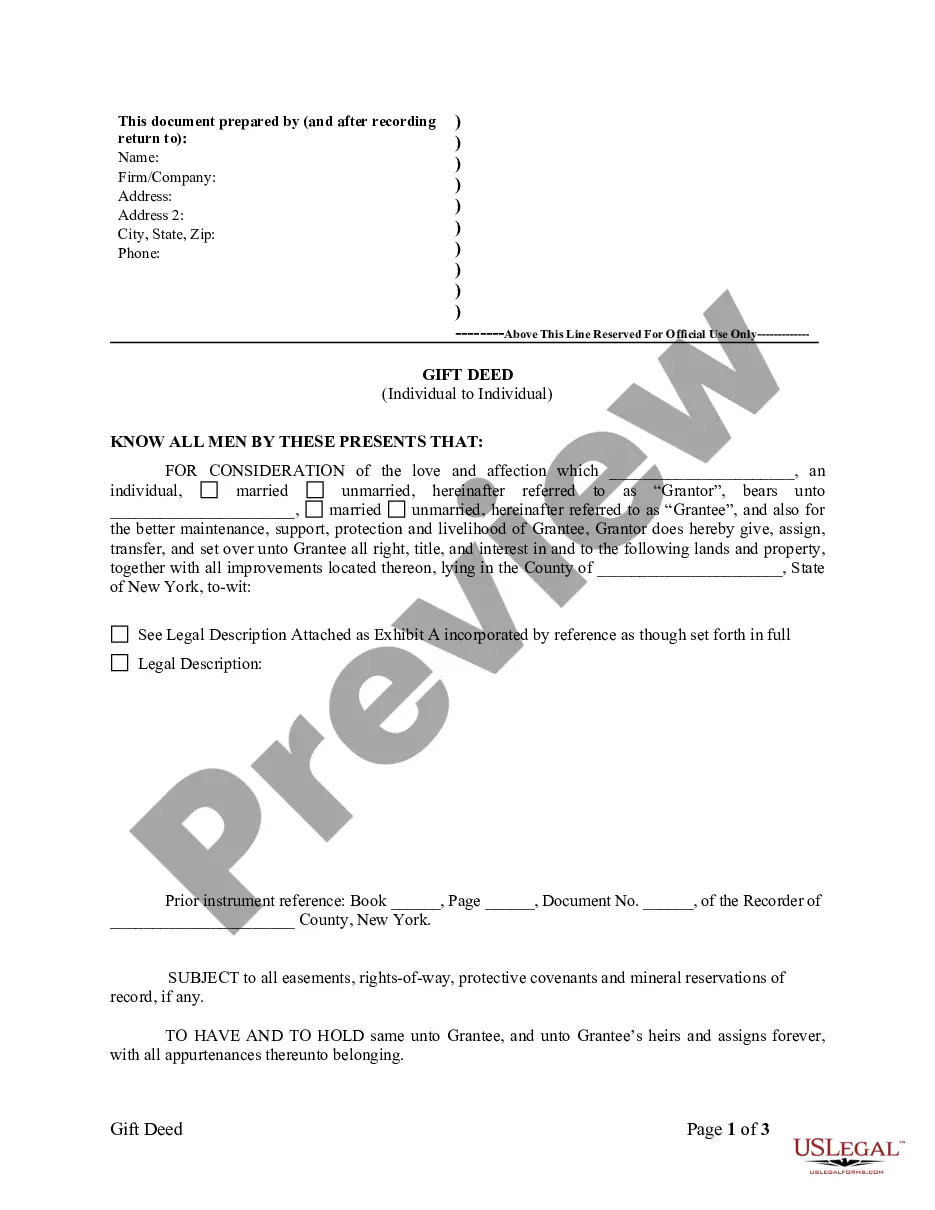

Kings New York Gift Deed for Individual to Individual

Description

How to fill out New York Gift Deed For Individual To Individual?

If you are in search of a legitimate document, it’s unattainable to discover a superior platform than the US Legal Forms site – one of the most extensive collections on the internet.

With this collection, you can obtain a vast array of document samples for organizational and personal purposes categorized by types and states, or keywords.

Utilizing our sophisticated search functionality, acquiring the latest Kings New York Gift Deed for Individual to Individual is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Obtain the document. Choose the format and save it to your device.

- Moreover, the accuracy of every document is confirmed by a group of professional attorneys who frequently review the templates on our platform and refresh them according to current state and county requirements.

- If you are already aware of our platform and possess a registered account, all you need to obtain the Kings New York Gift Deed for Individual to Individual is to Log In to your user profile and click the Download button.

- If you are utilizing US Legal Forms for the first occasion, simply refer to the guidelines below.

- Ensure you have selected the template you need. Review its description and use the Preview option to examine its content. If it doesn’t fulfill your requirements, employ the Search function at the top of the screen to locate the appropriate document.

- Confirm your choice. Hit the Buy now button. Following that, select your desired subscription plan and provide details to create an account.

