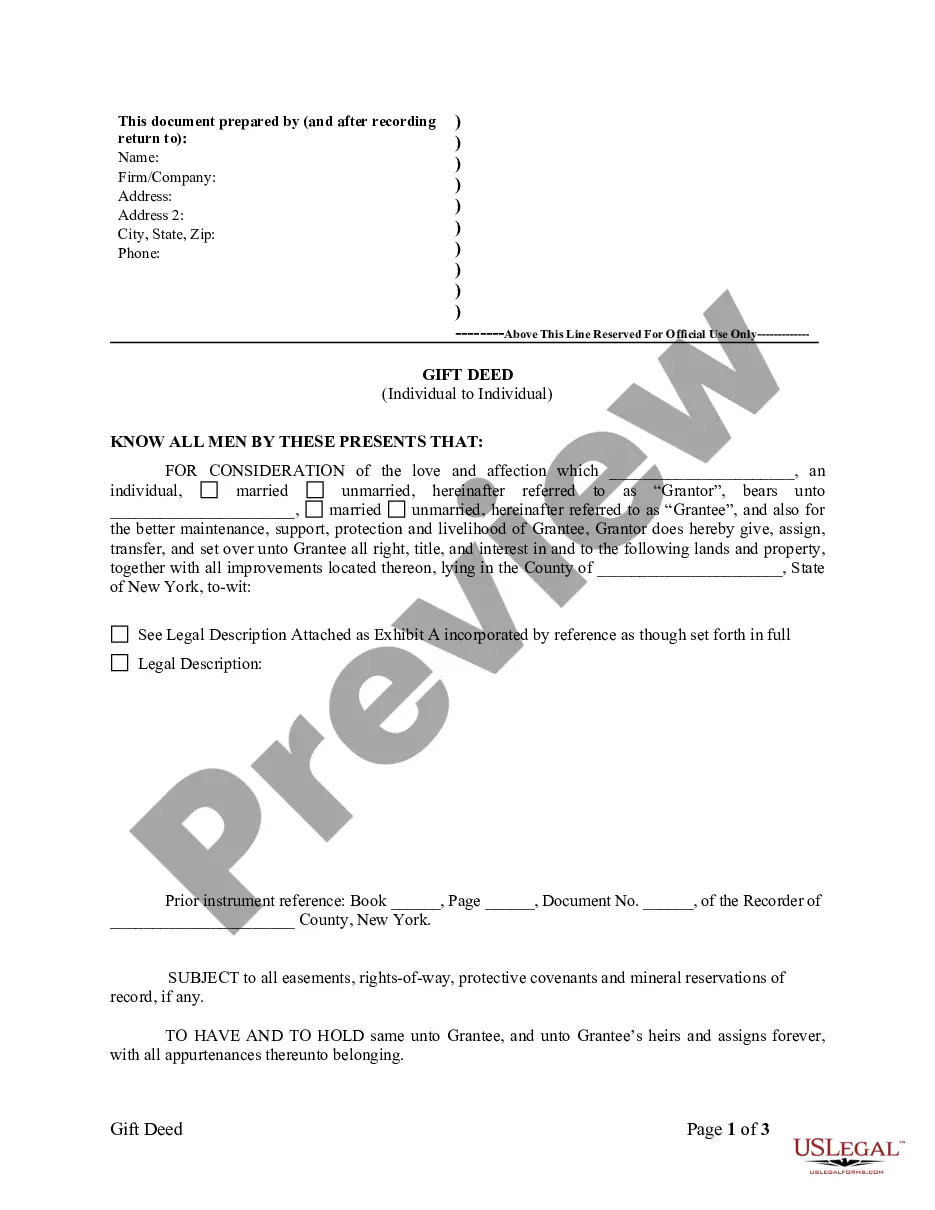

Rochester New York Gift Deed for Individual to Individual

Description

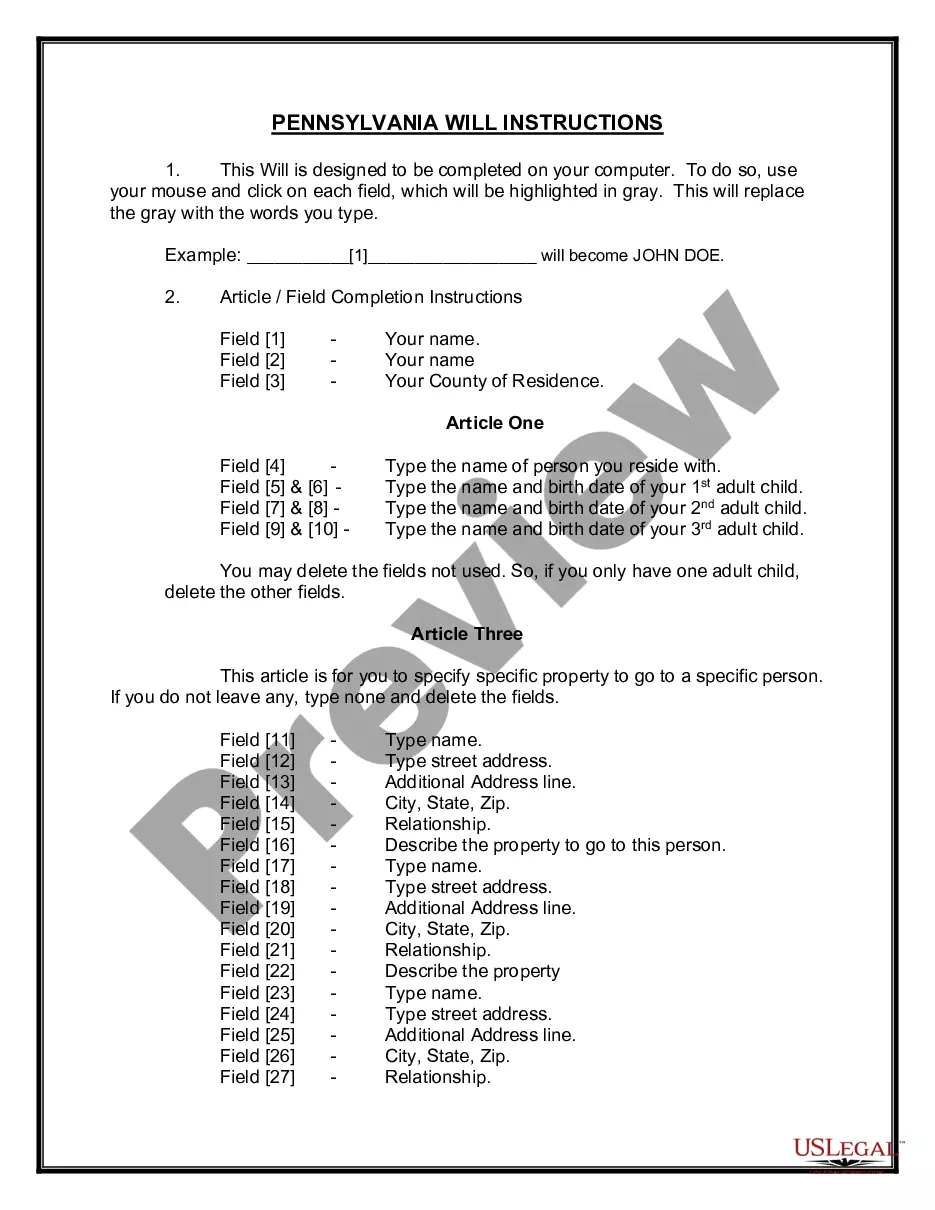

How to fill out New York Gift Deed For Individual To Individual?

Regardless of one's social or occupational standing, filling out law-related documents is a regrettable requirement in the current professional landscape.

Frequently, it is nearly impossible for an individual lacking legal expertise to generate such documentation from the ground up, largely due to the complex terminology and legal subtleties they contain.

This is where US Legal Forms comes to the rescue.

Ensure the template you've chosen is tailored to your locality because the rules of one region do not apply to another.

If the selected form does not suit your needs, you can restart and search for the appropriate document.

- Our platform offers an extensive library with over 85,000 readily available state-specific forms suitable for nearly any legal situation.

- US Legal Forms also acts as an excellent resource for associates or legal advisors who aim to enhance their efficiency by using our DIY papers.

- Whether you need the Rochester New York Gift Deed for Individual to Individual or another document fitting for your state or county, with US Legal Forms, everything you need is easily accessible.

- Here's how to swiftly acquire the Rochester New York Gift Deed for Individual to Individual using our dependable platform.

- If you are a current subscriber, you can go ahead and Log In to your account to retrieve the required form.

- However, if you are new to our library, make sure to follow these guidelines before downloading the Rochester New York Gift Deed for Individual to Individual.

Form popularity

FAQ

The fastest way to transfer a deed is to use a Rochester New York Gift Deed for Individual to Individual. This involves preparing the deed, having it signed by the grantor, and then filing it with the county clerk's office. By using services like uslegalforms, you can efficiently fill out the necessary documents and receive guidance on the filing process, ensuring a quick and smooth transfer.

