayment is due to a mathematical or other clerical error by the employer.? Such deductions are only permitted as follows: (a) Timing and duration.

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies)