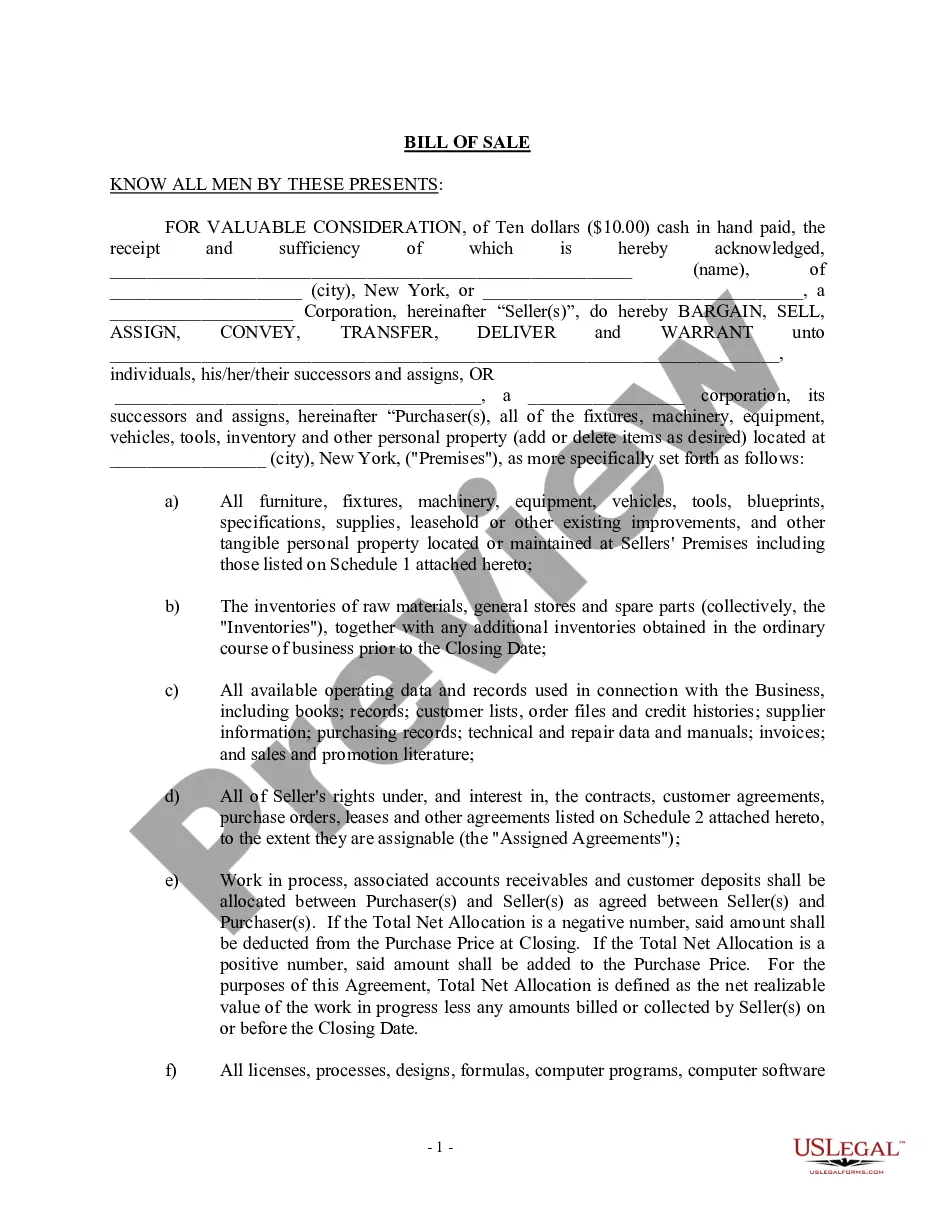

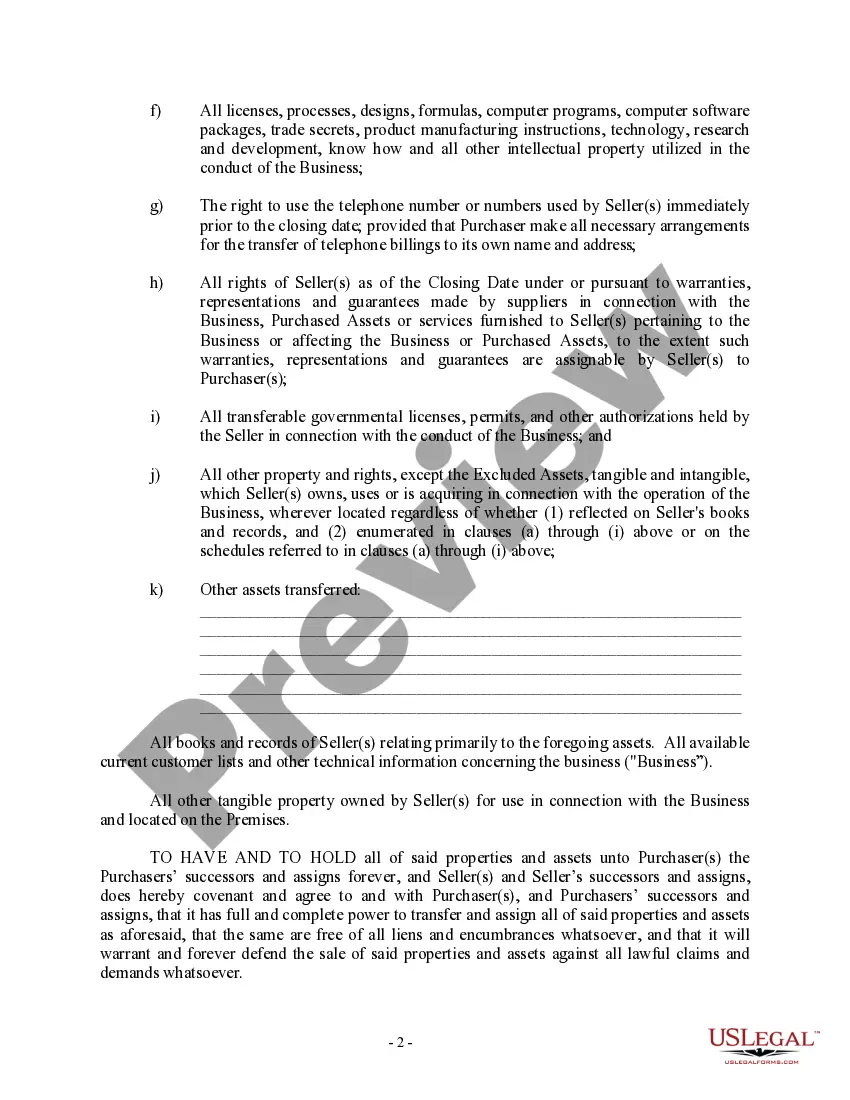

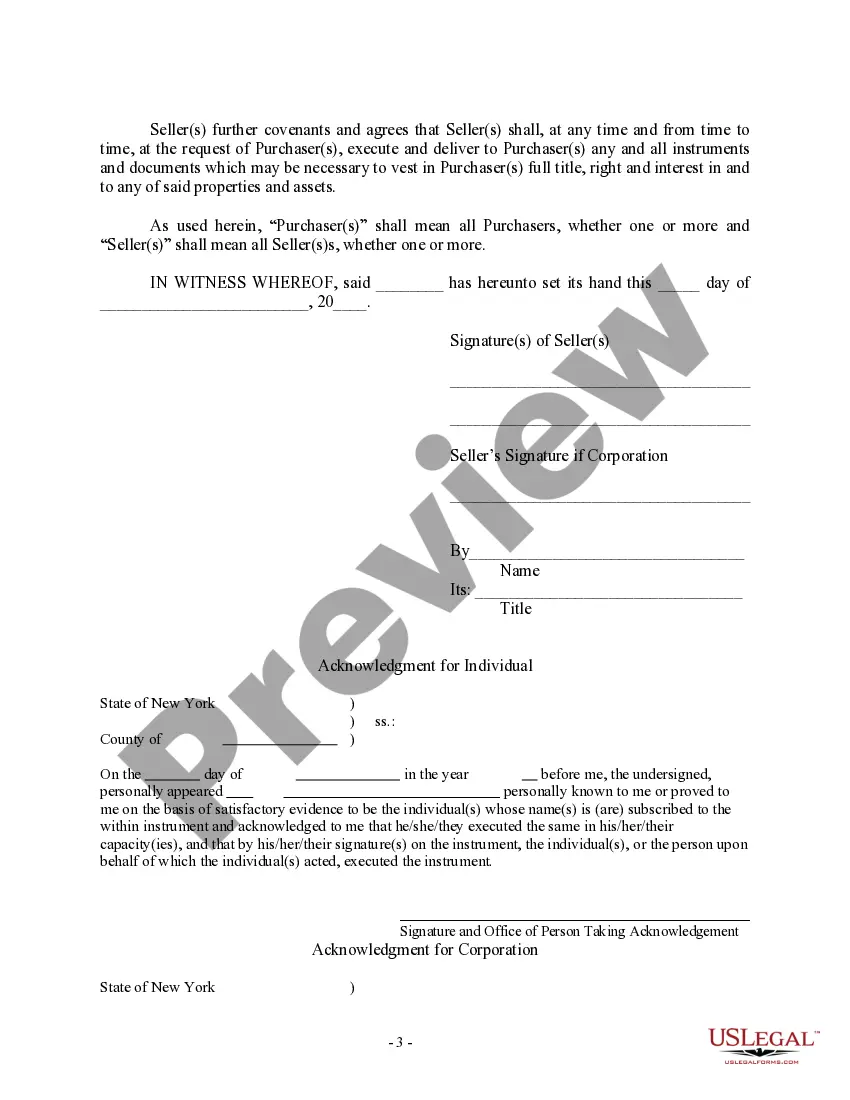

Suffolk New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller

Description

How to fill out New York Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller?

Do you require a trustworthy and economical provider of legal documents to purchase the Suffolk New York Bill of Sale Related to the Sale of Business by Individual or Corporate Seller? US Legal Forms is your preferred option.

Whether you require a basic agreement to establish guidelines for living with your partner or a collection of paperwork to facilitate your separation or divorce through the judicial system, we have you covered. Our platform features over 85,000 current legal document templates suitable for personal and business use. All templates we offer are not generic and are tailored according to the laws of distinct states and regions.

To download the form, you must Log In to your account, locate the necessary form, and click the Download button adjacent to it. Please remember that you can retrieve your previously acquired document templates at any time from the My documents section.

Is this your first visit to our site? Don’t worry. You can easily create an account, but before doing that, ensure to take the following steps.

Now you can establish your account. After that, select your subscription plan and continue to the payment process. Once the payment has been processed, download the Suffolk New York Bill of Sale Related to the Sale of Business by Individual or Corporate Seller in any available file format. You can return to the website whenever you need and redownload the form at no additional cost.

Finding current legal documents has never been simpler. Give US Legal Forms a chance today, and stop wasting hours trying to understand legal papers online once and for all.

- Verify if the Suffolk New York Bill of Sale Related to the Sale of Business by Individual or Corporate Seller complies with your state and local regulations.

