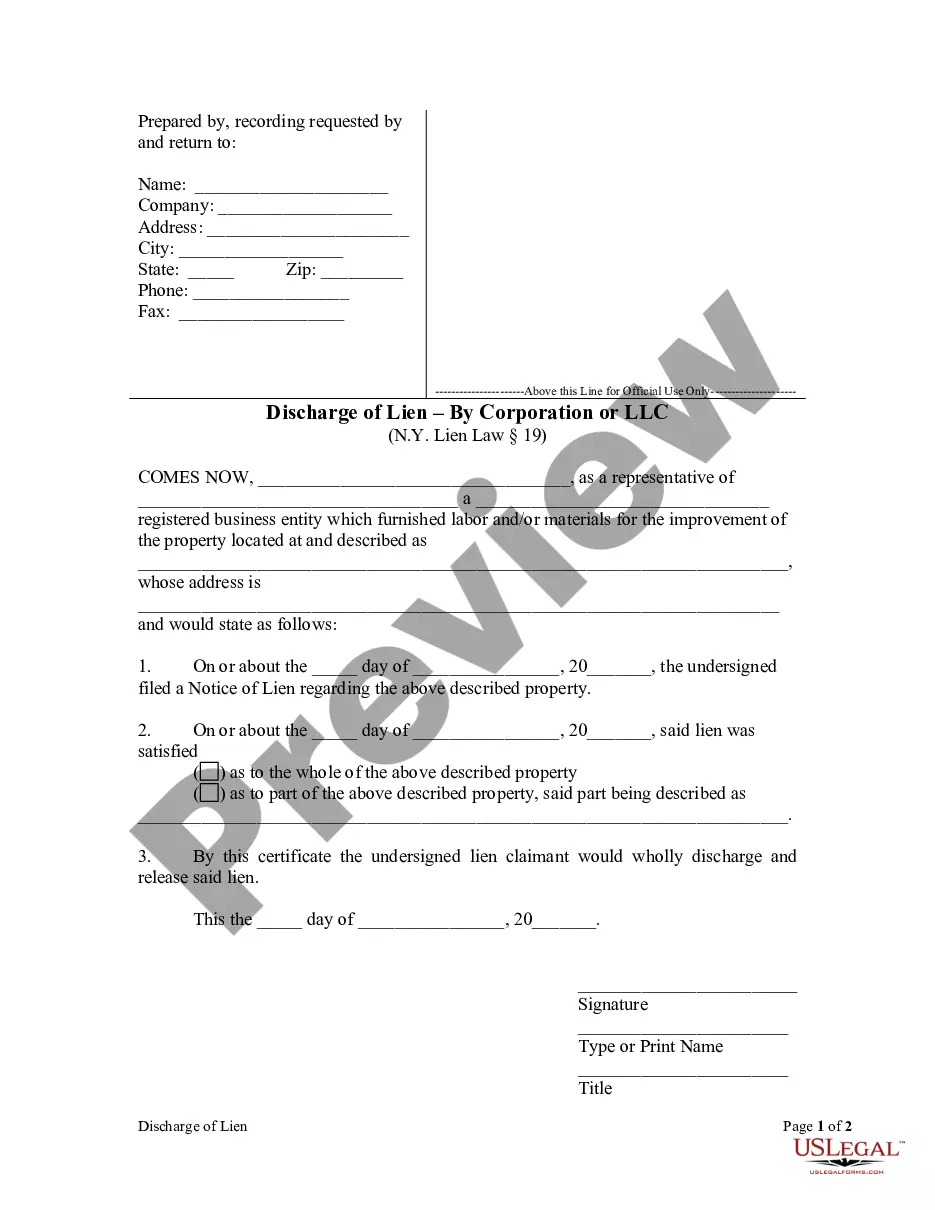

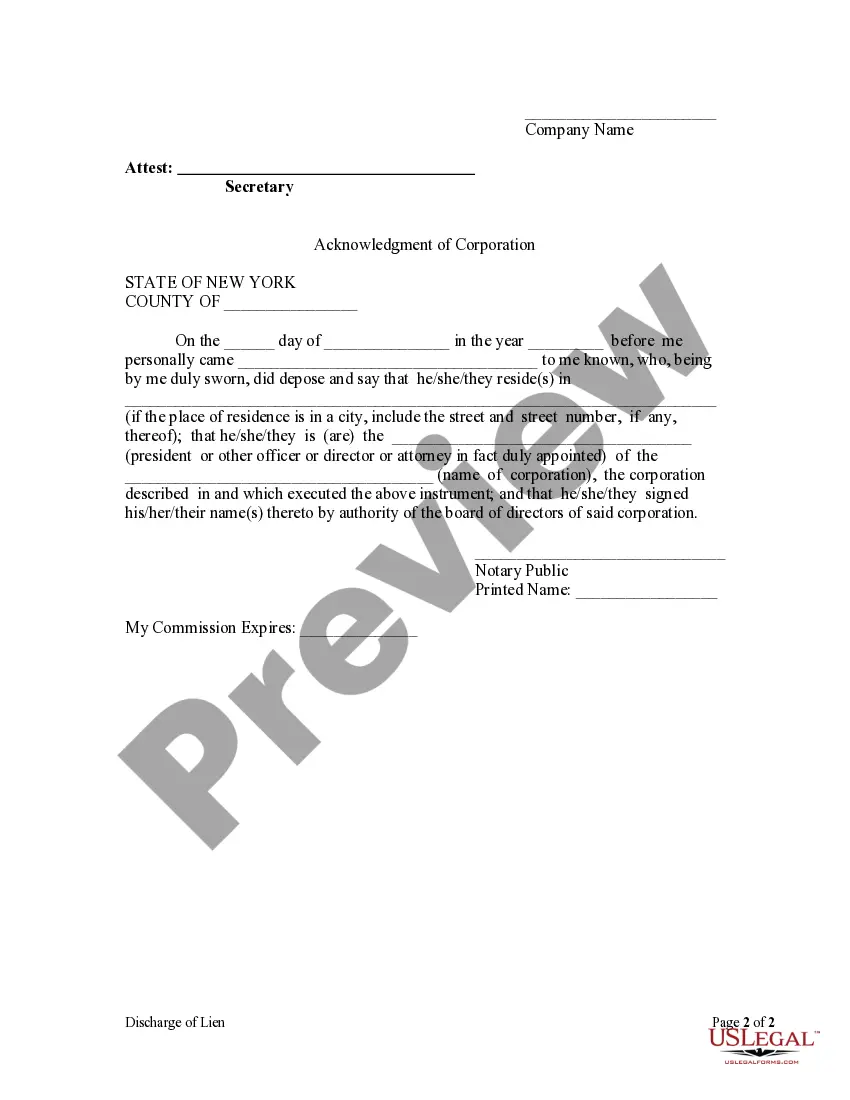

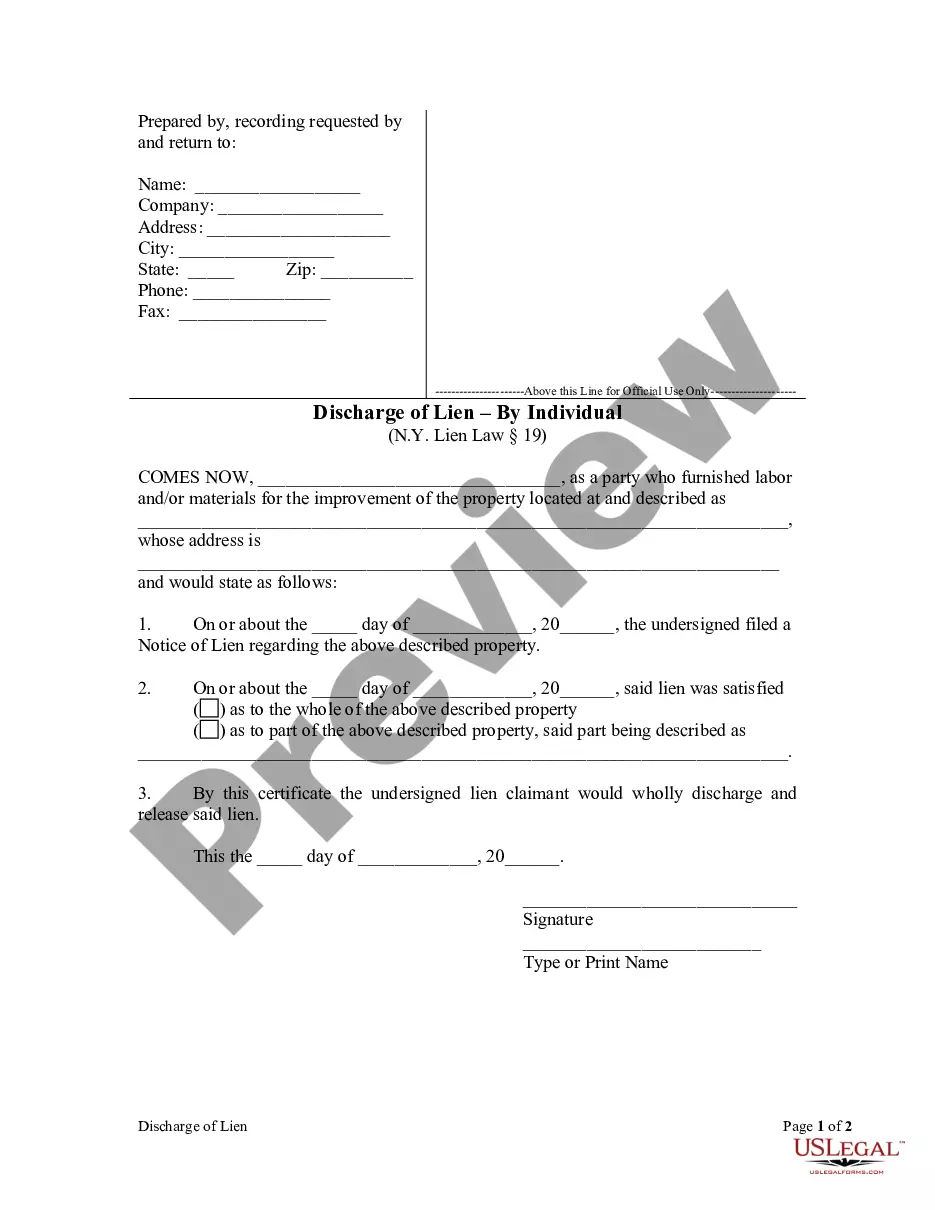

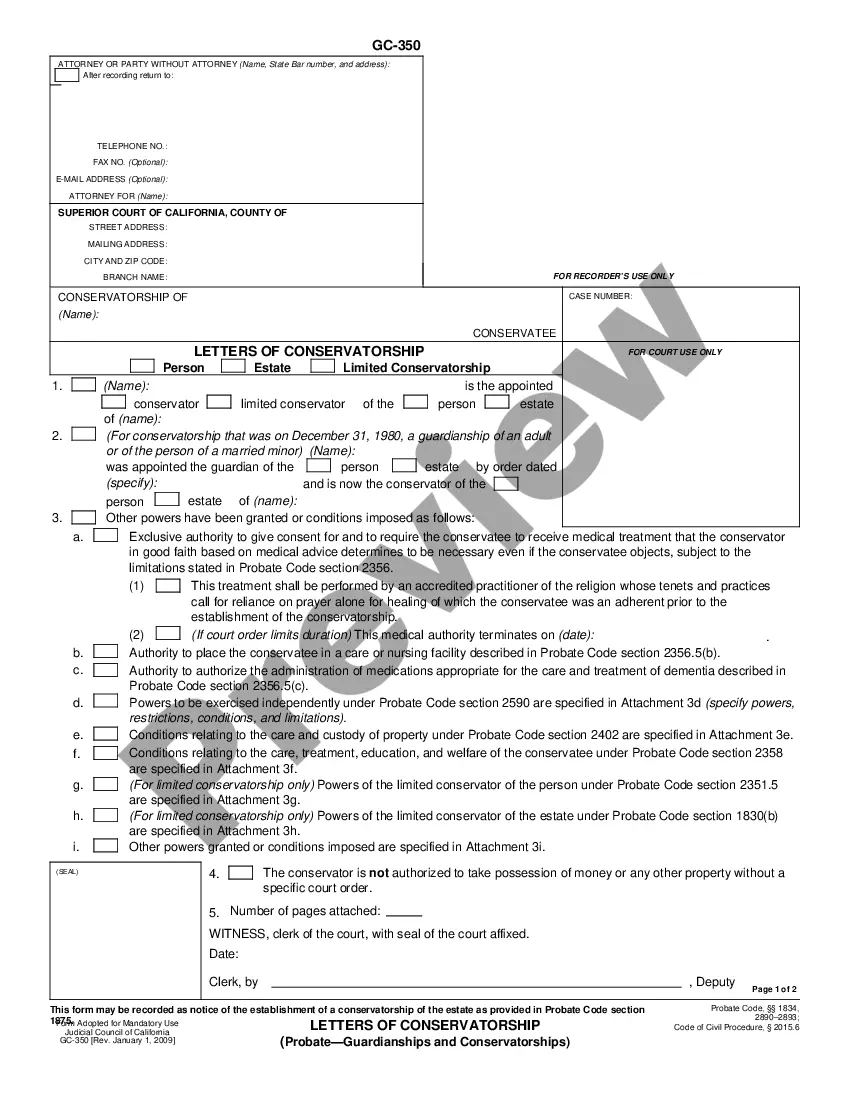

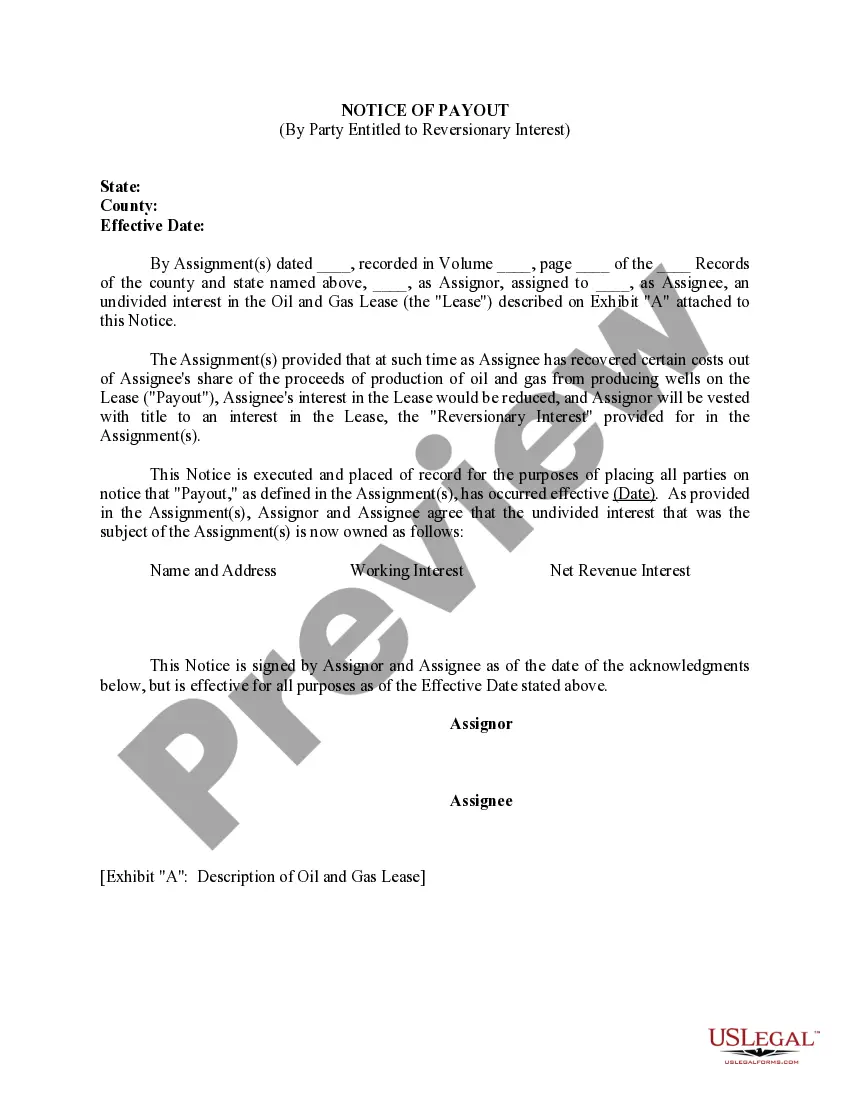

New York law permits a lien, other than a lien for public improvements, to be discharged by the issuing of a certificate, duly acknowledged by the lien holder and filed in the office where the notice of lien was filed.

Kings New York Discharge of Lien by Corporation

Description

