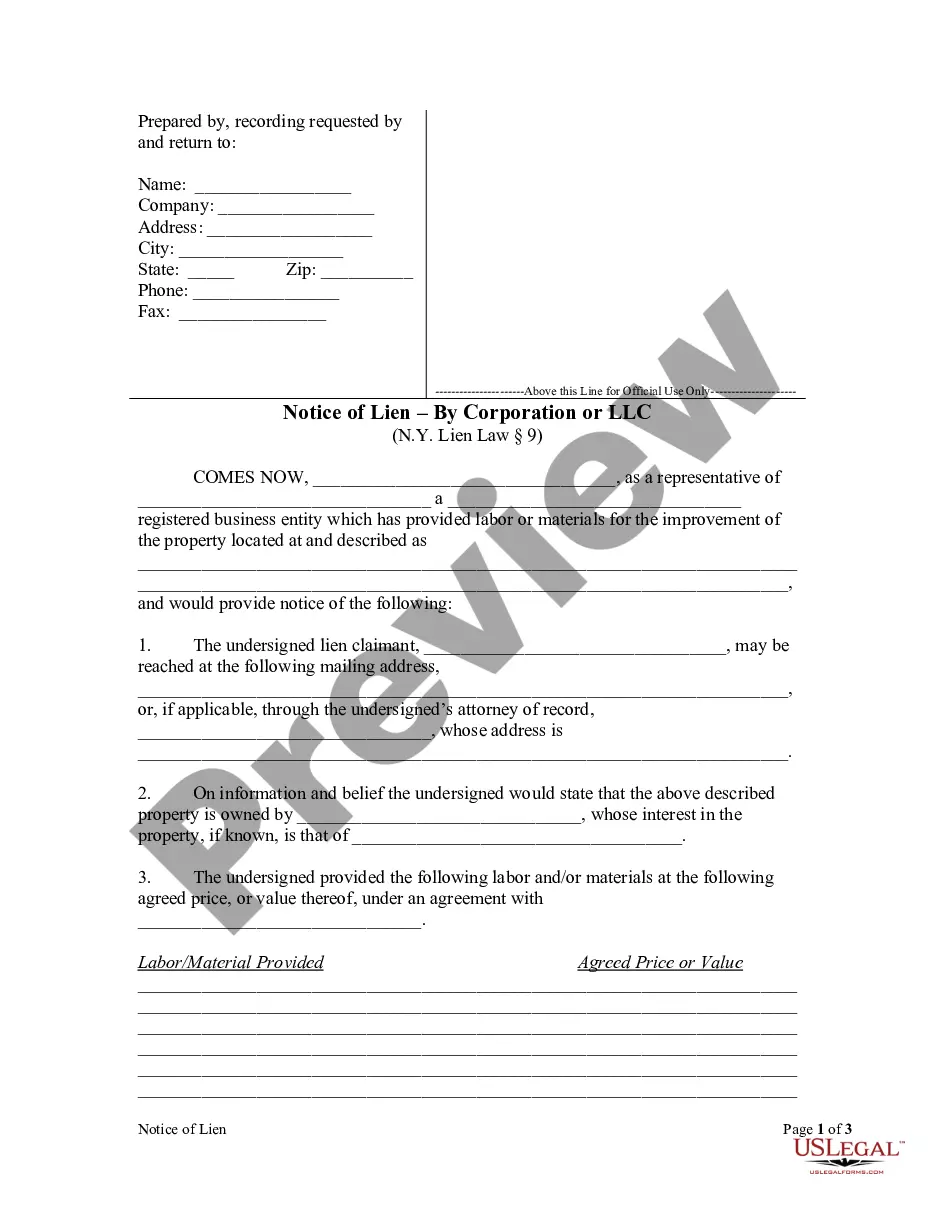

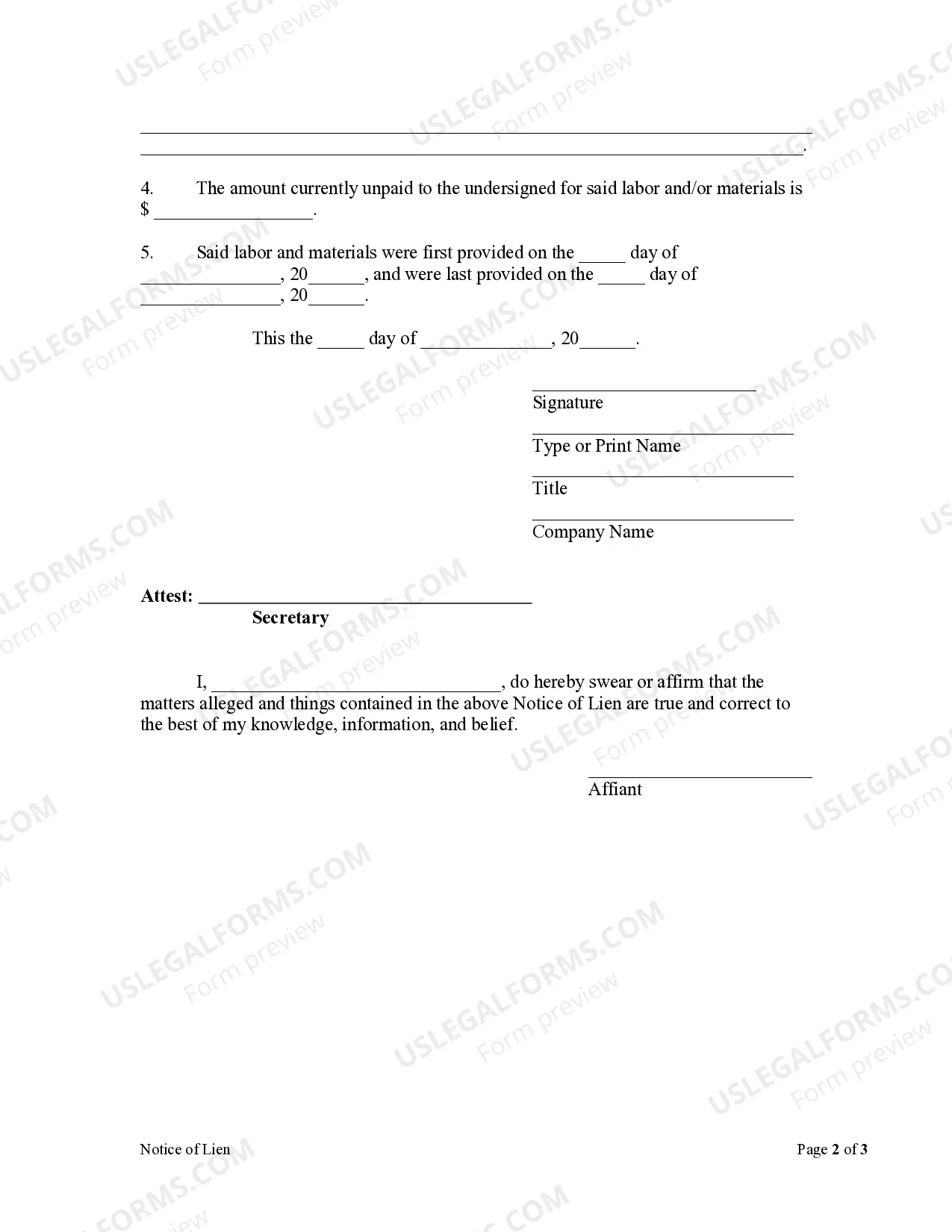

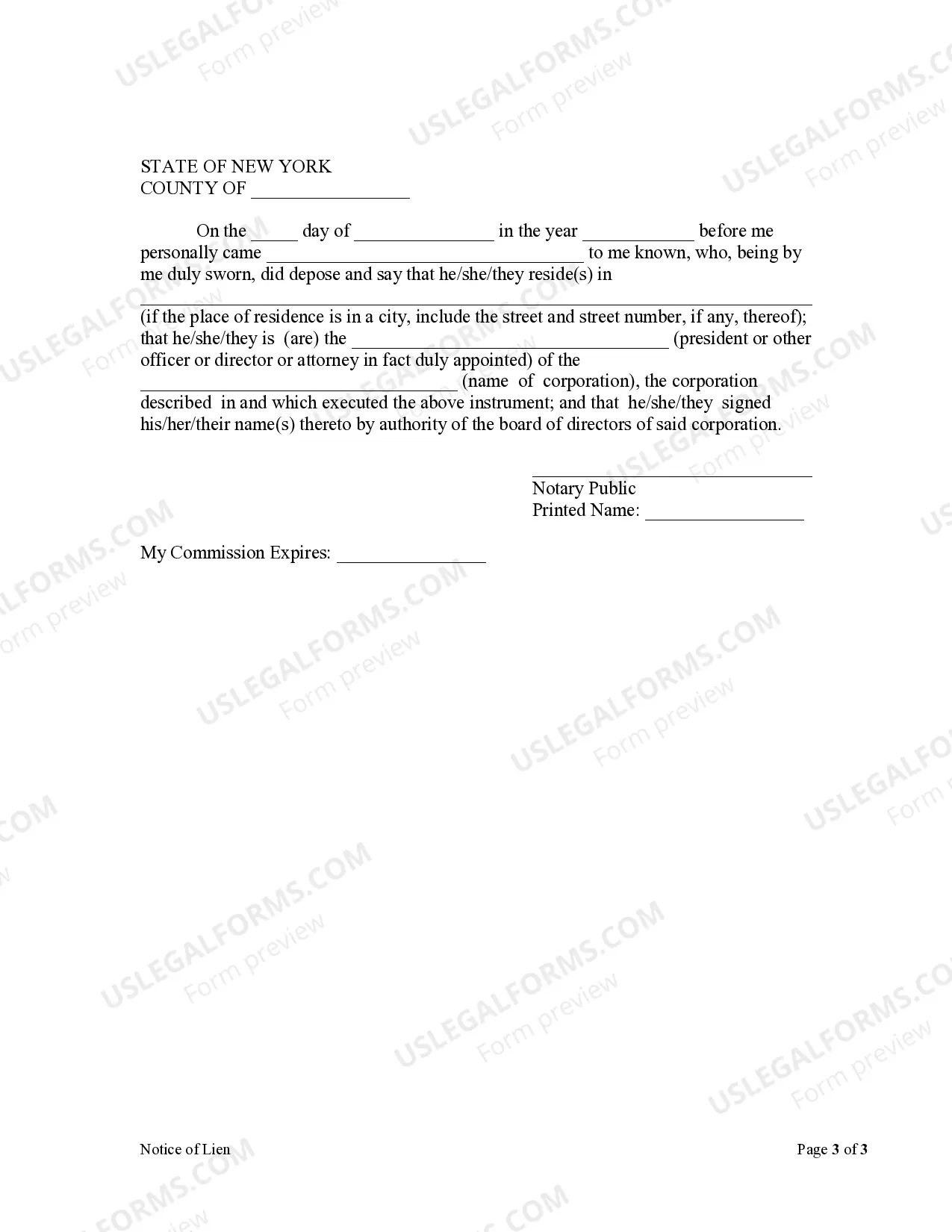

New York law requires a party desiring to claim a lien to file a Notice of Lien form in the office of the clerk of the county where the property is situated. The notice may be filed at any time during the progress of the work and the furnishing of the materials, or, within eight months after the completion of the contract, or the final performance of the work, or the final furnishing of the materials.