- Review the details of the form (if available) to understand for whom and what the form is designed.

- Start your search again if the form does not fit your particular circumstances.

Form popularity

FAQ

In New York, a bill of sale does not have to be notarized to be effective. However, having it notarized can provide added legal protection and credibility to the document, especially in significant transactions. For the Suffolk New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, consider notarization to ensure all parties feel secure. Always check any specific requirements related to your transaction.

Reporting the sale of business assets involves formally noting the transaction on your tax filings. You must report any gain or loss stemming from the sale, alongside building accurate records to reflect these transactions accurately. A Suffolk New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller can provide the necessary information for your records. It is wise to keep these documents secured for future reference.

To report the sale of business assets, you will need to include the income from the sale on your tax return. This usually involves filling out specific forms related to capital gains or business income. Accurate documentation, such as a Suffolk New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, is essential for substantiating your claims. Consulting a tax professional can also guide you through this process.

When you sell a business asset, you transfer ownership to the buyer in exchange for a payment or other compensation. This transaction should be documented clearly to avoid disputes. A Suffolk New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller serves as a formal record of this transfer. It is important for both parties to keep a copy for their records.

The sale of a business in Suffolk, New York, is mainly governed by state commercial law and local regulations. It is essential to comply with these laws to ensure a smooth transaction. Working with legal professionals can help you navigate the complexities. Understanding the Suffolk New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller is crucial.

To report the sale of business equipment, you typically need to document the transaction for tax purposes. This involves keeping a copy of the bill of sale and potentially reporting the sale on your tax filings. Using a Suffolk New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller on USLegalForms can help ensure you have all the necessary information recorded accurately.

A bill of sale does not automatically transfer the title of business equipment; however, it is an essential document in the transfer process. It indicates that the seller has relinquished ownership to the buyer. To ensure proper title transfer in Suffolk, New York, accompany your Suffolk New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller with the required title transfer documents.

Yes, a bill of sale can serve as proof of ownership in New York, especially when registering vehicles or equipment. This document demonstrates that the buyer has purchased the asset from the seller. To strengthen this proof, ensure your Suffolk New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller includes all relevant details and signatures.

In New York, when you sell a car privately, the buyer typically pays the sales tax at the time of registration. It's important for both parties to understand their obligations, as the bill of sale will be needed during this process. Thus, listing the sale amount on your Suffolk New York Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller helps clarify the transaction.

Typically, a bill of sale is a separate document from the title, although it serves as proof of the transaction. If you're selling a vehicle or equipment in Suffolk, New York, make sure to provide both the bill of sale and the title to establish full ownership transfer. This ensures that the buyer receives all necessary documentation for future registration or use.