Suffolk New York Pay Notice for Hourly Rate Employees - Notice and Acknowledgement of Pay Rate and Payday

Description

How to fill out New York Pay Notice For Hourly Rate Employees - Notice And Acknowledgement Of Pay Rate And Payday?

Regardless of your social or occupational rank, finalizing legal documents is an unfortunate necessity in the current professional landscape.

Frequently, it’s nearly impossible for someone lacking legal training to generate such paperwork from the ground up, primarily due to the complicated terminology and legal nuances they involve.

This is where US Legal Forms can be a lifesaver.

Confirm that the form you have located is appropriate for your area since the laws of one state or county are not applicable to another.

Review the document and review a brief description (if available) of situations the paper can be utilized for.

- Our platform offers an extensive library with over 85,000 state-specific documents ready for use that cater to nearly any legal situation.

- US Legal Forms also proves to be an invaluable resource for associates or legal advisors looking to save time with our DIY papers.

- Whether you need the Suffolk New York Pay Notice for Hourly Rate Employees - Notice and Acknowledgement of Pay Rate and Payday or any other document that will be valid in your state or county, US Legal Forms has everything readily accessible.

- Here’s how to quickly acquire the Suffolk New York Pay Notice for Hourly Rate Employees - Notice and Acknowledgement of Pay Rate and Payday using our reliable platform.

- If you are already a subscriber, proceed to Log In to your account to download the necessary form.

- If you are unfamiliar with our platform, make sure you adhere to these steps before downloading the Suffolk New York Pay Notice for Hourly Rate Employees - Notice and Acknowledgement of Pay Rate and Payday.

