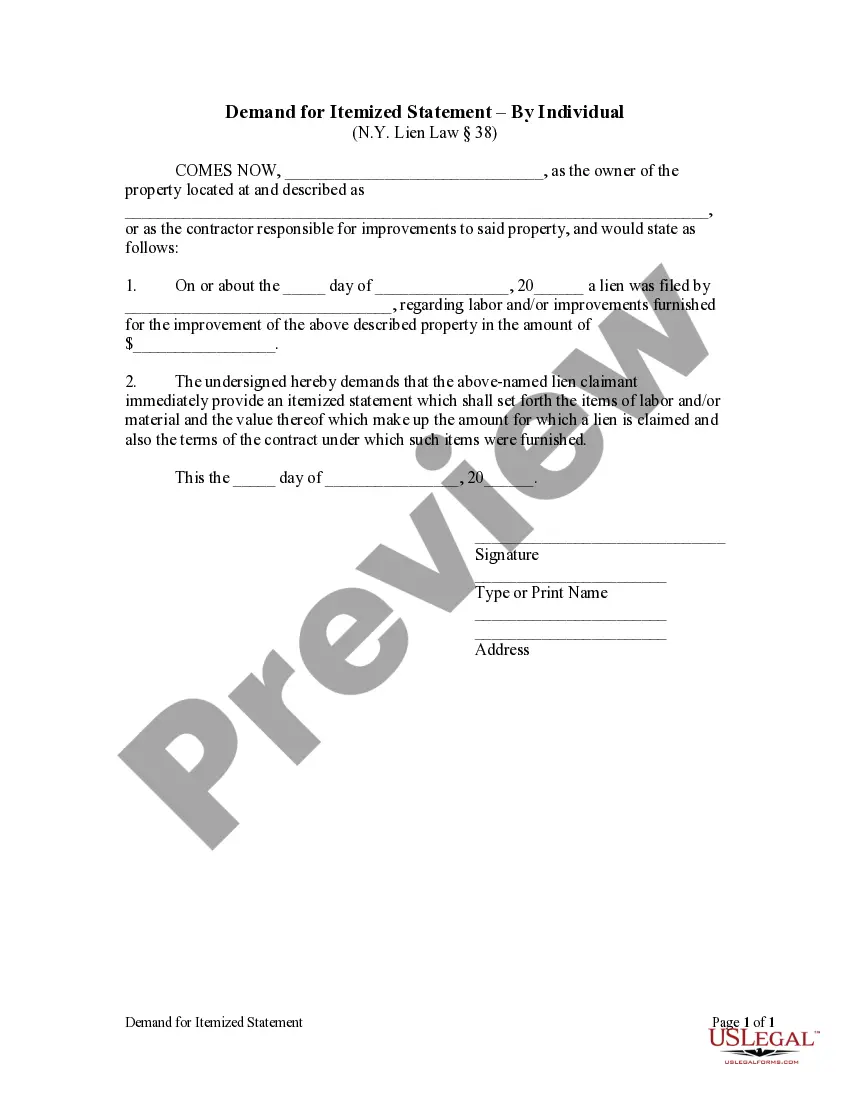

A property owner or contractor may issue a written demand using this form that the party who filed a notice of lien statement provide an itemized statement of labor and/or material provided, including the value or cost of said labor and materials. The lien holder is required to respond with an itemized statement within five (5) days, or the owner or contractor may petition the court to order such a statement to be produced. Failure to respond to the order of the court may result in the nullification of the lien.

Kings New York Demand for Itemized Statement by Corporation

Description

How to fill out New York Demand For Itemized Statement By Corporation?

We consistently endeavor to reduce or evade legal complications when handling intricate legal or financial issues.

To achieve this, we seek legal assistance that is often quite expensive.

Nevertheless, not all legal issues share the same level of complexity. Many can be managed independently.

US Legal Forms is an online repository of current DIY legal documents that cover everything from wills and powers of attorney to incorporation articles and dissolution petitions.

