Kings New York Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out New York Renunciation And Disclaimer Of Property Received By Intestate Succession?

Finding authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms collection.

This is an online repository of over 85,000 legal documents for both personal and professional purposes along with various real-world situations.

All the paperwork is suitably categorized by field of use and jurisdiction, making it as quick and simple as ABC to find the Kings New York Renunciation And Disclaimer of Property obtained through Intestate Succession.

Maintain organized documents in compliance with legal standards is highly significant. Leverage the US Legal Forms library to always have crucial document templates readily available for your requirements!

- Review the Preview mode and document description.

- Ensure you have selected the right one that fulfills your criteria and fully aligns with your local jurisdiction detail.

- Look for another template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the accurate one. If it meets your needs, proceed to the next phase.

- Purchase the document.

- Hit the Buy Now button and choose the subscription package that you prefer.

Form popularity

FAQ

The law of renunciation governs the process by which an heir can decline their inherited property under intestate succession. This law allows for flexibility in estate planning, letting individuals choose to pass on their rights to others. By understanding the Kings New York Renunciation And Disclaimer of Property received by Intestate Succession, heirs can make informed choices about their inheritance. Familiarizing yourself with this law can empower you in estate management.

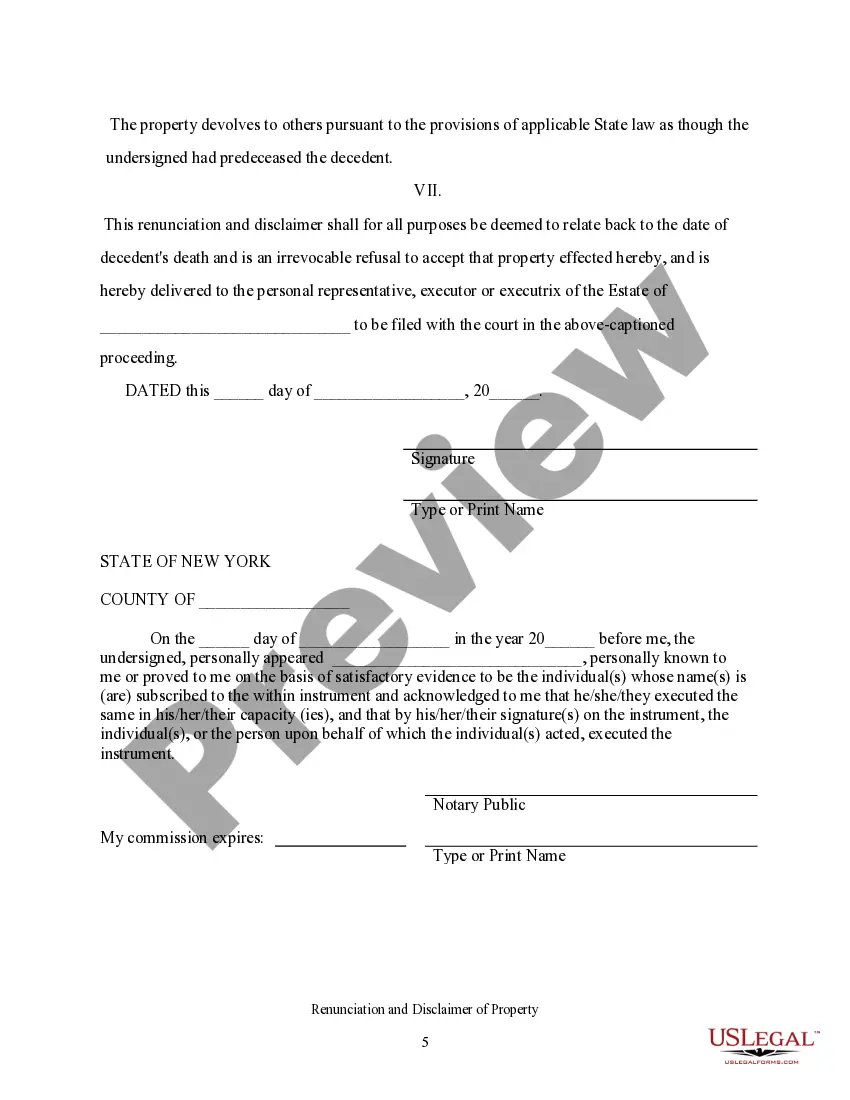

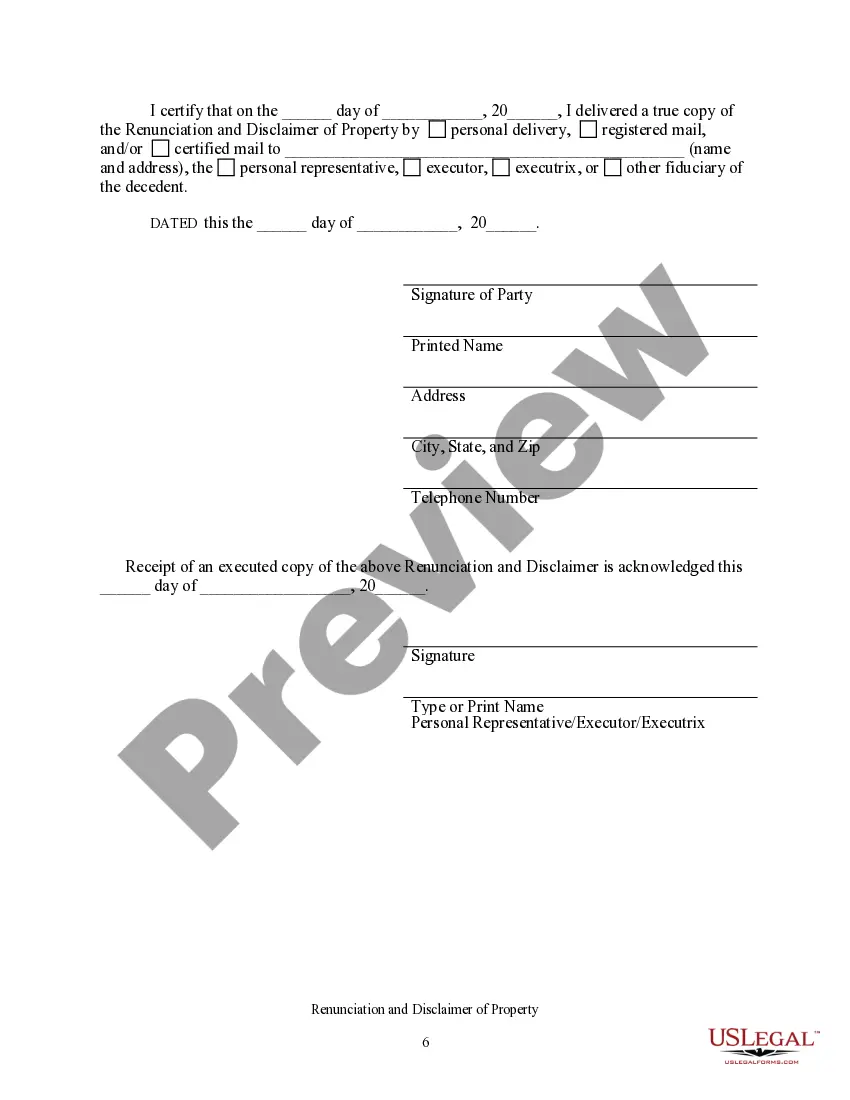

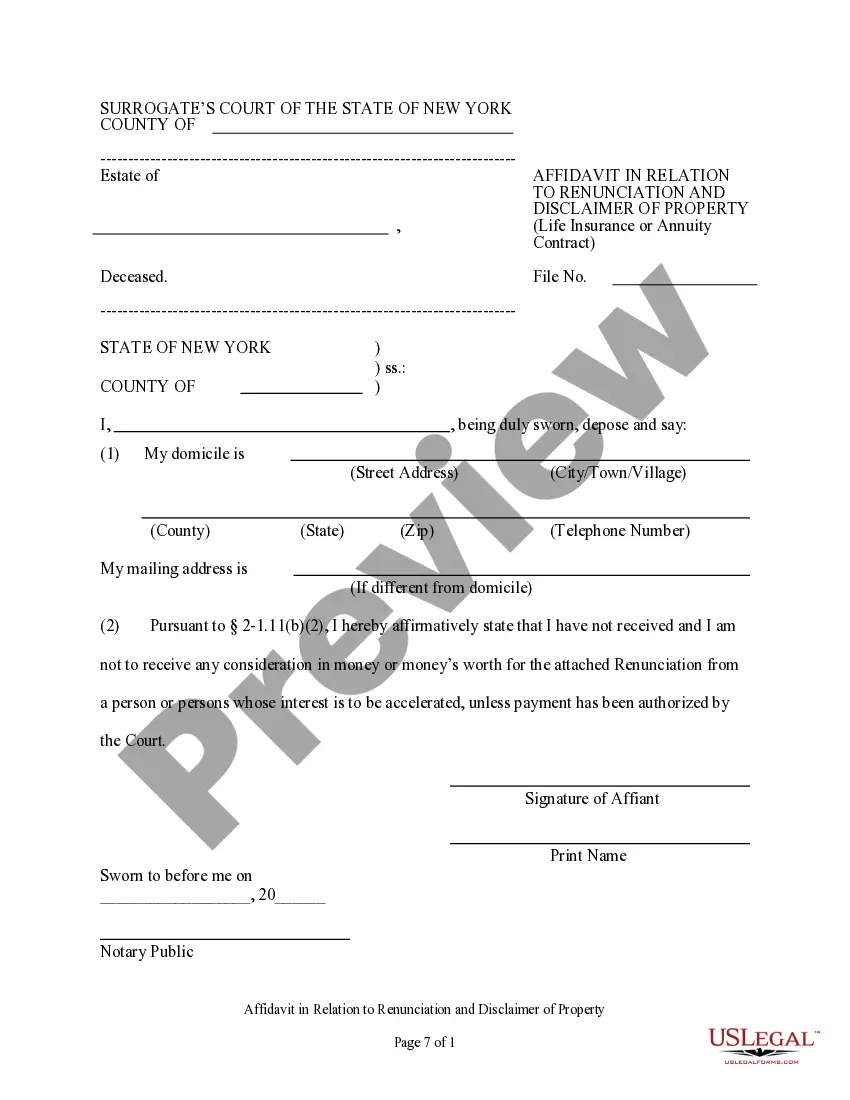

An affidavit of renunciation of inheritance is a legal document that signifies an heir's formal decision to relinquish their claim to an inheritance. This document must be completed accurately to ensure legality within the context of intestate succession. The Kings New York Renunciation And Disclaimer of Property received by Intestate Succession simplifies this process, allowing heirs to execute renunciation effectively and avoid complexities in asset distribution.

In New York, the statute of limitations regarding inheritance claims generally falls under six months from the date of appointment of the executor or administrator. This time frame is crucial for heirs who wish to claim their rightful share or dispute the distribution as per intestate laws. Therefore, it is wise to act promptly and consider options such as the Kings New York Renunciation And Disclaimer of Property received by Intestate Succession. Ensuring timely action can safeguard your interests.

No, renunciation is not considered an affirmative defense in New York. Instead, it is a voluntary declaration made by an heir who wishes to reject their claim to an inheritance. This choice can change the course of how assets are distributed among other heirs. The Kings New York Renunciation And Disclaimer of Property received by Intestate Succession highlights the importance of making informed decisions regarding inheritance.

Renunciation of the right of succession allows an individual to formally decline their inheritance under intestate succession. This option is particularly relevant in cases where accepting an inheritance could lead to financial complications, such as tax liabilities. By utilizing the Kings New York Renunciation And Disclaimer of Property received by Intestate Succession, heirs can pass their rights to other family members. This process provides flexibility in estate planning.

In New York, when an individual passes away without a will, the laws of intestate succession determine how the deceased's assets are distributed. Typically, immediate relatives such as spouses and children receive priority. Additionally, the Kings New York Renunciation And Disclaimer of Property received by Intestate Succession offers individuals the option to renounce their rights, potentially allowing other heirs to inherit. Understanding these rules is vital to navigate the distribution of assets.

