Nassau New York Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children

Description

How to fill out New York Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With Children?

Take advantage of the US Legal Forms and gain instant access to any form template you require.

Our helpful website featuring thousands of templates streamlines the process to locate and obtain nearly any document sample you desire.

You can download, fill out, and sign the Nassau New York Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children in just a few minutes rather than spending hours online searching for the right template.

Utilizing our collection is a superb method to enhance the security of your form submissions.

If you have not yet created an account, simply follow the steps below.

- Our qualified attorneys consistently assess all the documents to ensure that the templates are pertinent to a specific area and compliant with new laws and regulations.

- How can you acquire the Nassau New York Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children.

- If you are a subscriber, simply Log In to your account. The Download option will become visible on all documents you review. Additionally, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

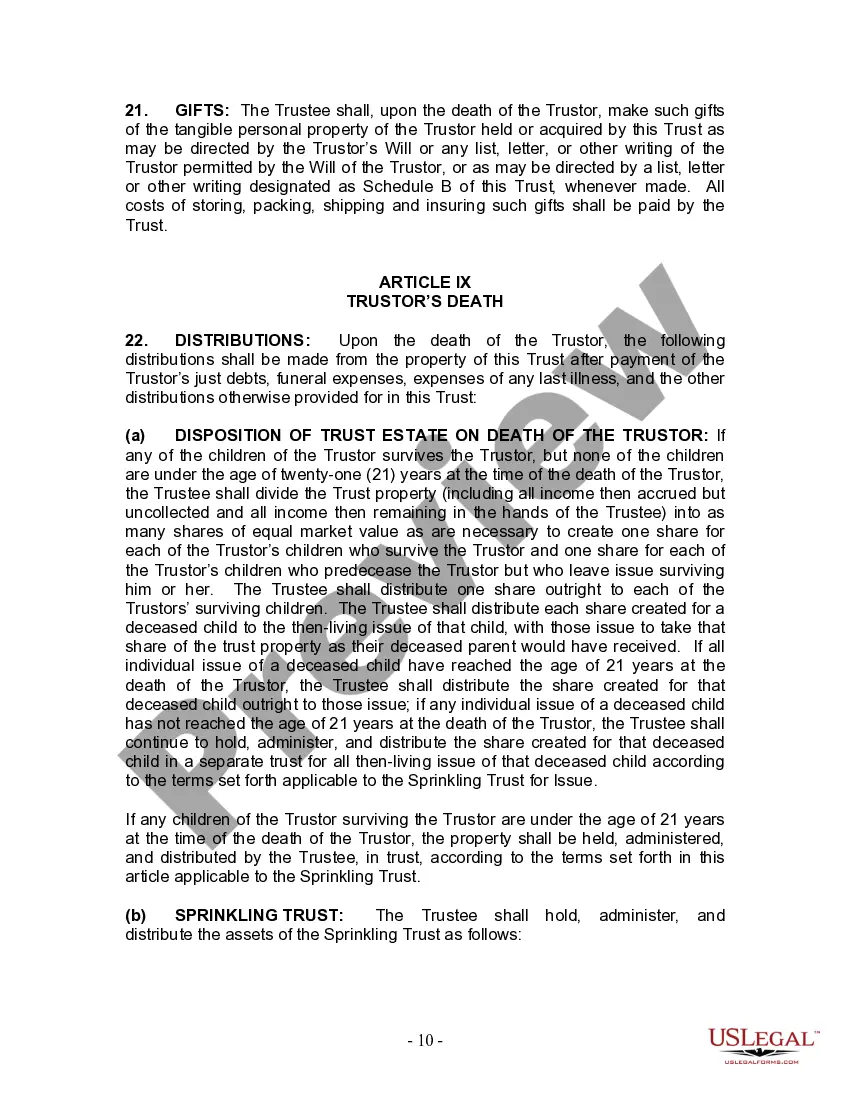

Establishing a trust can be a wise choice for parents wishing to protect their assets. A Nassau New York Living Trust for Individuals Who are Single, Divorced, or Widow or Widower with Children allows for seamless transfer of assets and can provide financial security for their children. It also helps avoid probate, which can save time and reduce costs. Ultimately, parents should discuss their options with a qualified attorney to determine the best course of action.

A common disadvantage of a family trust is the potential for management costs and administrative complexities. With a Nassau New York Living Trust for Individuals Who are Single, Divorced, or Widow or Widower with Children, these complexities can be minimized through expert guidance. Trusts require regular updates and communication to stay effective, which some individuals may neglect. Thus, working with knowledgeable professionals can prevent issues and enhance the trust’s effectiveness.

Some people view trusts negatively because they can be complex and may involve ongoing maintenance costs. However, when you establish a Nassau New York Living Trust for Individuals Who are Single, Divorced, or Widow or Widower with Children, clarity over asset management is created, mitigating these concerns. Additionally, trusts can offer privacy and control over asset distribution, contrasting with the notion that they are inherently bad. Ultimately, the benefits can outweigh the drawbacks with careful planning.

One of the biggest mistakes parents make is failing to clearly outline beneficiaries and distribution methods in a Nassau New York Living Trust for Individuals Who are Single, Divorced, or Widow or Widower with Children. Misunderstandings often lead to family disputes or unintentional disinheritance. It is vital to communicate intentions and involve trusted advisors to create a successful trust. Accurate documentation can significantly enhance clarity and family harmony.

The sole beneficiary of a living trust is the person or entity entitled to receive benefits from the trust. In the context of the Nassau New York Living Trust for Individuals Who Are Single, Divorced, or Widows and Widowers with Children, this can often be a child or another family member. It’s essential to specify your choice in the trust documents to avoid any confusion later on. Always consider consulting with a legal expert to confirm your decisions align with your overall estate planning goals.

Filling out trust paperwork may seem daunting, but it’s a straightforward process. First, gather all necessary documents, including your property details and intended beneficiaries. Next, clearly state your wishes regarding the Nassau New York Living Trust for Individuals Who Are Single, Divorced, or Widows and Widowers with Children. Utilizing online resources such as the US Legal Forms platform can also help ensure that you complete the paperwork correctly and in compliance with state laws.

When one spouse passes away, a living trust continues to function smoothly, avoiding the probate process. In the case of a Nassau New York Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children, the surviving spouse usually maintains access to trust assets. The trust typically stipulates how the assets will be managed or distributed after the passing, ensuring clarity during a difficult time. Understanding these mechanics is essential for effective estate planning.

While a Nassau New York Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children offers many benefits, there are downsides to consider. One significant issue is the complexity involved in setting up the trust correctly. Additionally, you may lose some control over the assets you place in an irrevocable trust, as they cannot be easily modified after creation. It’s vital to weigh these factors against your personal situation.

Yes, an irrevocable trust is generally subject to the 5-year rule. This means that if you establish such a trust, any assets transferred into it will be out of your estate for tax purposes only after five years. For individuals in Nassau New York who are single, divorced, or a widow or widower with children, this can greatly impact your estate planning strategy. Managing the timing of your trust is essential for maximizing its benefits.

The 5-year rule for trusts refers to the period during which assets transferred into an irrevocable trust may still be subject to estate taxes. Under this rule, assets held in a trust must generally remain there for five years to avoid being factored back into your estate. For someone considering a Nassau New York Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children, understanding this rule is crucial for effective long-term planning.