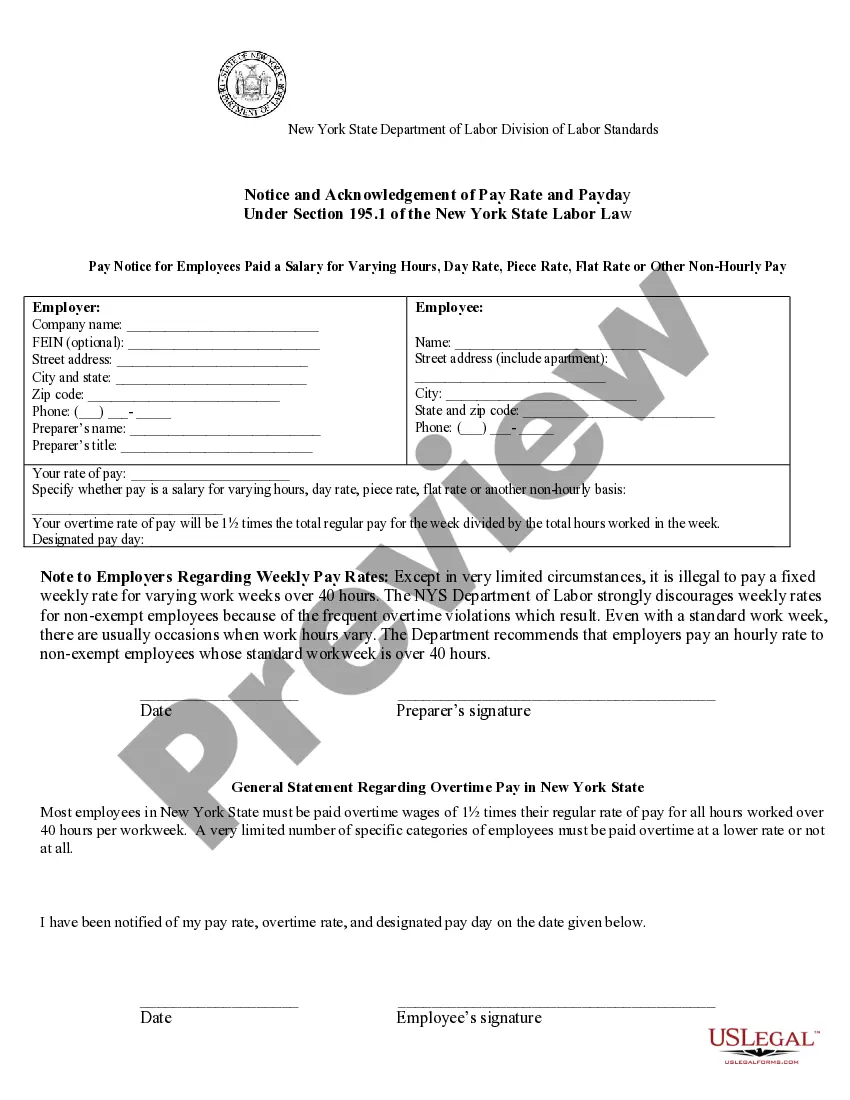

Yonkers New York Pay Notice for Multiple Hourly Rates- Notice and Acknowledgement of Pay Rate and Payday

Description

How to fill out New York Pay Notice For Multiple Hourly Rates- Notice And Acknowledgement Of Pay Rate And Payday?

If you have previously utilized our service, Log In to your account and download the Yonkers New York Pay Notice for Multiple Hourly Rates - Notice and Acknowledgement of Pay Rate and Payday onto your device by selecting the Download button. Ensure your subscription is active. If not, renew it according to your payment plan.

If this is your initial encounter with our service, adhere to these straightforward steps to obtain your document.

You have continuous access to every document you have purchased: you can find it in your profile within the My documents menu whenever you need to access it again. Utilize the US Legal Forms service to effortlessly locate and save any template for your personal or professional requirements!

- Ensure you’ve selected the correct document. Review the description and utilize the Preview feature, if available, to verify it aligns with your requirements. If it doesn’t suit you, use the Search tab above to discover the suitable one.

- Acquire the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and finalize the payment. Input your credit card information or choose the PayPal option to complete the transaction.

- Obtain your Yonkers New York Pay Notice for Multiple Hourly Rates - Notice and Acknowledgement of Pay Rate and Payday. Select the file format for your document and store it to your device.

- Finish your sample. Print it out or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

An employer cannot usually impose a pay cut unilaterally on employees. However, there are situations where this may be possible ? for example, the right to reduce their remuneration package may be covered in the employment contract.

Can they do this? Yes. If you are not in a union and do not have an employment contract, an employer may change the conditions of employment, including salary, provided that he or she pays at least the minimum wage and any required overtime, and continues to follow any other applicable laws.

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies)

Can your employer reduce your hours, or lay you off? The short answer is ? only if your employment contract allows it. If not, your employer will have to negotiate a change to your contract. Typically, this will involve many members of staff.

Form W-2, also known as the Wage and Tax Statement, is the document an employer is required to send to each employee and the Internal Revenue Service (IRS) at the end of the year. A W-2 reports employees' annual wages and the amount of taxes withheld from their paychecks.

Your name. Dates covered in payment period. Type of payment (hourly, salary, commission, etc) Rate of payment (regular rate and overtime rate)

Workers who have collective bargaining agreements or individual employment contracts are shielded from pay cuts while those agreements are in effect. If you work under a contract or collective bargaining agreement, your employer is not allowed to reduce your pay or hours arbitrarily.

Review Solicitors An employment contract cannot be unilaterally varied by one party without the consent of the other. If an employer attempts to reduce an employee's salary without their consent, this will entitle the employee to take any of the following action: Resign from their position.

In New York State, as part of the Wage Theft Prevention Act, employers are required to provide a Statement of Wages, also known as a Pay Stub, with each payment of wages.

Manual workers for non- profit entities must be paid in accordance with their agreed terms of employment but not less frequently than semi-monthly. Large employers of manual workers may apply to the Commissioner of Labor to pay manual workers semi-monthly.