Queens New York Notice of Lien by Corporation

Description

How to fill out New York Notice Of Lien By Corporation?

Regardless of your social or professional rank, completing legal-related documents is a regrettable requirement in today’s society.

Frequently, it’s nearly impossible for individuals without legal training to produce such documents from scratch, primarily because of the intricate language and legal nuances they involve.

This is where US Legal Forms comes in to assist.

Confirm that the template you found is suitable for your location, as the laws of one state or region do not apply to another.

Regardless of the matter you’re attempting to resolve, US Legal Forms is here to support you. Give it a try today and see for yourself.

- Our platform offers an extensive collection of over 85,000 ready-to-use state-specific forms applicable for nearly any legal situation.

- US Legal Forms is also a valuable resource for associates or legal advisors looking to save time by using our DIY forms.

- Whether you require the Queens New York Notice of Lien by Corporation or LLC, or any other document suitable for your state or region, with US Legal Forms, everything is easily accessible.

- Here’s how to obtain the Queens New York Notice of Lien by Corporation or LLC efficiently through our dependable service.

- If you are already a subscriber, feel free to Log In to your account to retrieve the desired form.

- If you are new to our collection, ensure you follow these steps before acquiring the Queens New York Notice of Lien by Corporation or LLC.

Form popularity

FAQ

Finding out if a company has a lien can be accomplished by searching public records or utilizing online lien databases. It is important to check records filed with the county clerk or secretary of state where the company operates. Tools like USLegalForms can be helpful when looking up information related to a Queens New York Notice of Lien by Corporation, providing you with accurate and up-to-date details about any existing liens.

To determine if there is a lien on a property in New York, start by searching the local property records at your county clerk's office. Alternatively, you can access online databases that provide property information. Additionally, consider using services like USLegalForms to obtain concise, reliable information regarding Queens New York Notice of Lien by Corporation. This can simplify the process and give you peace of mind.

To obtain a copy of a lien release in New York, you should contact the office that originally filed the lien. You may need to provide relevant information, including the lien number and property details. If you're uncertain about the process, using platforms like US Legal Forms can simplify obtaining a Queens New York Notice of Lien by Corporation and its release.

The three main types of liens are statutory liens, consensual liens, and judgment liens. Statutory liens arise due to laws requiring payment for services rendered, consensual liens are created by agreement, and judgment liens result from court decisions. Understanding these types can help you navigate issues related to a Queens New York Notice of Lien by Corporation.

Yes, you can put a lien on a corporation in New York. This legal claim can help secure debts owed to you by the corporation. If you're considering this option, it's important to follow proper procedures to file a Queens New York Notice of Lien by Corporation.

In Rhode Island, a lien generally lasts for a period of 10 years. However, the duration can vary depending on the type of lien. If you are dealing with a Queens New York Notice of Lien by Corporation, it's crucial to understand how it may affect your dealings in other states like Rhode Island.

To find out if a vehicle has a lien, you can check with the New York DMV. By providing the vehicle's identification number (VIN), you can access the lien status directly. This is essential, especially if you are considering purchasing a vehicle that might have a Queens New York Notice of Lien by Corporation.

A lien search in New York can take anywhere from a few minutes to several days, depending on the complexity. If you are conducting a search online, it may be quicker, while in-person requests might require more time. Ensuring that you have accurate information will streamline the process and help you identify any relevant Queens New York Notice of Lien by Corporation.

To perform a lien search on a company, you should check the New York Department of State's Division of Corporations database. Additionally, you may consider using credit reporting services, which can offer comprehensive details about any liens, including a Queens New York Notice of Lien by Corporation. This action can help protect your investments and make informed decisions.

Yes, liens are public records in New York. This means anyone can access this information by visiting the appropriate government office or reviewing online databases. Knowing that a Queens New York Notice of Lien by Corporation is a matter of public record can help you understand the financial standing of an entity or property.