Bronx New York Complex Will with Credit Shelter Marital Trust for Large Estates

Description

How to fill out New York Complex Will With Credit Shelter Marital Trust For Large Estates?

We consistently attempt to minimize or avert legal complications when handling intricate legal or financial issues. To achieve this, we enroll in legal services that are typically quite costly. Nonetheless, not every legal problem is that complicated. Many of them can be resolved independently.

US Legal Forms is an online directory of current DIY legal documents covering everything from wills and powers of attorney to incorporation articles and dissolution petitions. Our collection empowers you to manage your affairs independently without needing to utilize legal assistance. We provide access to legal document templates that are not always readily accessible. Our templates are specific to states and regions, which greatly simplifies the search process.

Utilize US Legal Forms whenever you need to locate and acquire the Bronx New York Complex Will with Credit Shelter Marital Trust for Large Estates or any other document swiftly and securely. Just Log In to your account and click the Get button beside it. If you lose the document, you can always re-download it in the My documents section.

The procedure is just as simple if you’re not familiar with the website! You can set up your account in a few minutes. Make sure to verify if the Bronx New York Complex Will with Credit Shelter Marital Trust for Large Estates conforms to the laws and regulations of your state and locality.

- Furthermore, it is essential to review the form’s outline (if provided), and if you notice any inconsistencies with your original requirements, look for an alternative template.

- Once you've confirmed that the Bronx New York Complex Will with Credit Shelter Marital Trust for Large Estates is appropriate for you, you can select a subscription plan and proceed with the payment.

- After that, you can download the document in any of the available formats.

- For more than 24 years in the industry, we have assisted millions by providing ready-to-customize and up-to-date legal forms.

- Take advantage of US Legal Forms now to conserve effort and resources!

Form popularity

FAQ

The best trust for a married couple often varies based on individual circumstances, but a combination of a marital trust and a credit shelter trust is common. This dual approach within the Bronx New York Complex Will with Credit Shelter Marital Trust for Large Estates provides tax benefits while supporting survivorship. Tailoring a trust solution that addresses the couple's needs can enhance financial security and peace of mind. Always consult a legal expert to find the best fit.

A credit trust primarily aims to utilize the estate tax exemption for the deceased, allowing heirs to inherit without incurring substantial taxes. It thus preserves wealth across generations. By incorporating the Bronx New York Complex Will with Credit Shelter Marital Trust for Large Estates, individuals can ensure their estate is structured to maximize these benefits. A well-planned credit trust offers financial security for your loved ones.

The main difference lies in the purpose and benefits they provide. A credit trust is designed to minimize estate taxes by utilizing the deceased's estate tax exemption, while a marital trust directly benefits the surviving spouse. By using the Bronx New York Complex Will with Credit Shelter Marital Trust for Large Estates, you can effectively structure these trusts for the best of both worlds. Understanding their differences aids in better asset protection.

Typically, the credit shelter trust itself is a separate entity and may file its own tax returns. Beneficiaries are often responsible for paying taxes on the income generated by the trust. With the Bronx New York Complex Will with Credit Shelter Marital Trust for Large Estates, understanding your tax obligations becomes essential to effective estate management. Consulting a tax advisor can further clarify specific situations.

A marital trust and a credit shelter trust serve different purposes in estate planning. The Bronx New York Complex Will with Credit Shelter Marital Trust for Large Estates allows you to combine these two to optimize estate taxes. While a marital trust benefits the surviving spouse, a credit shelter trust can protect assets from estate taxes. Knowing the distinctions helps in forming a tailored estate plan.

The primary beneficiary of a credit shelter trust is typically the surviving spouse, who can access the income generated from the trust without facing immediate tax consequences. However, the trust can also provide for additional beneficiaries, such as children or grandchildren, upon the death of the surviving spouse. In a Bronx New York Complex Will with Credit Shelter Marital Trust for Large Estates, this structure effectively protects assets from estate taxes, ensuring that the financial legacy is sustained for family members. Understanding these roles can significantly influence long-term asset management strategies.