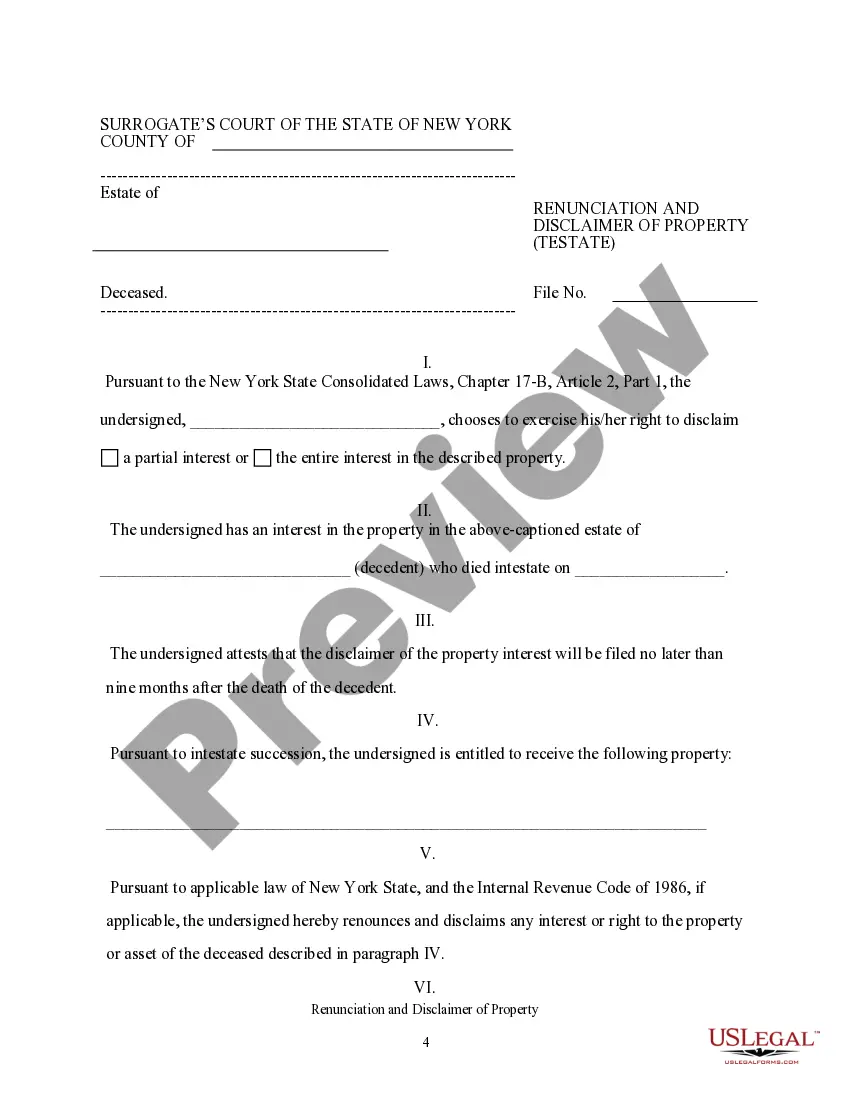

To effectively disclaim an inheritance in New York, draft a disclaimer according to the provisions in the Kings New York Renunciation And Disclaimer of Property received by Intestate Succession. This document should clearly express your intent to refuse the inheritance and meet any deadlines set forth by New York law. File this document with the estate representative or the court to complete the process. Seeking assistance from legal forms providers like uslegalforms can help in accurately formulating your disclaimer.

To disclaim an inheritance in New York, follow the guidelines defined by the Kings New York Renunciation And Disclaimer of Property received by Intestate Succession. Begin by notifying the estate's executor or filing a written disclaimer with the court. The disclaimer should meet the state’s specific requirements, such as timeliness and content. Consider using resources like uslegalforms to simplify this process and ensure all necessary criteria are met.

Disclaiming inherited property requires preparing a formal disclaimer that adheres to the Kings New York Renunciation And Disclaimer of Property received by Intestate Succession. This document should indicate your intention to renounce the property and must be filed with the appropriate court or executor. Ensure you create this disclaimer before accepting any benefits from the property, including its use or appreciation. Uslegalforms can help you draft a comprehensive disclaimer that meets legal standards.

In New York State, as of 2023, estates valued below $6.11 million do not incur estate tax. This means you can inherit this amount without facing taxation, making it essential to know the value of the estate you are involved with under the Kings New York Renunciation And Disclaimer of Property received by Intestate Succession. However, if inherited funds generate income, you may need to report this income on your tax return. Always consult a tax advisor for personalized guidance.