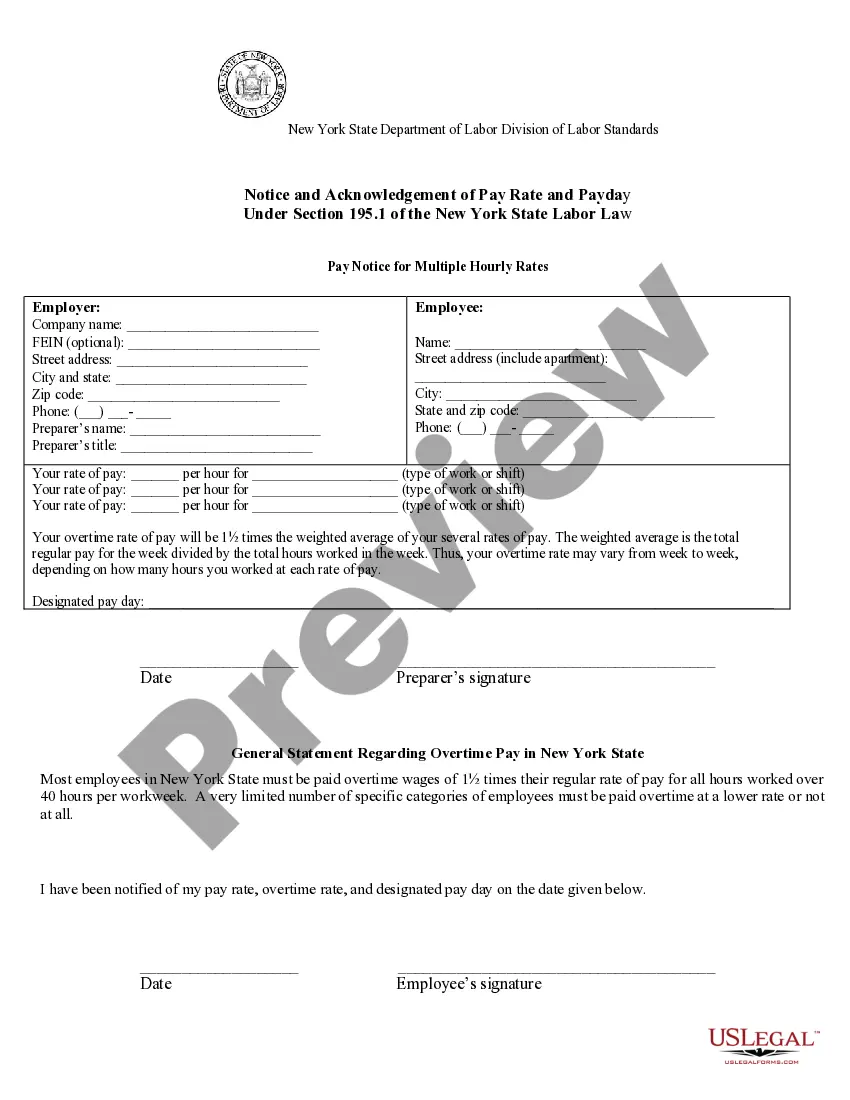

Rochester New York Pay Notice for Exempt Employees - Notice and Acknowledgement of Pay Rate and Payday

Description

How to fill out New York Pay Notice For Exempt Employees - Notice And Acknowledgement Of Pay Rate And Payday?

We consistently aim to reduce or avert legal exposure when addressing subtle legal or financial issues.

To achieve this, we enroll in legal services that are typically quite costly.

Nevertheless, not every legal concern is as complicated.

The majority can be managed independently.

Take advantage of US Legal Forms whenever you need to obtain and download the Rochester New York Pay Notice for Exempt Employees - Notice and Acknowledgement of Pay Rate and Payday or any other document effortlessly and securely.

- US Legal Forms is an online repository of current DIY legal documents ranging from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform empowers you to handle your affairs without seeking legal representation.

- We offer access to legal document templates that are not always readily accessible.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

Form popularity

FAQ

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies)

Review Solicitors An employment contract cannot be unilaterally varied by one party without the consent of the other. If an employer attempts to reduce an employee's salary without their consent, this will entitle the employee to take any of the following action: Resign from their position.

Wage Theft Prevention Act Explained New York law provides employees with the right to pursue their unpaid wages in court. This is done through the Wage Theft Act. Under this Act, employers are required to provide written wage notices and pay stubs or face penalties as high as ten thousand dollars.

Non-payment of wages is against the law under the Employment Rights Act 1966. If you delay payment, your staff could take you to court for breach of contract. Alternatively, you may face an employment tribunal for unlawful deduction of wages, and face a pay-out of up to £25,000.

In New York State, as part of the Wage Theft Prevention Act, employers are required to provide a Statement of Wages, also known as a Pay Stub, with each payment of wages.

Employers are not required by federal law to give a former employee his or her final paycheck immediately. Also, an employer is not required to pay an exempt employee his or her full salary in the terminal week of employment.

Work any number of hours each week: Employers are not restricted to a 40-hour work week. This means that your employer has the authority to require you to work more than 40 hours in a given calendar week. Of course, overtime laws apply to any hours over 40 worked in a calendar week.

New York employers who make an untimely wage payment may do so in violation of state and federal laws. Employers must pay their employees within seven days of their particular pay period, whether it is on a weekly or biweekly basis.

But whether workers are paid semi-monthly, weekly, or every two weeks, they should get paid within seven days of the end of the pay period. If a holiday lands on a business day, then an employer may pay the employee's wages on the next business day.