Form popularity

FAQ

To transfer property to family members in New York, you will typically need to complete a gift deed. The Kings New York Gift Deed for Individual to Individual is specifically designed for this purpose, allowing you to make a secure transfer. Once the deed is filled out and recorded, it effectively updates ownership in public records. Additionally, it’s wise to consult with a legal expert to ensure compliance with all local regulations.

Yes, you can gift a house to someone in New York. Utilizing the Kings New York Gift Deed for Individual to Individual is an effective way to execute this transfer. It allows for direct transfer of ownership without the formalities of a sale. However, be sure to consider any potential tax implications that may arise from the gift.

The best way to transfer property to a family member is often through a gift deed. The Kings New York Gift Deed for Individual to Individual provides a simple framework to transfer ownership without the complexities of a sale. This approach avoids taxes typically associated with selling property while ensuring both parties understand the terms. Engaging with a legal professional can help clarify the process further.

Removing someone from a deed in New York State involves executing a new deed that excludes the individual you want to remove. You can utilize the Kings New York Gift Deed for Individual to Individual to facilitate this process as well. It’s essential to have all parties involved agree to the removal, and once completed, the new deed must be recorded with the county. Legal advice might be beneficial to navigate this procedure smoothly.

The time it takes to complete a deed transfer in New York can vary, but it generally takes a few weeks. Once you file the Kings New York Gift Deed for Individual to Individual, the recording office may take additional time to process it. However, once recorded, the transfer is legally effective. Planning ahead can help you account for any potential delays.

To transfer property to a family member in New York, you can use the Kings New York Gift Deed for Individual to Individual. This deed allows for a straightforward transfer without the need for a sale. You must fill out the deed accurately, have it notarized, and then record it with the county clerk. This process can simplify the transfer while ensuring all legal requirements are met.

While a gift deed like the Kings New York Gift Deed for Individual to Individual can streamline asset transfers, there are some disadvantages. Primarily, the recipient may face tax implications, including potential gift taxes. Additionally, once the deed is executed and recorded, you may lose control over the property, so careful consideration is necessary before proceeding.

