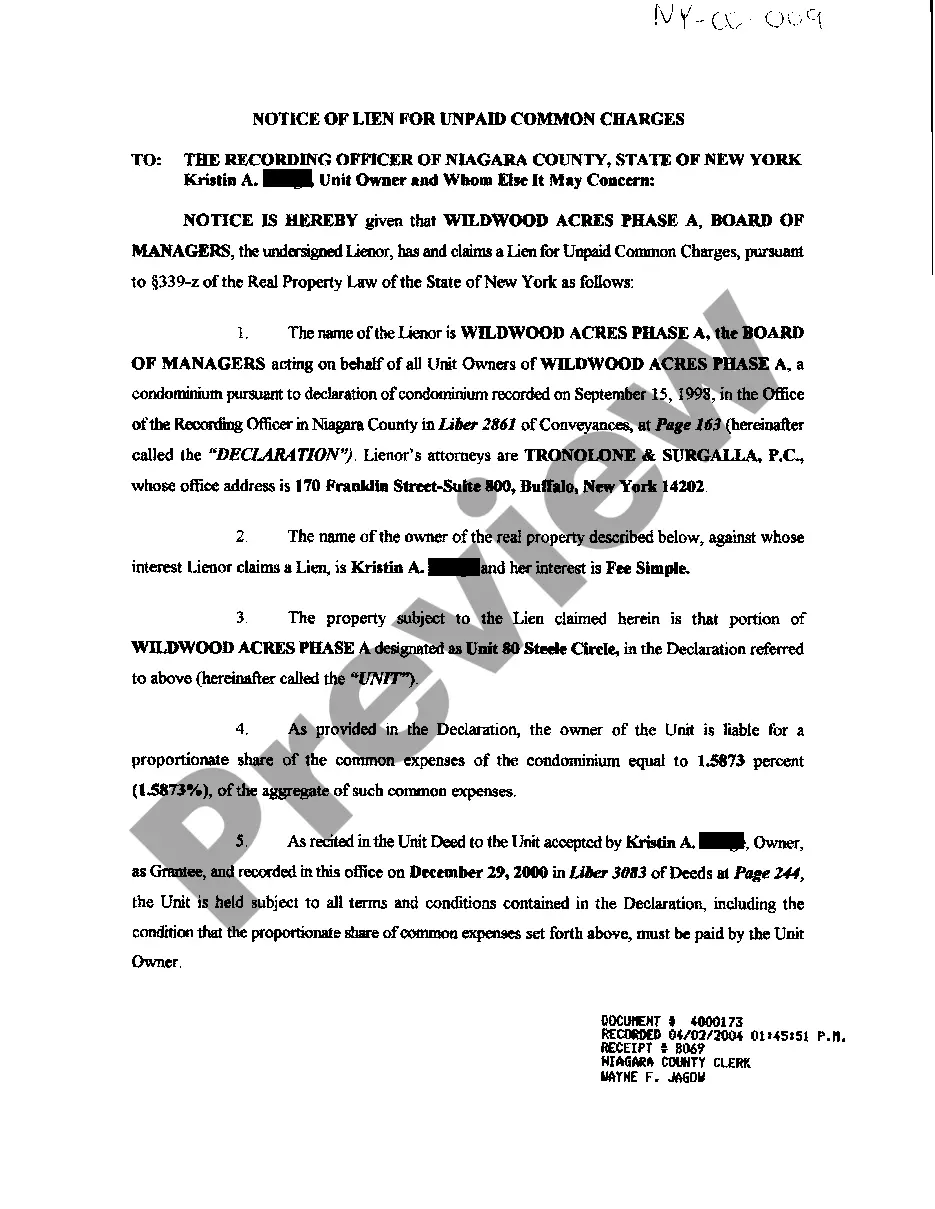

Rochester New York Notice of Lien for Unpaid Common Charges

Description

How to fill out New York Notice Of Lien For Unpaid Common Charges?

Finding validated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms library. It’s a digital repository of over 85,000 legal documents for both personal and business necessities and various real-life scenarios.

For those who are already acquainted with our service and have utilized it previously, obtaining the Rochester New York Notice of Lien for Unpaid Common Charges takes only a few clicks. All you have to do is sign in to your account, select the document, and click Download to store it on your device. This procedure will require just a few more steps for new users.

Follow the instructions below to begin with the largest online form collection.

Maintaining documentation organized and compliant with legal standards holds significant importance. Leverage the US Legal Forms library to always have essential document templates accessible for any requirements right at your fingertips!

- Inspect the Preview mode and form description. Ensure you’ve selected the accurate one that fulfills your needs and is fully aligned with your local jurisdiction requirements.

- Search for another template, if necessary. If you notice any discrepancies, use the Search tab above to locate the correct one. If it's suitable, proceed to the next step.

- Acquire the document. Click the Buy Now button and choose the subscription plan you prefer. You will need to create an account to access the library’s resources.

- Complete your purchase. Enter your credit card information or utilize your PayPal account to pay for the service.

