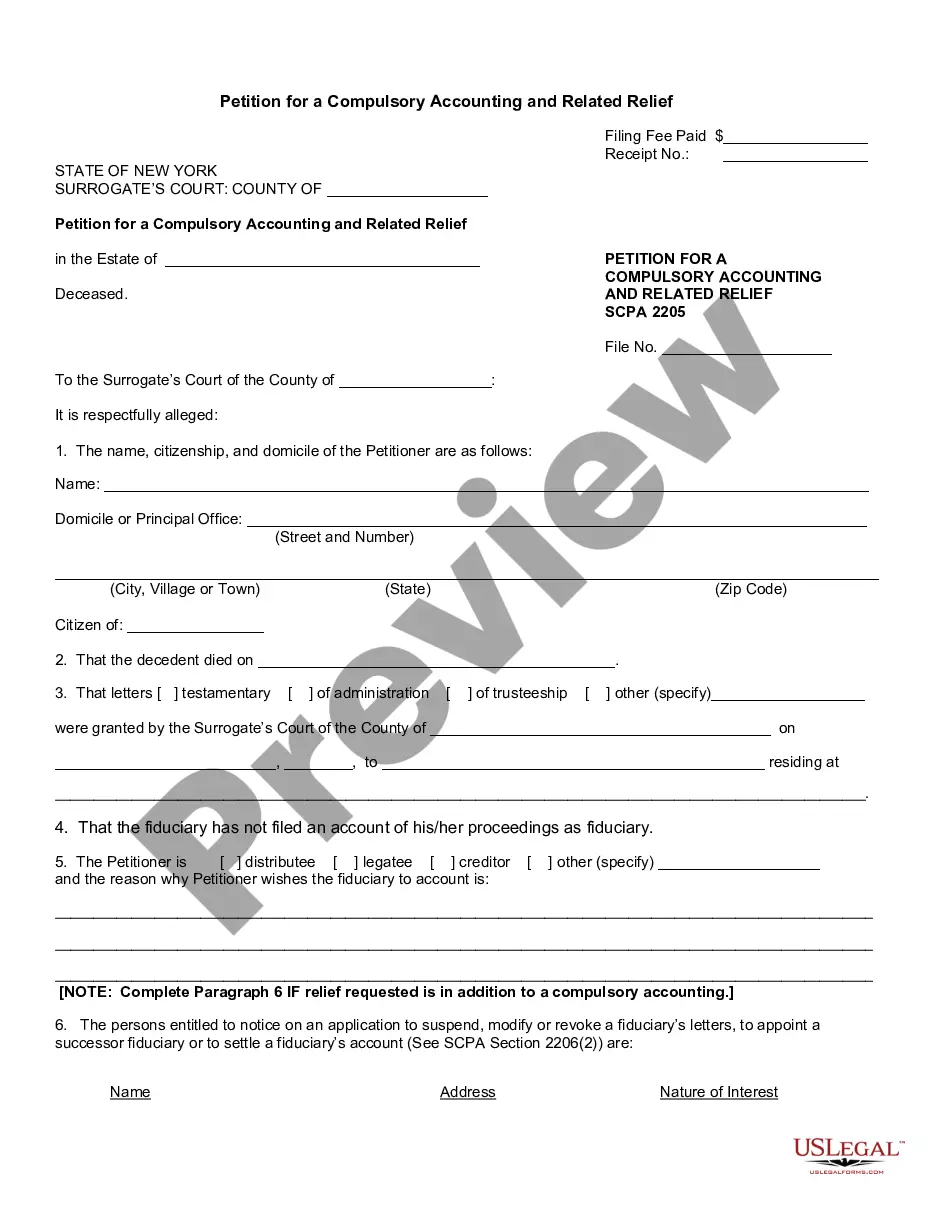

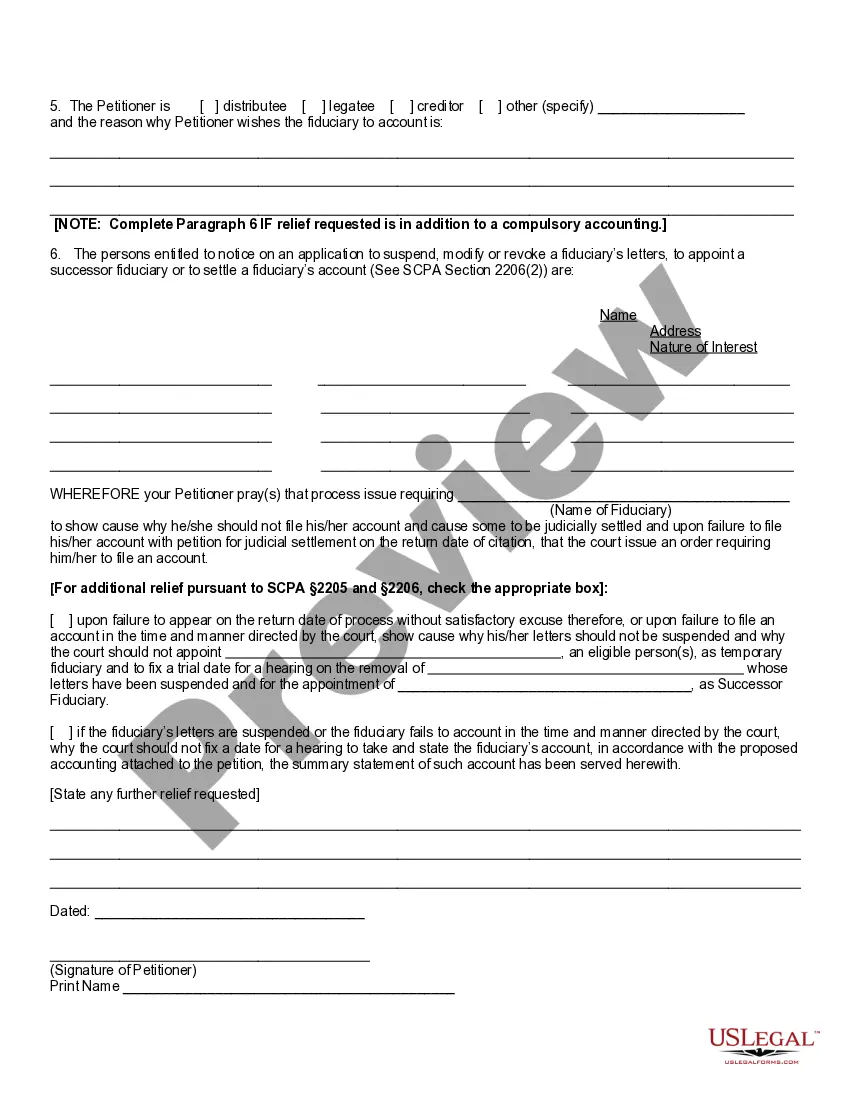

If the personal representative of a decedent's estate does not report to the court, the beneficiaries can ask the court to order him or her to file an accounting or take other actions to close probate. The court can remove the personal representative and appoint someone else.

Suffolk New York Petition for a Compulsory Accounting and Related Relief

Description

How to fill out New York Petition For A Compulsory Accounting And Related Relief?

If you are searching for an applicable form template, it’s challenging to discover a superior service than the US Legal Forms website – one of the most comprehensive collections available online.

Here you can locate thousands of document exemplars for organizational and personal use categorized by types and states, or keywords.

With our sophisticated search feature, finding the latest Suffolk New York Petition for a Mandatory Accounting and Associated Relief is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Choose the format and save it to your device.

- Additionally, the pertinence of each file is confirmed by a team of qualified lawyers who routinely assess the templates on our site and update them following the latest state and county stipulations.

- If you are already familiar with our platform and possess a registered account, all you need to obtain the Suffolk New York Petition for a Mandatory Accounting and Associated Relief is to Log In to your account and click the Download button.

- If this is your first time using US Legal Forms, simply adhere to the guidelines below.

- Ensure you have located the form you desire. Review its description and take advantage of the Preview feature to assess its content. If it does not suit your requirements, utilize the Search option at the top of the screen to find the appropriate document.

- Confirm your decision. Click the Buy now button. After that, select your desired pricing option and provide information to register for an account.

Form popularity

FAQ

To compel an accounting from a reluctant trustee, you should file a Suffolk New York Petition for a Compulsory Accounting and Related Relief. This legal action prompts the trustee to provide a detailed account of the assets and transactions related to the trust. If the trustee fails to comply, the court can impose sanctions or order them to fulfill their fiduciary duties. Utilizing US Legal Forms can simplify this process, offering customizable templates and clear instructions to help you navigate your legal needs efficiently.

A petition for accounting is a formal request made to the court, often involving a Suffolk New York Petition for a Compulsory Accounting and Related Relief. This petition seeks a detailed account of financial transactions by a trustee or personal representative. It ensures that all parties involved can understand how assets are managed and distributed. Utilizing services like USLegalForms can help streamline this process and provide necessary legal documents to simplify your experience.