Simply Log In to your account and click the Get button beside it. If you lose the document, you can always re-download it from within the My documents section. The process is equally simple if you're new to the platform! You can create your account in just a few minutes. Ensure to verify if the Kings New York Demand for Itemized Statement by Corporation or LLC complies with the regulations and laws of your particular state and region. It's also essential to review the form's outline (if available), and if you notice any inconsistencies with your initial expectations, look for an alternative form. After confirming that the Kings New York Demand for Itemized Statement by Corporation or LLC is suitable for your case, you can select a subscription plan and complete your payment. Then you can download the document in any available file format. With more than 24 years in the market, we've assisted millions of individuals by providing ready-to-customize and current legal forms. Take full advantage of US Legal Forms now to save time and resources!

- Our service empowers you to manage your own affairs without requiring attorney assistance.

- We provide access to legal form templates that may not always be openly available.

- Our templates are tailored to specific states and regions, greatly easing the search process.

- Make use of US Legal Forms whenever you need to obtain and download the Kings New York Demand for Itemized Statement by Corporation or LLC or any other form conveniently and securely.

Form popularity

FAQ

Lien Law 38 in New York establishes specific regulations related to construction projects and the rights of parties involved. It provides guidelines for the enforcement of mechanics' liens, particularly benefiting contractors and suppliers seeking payment. Understanding Lien Law 38 is important for those involved in legal matters surrounding the Kings New York Demand for Itemized Statement by Corporation, as it ensures compliance with state requirements.

In New York, a demand for a bill of particulars is a procedural mechanism used in legal cases to request detailed information regarding the opposing party's claims. This demand aims to clarify the basis of the allegations and specify the evidence supporting them, which is vital for an organized legal strategy. When dealing with the Kings New York Demand for Itemized Statement by Corporation, utilizing this tool can facilitate better communication and preparation.

A request for a bill of particulars refers to a formal inquiry made to obtain more details about existing claims in a legal case. This request helps to prevent surprises during the trial by ensuring all parties are aware of the specifics involved in the dispute. For instances that revolve around the Kings New York Demand for Itemized Statement by Corporation, this request can provide essential insights to guide your legal strategy.

You should use a bill of particulars when you need more clarity on the allegations or details within a legal claim. It is especially useful in complex cases or situations where the opposing party's claim lacks specificity. By filing a demand for a bill of particulars, you can streamline the legal process and address the Kings New York Demand for Itemized Statement by Corporation effectively.

A demand for a bill of particulars is a formal request made by one party in a legal case, seeking detailed information about the claims or defenses presented by the other party. This request aims to clarify any ambiguous points in a lawsuit, allowing both sides to prepare adequately for trial. By understanding the specifics, parties can effectively respond to the issues, particularly in cases related to the Kings New York Demand for Itemized Statement by Corporation.

In NYC, you can sue for an amount up to $10,000 in Small Claims Court. This makes it a valuable option for individuals seeking to resolve disputes without extensive legal fees. By incorporating the Kings New York Demand for Itemized Statement by Corporation in your documentation, you ensure that your claim is detailed and properly substantiated, thereby enhancing its credibility.

The maximum amount you can claim in Small Claims Court in NYC is $10,000. This limit is designed to simplify legal disputes for individuals without the need for extensive legal representation. If your claim aligns with a Kings New York Demand for Itemized Statement by Corporation, it can provide clarity on your financial request and improve your chances for a favorable outcome.

To sue someone for more than $10,000 in New York, you cannot use Small Claims Court, as the limit is set at $10,000. Instead, you may need to file a lawsuit in a higher court. This process may involve preparing a Kings New York Demand for Itemized Statement by Corporation to present thorough details in support of your claim, ensuring all legal aspects are covered.

Yes, you can take someone to Small Claims Court for as little as $100 in NYC. However, it’s important to consider the expenses involved in filing and serving the claim. Using the Kings New York Demand for Itemized Statement by Corporation could be beneficial, as it helps you clearly articulate your financial demands and supports your case even for smaller amounts.

Tenants can win cases in Small Claims Court often, particularly when they present clear evidence and documents supporting their claims. The Kings New York Demand for Itemized Statement by Corporation can strengthen your case by demonstrating your legal grounds for the claim. While success rates vary, being well-prepared and informed about your rights significantly enhances your chances of winning.