- Download the Rochester New York Notice of Lien for Unpaid Common Charges. Store the template on your device to continue with its completion and gain access to it in the My documents section of your profile whenever you require it again.

Form popularity

FAQ

In New York, a state tax lien generally lasts for a duration of 10 years. However, this period can be extended if the tax remains unpaid or if a new lien is filed. Regularly reviewing your property for liens, including the Rochester New York Notice of Lien for Unpaid Common Charges, is essential to avoid legal complications. Utilizing uslegalforms can provide you with timely updates and insights.

To buy a tax lien property in New York, you need to participate in a tax lien auction, held by the county each year. During the auction, you can bid on liens against properties for unpaid taxes. Once you own the lien, you have the right to collect the unpaid taxes, along with interest. Platforms like uslegalforms can help you navigate the specifics of this process, ensuring you meet all necessary requirements.

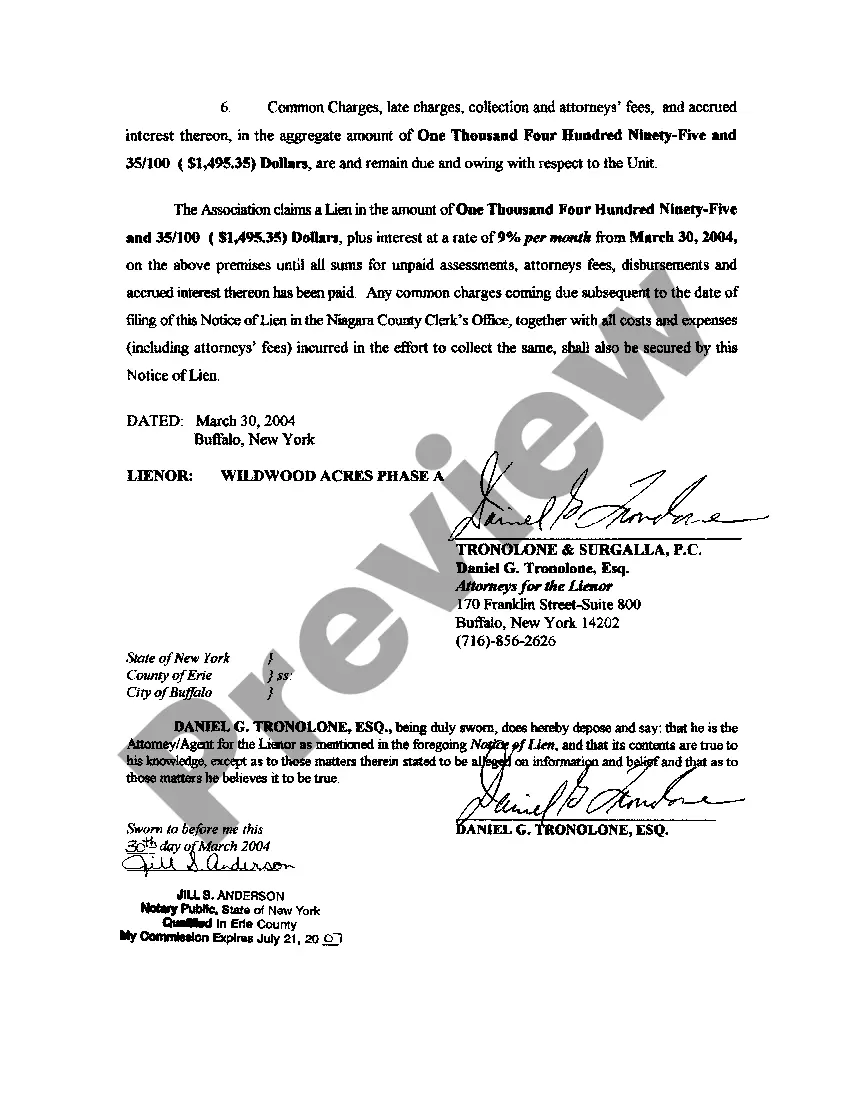

To file a lien in New York, you must complete a Notice of Lien form and submit it to the county clerk's office where the property is located. This form should outline the unpaid common charges along with supporting documentation. After filing, serve a copy of the lien to the property owner. Using platform services like uslegalforms can help simplify this process by providing necessary forms and detailed guidelines.

Section 34 of the New York lien law outlines the requirements for filing a lien, such as the necessity for a proper notice of lien related to unpaid common charges. This section ensures that property owners are informed about outstanding charges and their implications, which is crucial for maintaining property rights. For anyone dealing with liens in Rochester, New York, understanding this section helps navigate potential disputes effectively. You can find relevant forms and legal guidance on these matters through US Legal Forms.

In New York, liens, including a Rochester New York Notice of Lien for Unpaid Common Charges, do have a specific duration. Generally, a lien remains enforceable for a period of 10 years unless renewed. It's important to manage your liens carefully to ensure they remain valid for collection purposes. If you need help with lien management, consider utilizing the US Legal Forms platform for accurate forms and guidance.

In New York, a lien generally remains active for up to ten years. However, specific types of liens, such as those for unpaid property taxes, can have different durations. Staying informed about the life of a lien is important, especially if you're facing a Rochester New York Notice of Lien for Unpaid Common Charges, as timely action can prevent further complications.