How to fill out New York Discharge Of Lien By Corporation?

We consistently endeavor to minimize or prevent legal complications when handling subtle law-related or financial issues.

To achieve this, we seek legal remedies that are typically very expensive.

However, not all legal matters are equally intricate; most can be managed independently.

US Legal Forms is an online resource featuring a current DIY collection of legal documents covering everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

You can easily Log In to your account and click the Get button beside it. If you misplace the document, you can always retrieve it again in the My documents section.

- Our library enables you to handle your affairs autonomously without requiring a lawyer's services.

- We provide access to legal form templates that aren't always readily available.

- Our templates are tailored to specific states and regions, significantly simplifying the search process.

- Utilize US Legal Forms whenever you need to quickly and securely locate and download the Kings New York Discharge of Lien by Corporation or LLC or any other form.

Form popularity

FAQ

In New York, a lien generally remains valid for up to 10 years from the date it is filed. However, the duration can vary based on the specific type of lien. If you're looking to understand the particulars, a Kings New York Discharge of Lien by Corporation might be the answer you need, especially if you want to ensure that you are compliant and aware of your rights. For thorough insights, explore resources offered by platforms like US Legal Forms.

In New York, obtaining a lien release typically involves filing a Kings New York Discharge of Lien by Corporation with your local county clerk's office. You must provide proof of payment to the lienholder and complete the necessary forms. Utilizing US Legal Forms can simplify this process by offering templates and guidance tailored to New York law, ensuring you have everything you need for a successful filing.

