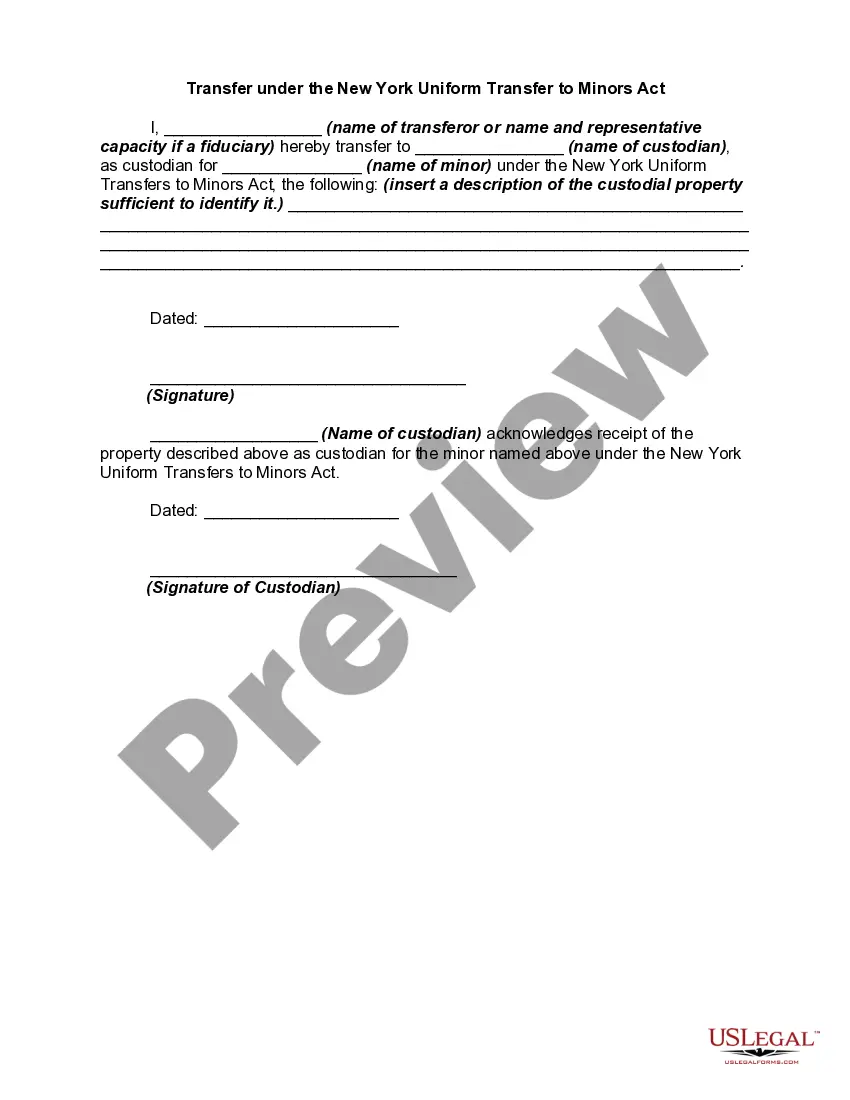

Under New York Law, custodial property is created and a transfer is made whenever:

1. An uncertificated security or certificated security in registered form is either:

(i) registered in the name of the transferor, an adult other than the

transferor, or a trust company, followed in substance by the words: "as custodian for (name of minor) under the New York Uniform Transfers to Minors Act"; or

(ii) delivered, if in certificated form, or any document necessary for

the transfer of an uncertificated security is delivered, together with

any necessary endorsement, to an adult other than the transferor or to a trust company, as custodian, accompanied by an instrument in substantially the form set forth in paragraph (b);

2. Money is paid or delivered, or a security held in the name of a broker, financial institution, or its nominee is transferred, to a broker or financial institution for credit to an account in the name of the transferor, an adult other than the transferor, or a trust company, followed in substance by the words: "as custodian for (name of minor) under the New York Uniform Transfers to Minors Act";

3. The ownership of a life or endowment insurance policy or annuity

contract is either:

(i) registered with the issuer in the name of the transferor, an adult

other than the transferor, or a trust company, followed in substance by the words: "as custodian for (name of minor) under the New York Uniform Transfers to Minors Act"; or

(ii) assigned in a writing delivered to an adult other than the

transferor, or to a trust company whose name in the assignment is followed in substance by the words: "as custodian for (name of minor) under the New York Uniform Transfers to Minors Act";