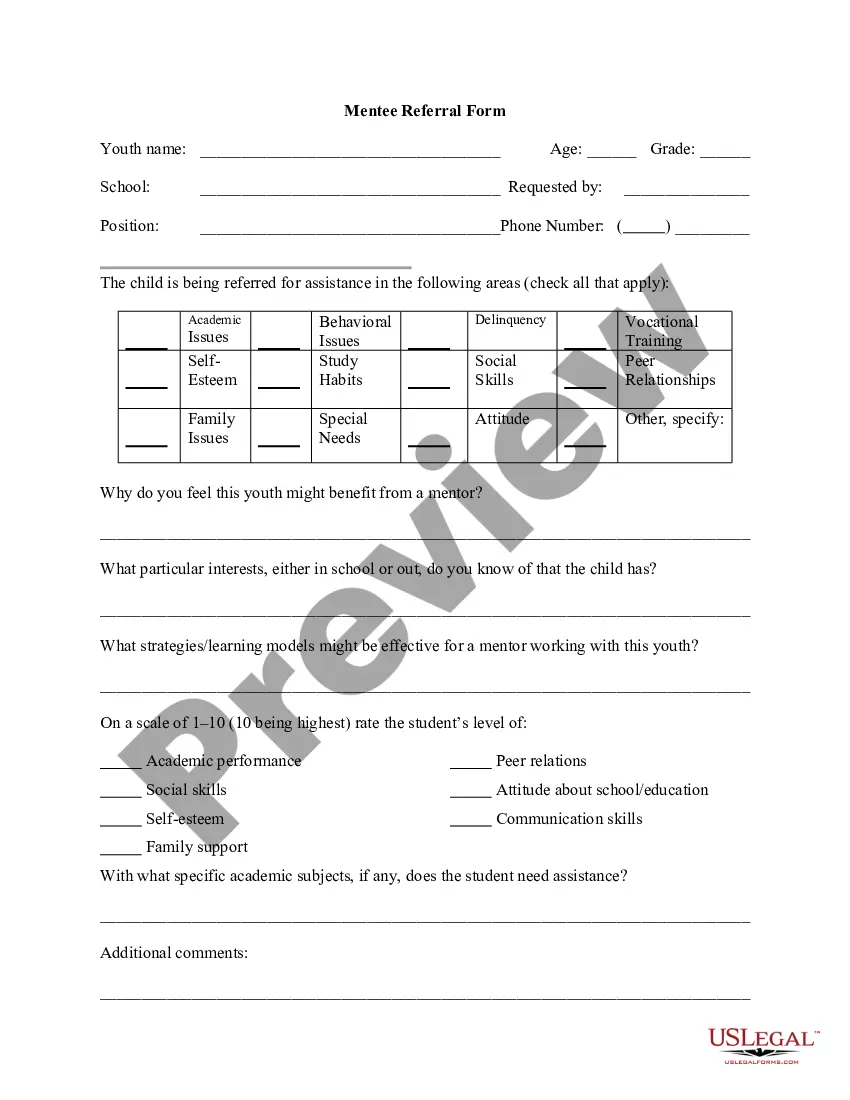

Beneficiaries of a trust fund can vary based on the specific terms set by the trust creator. Generally, they include family members, friends, or charitable organizations intended to receive assets upon certain conditions or ages. In a Bronx New York Complex Will with Credit Shelter Marital Trust for Large Estates, the choice of beneficiaries can help ensure that wealth is distributed according to the wishes of the deceased. This tailored approach provides financial security and support for future generations.

The main difference between a credit shelter trust and a marital trust lies in their purposes and tax implications. A credit shelter trust is designed to hold and manage assets up to the estate tax exemption limit, thereby minimizing tax liabilities. On the other hand, a marital trust allows the surviving spouse to access income and assets without tax consequences. In a Bronx New York Complex Will with Credit Shelter Marital Trust for Large Estates, both trusts work together to maximize the benefits for the family, balancing accessibility and tax efficiency.

One of the primary disadvantages of a credit shelter trust is the complexity of its management and setup. Creating a Bronx New York Complex Will with Credit Shelter Marital Trust for Large Estates requires careful planning and legal expertise. Additionally, there may be costs associated with maintaining the trust over time, such as filing taxes and legal fees. However, these potential downsides often pale in comparison to the significant tax savings and asset protection benefits it provides.

When the surviving spouse dies, the assets in a credit shelter trust are distributed according to the terms outlined in the trust document. In a Bronx New York Complex Will with Credit Shelter Marital Trust for Large Estates, this means that the trust continues to manage those assets for the benefit of the remaining beneficiaries, such as children or heirs. The trust helps avoid probate and ensures that the assets are preserved for future generations. This process can provide peace of mind for families, knowing their wealth remains protected.