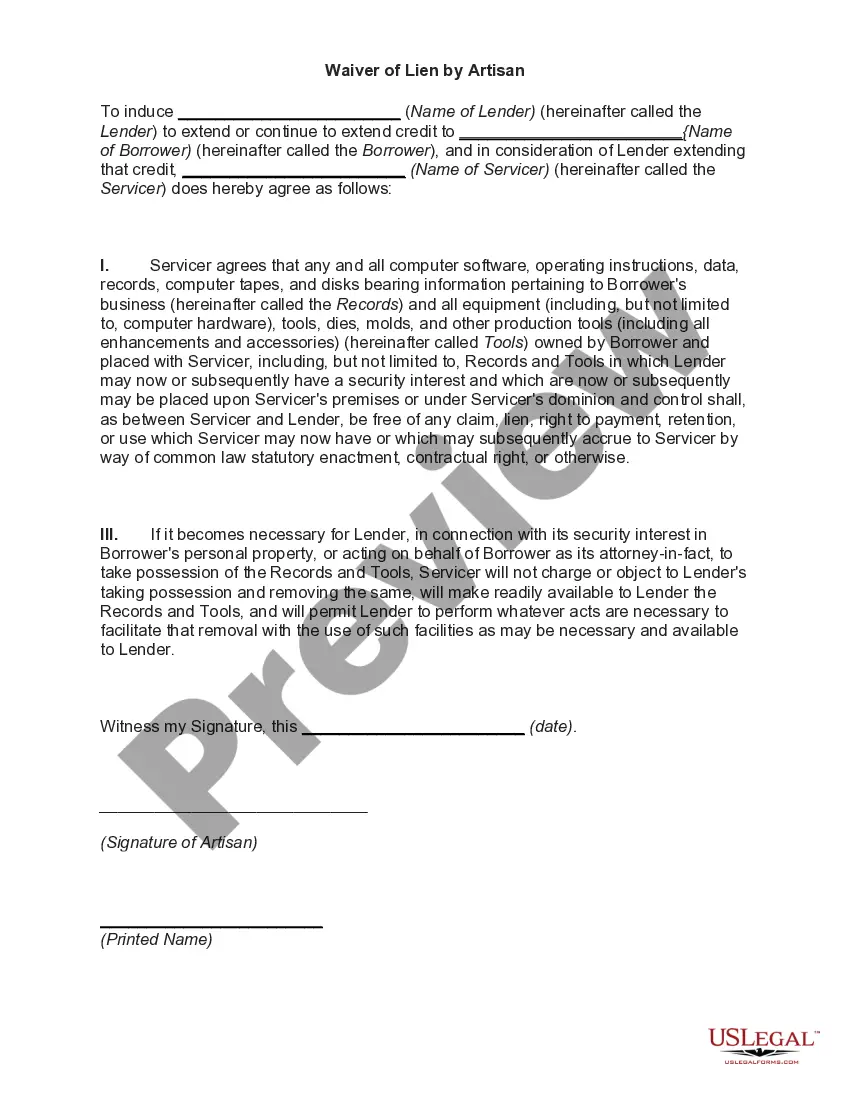

Filing a lien against a corporation involves preparing a lien statement that includes specific information regarding the debt and the parties involved. You'll then file this statement with the appropriate state agency, often the Secretary of State's office. Make sure you follow the guidelines set by your state for accuracy. If you need help, the uslegalforms platform can provide you with templates and instructions for this procedure.

You can typically obtain a lien release form from your local government office or online through official channels. Many legal document services, like uslegalforms, offer convenient access to lien release forms, which you can fill out to complete the discharge process. Ensure you have the proper information ready to accurately complete the form. This can streamline your experience regarding the Kings New York Discharge of Lien by Corporation.

To discharge a lien in New York, you typically need to file a lien discharge form with the county clerk's office where the lien is recorded. You'll want to ensure that you include necessary documentation proving the debt is satisfied. Doing this correctly helps clear the property title. This process is essential when dealing with the Kings New York Discharge of Lien by Corporation.

Yes, liens are considered public records in New York. This means anyone can access this information through local government offices or online databases. By knowing how to research these records, you can check for any liens that may be placed on a property. Understanding the implications of a lien can help you navigate the Kings New York Discharge of Lien by Corporation effectively.

The three common types of liens are consensual liens, statutory liens, and equitable liens. Consensual liens occur through agreements, while statutory liens arise under specific laws, and equitable liens are based on fairness and justice. Understanding these options can guide you in making informed decisions regarding the Kings New York Discharge of Lien by Corporation and how to navigate legal requirements.

In Rhode Island, a lien generally lasts for a period of 10 years from the date it is recorded. However, it can be extended under certain circumstances, and it is crucial to monitor the status of your lien. Understanding the longevity of a lien can help in effectively managing the Kings New York Discharge of Lien by Corporation process and protecting your rights as a creditor.

To fill out a lien affidavit, first collect all necessary information about the property involved, the lien amount, and the parties involved. It is important to be clear and accurate when detailing these elements to ensure compliance with local regulations. Additionally, consider using the US Legal Forms platform, which offers resources and templates that simplify the completion of documents related to the Kings New York Discharge of Lien by Corporation.