4. An irrevocable exercise of a power of appointment or an irrevocable present right to future payment under a contract is the subject of a written notification delivered to the payor, issuer, or other obligor that the right is transferred to the transferor, an adult other than the transferor, or a trust company, whose name in the notification is followed in substance by the words: "as custodian for (name of minor) under the New York Uniform Transfers to Minors Act";

5. An interest in real property is recorded in the name of the transferor, an adult other than the transferor, or a trust company, followed in substance by the words: "as custodian for (name of minor) under the New York Uniform Transfers to Minors Act";

6. A certificate of title issued by a department or agency of a state

or of the United States which evidences title to tangible personal

property is either:

(i) issued in the name of the transferor, an adult other than the

transferor, or a trust company, followed in substance by the words: "as custodian for (name of minor) under the New York Uniform Transfers to Minors Act"; or

(ii) delivered to an adult other than the transferor or to a trust

company, endorsed to that person followed in substance by the words: "as custodian for (name of minor) under the New

York Uniform Transfers to Minors Act"; or

7. (a) An interest in any property not described in subparagraphs (1) through (6) is transferred to an adult other than the transferor or to a trust company by a written instrument in substantially the form set forth in paragraph (b).

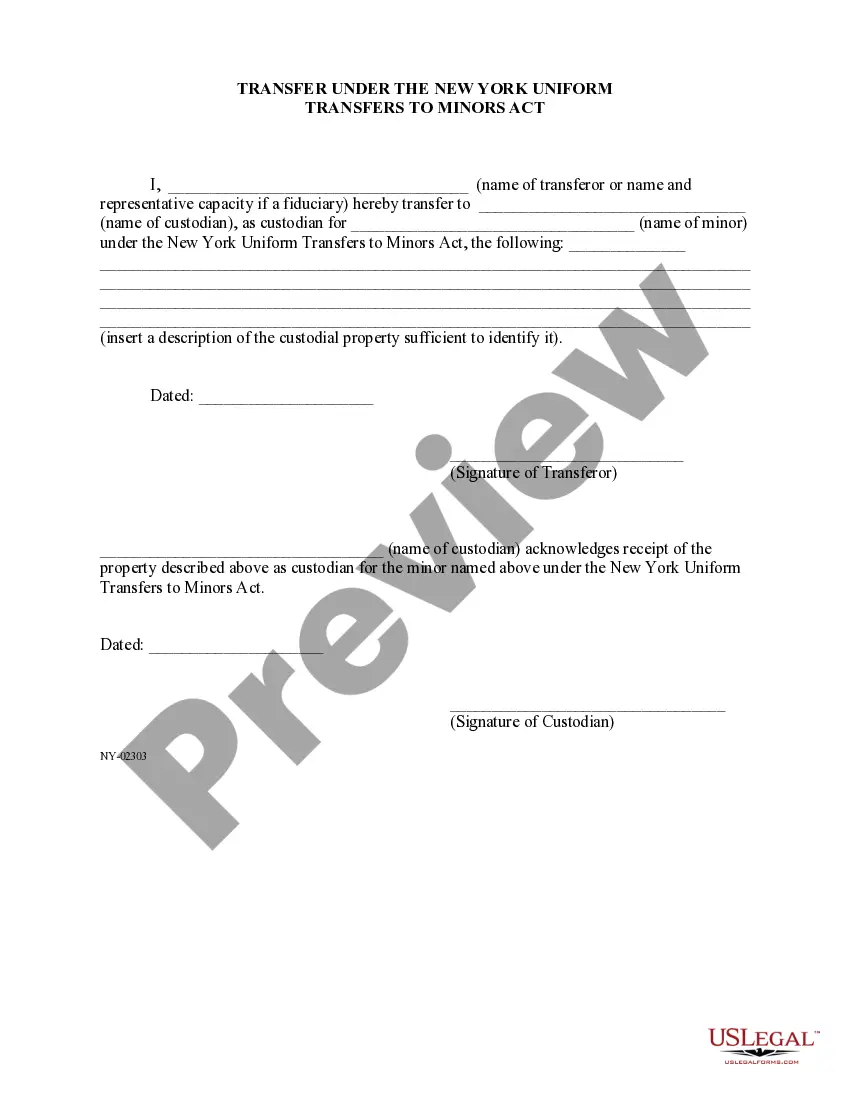

(b) An instrument in the following form satisfies the requirements of

clause (ii) of subparagraph (1) and subparagraph (7) of paragraph (a)