Yonkers, New York Assignment to Living Trust: A Comprehensive Guide Living trusts offer individuals in Yonkers, New York the opportunity to protect and manage their assets while still alive and ensure a smooth transfer of those assets upon their passing. An Assignment to Living Trust in Yonkers enables individuals to transfer ownership of their property into their established trust, allowing for greater control and flexibility. There are various types of Yonkers New York Assignment to Living Trust, each designed to suit different needs and preferences. Some common types include: 1. Revocable Living Trust: This type of trust provides individuals with the flexibility to make changes or cancel the trust during their lifetime. It allows them to maintain control over their assets while providing for a seamless transfer upon their passing. Most Yonkers residents opt for a revocable living trust, especially if they have complex estate planning needs. 2. Irrevocable Living Trust: Unlike a revocable living trust, this type of trust cannot be amended or revoked once established. Once assets are transferred into an irrevocable living trust, the individual no longer has ownership or control over them. Irrevocable trusts are often used for tax planning, Medicaid planning, or protecting assets from potential creditors. It's essential to consult with a trusted estate planning attorney before considering this type of assignment in Yonkers, New York. 3. Testamentary Trust: This trust is created within a person's will and goes into effect upon their passing. Unlike revocable living trusts, a testamentary trust becomes irrevocable and cannot be changed or canceled after the individual's death. Yonkers residents with simpler estate planning needs may choose this option as it allows for flexibility during their lifetime while still ensuring their assets are properly distributed upon their passing. 4. Special Needs Trust: Yonkers residents who have a loved one with special needs can establish a special needs trust to protect their beneficiary's eligibility for government assistance programs. This trust ensures that the beneficiary receives the necessary care and financial support without jeopardizing their eligibility for vital benefits. When considering a Yonkers New York Assignment to Living Trust, it is crucial to consult with an experienced estate planning attorney who specializes in trusts and asset protection. They can help individuals navigate the complexities of the legal process, ensure the trust is properly drafted and funded, and provide peace of mind knowing that their assets are protected and their wishes will be honored. In conclusion, a Yonkers New York Assignment to Living Trust allows residents to proactively manage and protect their assets while alive and ensure a smooth transfer of those assets upon their passing. Whether it's a revocable living trust, irrevocable living trust, testamentary trust, or special needs trust, establishing a trust in Yonkers provides individuals with greater control, flexibility, and peace of mind.

Yonkers New York Assignment to Living Trust

Description

How to fill out Yonkers New York Assignment To Living Trust?

If you’ve previously accessed our service, Log Into your account and obtain the Yonkers New York Assignment to Living Trust on your device by selecting the Download button. Ensure your subscription is active. If not, renew it as per your payment plan.

If this is your initial engagement with our service, adhere to these straightforward steps to acquire your document.

You have perpetual access to every document you have purchased: you can find it in your profile under the My documents section whenever you wish to use it again. Make use of the US Legal Forms service to swiftly locate and save any template for your personal or business purposes!

- Ensure you’ve located the suitable document. Examine the details and utilize the Preview feature, if offered, to verify if it fulfills your requirements. If it does not meet your standards, use the Search section above to find the correct one.

- Buy the template. Press the Buy Now option and select a monthly or yearly subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Yonkers New York Assignment to Living Trust. Choose the file format for your document and store it on your device.

- Fill out your template. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

To set up a living trust in New York, you should first decide on the type of trust that best suits your needs, such as a Yonkers New York Assignment to Living Trust. Next, you will draft the trust document, outlining terms, assets, and beneficiaries. It is often beneficial to work with a legal expert to ensure compliance with state laws. After the document is created, you should fund the trust by transferring your assets into it, which requires executing deeds or transferring ownership titles.

There is no legal minimum amount required to establish a living trust in New York. Even a modest estate can benefit significantly from a Yonkers New York Assignment to Living Trust. The key is to ensure that the assets you want to include are properly funded into the trust. Regardless of the size of your estate, having a trust can provide peace of mind and ease the transfer process for your loved ones.

To transfer property to a trust in New York, you must execute a deed that changes the title of the property from your name to the name of the trust. This includes filing the new deed with the county clerk where the property is located. When performing a Yonkers New York Assignment to Living Trust, it's advisable to consult an attorney to ensure that the transfer is conducted legally and correctly. Preparing appropriate documents and understanding the implications can simplify the process significantly.

One of the most significant mistakes is failing to fund the trust adequately. Parents often create a Yonkers New York Assignment to Living Trust but forget to transfer their assets into it, rendering the trust ineffective. This oversight can lead to lengthy probate processes and unexpected challenges for beneficiaries. It's essential to regularly review and update the trust to ensure that all intended assets are included.

In New York, a trust acts as a legal entity that holds property or assets for the benefit of designated beneficiaries. When establishing a Yonkers New York Assignment to Living Trust, the trust creator, or grantor, transfers ownership of certain assets into the trust while retaining control over them during their lifetime. Upon the grantor's passing, the assets transfer directly to the beneficiaries, avoiding probate. This process makes management and distribution smoother and often faster.