If a trustee refuses to provide an accounting, you may need to file a Suffolk New York Petition for a Compulsory Accounting and Related Relief. This legal request compels the trustee to disclose financial records and account for the management of trust assets. It's essential to address this issue promptly, as transparency is crucial in trust administration. Solutions like USLegalForms can guide you through the process and offer the necessary forms to support your petition.

The purpose of a fiduciary accounting is to provide beneficiaries with a clear picture of the financial management of a trust or estate. It details income, expenses, and distributions, ensuring that the fiduciary acts in the beneficiaries' best interests. In the context of a Suffolk New York Petition for a Compulsory Accounting and Related Relief, this accounting helps to ensure that the trustee adheres to their legal obligations. Understanding this process can empower you to advocate for proper financial stewardship.

When a trustee fails to provide accounting, beneficiaries may face challenges in understanding the financial status of the trust. This situation can lead to distrust and disputes among involved parties. In Suffolk New York, filing a Petition for a Compulsory Accounting and Related Relief may be necessary to compel the trustee to disclose financial information. By addressing this issue promptly, you can protect your rights and ensure transparency in the trust’s management.

A petition to compel accounting is a formal request submitted to the Surrogate Court, seeking to require an executor or administrator to provide a complete financial accounting. By filing a Suffolk New York Petition for a Compulsory Accounting and Related Relief, interested parties can initiate this process, ensuring that they receive necessary financial information. This legal step helps uphold the integrity of estate administration.

To compel an accounting means to legally require an executor or administrator to provide a detailed financial report of the estate. This process often involves filing a Suffolk New York Petition for a Compulsory Accounting and Related Relief, which serves to protect the rights of beneficiaries and ensure responsible estate management. This legal action fosters transparency and accountability in the administration of the estate.

To request an accounting of an estate, you generally need to file a petition with the Surrogate Court, citing your interest in the estate. This process may involve submitting a Suffolk New York Petition for a Compulsory Accounting and Related Relief, which formally demands an accounting from the executor or administrator. This legal step can help you obtain essential information about the estate's financial status.

Yes, executors are legally obligated to provide an accounting to beneficiaries, detailing the management of the estate's assets. This ensures that all parties have access to the financial activities and can confirm that their interests are safeguarded. If you are a beneficiary seeking accountability, consider requesting a Suffolk New York Petition for a Compulsory Accounting and Related Relief to enforce this obligation.

