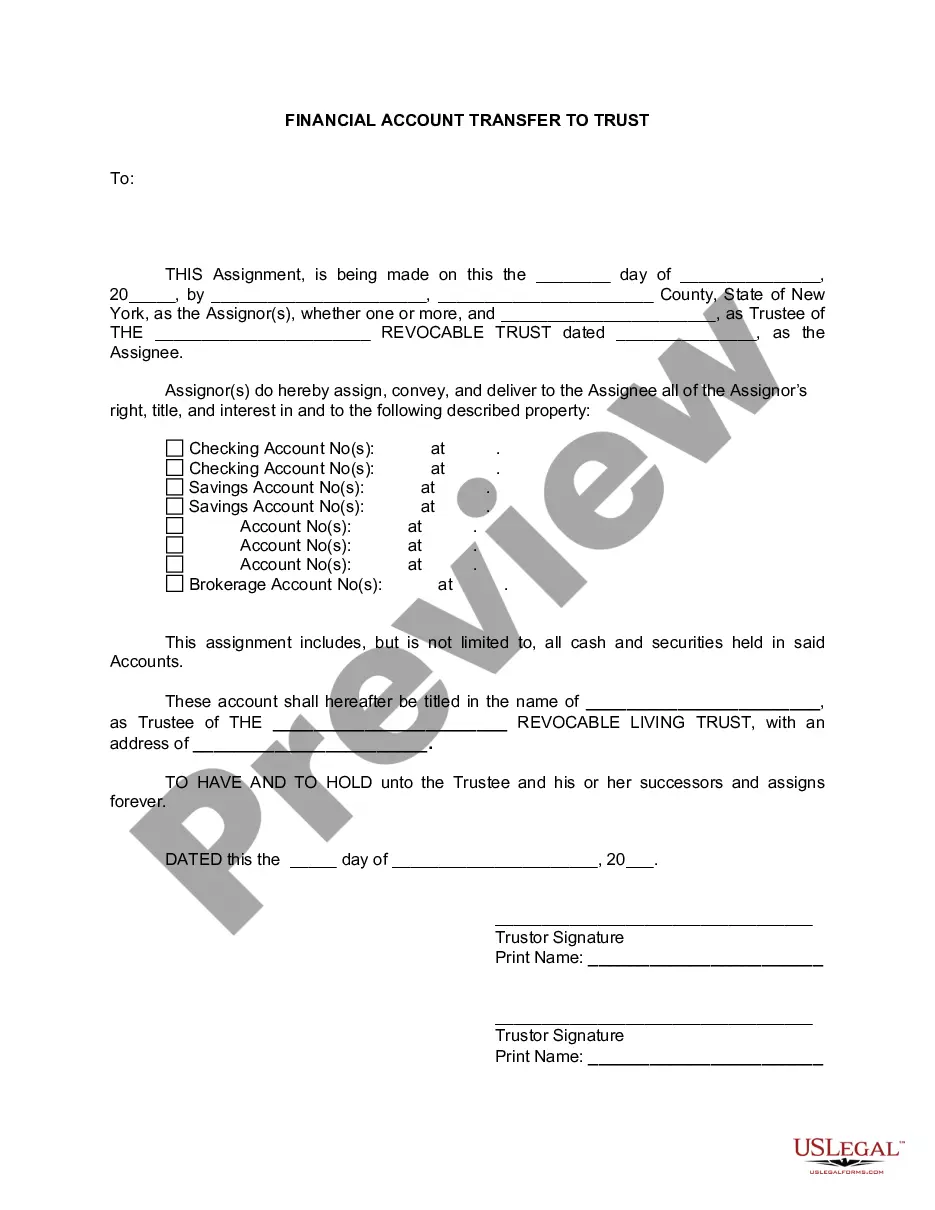

Kings New York Financial Account Transfer to Living Trust

Description

How to fill out New York Financial Account Transfer To Living Trust?

Are you in search of a dependable and cost-effective provider for legal forms to obtain the Kings New York Financial Account Transfer to Living Trust? US Legal Forms is your prime option.

Whether you need a simple agreement to establish rules for living with your partner or a collection of documents to facilitate your divorce through the legal system, we have you covered. Our platform offers over 85,000 current legal document templates for both personal and business purposes. All templates we provide are not generic and are designed according to the needs of particular states and regions.

To acquire the form, you must Log In to your account, locate the required template, and click the Download button adjacent to it. Please note that you can download your previously acquired document templates at any time from the My documents section.

Are you a newcomer to our site? No problem. You can set up an account swiftly, but firstly, ensure to do the following.

Now you can proceed to create your account. Next, choose a subscription plan and move on to payment. After the transaction is complete, download the Kings New York Financial Account Transfer to Living Trust in any available file format. You can revisit the website at any time and redownload the form at no additional cost.

Obtaining current legal documents has never been simpler. Try US Legal Forms today, and bid farewell to spending hours studying legal paperwork online.

- Verify if the Kings New York Financial Account Transfer to Living Trust complies with the laws of your state and local area.

- Review the form’s description (if available) to find out who and what the form is intended for.

- Reinitiate the search if the template does not meet your particular needs.

Form popularity

FAQ

Transferring your checking account to your living trust involves a few simple steps. Contact your bank for the required forms and complete them with your trust details. Following through with this process will ensure compliance with the Kings New York Financial Account Transfer to Living Trust.

Yes, you can transfer a mortgaged property to a trust. However, you should notify your lender, as some may have specific requirements or restrictions. This transfer is an important consideration in your Kings New York Financial Account Transfer to Living Trust planning.

Placing your house in a trust can come with disadvantages, such as potential costs and complexity in setting it up. Additionally, you may lose certain tax benefits. However, understanding these factors is key in effectively navigating the Kings New York Financial Account Transfer to Living Trust process.

Many banks support trust checking accounts, including larger institutions and some local banks. It's essential to research which banks offer the best terms and services for your needs. Consider the options available as part of your Kings New York Financial Account Transfer to Living Trust strategy.

Transferring your bank account to a living trust is a straightforward process. Start by contacting your bank and requesting the necessary forms. Complete and submit these documents to ensure your bank account aligns with the Kings New York Financial Account Transfer to Living Trust.

When someone dies, a trust checking account typically remains under the control of the trust. The account's funds are managed according to the trust terms, ensuring that the beneficiaries receive the assets. This structure is part of what makes the Kings New York Financial Account Transfer to Living Trust so beneficial for estate planning.

Yes, you can place your checking account in a trust. This action helps manage assets efficiently, ensuring your funds are accessible to your beneficiaries without the need for probate. Incorporating it into the Kings New York Financial Account Transfer to Living Trust can provide peace of mind and simplify financial management.

Transferring your brokerage account to a living trust involves contacting your brokerage firm. You will need to complete a trust transfer form provided by the firm, detailing the trust and its beneficiaries. This step ensures that your investments are managed according to your wishes after you pass on, aligning with the Kings New York Financial Account Transfer to Living Trust intentions.

To transfer your mortgage to a living trust, you need to contact your mortgage lender. You will likely need to provide documentation regarding the trust. Keep in mind that while the property can be placed in the trust, the mortgage obligation remains with you. This process is crucial for the Kings New York Financial Account Transfer to Living Trust.

Transferring stock to a revocable trust typically has minimal tax consequences, as you retain control over the assets while alive. Since revocable trusts do not change your tax status, any income generated will still be reported on your tax return. It's beneficial to consult with a tax professional to understand any specific implications related to the Kings New York Financial Account Transfer to Living Trust.