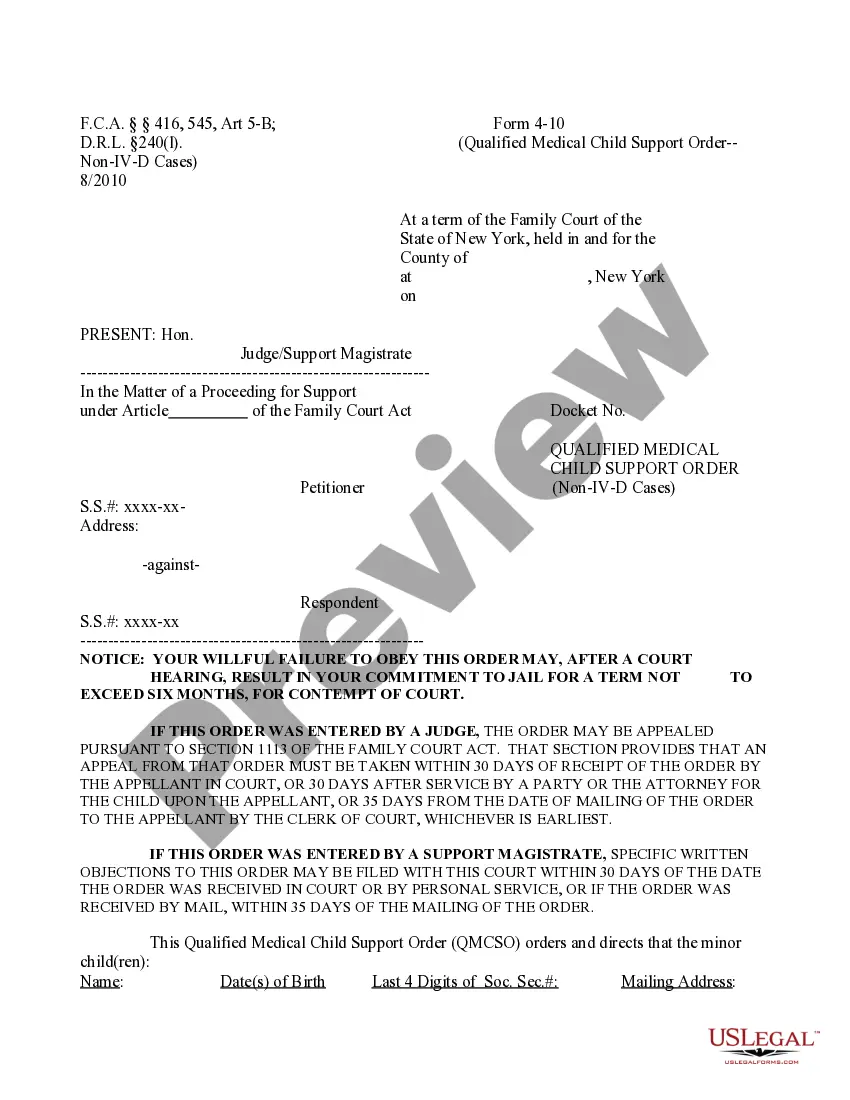

Syracuse New York Qualified Domestic Relations Order

Description

How to fill out New York Qualified Domestic Relations Order?

If you are in search of a pertinent form template, it's challenging to select a superior service compared to the US Legal Forms website – likely the most comprehensive collections available online.

Here you can obtain a multitude of document examples for business and personal use categorized by types and regions, or keywords.

With the excellent search capability, acquiring the latest Syracuse New York Qualified Domestic Relations Order is as straightforward as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration.

Obtain the template. Specify the format and save it to your computer. Edit it. Complete, alter, print, and sign the acquired Syracuse New York Qualified Domestic Relations Order.

- Each document's relevance is verified by a team of proficient lawyers who routinely review the templates on our platform and update them according to the latest state and county regulations.