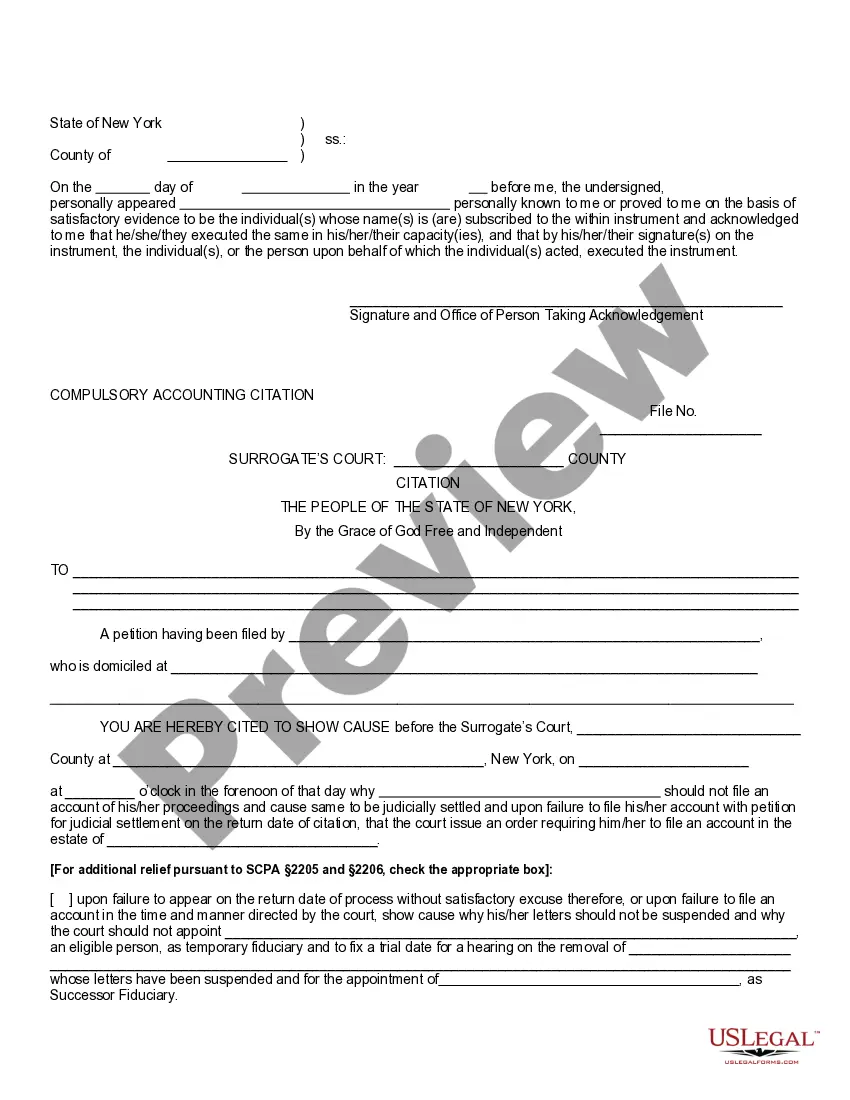

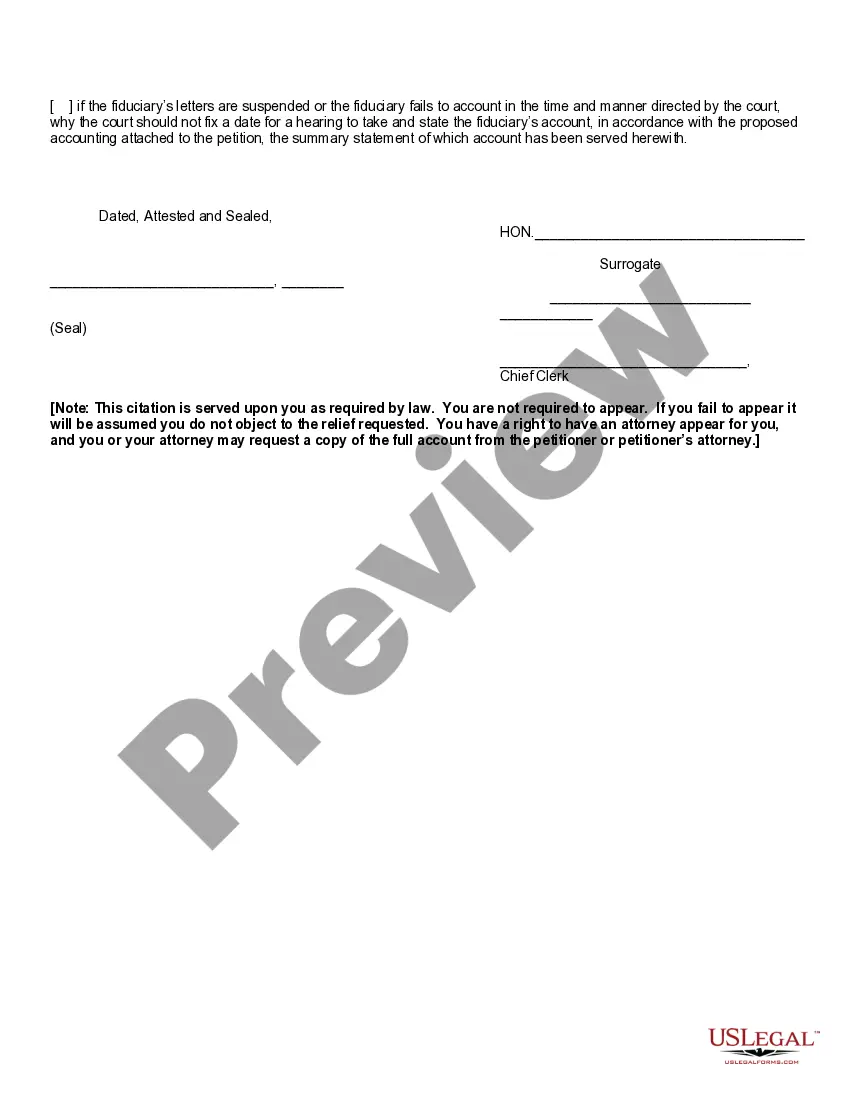

A compulsory accounting citation is a court order that compels an executor or administrator to provide a complete accounting of an estate. This citation serves to inform interested parties that they have the right to review the estate's financial matters. By pursuing a Suffolk New York Petition for a Compulsory Accounting and Related Relief, you can initiate this essential process to protect your interests.