Form popularity

FAQ

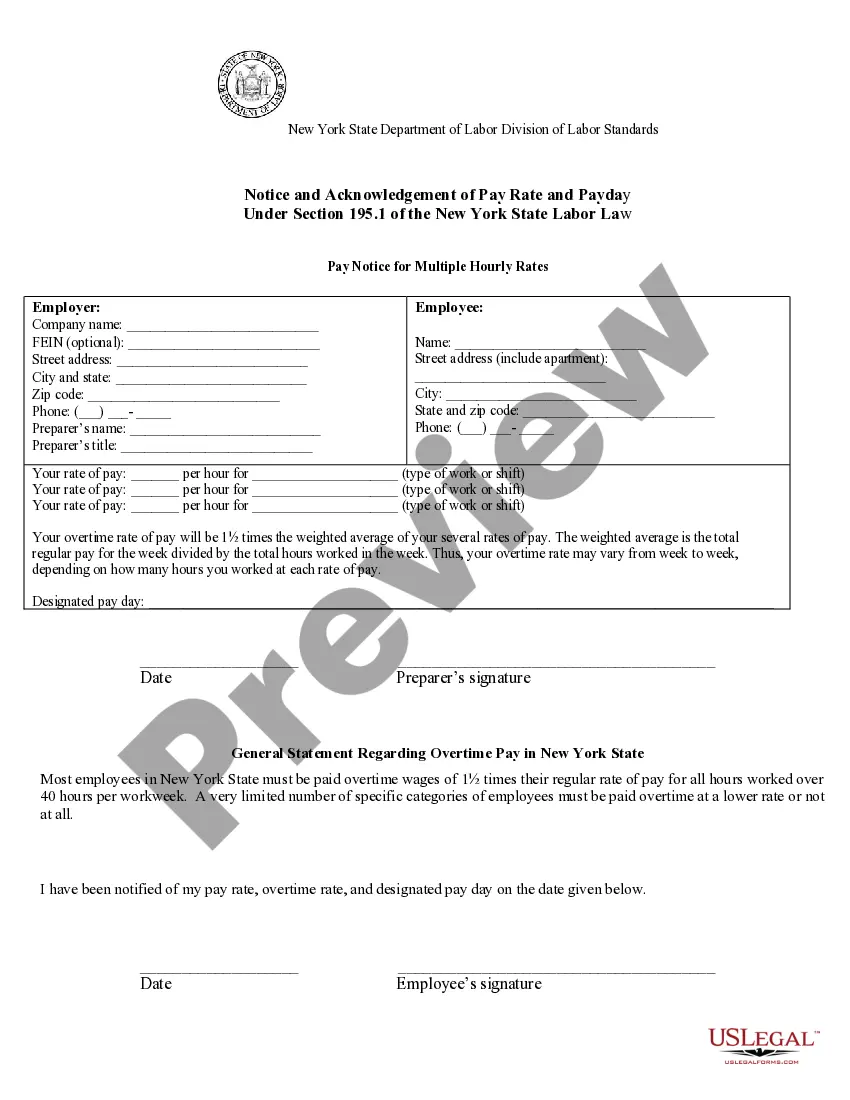

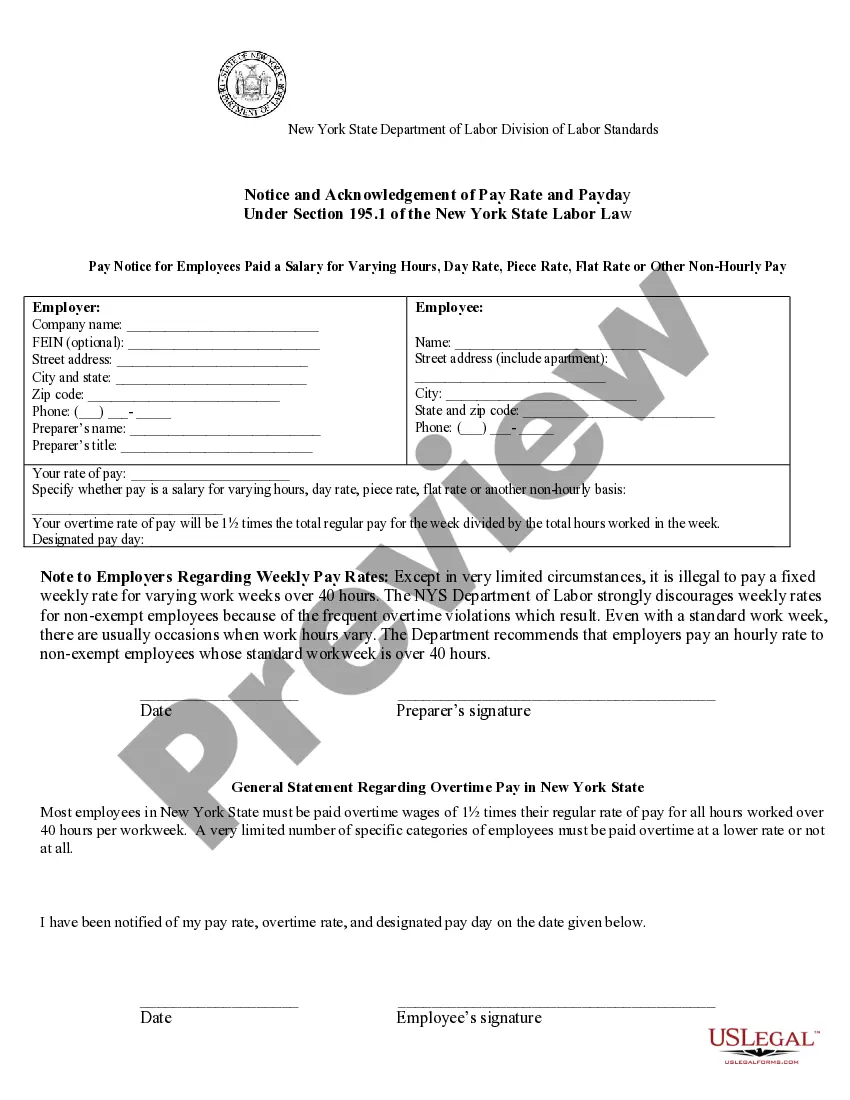

Notice and Acknowledgement of Pay Rate and Payday Under Section 195.1 of the New York State Labor Law.

Section 193, subdivision 1(c), of the New York State Labor Law permits an employer to make deductions from an employee's wages for ?an overpayment of wages where such overpayment is due to a mathematical or other clerical error by the employer.? Such deductions are only permitted as follows: (a) Timing and duration.

In New York State, as part of the Wage Theft Prevention Act, employers are required to provide a Statement of Wages, also known as a Pay Stub, with each payment of wages.

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies) How the employee is paid: by the hour, shift, day, week, commission, etc.

Review Solicitors An employment contract cannot be unilaterally varied by one party without the consent of the other. If an employer attempts to reduce an employee's salary without their consent, this will entitle the employee to take any of the following action: Resign from their position.

Your name. Dates covered in payment period. Type of payment (hourly, salary, commission, etc) Rate of payment (regular rate and overtime rate)

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies)

LS 54 Notice for Hourly Rate Employees This form is for hourly employees who are not exempt from coverage under the applicable State and Federal overtime provisions. For example, use for an employee whose regular rate of pay is $10 per hour and overtime rate is $15 per hour.

A wage statement (sometimes called a pay stub) is a document employers give their employees every pay period that explains how their paycheck was calculated. ?1 California has specific laws that govern the information that employees are entitled to receive when they are paid.