- If you are familiar with our system and possess a registered account, all you need to do to obtain the Syracuse New York Qualified Domestic Relations Order is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, just adhere to the guidelines outlined below.

- Ensure you have located the form you require. Review its details and use the Preview feature (if accessible) to view its content. If it does not satisfy your needs, utilize the Search bar at the top of the page to find the suitable document.

- Validate your choice. Press the Buy now button. Then, select your preferred subscription plan and provide your information to create an account.

Form popularity

FAQ

The time it takes for a Qualified Domestic Relations Order (QDRO) to be processed in Syracuse, New York, can vary significantly. Typically, once you submit the QDRO to the court, it may take several weeks to months, depending on the court's workload and requirements. This process can be expedited by ensuring all documentation is accurate and complete. Using a service like USLegalForms can help reduce wait times by providing clear guidance and assistance on your Syracuse New York Qualified Domestic Relations Order.

You can write your own Qualified Domestic Relations Order (QDRO) in Syracuse, New York, but it is wise to proceed with caution. The language and structure of your QDRO must comply with specific legal requirements to be valid. Mistakes can lead to delays or rejections. For many individuals, using a professional service like USLegalForms can simplify the process and ensure compliance with a Syracuse New York Qualified Domestic Relations Order.

For couples who are married but living apart, the tax status can often be more complex. You may choose to file as married filing jointly or married filing separately, depending on your financial situation. Additionally, if there is a divorce in progress and a Syracuse New York Qualified Domestic Relations Order is involved, it is vital to seek professional advice to understand how any settlements will affect your tax obligations.

To avoid the 20% tax on your 401k withdrawal, consider requesting a direct rollover into an IRA or another qualified plan instead of taking a lump-sum payment. If you are receiving funds through a Syracuse New York Qualified Domestic Relations Order, make sure to consult with a tax advisor or financial planner to explore your options for minimizing taxes. This proactive approach can help you retain more of your assets.

Divorce settlements can have various tax implications, which may affect how you manage your finances post-divorce. Generally, the transfer of assets between spouses is not considered taxable income. However, certain retirement accounts involved in a Syracuse New York Qualified Domestic Relations Order can have tax consequences upon withdrawal, so understanding your specific situation is key to making informed decisions.

While it is possible to prepare a QDRO yourself, doing so requires careful attention to detail and an understanding of the legal standards in Syracuse, New York. Mistakes in the QDRO can lead to delays or financial losses during the divorce settlement process. To simplify this, consider using USLegalForms, which provides resources and templates specifically designed for creating a Syracuse New York Qualified Domestic Relations Order.

To prepare a qualified domestic relations order (QDRO) in Syracuse, New York, you need to first gather relevant information about the retirement accounts involved and the specific terms of your divorce settlement. It is wise to consult with your attorney to ensure the QDRO complies with federal and state laws. You can also utilize USLegalForms to access templates and guidance tailored to Syracuse New York Qualified Domestic Relations Orders, helping you create a document that meets legal requirements.

If your ex-spouse never filed a QDRO, you still have options in Syracuse, New York. You can file a QDRO yourself or request that your ex do so to divide retirement assets appropriately. Understanding your rights is essential, and legal guidance can streamline this process. USLegalForms provides helpful tools to facilitate your QDRO filing, ensuring a fair division of benefits.

Yes, you can file a Qualified Domestic Relations Order after your divorce is finalized in Syracuse, New York. It's common for individuals to address the division of retirement assets post-divorce. Filing a QDRO can help ensure that both parties receive their entitled benefits. If you need assistance navigating this process, USLegalForms offers resources to simplify QDRO filing.

In Syracuse, New York, there is no specific statute of limitations for filing a Qualified Domestic Relations Order (QDRO). However, it is best to initiate the process as soon as possible following your divorce. Delays may complicate access to retirement benefits, making timely action important. If you have questions about timing, consider consulting USLegalForms for additional guidance.