To file a lien in New York State, you must prepare a lien claim, detailing the amounts owed and the nature of the debt. Next, file this claim with the county clerk's office in the county where the property is located. It’s advisable to work with a legal professional to ensure accuracy and compliance, especially for a Rochester New York Notice of Lien for Unpaid Common Charges.

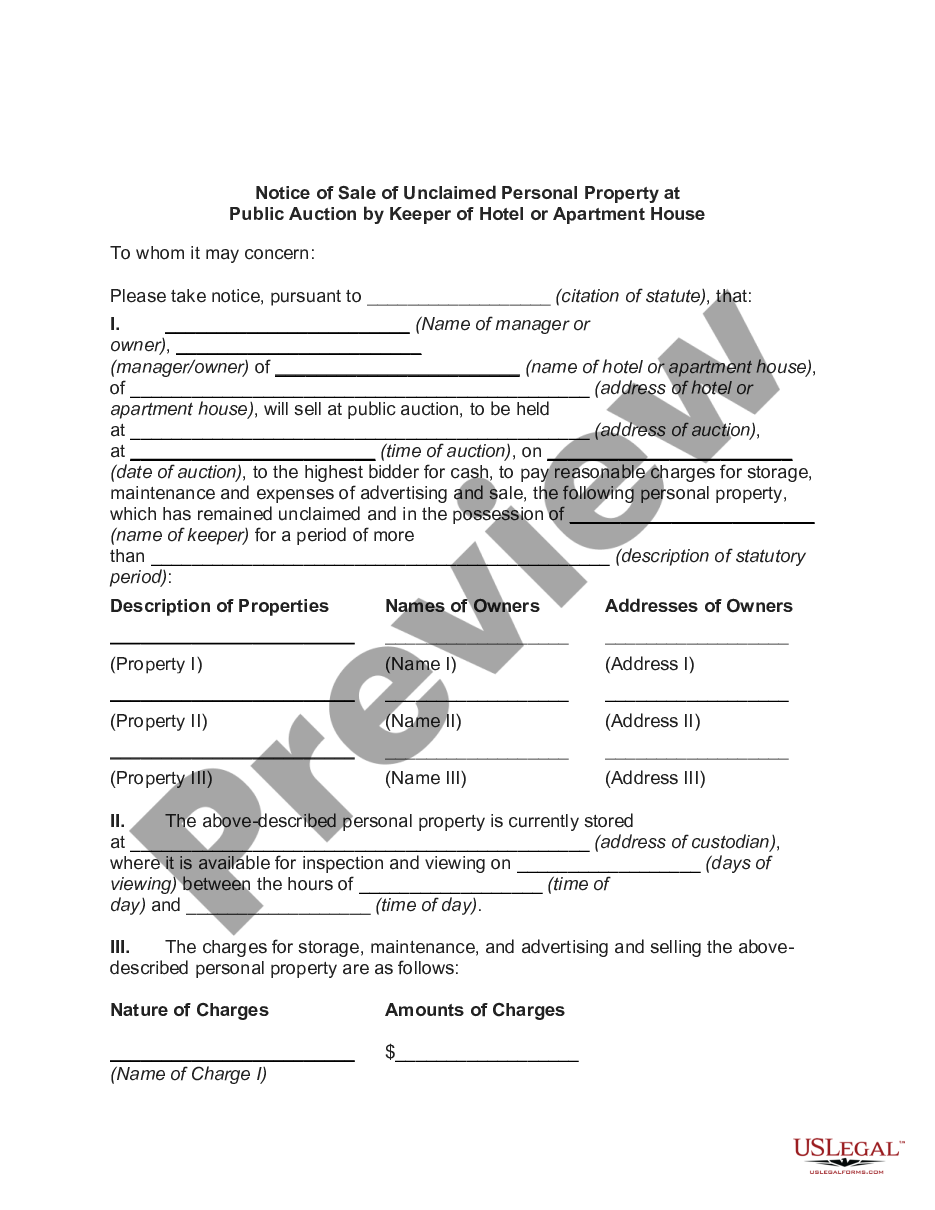

A notice of intent to lien in New York serves as a preliminary alert that a lien may be filed against your property. This document is typically issued when debts remain unpaid, providing you a chance to address the issue before a formal lien is filed. Understanding this notice can help you better respond to potential claims, especially concerning a Rochester New York Notice of Lien for Unpaid Common Charges.

In New York, various parties can place a lien on your house, such as contractors, suppliers, and homeowners' associations. These liens often arise from unpaid debts related to construction or unpaid common charges. If you find yourself facing a Rochester New York Notice of Lien for Unpaid Common Charges, it’s crucial to understand your rights and options to resolve the matter.

To file a notice of pendency in New York, you need to prepare the document typically through a legal professional. This notice alerts interested parties that a legal action involving your property is pending. Make sure to file the notice in the county clerk’s office where the property is located. This process is essential when dealing with a Rochester New York Notice of Lien for Unpaid Common Charges.