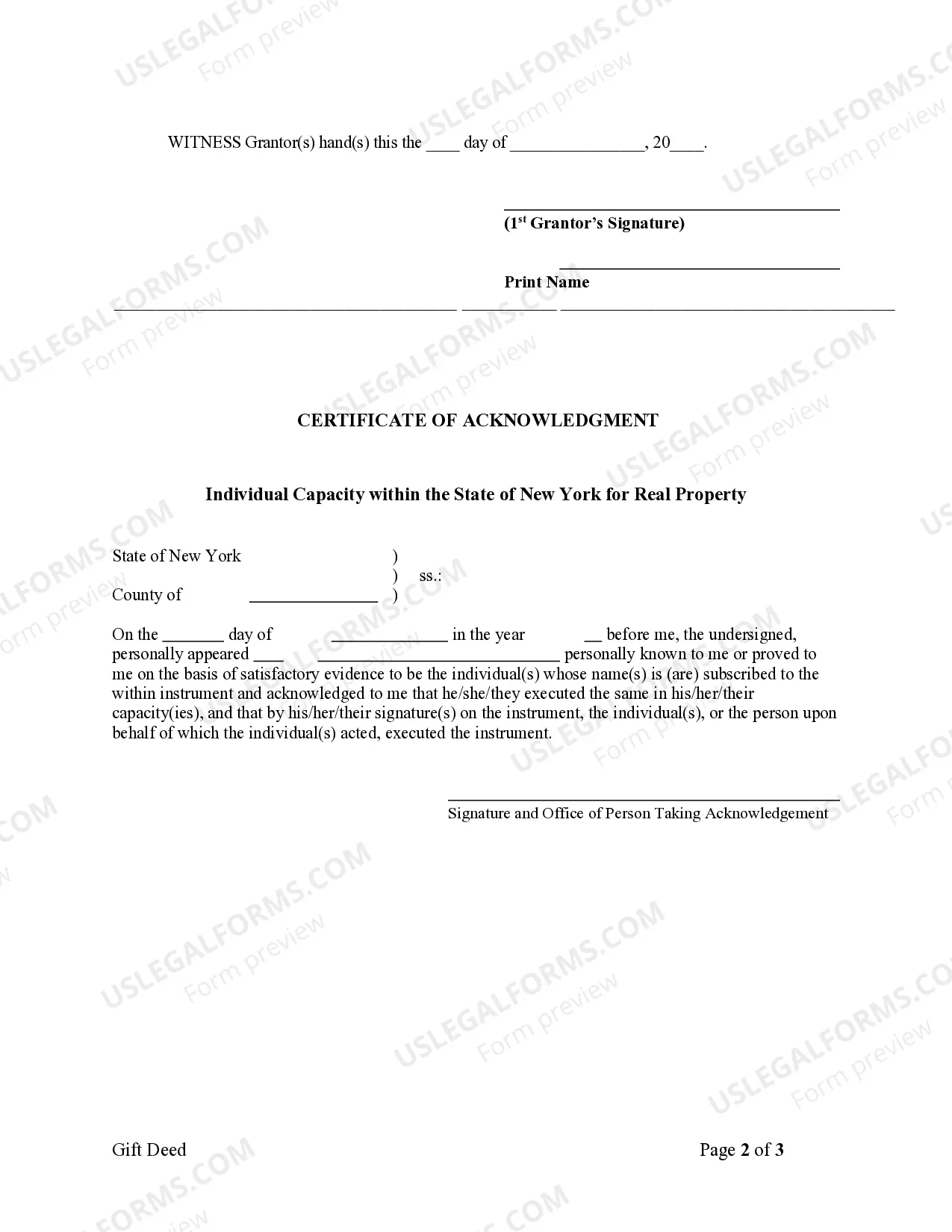

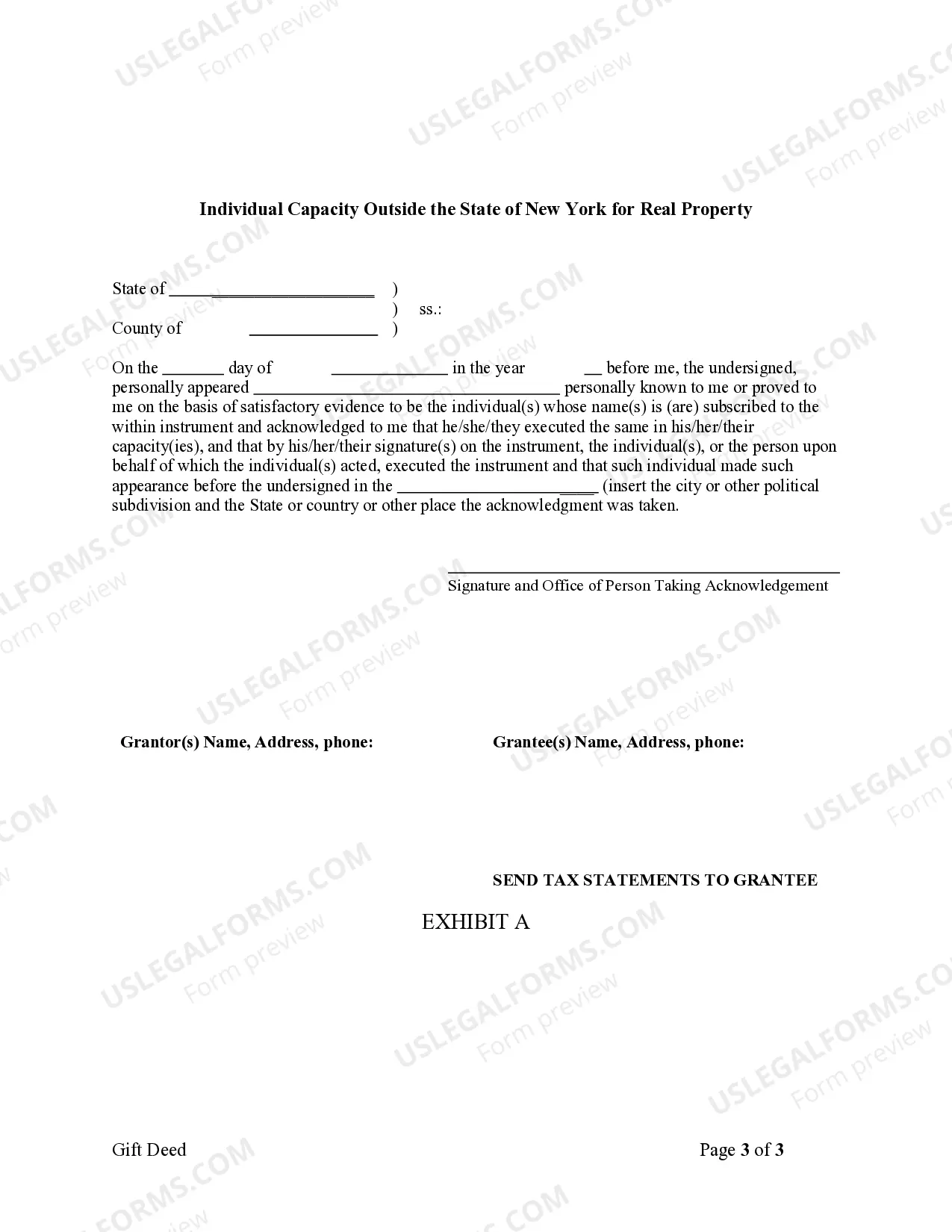

To transfer ownership of a house in New York, you typically need to complete a Rochester New York Gift Deed for Individual to Individual. This legal document specifies the transfer of property from one individual to another without a monetary exchange. After preparing the deed, you must sign it in front of a notary public and then file it with your local county clerk's office. By following these steps, you ensure a smooth transfer while maintaining compliance with New York property laws.

To add someone to your deed in New York, create a new deed that includes both your name and the person's name you wish to add. Utilizing a Rochester New York Gift Deed for Individual to Individual can simplify this transition. After signing, file the new deed with the local County Clerk’s office to formalize the addition.

To add a person to a deed in New York, execute a new deed that includes both the current owner and the person being added. This can often be done via a Rochester New York Gift Deed for Individual to Individual. It is important to have the deed properly filed to ensure that the addition is legally recognized.

To transfer ownership of property in New York, you typically need to create and execute a new deed that reflects the new ownership details. A Rochester New York Gift Deed for Individual to Individual provides a straightforward way to accomplish this when gifting property. Ensure the deed is properly filed with local authorities for it to become effective.

Adding someone to a deed in New York can have significant tax implications, including potential gift taxes. Using a Rochester New York Gift Deed for Individual to Individual can help clarify this process. It's crucial to consult tax experts to understand how this might affect your unique financial situation.

In New York State, the federal gift tax limit is generally $15,000 per person, per year, as of 2021. However, gifting a property through a Rochester New York Gift Deed for Individual to Individual can have different considerations regarding valuations. Consulting with a tax professional is advisable to understand the implications.

To transfer a deed in New York State, you need to prepare a new deed that reflects the new owner’s information, sign it, and then file it with the County Clerk’s office. Utilizing a Rochester New York Gift Deed for Individual to Individual makes this process clear and direct. Make sure all necessary information is accurate to avoid complications.

The time it takes for a deed transfer in New York can vary, usually ranging from a few days to a couple of weeks, depending on the specific circumstances and local office processing times. Filing a Rochester New York Gift Deed for Individual to Individual can expedite the process. After recordation, it becomes official and can be verified.

To transfer property to a family member quickly in New York, consider using a Rochester New York Gift Deed for Individual to Individual. This method allows you to gift the property directly without going through lengthy processes. Ensure the deed is filed with the County Clerk's office after it is signed.