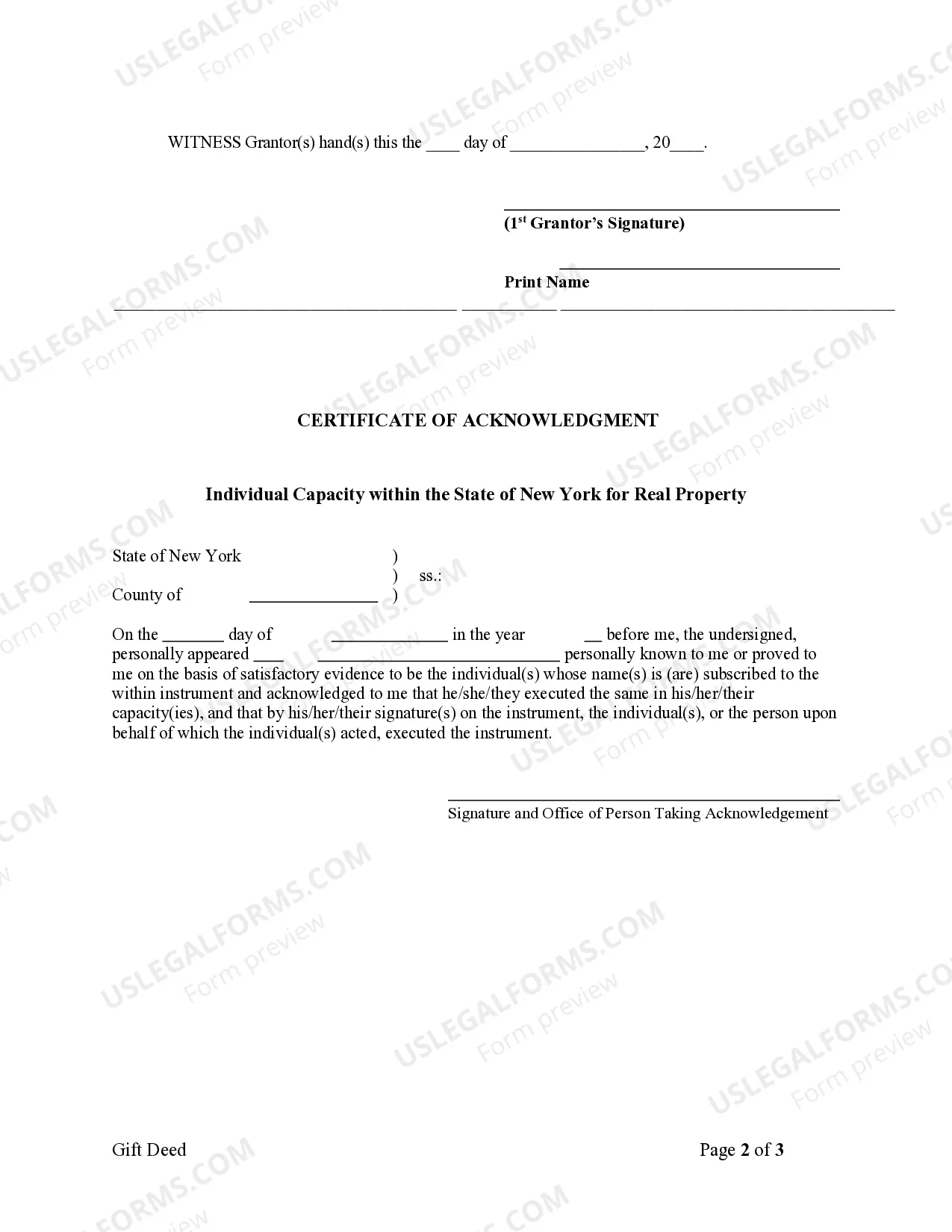

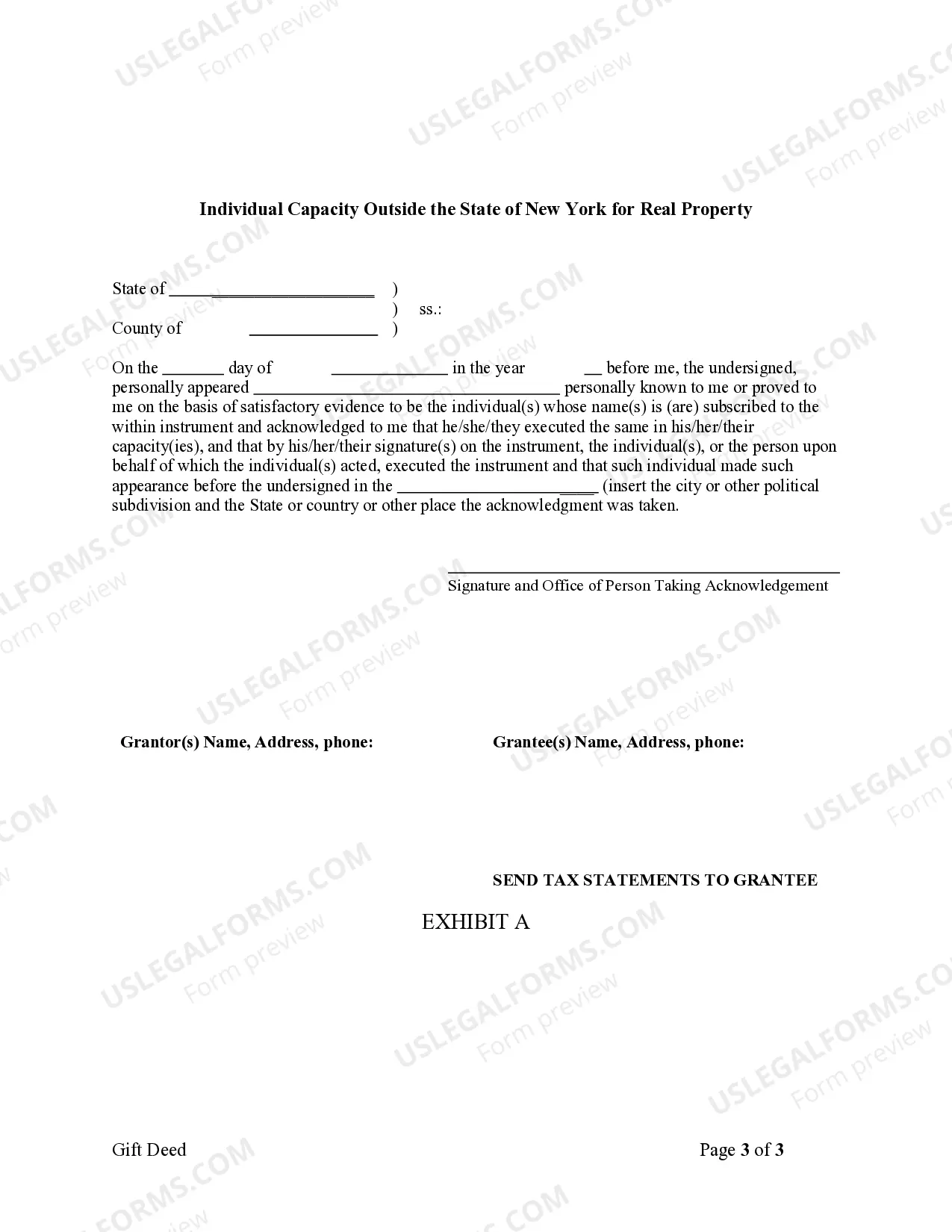

Transferring real estate as a gift involves creating a gift deed. The Kings New York Gift Deed for Individual to Individual is a specific option for this purpose. Properly fill out the deed, sign it in front of a notary, and file it with the county office to finalize the transfer legally and effectively.

To transfer ownership of a house in New York, you can use the Kings New York Gift Deed for Individual to Individual. Start by drafting the deed, then sign it in the presence of a notary. After that, record the deed with the county clerk’s office, which officially updates the ownership records.

Yes, you can gift a house to someone in New York state using the Kings New York Gift Deed for Individual to Individual. This legal document allows you to transfer ownership without requiring payment. However, it’s important to consider tax implications and ensure all necessary steps are taken to formalize the gift.