Transferring assets into your Yonkers New York Assignment to Living Trust involves several steps. Generally, you will collect all necessary documents for your assets and formally change titles to the trust's name. This applies to real estate, bank accounts, and investments. Utilizing a service like US Legal Forms can guide you through the documentation and ensure a seamless transfer, safeguarding your legacy.

To establish a living trust in Yonkers, New York, start by defining your goals and identifying your assets. Next, create a detailed trust document that outlines how you want your assets managed during your lifetime and after your death. It’s advisable to work with a qualified attorney or a trusted platform like US Legal Forms, which can simplify the process. Proper setup ensures your wishes are honored while maximizing benefits for your heirs.

When considering a Yonkers New York Assignment to Living Trust, it’s important to know certain assets generally cannot be placed in a trust. For instance, retirement accounts like 401(k)s and IRAs often require specific designations or beneficiaries to avoid tax implications. Additionally, personal belongings such as cars may need different handling, so consulting with a legal professional is wise. Overall, understanding asset limitations is key when setting up your trust.

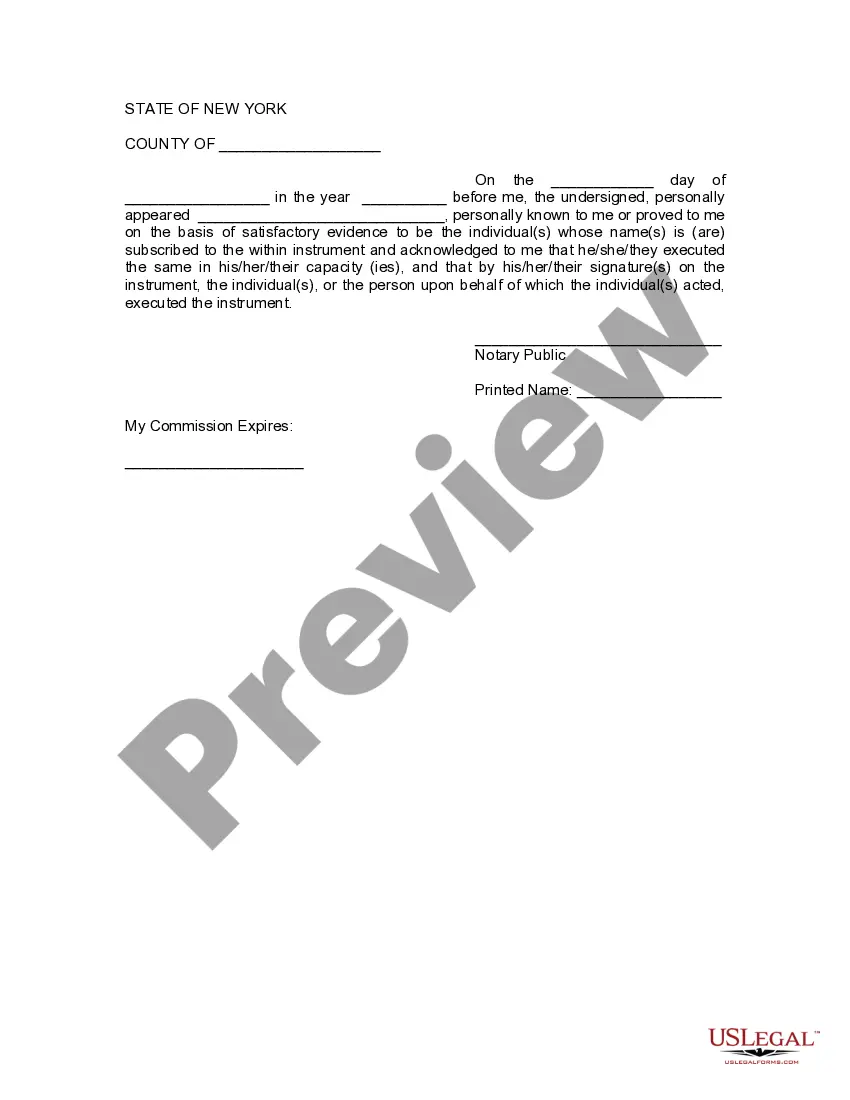

To transfer your property into a trust in New York, you first need to create the trust document that outlines the trust's terms. After establishing the trust, execute a deed that clearly states the transfer of property from your name to the trust. This deed must be signed and notarized, then recorded with the local county clerk's office to make the transfer official. If you seek guidance through the process, consider using uslegalforms to access the necessary legal forms and instructions for your Yonkers New York Assignment to Living Trust.

To set up a living trust in Yonkers, New York, start by deciding what assets you want to include in the trust. Next, draft a trust document that outlines how your assets will be managed and distributed. You can either do this with the help of an attorney or use an online service like US Legal Forms to simplify the process. Once you have your document, fund the trust by transferring your assets, ensuring your wishes are clear and enforceable.